Understanding Your Texas Notary Surety Bond Cost

If you’re looking into becoming a notary public in Texas, understanding the texas notary surety bond cost is a crucial first step. The good news? It’s surprisingly affordable.

Here’s a quick breakdown of the primary costs:

- Bond Amount Required: $10,000

- Typical Bond Premium (for 4 years): $50

- Texas State Application Fee: $21

- Minimum Total Initial Cost (for 4 years): $71

This guide will explain everything you need to know about getting bonded in Texas. We will cover why this bond is needed, who needs one, and how it protects the public. We will also dive into all the associated fees and how to get your bond quickly and easily.

I’m Haiko de Poel, Jr., and as a growth architect and CEO of MASS IMPACT®, I’ve helped scale ventures across industries like insurance and legal services, giving me deep insights into the texas notary surety bond cost and related compliance. My two decades of leadership experience ensure I can simplify complex financial requirements for you.

What Exactly is a Texas Notary Bond (And Why Do You Need One?)

Let’s be honest, the term “surety bond” can sound a bit intimidating, conjuring up images from legal dramas. But for aspiring Texas Notaries, it’s actually a straightforward and absolutely essential part of becoming commissioned. In simple terms, a surety bond is a financial promise, a guarantee. It ensures that you, as a Notary Public, will perform your duties faithfully and in full compliance with Texas law.

Think of it as a safety net, but here’s the crucial twist: this net isn’t for you. Its primary purpose is public protection. The bond acts as a promise that if a member of the public ever suffers financial harm because of your notarial misconduct or errors – whether it’s due to negligence, fraud, or any other improper act – they have a way to seek reimbursement. The bond makes sure that funds are available to cover these damages, up to a specified amount, which for Texas Notaries is $10,000.

The State of Texas takes protecting its citizens very seriously. That’s precisely why The Texas Secretary of State requires notaries to file a bond. This isn’t just a suggestion; it’s a mandatory requirement. Your bond is “conditioned on your faithful performance of office duties,” meaning you’re expected to uphold the highest standards of integrity and accuracy in every single notarization you perform.

At its core, a surety bond involves a three-party agreement:

- The Principal: That’s you, the Notary Public, who is required to obtain the bond. You are making a promise to adhere to the law.

- The Surety Company: That’s us, BEST SURETY BOND COMPANY, the financial institution that issues the bond and backs your promise. We guarantee to the state that funds are available if a valid claim arises.

- The Obligee: This is the party requiring the bond, which in this case is the Texas Secretary of State, representing the public. The obligee is the beneficiary of the bond, meaning they are the ones protected.

So, while the concept might seem a bit formal, its role is beautifully simple: it ensures public trust and offers financial protection for anyone who interacts with a Texas Notary Public.

Who is Required to Get a Texas Notary Bond?

The short answer is: pretty much anyone who wants to perform official notarial acts in the Lone Star State! Texas law mandates that all individuals seeking to become a Notary Public must secure this bond. This requirement isn’t just for first-timers; it’s a continuous obligation for:

- New Notaries: If you’re just starting your journey to become a Texas Notary, obtaining this bond is one of the very first steps you’ll take.

- Renewing Notaries: Notary commissions in Texas last for four years. When it’s time to renew your commission, you’ll also need to renew your bond. It’s a continuous requirement for the duration of your service.

- Mobile Notaries and Notary Signing Agents: Whether you plan to offer traditional notary services from a fixed location or travel to clients as a mobile notary or signing agent, the bond requirement remains the same. Your mobility doesn’t exempt you from this state law mandate.

Essentially, if you’re going to put your official stamp on a document in Texas, you need to be bonded. It’s a fundamental part of the state’s regulatory framework designed to safeguard its citizens and ensure every notarization is handled correctly.

How the Bond Protects the Public

We’ve emphasized that the bond protects the public, so let’s dive a little deeper into how this works in practice. Imagine a scenario where a notarial error or an act of misconduct leads to financial harm for an individual. Perhaps a critical date was accidentally transcribed incorrectly, or a signature was improperly verified, leading to a significant legal or financial loss for a third party.

In such a situation, the affected party can file a claim against your notary bond. If the claim is investigated and found to be valid, the surety company (that’s us!) will pay out the claim up to the $10,000 bond limit. This reimbursement for damages ensures that the public is made whole, helping to mitigate the financial impact of your error or misconduct.

However, understand this key point: while the bond pays out to the injured party, it does not provide insurance for you, the Notary. If a valid claim is paid out on your bond, you, the Notary (the Principal), are personally liable for the full amount paid by the surety company. This means you are legally obligated to reimburse us for any funds we disbursed due to your negligence or fraud. This personal liability is a core mechanism that encourages notaries to perform their duties with the utmost care and diligence. It’s a powerful incentive to get it right every single time!

Breaking Down the Texas Notary Surety Bond Cost

Let’s get down to the numbers, because when it comes to the texas notary surety bond cost, transparency is key. You might expect a hefty price tag for a $10,000 guarantee, but prepare to be pleasantly surprised!

How Much is the $10,000 Bond? A Clear Look at the Texas Notary Surety Bond Cost

This is where the “Spoiler Alert: It’s Affordable!” truly comes into play. The rate for a $10,000 Texas Notary Bond is typically a flat fee of just $50 for the entire 4-year term. That’s right, fifty bucks for four years of peace of mind for the public. We pride ourselves on offering competitive, low rates, and for Texas Notary Bonds, it’s a fixed, straightforward price.

There are no hidden fees or complicated calculations based on your financial history. The cost is a simple, fixed premium, making it one of the most accessible and affordable bonds you’ll encounter. With BEST SURETY BOND COMPANY, you can get instant online quotes and purchase your bond quickly, knowing exactly what you’ll pay upfront.

Are There Other Mandatory Costs?

While the $10,000 surety bond itself is a fixed $50, there are a few other mandatory costs associated with becoming a Texas Notary Public. These are state-mandated fees and required supplies that ensure you can perform your duties legally and effectively.

Here’s a breakdown of what else you’ll need to budget for:

- Texas State Application Fee: In addition to your bond, the Texas Secretary of State requires a $21 application fee to process your Notary Public commission. This fee is paid directly to the state when you submit your application.

- Notary Seal (Stamp or Embosser): Texas law requires you to use an official seal for all notarial acts. This is typically a self-inking stamp or an embosser. The cost for a quality notary seal can range from $15 to $30, depending on the vendor and type.

- Notary Record Book (Journal): While not explicitly stated as a separate fee, a notary record book (or journal) is crucial for maintaining a detailed log of all your notarial acts. This is considered a best practice and is often bundled with notary supplies. A basic record book might cost around $8 to $25.

So, when you factor in all the mandatory components, the minimum total cost to become a Texas Notary Public for a 4-year term is approximately $71 (bond + state application fee) plus the cost of your seal and record book. Many providers offer “basic notary packages” that bundle the bond, state fees, seal, and record book for around $95, offering a convenient all-in-one solution.

Here is a list of the required items to become a Texas Notary:

- A $10,000 Texas Notary Surety Bond

- Completed Texas Notary Public Application (Form 2301)

- $21 State Application Fee

- Official Notary Seal (Stamp or Embosser)

- Notary Record Book (Journal)

Does My Credit Score Affect the Texas Notary Surety Bond Cost?

This is a fantastic question, and for many types of surety bonds, the answer would be a resounding “yes!” For most bonds, a surety company will indeed look at your credit score and financial history to assess risk, and this can significantly impact your premium.

However, when it comes to the texas notary surety bond cost, we have excellent news: your credit score does not affect the cost!

The Texas Notary Bond is considered a low-risk bond. Because the bond amount is relatively small ($10,000) and the state has clear guidelines for notary conduct, surety companies offer it at a fixed, affordable premium of $50 for the entire four-year term. This means:

- No Credit Check: You won’t undergo a credit check specifically for this bond.

- Instant Approval: Because there’s no credit underwriting, the approval process is often instant.

- Fixed Price: Everyone pays the same $50 for the bond, regardless of their credit history.

This makes obtaining your Texas Notary Bond incredibly accessible, even if you have less-than-perfect credit. Our goal at BEST SURETY BOND COMPANY is to provide fast approvals and low rates, and the Texas Notary Bond perfectly exemplifies this commitment.

Notary Bond vs. E&O Insurance: What You Need to Know

It’s completely understandable if you find yourself a little confused between your Texas Notary Bond and something called Errors & Omissions (E&O) Insurance. While both offer a form of protection, they’re actually quite different and serve distinct purposes. Think of it this way: they protect different people and are required by different entities.

Here’s the clearest distinction: Your Notary Bond is all about protecting the public and the state of Texas. It’s a financial guarantee that ensures if your notarial errors or misconduct cause financial harm to someone else, that person can be reimbursed up to the bond amount. So, if a valid claim is paid out on your bond, you, the Notary, are still personally responsible for reimbursing the surety company. The bond is a public safety net, not insurance for you.

On the other hand, Errors & Omissions (E&O) Insurance is designed to protect you, the Notary. It’s a type of professional liability insurance that steps in to cover your legal expenses and any potential damages if a client or another party sues you for an unintentional mistake or oversight made during your notarial duties. It’s your personal shield against unexpected legal battles.

And the requirement status? Your Notary Bond is required by the state of Texas; you absolutely need it to become a commissioned Notary Public. E&O Insurance, however, is optional in Texas. It’s not a state mandate for commissioning. So, while the bond is like a security deposit for the state to protect the public, E&O insurance is like your personal umbrella, protecting you from unexpected legal storms.

What is Errors & Omissions (E&O) Insurance?

Errors & Omissions (E&O) Insurance is a specific type of professional liability coverage for notaries. While the Texas Notary Bond ensures public protection, E&O insurance is custom to safeguard you, the notary, from financial losses that might arise from claims of errors or omissions in your professional work.

It’s an extra layer of protection that many notaries choose to add. If you accidentally make a mistake, overlook something, or even face a groundless lawsuit related to your notarial duties, E&O insurance can help cover your legal defense costs and any judgments or settlements, up to the limits of your policy. While it’s not required by the state of Texas, many notaries find this optional coverage brings valuable peace of mind and financial security.

How to Get and File Your Texas Notary Bond: A Simple Guide

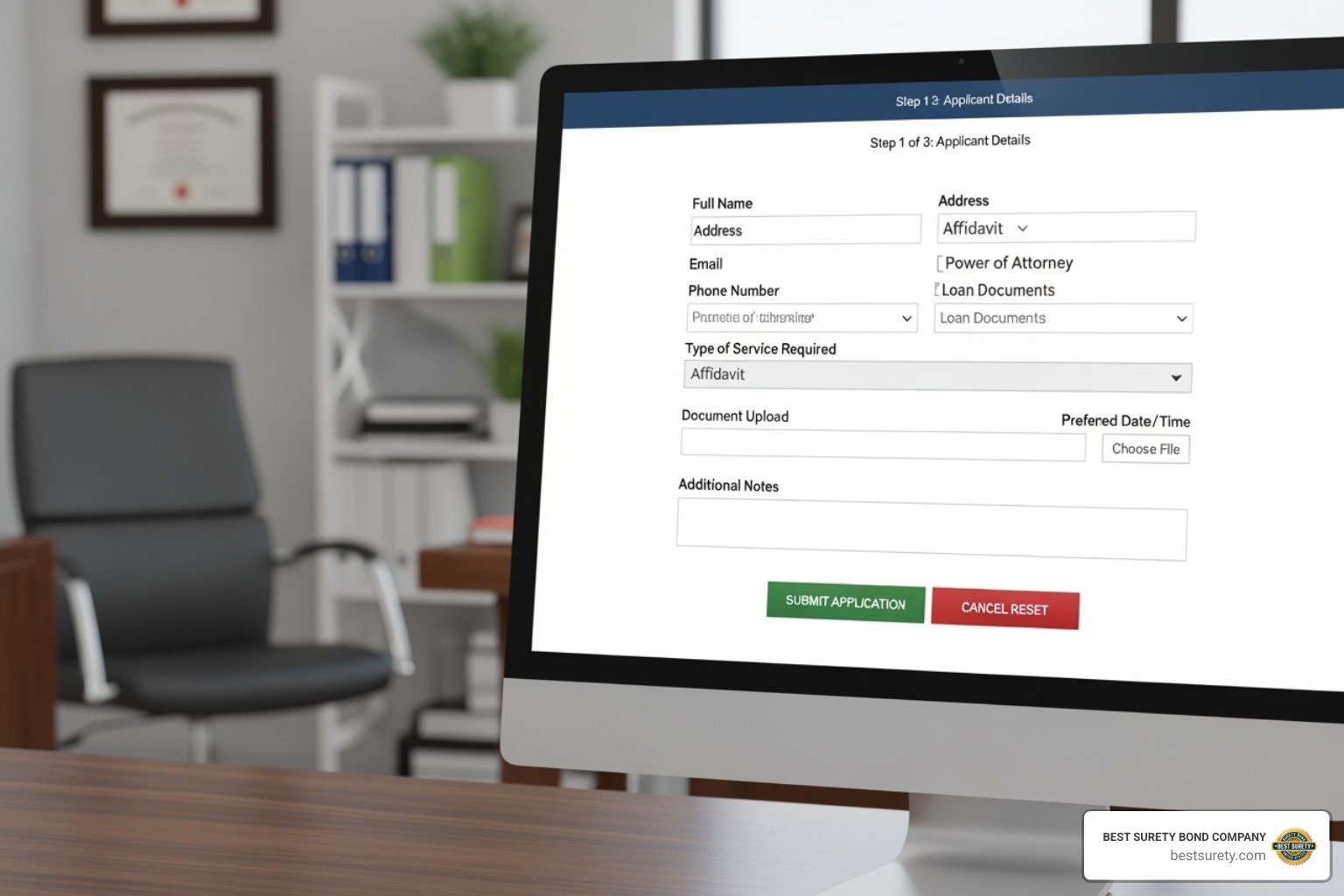

Getting your Texas Notary Bond and then filing it with the state might sound like a big task, but you’ll be happy to know it’s a surprisingly straightforward process! Especially when you work with us at BEST SURETY BOND COMPANY, we’ve gone the extra mile to make our online application super quick and easy.

We’re here to guide you every step of the way. Here’s a simple, step-by-step guide to get you commissioned and ready to notarize:

Step 1: Purchase Your Bond from BEST SURETY BOND COMPANY

Your very first step, and often the easiest, is to secure your essential $10,000 Texas Notary Bond. You can do this right through our website! We pride ourselves on offering fast approvals and keeping the texas notary surety bond cost as low as possible, ensuring you get the best value without compromising on speed or service.

Our online bond applications are designed for ultimate efficiency. Simply hop onto our website, select the Texas Notary Bond option, provide your basic information, and complete our secure payment process. You’ll love our same-day service; in most cases, your bond can be issued instantly and delivered straight to your email inbox within minutes. That means no waiting around for snail mail! You’ll have your official bond documentation ready for the next step almost immediately.

Step 2: Complete the State Application

Once you have your bond documentation safely in your email, the next crucial step involves the Texas Secretary of State. You’ll need to complete their official state application to get your Notary Public commission.

The primary form you’ll need is the Completed Form 2301. You’ll submit this form, along with your shiny new bond, through the state’s convenient SOS Portal Notary System. This portal allows for electronic filing, making the whole process much faster. During your online application, you’ll be prompted to upload your bond documentation (the form we emailed you) and pay the mandatory $21 state application fee. A pro tip: make absolutely sure that the name on your bond form matches the name you submit on your online application exactly. This helps avoid any frustrating delays!

While electronic filing through the SOS Portal Notary System is the most common and efficient method, you do have the option to mail or physically deliver your completed application and bond documentation to the Texas Secretary of State. However, for sheer speed and convenience, the online portal is definitely the preferred route.

Step 3: Receive Your Commission

After you’ve successfully submitted your complete application, bond, and paid the state fee, the Texas Secretary of State will review your submission. This approval process typically moves quite smoothly, especially if all your documentation is in order and you meet the state’s basic qualifications (like being at least 18 years old, a legal resident of Texas, and having no disqualifying criminal convictions).

Once your application gets the green light, you’ll receive an exciting email notification from the state. This email will include a link to your official commission certificate. Congratulations! With your commission officially in hand, you are now fully ready to start notarizing documents across Texas. Your commission is valid for four years, running concurrently with your bond term. And don’t worry, we’ll be right here to help you renew when the time comes!

Frequently Asked Questions about Texas Notary Bonds

We know you might have more questions about becoming a Texas Notary. It’s natural to wonder about the details, especially regarding the texas notary surety bond cost and how everything works. Here are some of the most common questions we hear, broken down simply for you.

How long is a Texas Notary Bond valid?

That’s a great question! Your Texas Notary Bond is valid for a full four-year term. This term runs perfectly alongside your four-year notary public commission. Think of them as a pair – they start and end at the same time.

To keep notarizing legally, it’s super important to renew both your commission and your bond before their expiration date. We’ll be here to help you when that time comes!

What happens if a claim is made against my bond?

This is a really important point to understand. Your bond is there to protect the public. So, if someone experiences financial harm because of a notarial error or misconduct on your part, they might file a claim against your bond.

If their claim is investigated and found to be valid, our surety company will pay them for their loss, up to the $10,000 bond limit.

Now, here’s the key: the bond is not insurance for you. It doesn’t protect your personal finances directly. If we pay out a claim on your behalf, you are then legally required to pay that money back to us, the surety company. This “indemnification” makes sure notaries are careful and perform their duties correctly every time. It’s a big reason why notaries are so trusted!

Can I get a Texas Notary Bond with bad credit?

Absolutely, yes! This is excellent news for many aspiring notaries. The texas notary surety bond cost is very straightforward, and your credit score simply doesn’t play a role.

The Texas Notary Bond is considered a low-risk bond. Because of this, the premium is a fixed, affordable $50 for the entire four-year term. We don’t run a credit check for this type of bond. So, whether your credit is perfect or you’ve had some bumps in the road, it won’t affect your ability to get bonded or the price you pay. It’s the same low cost for everyone, making it super accessible!

Get Bonded Fast and Affordably in Texas

So, we’ve walked through the ins and outs of becoming a Texas Notary Public, and hopefully, demystified the texas notary surety bond cost for you. It really is quite affordable! For just $50, you secure your bond for a full four-year term. That’s incredible value for a state-required protection.

Our goal at BEST SURETY BOND COMPANY is to make this essential step as simple and stress-free as possible. We understand you’re busy, and getting your notary commission shouldn’t involve complicated paperwork or hidden fees. That’s why we pride ourselves on offering fast approvals and low rates, ensuring you can meet state compliance quickly and confidently.

Think of us as your friendly guide in surety bonds. We’ve streamlined the entire process. No more navigating confusing forms or waiting weeks for approval. Just a few clicks, and you’re well on your way to earning your notary commission.

Ready to take that final, easy step? Don’t let anything hold you back from serving your community as a commissioned Texas Notary Public. We’re here to help you get bonded fast and affordably in Texas.

Ready to take the next step in your notary journey? Let’s get you set up today!