Why Insurance License and Permit Bonds Are Required for Business Operations

What is an insurance license and permit bond is a surety bond required by government agencies that guarantees insurance professionals will comply with state laws and regulations while conducting business. Here’s what you need to know:

Quick Answer:

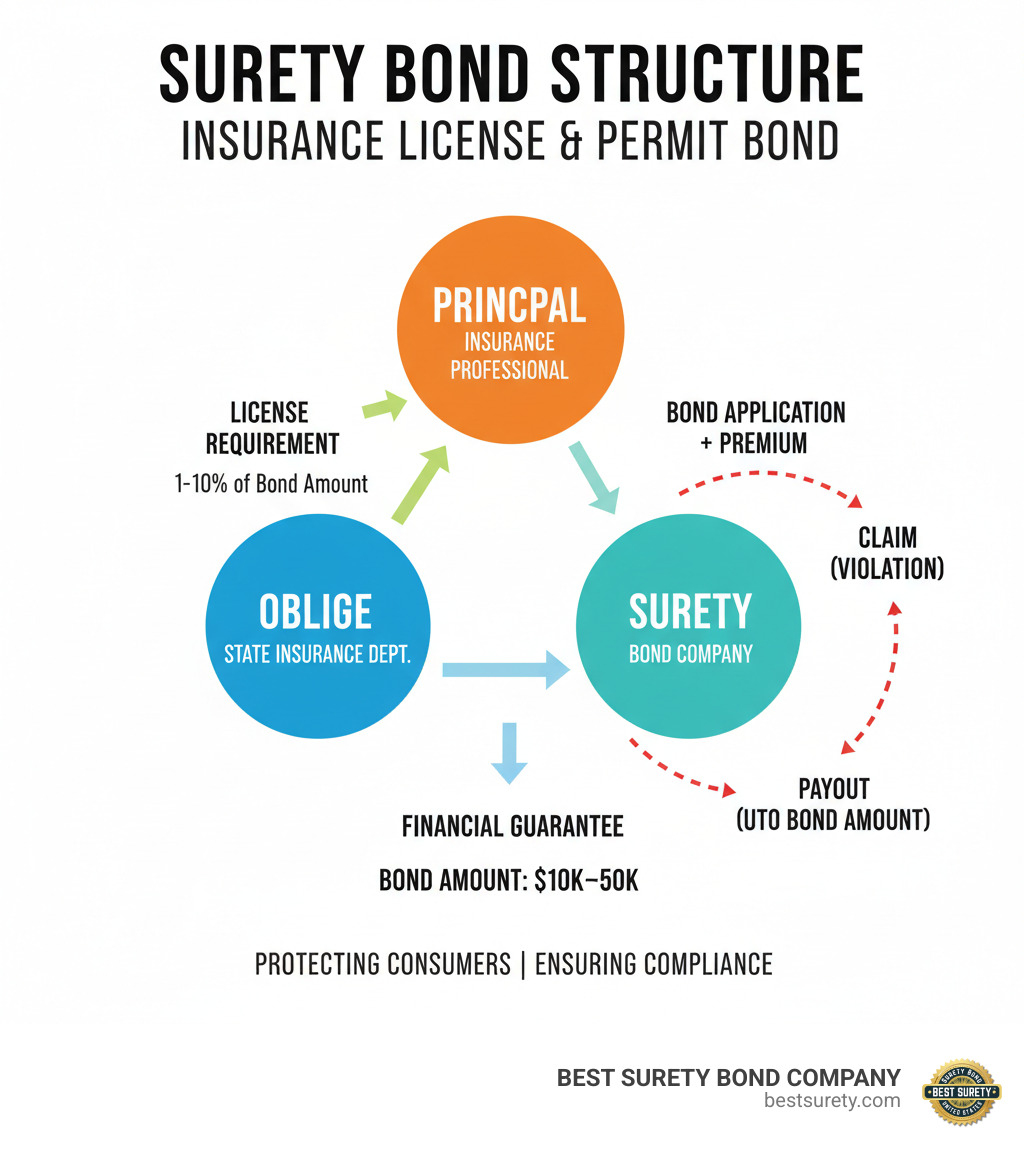

- Type: Commercial surety bond (three-party agreement)

- Purpose: Protects consumers from insurance professional misconduct

- Required by: State insurance departments and licensing boards

- Bond Amount: Typically $10,000-$50,000 depending on state requirements

- Cost: Usually 1-10% of the bond amount annually

- Parties: Principal (insurance professional), Obligee (state agency), Surety (bond company)

If you’re an insurance broker, agent, or adjuster in Texas or any other state, you likely need this bond before you can legally operate. The bond acts as a financial safety net – if you violate licensing laws or harm a client through unethical practices, the bond provides compensation up to the bond amount.

License and permit bonds are a generalized class of commercial surety required by government agencies as a prerequisite to starting certain businesses. They protect consumers by guaranteeing businesses adhere to laws and other regulations.

Getting bonded isn’t the same as getting licensed – you need both. The license gives you legal permission to operate, while the bond guarantees you’ll follow all the rules that come with that license.

What is an Insurance License and Permit Bond and Who Needs One?

Picture this: you’re ready to launch your insurance career in Texas, but there’s one final hurdle – getting bonded. Don’t worry, you’re not alone in wondering what is an insurance license and permit bond and why it’s standing between you and your business dreams.

Think of a license and permit bond as your professional promise, backed by real money. It’s a three-party contract that works like this: you (the principal) promise to follow all the rules, a government agency like the Texas Department of Insurance (the obligee) requires this promise, and a surety company like us (the surety) guarantees you’ll keep your word. If you break that promise, we step in to make things right – but then you’ll need to pay us back.

This isn’t just bureaucratic red tape. These bonds serve as a financial guarantee that protects consumers from unethical business practices. When clients see you’re bonded, they know there’s real financial backing behind your professional conduct. It’s regulatory compliance that actually builds trust.

At BEST SURETY BOND COMPANY, we’ve helped thousands of Texas professionals steer these requirements. We’re proud to offer comprehensive commercial surety solutions to businesses across the Lone Star State and nationwide.

Defining what is an insurance license and permit bond

Here’s where things get interesting – and where many people get confused. What is an insurance license and permit bond isn’t actually insurance at all. It’s a surety bond, and the difference matters more than you might think.

When you buy insurance, you’re protecting yourself from financial loss. But when you get a surety bond, you’re protecting your clients and the public from your potential mistakes or misconduct. It’s essentially the opposite of insurance – it protects everyone except you.

Here’s how it works in practice: if you mishandle client funds or violate state regulations, the harmed party can file a claim against your bond. We’ll investigate the claim, and if it’s valid, we’ll pay out damages up to the bond amount. But here’s the catch – you’re still on the hook to reimburse us for every penny we pay out, plus costs.

This structure ensures consumer protection while demonstrating your commitment to ethical conduct. It’s your way of saying, “I’m so confident in my professionalism that I’m willing to put money behind it.” States like Texas take this seriously – insurance brokers are required to file surety bonds under state insurance codes, showing how widespread these requirements have become.

Who Requires These Bonds in Texas and Other States?

If you’re working in the insurance industry, chances are good you’ll need a bond. Texas, like most states, requires bonds for professionals who handle client money, make important decisions on behalf of others, or work in industries where consumer protection is paramount.

In the insurance world, this typically includes insurance brokers who help clients find coverage, property & casualty agents who sell policies, personal lines agents handling individual insurance needs, and public adjusters who advocate for policyholders during claims. Each of these roles involves significant trust and potential financial impact on consumers.

State licensing boards don’t just suggest these bonds – they require them. The Texas Department of Insurance and similar agencies across the nation take these requirements seriously. Before you can even apply for your license, you’ll need proof that you’re bonded.

What makes this tricky is that requirements vary by state, and sometimes even by municipality. A bond that works in Houston might not meet requirements in Dallas, and Texas requirements are different from those in other states. That’s where our national reach comes in handy – we’re licensed in all 50 states and understand the specific requirements wherever your business takes you.

The good news? Once you understand the process, getting bonded is usually straightforward. Most insurance professionals need bonds ranging from $10,000 to $50,000, and with good credit, you’ll typically pay just 1-3% of the bond amount annually. It’s a small price for the professional credibility and legal compliance that keeps your business running smoothly.

How Insurance License Bonds Work and Common Examples

When you’re trying to understand what is an insurance license and permit bond, it helps to see the bigger picture of how these financial guarantees actually work in practice. Think of it like a safety net that’s always there, even though you hope you’ll never need it.

The beauty of the surety bond system lies in its three-party structure. You, as the insurance professional, make a promise to follow all the rules. We, as your surety company, back up that promise with our financial strength. And the state agency gets peace of mind knowing that if something goes wrong, there’s money available to make things right for consumers.

When a claim is made against a license and permit bond, the process generally involves several key steps. The process is designed to be fair but thorough, ensuring legitimate claims are paid while protecting against fraudulent ones.

The Mechanics: From Application to a Potential Claim

Here’s how the bond process unfolds in real life. When you first apply with us at BEST SURETY BOND COMPANY, you’re entering into that crucial three-party agreement. You promise the state licensing board (the obligee) that you’ll follow all insurance laws and regulations. We guarantee your promise with our financial backing.

Most of the time, everything goes smoothly. You conduct your insurance business ethically, your clients are happy, and the bond just sits quietly in the background doing its job. But occasionally, things can go sideways.

When a claim happens, here’s the step-by-step process: First, someone alleges you’ve violated licensing laws, perhaps through fraudulent acts or mishandling client funds. Next, either a harmed consumer or the state agency files a claim against your bond seeking compensation. We then step in as investigators, thoroughly examining the claim to determine if it’s valid – think of us as financial detectives working to get to the truth.

If we determine the claim is legitimate, we’ll pay the claimant up to your bond amount. But here’s the key difference between a bond and insurance: you’re still on the hook financially. Through the indemnity agreement you signed, you’re responsible for reimbursing us for any amounts we paid out, plus legal fees and expenses.

This system ensures that harmed parties get compensated quickly while maintaining accountability. It’s not a “get out of jail free” card – it’s more like having a financially responsible friend who will cover your mistakes but expects you to pay them back.

Common License and Permit Bonds for Texas Professionals

Here in Texas, we see a wide variety of professionals who need license and permit bonds. While we’re focusing on insurance bonds, it’s helpful to understand the broader landscape of how these financial guarantees protect consumers across different industries.

Insurance professionals are among our most common clients. Insurance Broker Bonds ensure that brokers handle client premiums properly and follow state insurance codes. Insurance Adjuster Bonds guarantee that claims adjusters investigate fairly and ethically – crucial when someone’s already dealing with the stress of a claim.

Mortgage Broker Bonds are another area where we see overlap with insurance, since mortgage brokers often work closely with insurance products and need to demonstrate their commitment to ethical lending practices.

Beyond insurance, we help many other Texas professionals meet their bonding requirements. Notary Bonds protect the public when documents are being witnessed and signed. We’re also experts in Auto Dealer Bonds, which are particularly important in Texas’s robust automotive market. More info about Texas auto dealer bonds

Contractor License Bonds represent another major category, ensuring that construction professionals adhere to building codes and honor their contracts. More info about Texas contractor bonds

What ties all these bonds together is their fundamental purpose: protecting consumers while giving professionals the credibility they need to operate. Whether you’re selling insurance policies in Houston or adjusting claims in Dallas, your bond demonstrates that you’re serious about following the rules and treating your clients fairly.

The Cost and Process of Getting Your Bond

Let’s talk about the elephant in the room – cost. When we meet with clients at our Houston office, the first question is almost always, “What’s this going to cost me?” I get it. You’re trying to budget for your new business or license renewal, and every dollar matters.

Here’s the good news: what is an insurance license and permit bond costs are typically much more affordable than most people expect. The premium you pay is just a small percentage of the total bond amount – think of it like a yearly membership fee that keeps your license active and your clients protected.

How Much Does an Insurance License and Permit Bond Cost?

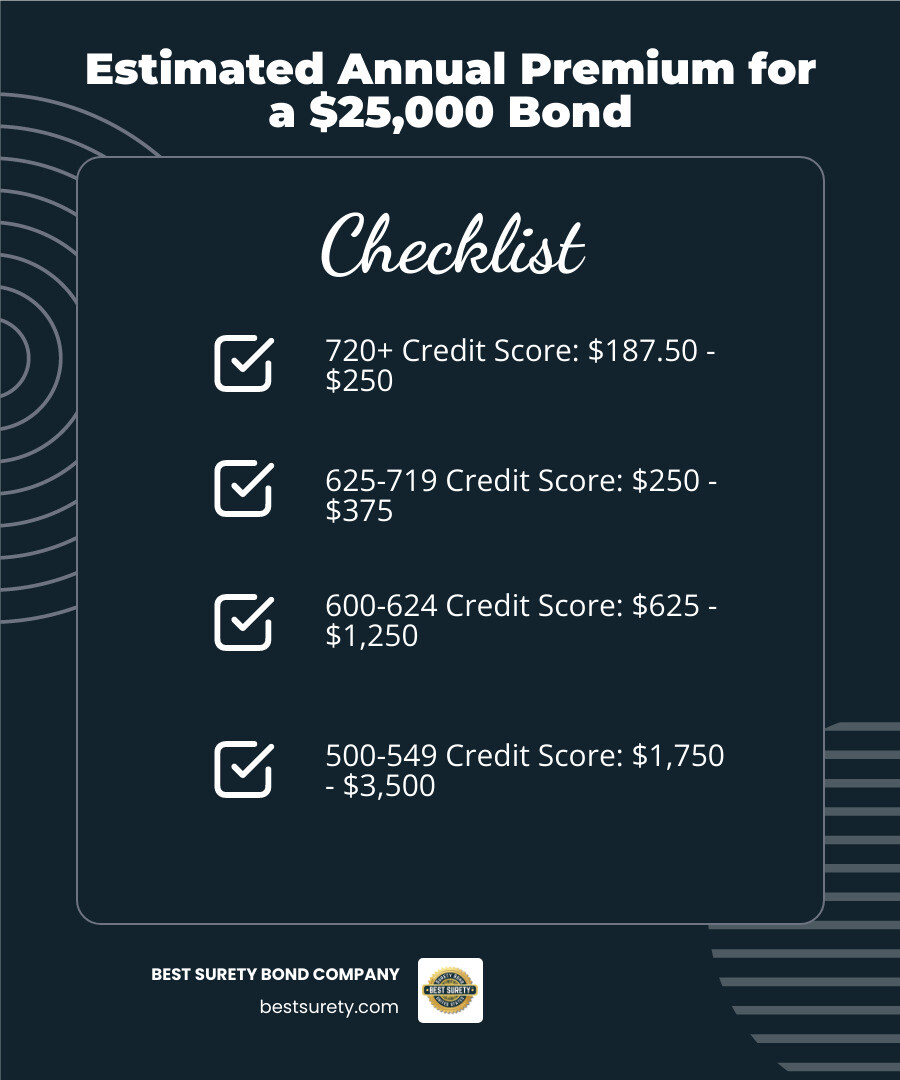

The annual premium for your insurance license and permit bond typically ranges from 1% to 10% of the total bond amount. Most government agencies require bonds under $50,000 for these professional licenses, which means you’re usually looking at somewhere between $200 to $500 annually.

Your credit score plays the starring role in determining exactly where you’ll land in that range. If you’ve got solid credit (700 or above), you’re in the sweet spot for the lowest rates – sometimes as low as 1% to 3% of the bond amount. Lower credit scores mean higher premiums, potentially reaching 5% to 10% or more, but here’s what’s important: bad credit doesn’t disqualify you. We work with surety companies that specialize in helping folks with less-than-perfect credit get bonded.

During our underwriting process, we look at factors beyond just your credit score. Your business experience, financial stability, and the specific bond requirements all play a role in getting you the best possible rate.

| Credit Score Range | Estimated Annual Premium for a $25,000 Bond |

|---|---|

| 720+ | $187.50 – $250 |

| 625 – 719 | $250 – $375 |

| 600 – 624 | $625 – $1,250 |

| 575 – 599 | $750 – $1,500 |

| 550 – 574 | $1,250 – $2,500 |

| 500 – 549 | $1,750 – $3,500 |

Your Fast-Track Guide to Obtaining a Bond

Getting bonded doesn’t have to feel like navigating a government maze. We’ve streamlined the entire process because we know you want to get back to focusing on your business, not paperwork.

First, identify your specific requirements. Every state has slightly different bond amounts and filing procedures. Texas might require a $25,000 bond for insurance brokers, while another state could require $50,000. Not sure what you need? Give us a call – our Texas surety experts know these requirements inside and out.

Next, apply online for an instant quote. Our application takes just a few minutes to complete. You’ll provide basic business information, personal details, and answer a few questions about your credit and business history. For standard license bonds, you’ll often see your quote immediately on screen.

Same-day issuance is our specialty. Once you’ve selected your quote and completed payment, we can usually have your bond documents ready within hours, not days. We’ve bonded over 10,000 clients using this streamlined approach, and it works.

Finally, file your bond with the appropriate government agency. We’ll provide you with the official bond documents and clear instructions on where and how to file them. Some agencies accept electronic filing, while others still require paper documents – we’ll let you know exactly what your situation requires.

The whole process from application to having your bond in hand typically takes less than 24 hours. Ready to get started?

Apply for your license and permit bond online now!

Comparing Bond Types and Understanding Violations

The surety bond world might seem overwhelming at first, but once you understand the different categories, everything starts to make sense. Think of it like understanding different types of insurance – each serves a unique purpose. What is an insurance license and permit bond fits into a specific category that’s all about regulatory compliance and consumer protection.

Surety bond categories generally fall into regulatory versus performance guarantees, and knowing the difference helps you understand exactly what you’re getting into. License and permit bonds are all about legal compliance – they’re your promise to follow the rules. Construction bonds, on the other hand, are about getting the job done right. It’s the difference between “I’ll play by the rules” and “I’ll finish what I started.”

More info about construction surety bonds

Professional ethics play a huge role in license bonds, especially in the insurance industry where you’re handling people’s most important financial protections. That’s why Texas and other states take these requirements so seriously.

What is the difference between an insurance license and permit bond and other surety bonds?

Here’s where things get interesting – not all surety bonds are created equal, and understanding the differences can save you time, money, and confusion down the road.

License and Permit Bonds are what we’re focusing on here. These are required by government entities before they’ll grant you permission to do business. Think of them as your “good behavior guarantee” – they ensure you’ll follow all applicable laws, regulations, and ethical standards. They’re specifically designed to protect consumers and the public from professional misconduct.

Construction Bonds operate in a completely different arena. These guarantee that contractors will complete projects according to contract terms, pay their subcontractors, and deliver what they promised. If you’re building a bridge, this bond ensures it gets built. If you’re selling insurance, a license bond ensures you do it ethically.

Court Bonds are required by courts to ensure people fulfill court-appointed duties or follow court orders. These might include probate bonds for estate executors or appeal bonds for legal proceedings. More info about court surety bonds

Commercial Bonds is actually the broader umbrella that includes license and permit bonds, but this category also covers things like fidelity bonds (protecting against employee theft) and supply bonds (guaranteeing delivery of goods).

The key difference with license and permit bonds is their regulatory nature. They’re tied directly to your legal right to operate and the ethical conduct required to maintain that right. Other surety bonds might guarantee you’ll complete a project or follow a court order, but license bonds guarantee you’ll follow the professional rules that come with your license.

This isn’t insurance – it’s a guarantee of performance where you’re ultimately responsible for reimbursement if something goes wrong. The surety versus insurance distinction is crucial here.

Consequences of Violating Bond Terms

Let’s be honest – nobody goes into business planning to violate their bond terms. But understanding what happens if things go wrong isn’t just smart business planning; it’s essential for protecting your livelihood.

When we talk about violations, we’re looking at fraudulent acts, misrepresentation, or failure to follow licensing regulations. These aren’t minor infractions – they’re serious breaches that can trigger a cascade of consequences that could end your career in insurance.

The immediate financial impact hits first. The surety company pays out the claim to whoever was harmed, but that’s just the beginning of your financial obligations. You’re legally bound to reimburse every dollar paid out, plus legal fees and expenses. Think of it as an expensive loan you never wanted to take.

License revocation is often the most devastating consequence. The Texas Department of Insurance doesn’t mess around when it comes to bond violations. Lose your license, and you can no longer legally sell insurance – period. Your business essentially stops overnight.

Fines and penalties from regulatory authorities pile on top of everything else. These can be substantial, especially for serious violations involving consumer harm or fraudulent practices. We’re talking about penalties that can reach tens of thousands of dollars.

Legal action doesn’t stop with the bond claim. Aggrieved clients can file direct lawsuits, and regulatory agencies might pursue additional enforcement actions. You could find yourself fighting legal battles on multiple fronts.

The reputational damage might be the hardest to recover from. In the insurance industry, trust is everything. News of bond claims or license violations spreads quickly through professional networks and can make it nearly impossible to rebuild your business, even if you eventually get your license back.

All of this leads to operational disruption that can force you to cease operations entirely. Between legal battles, financial obligations, and reputation repair, many businesses never recover from serious bond violations.

The bottom line? Understanding and following your bond terms isn’t just paperwork – it’s the foundation that keeps your insurance business running legally and ethically in Texas and beyond.

Frequently Asked Questions about Insurance License and Permit Bonds

We get it – surety bonds can feel overwhelming at first. That’s why our team at BEST SURETY BOND COMPANY loves answering questions from professionals across Texas and beyond. Whether you’re starting your insurance career in Houston or expanding your practice nationwide, these are the questions that come up most often in our conversations.

Is being “licensed and bonded” the same thing?

This is probably our most common question, and the answer is a definitive no – they’re completely different things that work together. Think of it this way: your license is like getting permission from your parents to drive the car, while your bond is like having car insurance to protect everyone else on the road.

More specifically, a license grants legal permission to operate from a government entity like the state of Texas. It proves you’ve met all the educational requirements, passed the necessary exams, and demonstrated you know what you’re doing. A bond is a separate financial guarantee that you will follow all laws and regulations associated with that license.

You absolutely need both to operate legally. The license lets you do the work, and the bond protects your clients and the public if something goes wrong. It’s a partnership that builds trust and ensures everyone’s protected.

Can I get a license and permit bond in Texas with bad credit?

Here’s some good news that might surprise you: yes, you absolutely can get bonded even with less-than-perfect credit. While a lower credit score typically results in a higher premium, many surety providers specialize in offering bonds to applicants with less-than-perfect credit, ensuring you can still meet your licensing requirements.

We’ve worked with thousands of professionals who thought their credit would be a roadblock. The reality is that bad credit doesn’t disqualify you – it just means you’ll pay a bit more for your premium. We have relationships with multiple surety companies specifically because we want to find solutions for everyone, regardless of their financial history.

Don’t let past credit challenges stop you from pursuing your insurance career. Our Houston-based team has helped countless professionals get bonded and get back to business, even when other companies turned them away.

How long does an insurance license bond last?

The term of a license bond usually matches the term of the professional license it supports, which is often one or two years. The bond must be renewed along with your license to remain in compliance.

Here’s what’s important to remember: your bond needs to stay active for as long as you want to keep your license. If your Texas insurance license is good for two years, your bond needs to cover that entire period. We’ll send you renewal reminders well before your bond expires, so you never have to worry about accidentally letting it lapse.

Most of our clients find the renewal process even easier than the initial application. Since we already have your information on file and you’ve established a payment history, renewals often happen with just a quick phone call or online update. It’s one less thing to stress about when you’re busy growing your business.

Conclusion: Secure Your Texas Business with the Right Bond

When you truly understand what is an insurance license and permit bond, you’re not just checking off a regulatory requirement – you’re taking a meaningful step toward building a business that clients can trust completely. These bonds represent far more than paperwork; they’re your public commitment to ethical practices and professional excellence.

Think about it from your client’s perspective. When they see that you’re properly bonded, they know you’ve put your money where your mouth is. You’ve guaranteed that if something goes wrong, they have financial protection. That peace of mind is invaluable in the insurance industry, where trust is everything.

At BEST SURETY BOND COMPANY, we’ve made it our mission to remove every possible barrier between you and getting bonded. Whether you’re starting your first insurance agency in Houston or expanding your practice across Texas, we understand that time is money – and every day without your bond is a day you can’t serve clients.

Our fast approvals and low rates aren’t just marketing buzzwords. They’re the result of our streamlined processes and deep relationships within the surety industry. We’re Houston’s trusted surety provider, but our reach extends to all 50 states, giving you the local expertise you want with the national authority you need.

The beauty of working with us is that you get both human service and digital convenience. Need to speak with someone? Our Texas-based experts are here for you. Want to handle everything online at 2 AM? Our platform is ready when you are.

Don’t let bonding requirements become the bottleneck in your professional journey. Your future clients are waiting, and every day you delay is a day your competitors get ahead. Take control of your licensing requirements today and show the world you’re serious about doing business the right way.

Get your instant quote for a Texas license and permit bond today!