Why Your Auto Dealer Bond is Your License to Operate

Every auto dealer knows that a valid license is non-negotiable. Crucial to maintaining that license is your annual auto dealer bond renewal. It’s not just a piece of paper; it’s your promise to the state and your customers that you’ll operate ethically.

Here’s what you need to know about auto dealer bond renewal:

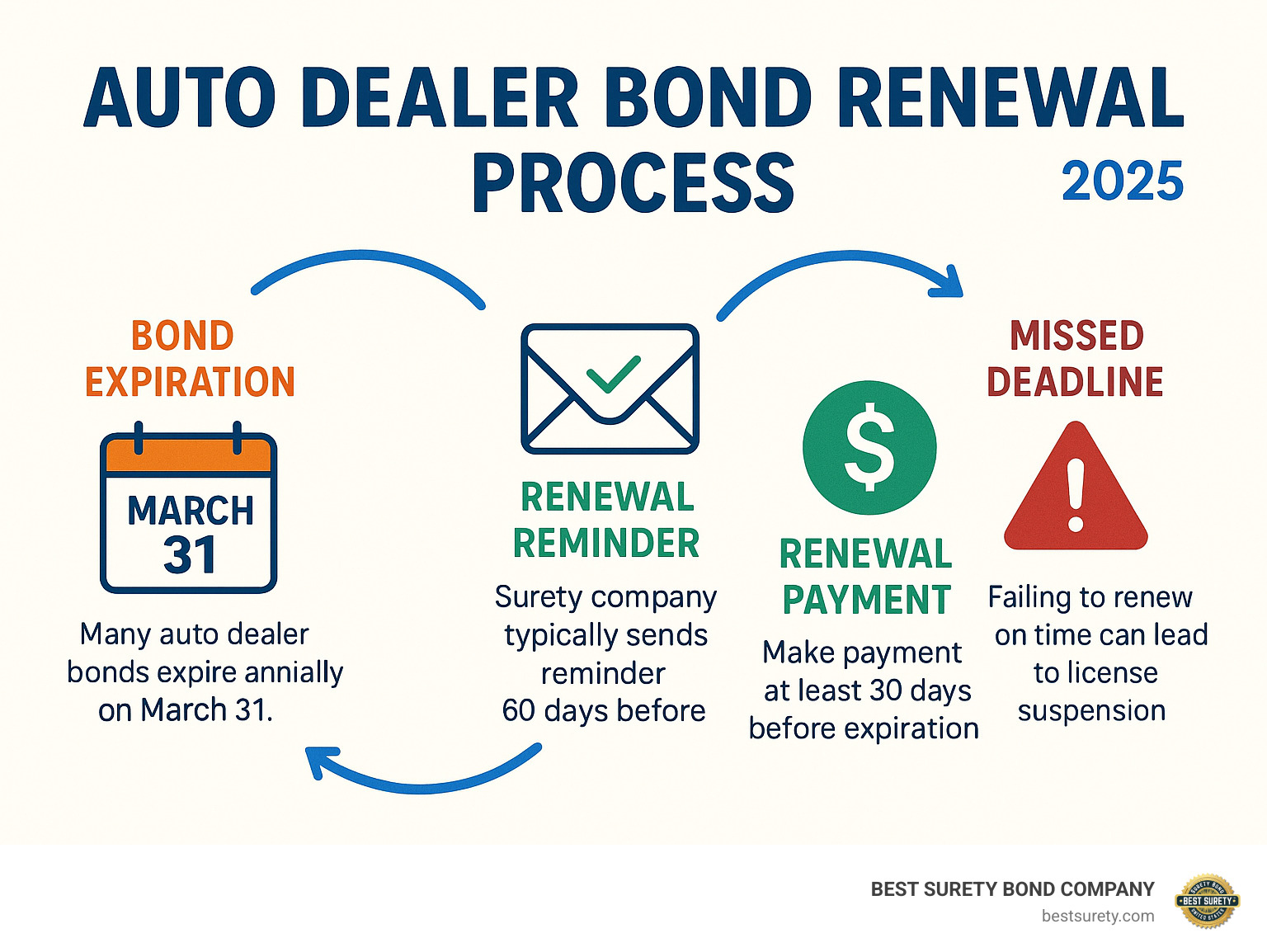

- When do bonds expire? Most auto dealer bonds expire annually. Many states, like New Jersey, have a March 31st deadline, while others, such as Illinois, Louisiana, Montana, Nebraska, Oklahoma, and Rhode Island, use December 31st.

- What’s the timeline? Surety companies typically send renewal reminders 60 days before the bond’s deadline. You’ll usually need to make your renewal payment at least 30 days before your bond and license expire.

- How much does it cost? The annual premium for an auto dealer bond usually ranges from 1% to 10% of the total bond amount. For example, a $10,000 bond might cost $100-$300 for someone with excellent credit (over 700), but $500-$1,000 for those with lower scores (below 599).

- What if I miss it? Failing to renew on time can lead to serious problems, including license suspension, fines, and even business interruption.

I’m Haiko de Poel. With over two decades of experience scaling businesses and navigating complex regulatory landscapes, I specialize in streamlining processes like your annual auto dealer bond renewal.

Auto dealer bond renewal glossary:

The Critical Link Between Your Bond and Your Dealer License

Imagine your auto dealer license as the engine of your business. Now, think of your auto dealer bond as the essential oil that keeps that engine running smoothly. It’s not just a nice-to-have; it’s a mandatory requirement in most states, acting as your promise of legal compliance. Without it, your license is essentially on shaky ground.

This bond isn’t just about ticking a box; it’s a critical financial guarantee that you, as a dealer, will stick to state laws and regulations. It’s all about protecting consumers from any potential fraudulent practices or financial losses that might occur due to a dealer’s actions. It also protects the state, ensuring you pay all your taxes and follow licensing rules.

Here’s how it works: the bond acts as a safeguard. If, for example, there’s a valid claim against you – maybe a customer was misled about a car’s condition, or a deal went sour – the affected party can file a claim against your bond. Your surety company steps in, investigates, and if the claim is legitimate, they pay the claimant. But remember, you, the dealer, are ultimately responsible for reimbursing the surety company for any amount paid out. It’s like a safety net for everyone else, not a free pass for you.

Failure to maintain an active bond can bring your business to a screeching halt. We’re talking immediate business interruption and the very real risk of license suspension. Can you imagine showing up to your dealership one morning only to find a “Business License Suspended” notice on your door because your bond lapsed? Not exactly the start to a profitable day! Keeping your bond active and in good standing ensures you maintain that crucial relationship with the state DMV and avoid these truly uncomfortable scenarios.

Understanding Bond Expiration and Renewal Deadlines

Just like your car needs its annual inspection, most auto dealer bonds, require annual renewal. The exact expiration dates can vary by state, so it’s super important to know your specific deadline. As you might know, New Jersey bonds, for instance, typically expire on March 31st. On the other hand, six states – including Illinois, Louisiana, Montana, Nebraska, Oklahoma, and Rhode Island – align their deadlines with December 31st for both their license and surety bond.

Don’t wait for a last-minute scramble! Reputable surety companies like BEST SURETY BOND COMPANY are usually on the ball and will send you renewal invoices or reminders well in advance, often at least 60 days before your bond’s deadline. This generous notice period gives you plenty of time to get everything in order. A good rule of thumb is to aim for your auto dealer bond renewal payment to be made at least 30 days before your bond and license are set to expire. Being proactive ensures continuous coverage and helps you steer clear of any dreaded lapses!

The Step-by-Step Auto Dealer Bond Renewal Process

Renewing your auto dealer bond with BEST SURETY BOND COMPANY is designed to be as smooth as a freshly waxed car rolling off your lot! We truly believe it should be a hassle-free experience, allowing you to focus on what you do best: selling cars and growing your business. Our goal is always fast approvals and low rates, making your annual renewal a breeze.

1. Receive Your Renewal Notice

The first step in a successful auto dealer bond renewal journey usually begins with us reaching out to you! As your dedicated surety partner, we understand how busy you are. That’s why we make sure to send out renewal notices well in advance – typically at least 60 days before your bond’s expiration date. You can expect these reminders via email or traditional mail, often including your renewal invoice. This ample notice gives you plenty of time to review your terms and prepare for the upcoming renewal, ensuring you never have to worry about missing your expiry. We’re here to give you that peace of mind!

2. Underwriting and Quoting

For your auto dealer bond renewal, we’ll go through a straightforward re-underwriting process. Now, don’t let that fancy word intimidate you! It simply means we’ll take a fresh look at your current standing to make sure we’re offering you the absolute best rate possible. This involves a soft credit check (good news: it won’t impact your credit score!), a quick review of your claims history, and a look at your overall financial stability. Factors like how long you’ve been in business and your industry experience also play a role in helping us assess your profile. Based on this, we’ll quickly provide you with your new, competitive premium. Our aim is always to secure you the most affordable rates for your bond!

3. Payment and Securing Your New Bond

Once you’re happy with your quote, the final step is incredibly simple: payment. We offer convenient online payment options to make this process as quick and easy as possible, fitting right into your busy schedule. After your payment is processed, we’ll promptly issue a continuation certificate or a new bond form. Think of this document as your official proof that your bond remains in full force for another term. You’ll then file this with your state’s licensing authority, such as the New Jersey Motor Vehicle Commission, to prove your continuous coverage. This simplified process, including options for digital submission, is all part of our commitment to providing top-tier license and permit bond services, keeping your dealership running smoothly without interruption.

Decoding Your Renewal Premium: What Affects the Cost?

The cost of your auto dealer bond renewal isn’t just a fixed price, like a sticker on a new car. Instead, it’s a dynamic figure that dances to the tune of several key factors. Primarily, we look at your financial health and your claims history. Think of it as a personalized quote, custom to your dealership’s unique profile. Let’s peel back the layers and understand what truly determines your premium.

How Your Credit Score Impacts Your Auto Dealer Bond Renewal Rate

Your personal credit score is hands down one of the most important pieces of the puzzle when calculating your bond premium. Why does it matter so much? Because it’s a strong indicator of your financial responsibility. Surety companies use it to gauge how likely you are to repay them if, heaven forbid, a claim is ever paid out on your bond. It’s all about assessing the risk.

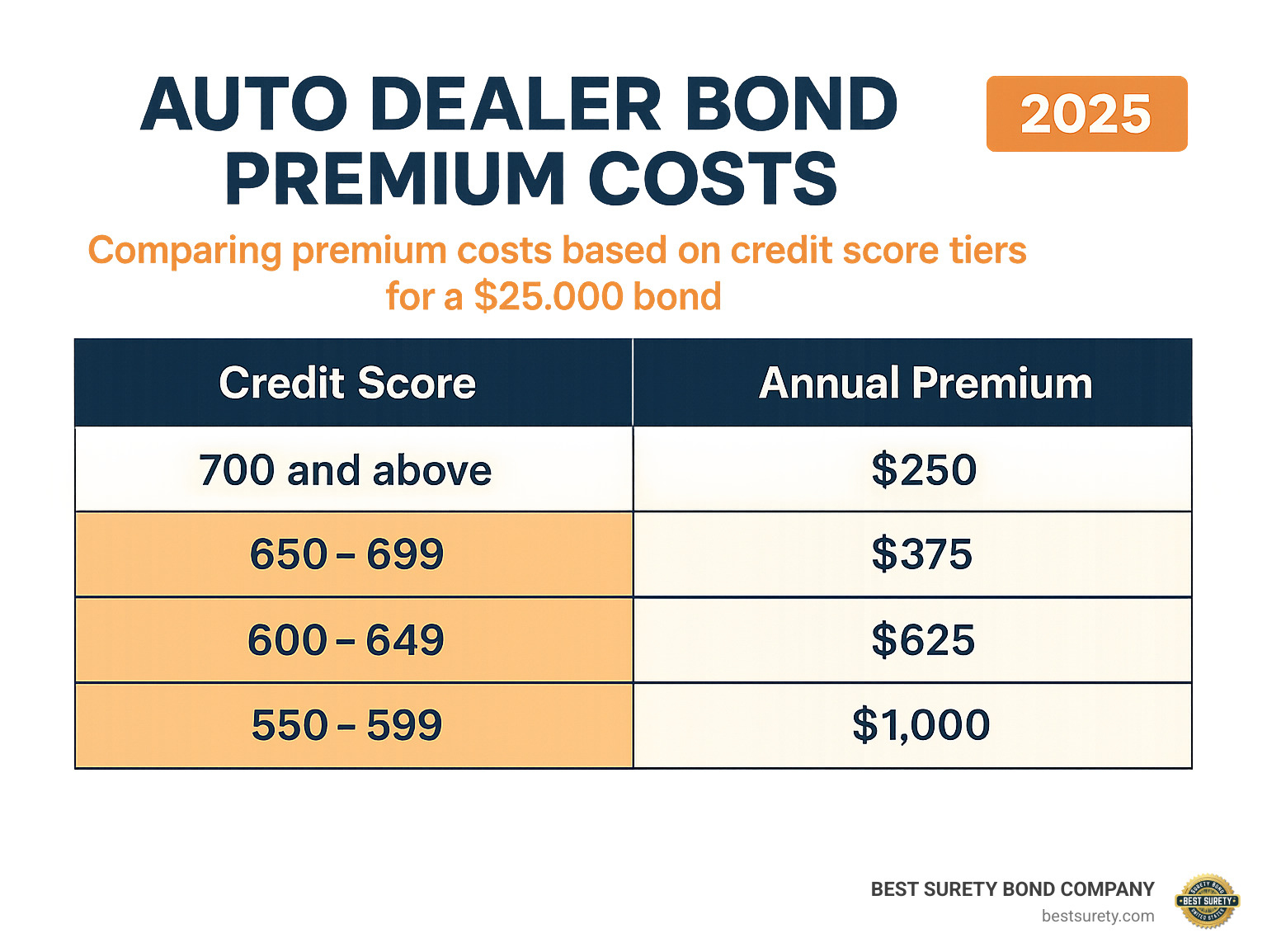

So, how does that translate into dollars and cents for your auto dealer bond renewal? Let’s consider a common bond amount, like a $25,000 auto dealer bond. If your credit score is 700 or above, you’re seen as a low-risk, responsible dealer. This often means you’ll enjoy the lowest rates, perhaps paying as little as 1% to 3% of the bond amount annually, which would be around $250-$750. You’ve earned that favorable rate!

Now, if your credit score falls between 600-699, you might find your premium in the mid-range, typically around 3% to 5% of the bond amount. For that same $25,000 bond, this could mean an annual premium of $750-$1,250. And if your credit score is below 599, you’re considered a higher risk, and your premium could climb to 5% to 10% or more, putting your annual cost for a $25,000 bond anywhere from $1,250 to $2,500 or even higher.

The takeaway? Keeping your credit score strong is one of the very best ways to secure the most affordable rates for your auto dealer bond renewal. We get it, life happens, and sometimes credit scores can take a dip. But don’t let that discourage you! Even with a less-than-perfect credit history, BEST SURETY BOND COMPANY is dedicated to working with you, exploring every option to find competitive rates that keep your dealership moving forward.

The Role of Claims History and Business Finances

Beyond your credit score, your dealership’s claims history plays a huge role in your renewal cost. Think of it like a “no-claims bonus” for your car insurance. If you’ve maintained a clean record with no claims paid against your bond, you’re likely to be rewarded with discounts or more favorable rates. It shows you’re running a tight, trustworthy ship!

On the flip side, if there have been valid claims paid out against your bond, it signals a higher risk to the surety. This can, unfortunately, lead to an increase in your premiums when it’s time for your auto dealer bond renewal. It’s simply how sureties balance the risk.

Surety companies also peek into your overall business finances. They consider factors like how many years you’ve been in business and your industry experience. An established dealership with a solid track record of ethical operations and financial stability generally looks more appealing than a brand-new venture. At BEST SURETY BOND COMPANY, we’re here to help you highlight all your strengths and present the strongest possible case for the most affordable premiums, ensuring your dealership’s success isn’t bogged down by unnecessary costs.

The High Cost of Delay: Consequences of a Lapsed Bond

Imagine the unexpected: one day, your dealership is busy, and the next, it’s forced to halt operations. Sounds like a nightmare, right? Well, for auto dealers, letting your auto dealer bond renewal slip can quickly turn that nightmare into reality. It’s not just a minor hiccup; it can have truly massive consequences for your business.

License Suspension and Reinstatement Problems

The moment your bond lapses, your dealer license is at risk. It’s an automatic process. When your surety company (like us at BEST SURETY BOND COMPANY!) sees that your bond isn’t renewed, we’re required to inform the state. And just like that, your license can be suspended.

What does license suspension mean for you? It means you have to immediately stop all your dealership activities – no buying, no selling, no dealing in vehicles. It’s a sudden, jarring halt to your livelihood and can lead to immediate business closure. Imagine the financial hit! Not only do you lose out on sales, but you might also face hefty fines and penalties from the state. In severe cases, your license could even be revoked entirely.

Getting your license back isn’t a quick fix either. You’ll likely face reinstatement fees, and the whole process can be long and complicated. Your business could remain stuck in limbo, unable to operate, for quite some time. It’s a situation we definitely want to help you avoid!

The Difference Between Renewal and Getting a New Bond After Cancellation

If your bond lapses or is canceled, obtaining a new bond is a much steeper hill to climb than a simple auto dealer bond renewal. It’s like trying to get a new car loan right after missing several payments – you’re seen as a higher risk, and that comes with a “red flag.”

First off, expect those premiums to jump significantly. Remember how your credit score and claims history affect your rates? A lapse screams “higher risk” to surety companies. You could end up paying up to 10% or more of the total bond amount, which is a lot more than you’d pay for a smooth renewal.

It also gets tougher to even find a surety company willing to work with you. Some might hesitate to bond a dealer with a history of lapses or cancellations, especially if there were claims involved. This can limit your options and push you into less favorable terms. And don’t forget the underwriting process! It becomes much stricter. Surety companies will dig deep into your financial situation and really scrutinize why your bond lapsed.

In the worst-case scenarios, especially with repeated non-compliance or major claims, you could even face outright denial. This would make it impossible to get a new bond and, sadly, to legally operate your dealership. Beyond the bond, you might even have to re-apply for your entire dealer license. That means going through all the initial steps again, like background checks and inspections – a huge headache no one wants.

This is why we can’t stress enough the importance of proactive auto dealer bond renewal. It’s not just about staying compliant; it’s about protecting the very future of your business and ensuring you can keep those doors open and cars moving!

Pro Tips for a Smooth and Affordable Renewal

Let’s be honest, nobody loves paperwork. But when it comes to your auto dealer bond renewal, a little proactive effort goes a long way. At BEST SURETY BOND COMPANY, we’re all about making this annual task as smooth and affordable as possible, keeping your dealership humming along like a perfectly tuned engine. Here are our top tips to make your next renewal a breeze:

-

Mark Your Calendar and Start Early: This might sound obvious, but procrastination is the enemy of a smooth renewal! Don’t wait until the last minute. Set reminders for 90, 60, and even 30 days before your bond’s expiration. While we always send out friendly reminders, your personal vigilance adds an extra layer of peace of mind. Getting a head start means you have plenty of time to address any issues and secure the best rates.

-

Maintain a Strong Credit Score: We’ve talked about this before, and it bears repeating: your credit score is a major player in determining your premium. A healthy score signals lower risk to sureties, translating into lower rates for you. So, keep those bills paid on time and manage your finances wisely. It’s an investment in your dealership’s financial future!

-

Keep a Clean Claims Record: Think of your bond as an ethical promise. Operating your dealership with integrity and addressing customer concerns promptly can prevent claims from ever being filed against your bond. A claims-free history is like a gold star on your record, often leading to more favorable renewal rates. It’s a win-win: happy customers and a happier wallet!

-

Work with a Responsive Surety Partner: This is where we come in! Choosing a surety company that communicates clearly, offers fast approvals, and provides excellent support can make all the difference. At BEST SURETY BOND COMPANY, we pride ourselves on being that trusted partner. We combine human service with digital convenience, ensuring you get the support you need, when you need it.

How to Prepare for Your Auto Dealer Bond Renewal

Being prepared isn’t just about marking dates; it’s about setting your business up for success. Here’s what you can do to get ready for your auto dealer bond renewal:

First, practice some financial housekeeping. Take a moment to regularly review both your personal and business financial statements. Ensuring all your accounts are in order helps paint a clear picture of your financial health, which is always a good thing, especially when it comes to securing favorable bond rates.

Next, focus on paying bills on time. We can’t stress enough how directly this impacts your credit score. And as you now know, a strong credit score is absolutely crucial for getting the best possible rates on your bond. It’s a simple habit with big financial rewards.

Also, make it a priority to resolve customer disputes quickly. Don’t let small issues fester and potentially escalate into a bond claim. Promptly addressing and resolving any customer complaints can save you a lot of headache, protect your reputation, and ultimately, save you money in the long run by keeping your claims record clean.

Finally, consider gathering financial documents. While BEST SURETY BOND COMPANY typically only needs a soft credit check for most renewals, having your recent financial statements, tax returns, and business records organized and ready can speed up the process if any further underwriting details are needed. Being prepared means less scrambling later!

Shopping for Better Rates

Even if you’ve been a loyal customer with the same surety company for years, it never hurts to explore your options. The market can shift, and your own financial situation might have improved, opening doors to even better rates for your auto dealer bond renewal.

Don’t hesitate to compare quotes. Reach out to different surety providers to get competitive offers. However, a word of caution: if a deal seems too good to be true, it probably is. Always verify the credibility of the provider.

This is where working with a surety specialist like BEST SURETY BOND COMPANY truly shines. We are experts in the surety bond market, with deep roots in Texas and a strong national reach. We can help you thoroughly understand your current bond terms and explore all available options for more affordable premiums. Our unwavering goal is to offer you the lowest rates in the industry while providing incredibly fast surety bond approval.

Before you start shopping, make sure you understand your current terms. Know your exact bond amount, your current premium, and, most importantly, your precise expiration date. This key information is essential when you’re requesting new quotes and comparing offers.

And if you do decide to switch, ensuring continuous coverage is paramount. A lapse in your bond, even for a single day, can lead to immediate license suspension and significant business interruption. At BEST SURETY BOND COMPANY, we can expertly guide you through a seamless transition, guaranteeing your bond remains active and your dealership stays compliant without a hitch.

Frequently Asked Questions about Auto Dealer Bond Renewals

We hear a lot of questions about auto dealer bond renewal, and we’re here to clear things up for you! We know it can feel a bit complex, but our goal is to make it as straightforward and stress-free as possible.

What happens if my credit score has gone down since my last renewal?

It’s a common concern, and we understand that life happens. If your credit score has taken a dip since your last auto dealer bond renewal, it’s likely that your premium will increase. This isn’t meant to be a punishment, but simply because the surety company views a lower credit score as an indicator of higher risk. You might also find we ask for a bit more detailed financial information to help us get a complete picture of your current situation.

The good news? Even if your credit isn’t perfect, it’s still absolutely possible to get bonded! Our team specializes in finding solutions for dealers with less-than-perfect credit, ensuring you can still buy a surety bond online and maintain your essential dealer license. We’re here to work with you and explore every option.

Can I switch surety companies during my renewal period?

Absolutely, you can shop for a new bond! In fact, it’s a really smart practice to ensure you’re always getting the best rates and the most responsive service for your auto dealer bond renewal. We encourage you to explore your options.

When you decide to switch, the process involves your new surety company issuing a brand-new bond to replace your old one. The most crucial step is to ensure there is no lapse in coverage. You must file this new bond with your state’s licensing authority before your old bond expires. This keeps your license active and your business running smoothly. We’re experts at helping you apply for a license bond with ease and ensuring a seamless transition, so you never have to worry about a gap in coverage.

What is a bond continuation certificate?

A bond continuation certificate is a really handy document issued by your surety company. Think of it as official proof that your existing bond remains in force for a new term, usually for another year. It’s designed to simplify your auto dealer bond renewal process.

Instead of needing a completely new bond form each year, this certificate confirms to the state that your continuous coverage is still active. It’s filed directly with your state’s licensing authority—whether that’s the New Jersey Motor Vehicle Commission, the Texas Department of Motor Vehicles, or another state agency—to show that your bond is continuously valid. It’s a key part of keeping your auto dealer bond active and your dealer license in good standing, making sure you’re always in compliance.

Secure Your Dealership’s Future with a Timely Renewal

As we’ve explored, your auto dealer bond renewal isn’t just another item on your to-do list. It’s truly a cornerstone for your dealership’s continued success and legal operation. Renewing on time is like giving your business a solid, reliable foundation. It protects your hard-earned license, helps you steer clear of expensive penalties, and keeps your dealership’s good name shining bright.

Here at BEST SURETY BOND COMPANY, we’re genuinely passionate about making your auto dealer bond renewal process as smooth, quick, and affordable as possible. Whether you’re searching for the very best surety bond rates right here in Texas or need a reliable nationwide surety bond agency, our friendly, licensed agents are always ready to lend a hand. We believe in combining warm, human service with the convenience of digital tools, so you get exactly the support you need, fast and efficiently.

Don’t let your bond expire and put your dealership’s future at risk. You’ve worked too hard for that! Take control of your renewal process today and secure your peace of mind.

Get Your Instant Bond Quote Today