What is a Bid Bond and Why is it Crucial for Your Project?

A bid bond is a surety-backed promise that you, the contractor, will honor your bid and sign the contract if selected. It protects the project owner from low-ball bids that vanish when it’s time to perform.

Bid Bond in 60 Seconds

- What it is: A surety bond guaranteeing you’ll enter the contract at your bid price

- Who needs it: Most contractors bidding jobs over $50,000 (public or private)

- Amount: 5–10 % of your bid (up to 20 % on federal work)

- Cost: Usually free; you pay premiums only if you win and need a performance bond

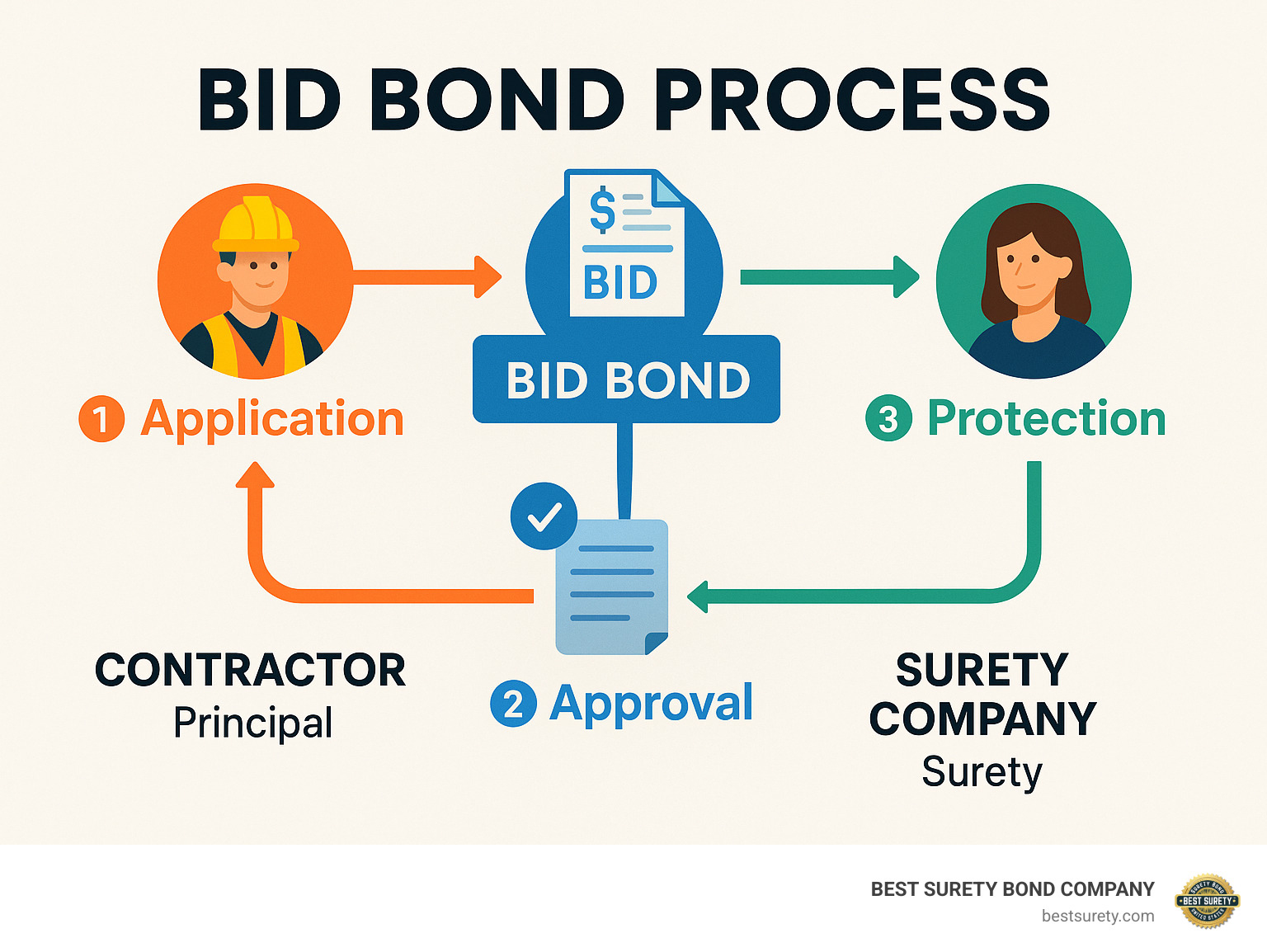

Bid bonds involve three parties:

- Principal – You, the contractor

- Obligee – The project owner

- Surety – The company guaranteeing your promise

Why They Matter

- Credibility – Signals you’ve been vetted by a surety

- Access – Lets you chase bigger, bonded projects

- Cash flow – Replaces large bid deposits with a paper guarantee

- Integrity – Keeps the bidding field fair by deterring frivolous bids

The Purpose in Construction

Bid bonds transform bidding from guesswork into a disciplined, legally protected process. Under the Miller Act (and similar state “Little Miller” laws), they’re mandatory on most public jobs, ensuring taxpayer dollars are safeguarded.

They also appear on more private jobs over $50,000, because owners learned the small hassle of requiring a bond saves big headaches later.

Who Typically Needs One?

- General contractors

- Subcontractors on large packages

- Service contractors (HVAC, janitorial, etc.) bidding big maintenance deals

- Suppliers on sizeable material contracts

- Anyone chasing federal, state, or municipal work

Key Benefits for Contractors

- Third-party validation of your financial stability

- Opens doors to six- and seven-figure contracts

- Lets smaller Texas firms compete head-to-head with national players

- Frees working capital you’d otherwise tie up in bid deposits

How a Bid Bond Works: From Bid Day to Bonding

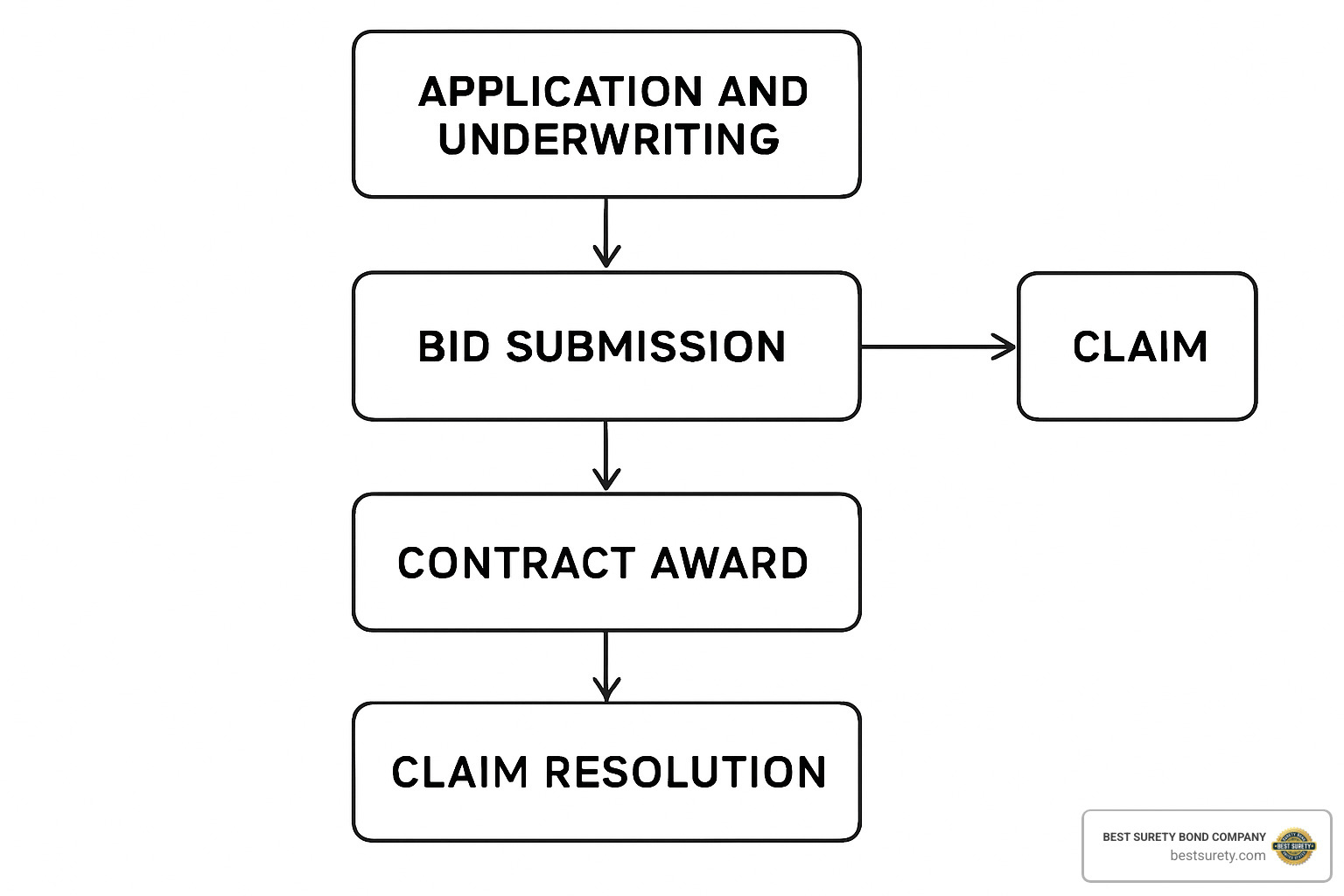

Picture a three-step play:

- Prequalify – You share financials and work history; the surety sets your bonding capacity, often within 24 hours for returning clients.

- Submit Bid – You attach the surety’s bid bond (usually 5–10 % of your price) to the proposal. If your paperwork is clean, you stay in the running.

- Win & Perform – If awarded, you sign the contract and replace the bid bond with performance and payment bonds. Fail to do so and the owner may claim the difference between your bid and the next lowest—up to the bond amount.

What the Surety Looks At

- CPA financial statements (needed for bids above ~ $250k)

- Work-in-progress schedule to ensure you’re not overextended

- Relevant project experience and personal credit

Default & Claims

If you refuse the award or can’t post performance bonds:

- Owner files a claim

- Surety verifies facts and, if valid, pays the owner

- You reimburse the surety under your indemnity agreement

Default is rare because the risk—and personal liability—keeps bidders honest.

Bid Bond Costs and Requirements—Quick Guide

How Much Will I Pay?

Most contractors pay $0 for each bid bond. Instead, you open an annual bonding facility (about $1,500–$5,000 per year) that covers unlimited bid bonds. You only pay a premium—typically 1–3 % of the contract—when you win and need a performance bond.

Key Cost Drivers

- Working capital & net worth

- Job type and size

- Personal and business credit (lower scores may still qualify but might pay on the higher end)

Minimum Paperwork Checklist

- Bid invitation / RFP

- Completed bid‐bond application

- Job specs

- Financials for bids above $250k (CPA prepared for larger jobs)

- Current work-in-progress report

- List of similar completed projects

Staying organized cuts approval time—critical when bid day is 48 hours away in Houston traffic!

Bid Bond vs. Performance Bond: Know the Difference

| Bid Bond | Performance Bond | |

|---|---|---|

| Purpose | Guarantee bidder signs contract | Guarantee contractor finishes work |

| When Needed | With the bid proposal | After award, before work starts |

| Coverage | Bid price difference (5–20 %) | Up to 100 % of contract value |

| Typical Cost | Usually free | 1–3 % of contract |

Think of it this way: the bid bond gets you in the door; the performance bond keeps you in the building until the project is complete.

Frequently Asked Questions

Can I Get a Bid Bond with Bad Credit?

Yes. Sureties weigh overall financial strength, experience, and cash flow. Expect closer scrutiny and possibly a higher premium on the follow-on performance bond, but many Texas contractors get bonded every day with sub-700 scores.

When Is the Bond Released?

If you lose the bid, the bond is returned automatically. If you win, it’s replaced by performance and payment bonds once the contract is signed—usually within 14 days.

What If Someone Files a False Claim?

Notify your surety immediately. They’ll investigate at no cost to you. Frivolous claims are rare because owners risk losing future bonding support if they abuse the process.

Secure Your Next Project with Confidence

Bid requirements shouldn’t block your growth. BEST SURETY BOND COMPANY delivers fast approvals, low rates, and Texas-savvy service so you can bid—and win—without cash-flow headaches.

Ready to level up? Get Your Free Bid Bond Quote Today and find why contractors across Houston, Dallas, Austin, and all 50 states trust our licensed agents for same-day bonding.