Why Every Freight Broker Needs a BMC-84 Bond

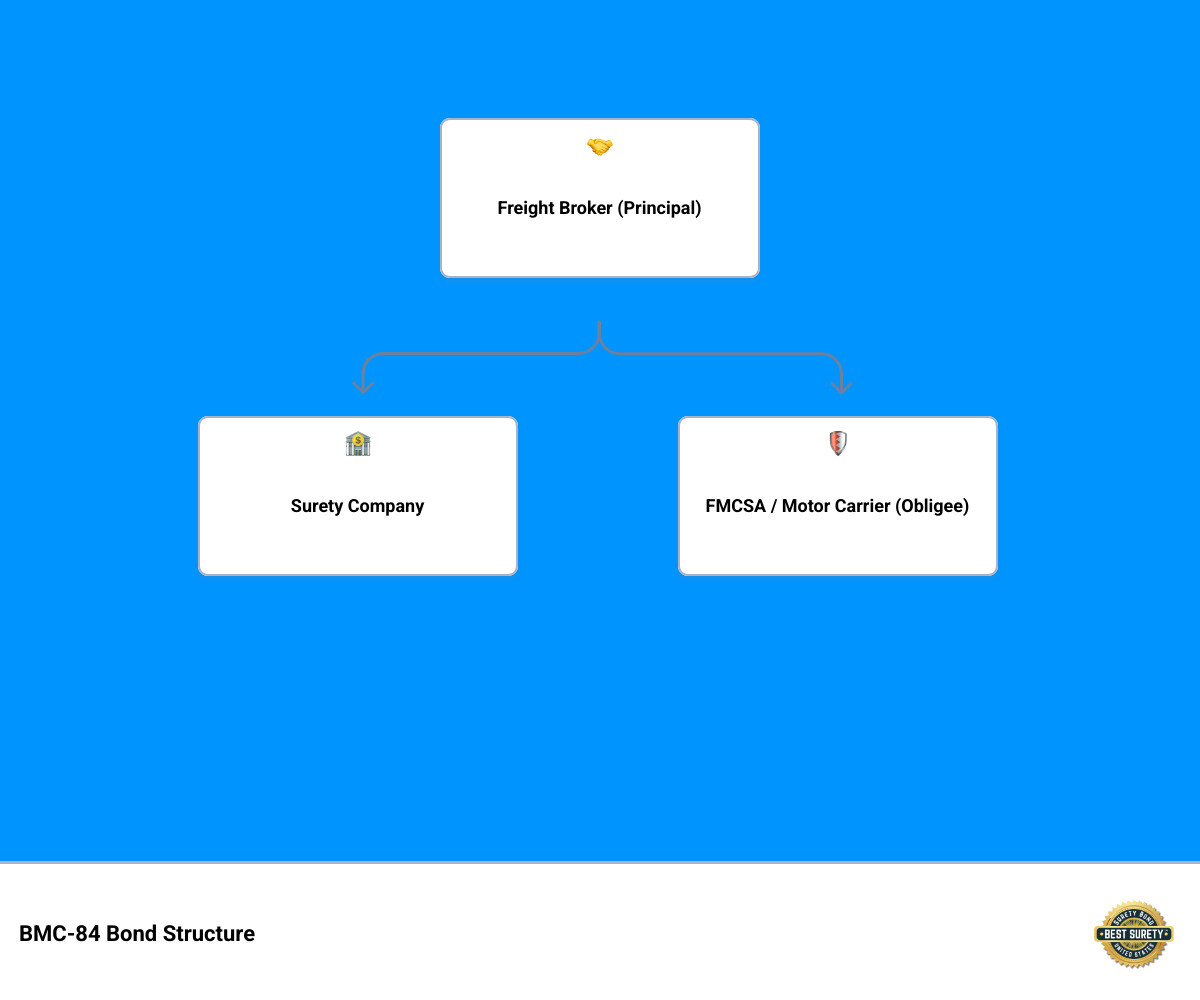

A BMC 84 bond is a $75,000 surety bond required by the Federal Motor Carrier Safety Administration (FMCSA) for all freight brokers and freight forwarders operating in the United States. This financial guarantee protects motor carriers and shippers if a broker fails to pay for services rendered.

Quick BMC-84 Bond Facts:

- Required Amount: $75,000 minimum

- Cost: Starting at $938/year (1.25%-12% of bond amount)

- Validity: 12 months, must be renewed annually

- Filing: Electronic submission by surety company to FMCSA

- Purpose: Guarantees payment to motor carriers and shippers

- Alternative: BMC-85 Trust Fund Agreement (requires full $75,000 collateral)

According to the Bureau of Transportation Statistics, more than $65 billion worth of motor freight traveled throughout North America between June 2018 and June 2019. Without proper bonding, this massive freight network would collapse under payment disputes and broken promises.

The BMC-84 bond serves as your license to operate legally. It’s not just paperwork – it’s protection for the hardworking truckers who move America’s goods. When you fail to pay a motor carrier, they can file a claim against your bond for compensation up to $75,000.

As Haiko de Poel, I’ve helped countless small business owners steer the complex world of surety bonds, including BMC 84 bonds for freight brokers across Texas and nationwide. My experience in scaling businesses across transportation and logistics sectors has shown me how critical proper bonding is for sustainable freight operations.

What is a Freight Broker Bond and Why is it an FMCSA Requirement?

A BMC-84 bond is a license surety bond mandated by the Federal Motor Carrier Safety Administration (FMCSA) for all freight brokers and freight forwarders in the United States, including property and household goods brokers. The FMCSA requires this bond to ensure compliance with federal motor carrier safety and commercial standards.

The bond requirement stems from the Moving Ahead for Progress in the 21st Century Act (MAP-21) of 2012, which increased the minimum financial responsibility for freight brokers from $10,000 to the current $75,000. This change was made to better protect motor carriers and shippers, hold brokers to a higher standard, and deter high-risk operators from entering the industry.

If you arrange truck transportation of cargo for others using for-hire carriers, you need this bond. This applies whether you are a freight forwarder who takes responsibility for the cargo or a broker who simply arranges the shipment. The FMCSA requires all freight brokers and forwarders to be licensed and bonded to operate legally.

The Purpose and Protection of the Bond

The BMC-84 bond is a financial guarantee ensuring that freight brokers and forwarders follow regulations and honor their contracts. Its primary purpose is to protect motor carriers and shippers from financial loss if a broker fails to pay for services or comply with agreements.

If a broker fails to pay a motor carrier for a completed shipment, the BMC-84 bond provides recourse. The carrier can file a claim against the bond to recover payments due, up to the $75,000 limit. This creates a crucial financial safety net.

Beyond being a financial backstop, the bond builds industry trust. Bonded brokers are seen as more reliable by motor carriers, which fosters better working relationships and improves the reputation of the brokerage industry by holding bad actors accountable. This ensures payments for completed jobs are secured. We know how important financial security is, which is why we also offer more info about commercial surety bonds for various business needs.

Consequences of Operating Without a Valid Bond

Operating as a freight broker or forwarder without a valid BMC-84 bond is illegal. The FMCSA strictly enforces this rule, and non-compliance leads to severe consequences.

Consequences include significant fines from the FMCSA and the immediate revocation of your operating authority. Without this authority, your business will be shut down, and you cannot legally arrange any freight shipments.

Operating without a bond will also damage your reputation. Carriers are hesitant to work with unbonded brokers due to the lack of financial protection, making it difficult to secure reliable transport. Complaints filed in the FMCSA’s National Consumer Complaint Database can tarnish your standing and invite further scrutiny. In short, lacking a BMC-84 bond puts your entire business at risk.

Exemptions to the Rule

While the BMC-84 bond is a broad requirement, the FMCSA does not regulate all commodities, meaning some shipments are exempt from bond claims.

Specifically, claims cannot be made against a BMC-84 bond for loads listed in 49 U.S.C. § 13506(a). These exempt commodities include, but are not limited to:

- Ordinary livestock (cattle, hogs, sheep, horses, etc.)

- Agricultural products (fruits, vegetables, fish, etc.)

- Newspapers

- Wood chips

- Other specific unprocessed or unmanufactured agricultural commodities

Brokers must understand these exemptions. They don’t eliminate the need for a bond if you also handle regulated goods, but they clarify which shipments fall outside the bond’s protection. Always consult official FMCSA guidelines to ensure compliance.

How to Get Your BMC 84 Bond in Texas and Nationwide

Getting your BMC 84 bond should be fast and simple. Whether you’re launching a brokerage in Houston, expanding across Texas, or serving clients nationwide, we’ve streamlined the process to get you bonded and operational quickly.

At BEST SURETY BOND COMPANY, we know every day without a bond is a day you can’t legally operate. Our Texas-based experts created an online application for fast approvals and competitive rates. We combine local service with modern technology, helping freight brokers in all 50 states get bonded with confidence.

Our team knows the freight industry and has helped countless brokers with their BMC 84 bond requirements. When you work with us, you gain a partner who understands your business.

Applying for Your BMC 84 Bond: Information and Documentation

Our application for a BMC 84 bond is designed to be straightforward and efficient, gathering only the necessary information so you can focus on growing your brokerage.

Business information is the foundation of your application. You’ll need to provide your legal business name, physical address, and contact details for verification and proper FMCSA filing.

Your Master Carrier (MC) number is crucial for final filing. You can get a quote without it, but the number is required for us to file your bond electronically with the FMCSA. New brokers can obtain an MC number via the FMCSA’s Unified Registration System, and we can guide you through that process.

Personal and business financial information helps us assess your risk profile and determine your premium. For newer freight brokerages, we’ll typically request personal financial statements. Established companies will provide business financials like balance sheets and income statements.

Your credit score plays a significant role in determining your premium. Both personal and business credit scores are evaluated. Don’t worry if your credit isn’t perfect – we work with applicants across the credit spectrum.

Industry experience in freight, logistics, or transportation can help you secure better rates. This background demonstrates your understanding of the business to underwriters.

Finally, you’ll need your Employer Identification Number (EIN) and basic personal information for business owners, like a driver’s license copy. Our online application guides you through each step.

Understanding the Cost of a BMC 84 Bond

The cost of a BMC 84 bond, known as the premium, is a small fraction of the $75,000 bond amount. It’s an annual payment that keeps your bond active and your business compliant.

Premiums typically range from $938 to $15,000 annually, or 1.25% to 12% of the $75,000 bond amount. This wide range reflects the varying risk profiles of applicants.

Your credit score is the biggest factor affecting your premium. Brokers with excellent credit and established businesses often qualify for our lowest rates, starting around $938 annually (1.25%).

Business experience also impacts your rate. Established brokerages (2+ years) with clean operations and strong financials receive better pricing. New brokerages typically pay higher premiums, often 3% to 5% annually, due to their limited history.

Financial strength matters too. Your business assets, cash flow, and overall financial health help determine your ability to fulfill obligations. Stronger financials translate to lower premiums.

A claims history will increase your costs. Previous bond claims or payment disputes with carriers lead to higher premiums while you rebuild trust.

Most of our freight broker clients in Texas and nationwide pay between $2,250 and $3,000 annually for their BMC 84 bond, representing a 3% to 4% premium rate. Canadian companies requiring bonds typically fall into this same range.

We offer some of the most competitive rates and fast, personal service. For more information on our bonding services, check out our license and permit bonds offerings.

Managing Your Bond: Filing, Verification, and Additional Insurance

Getting your BMC 84 bond approved is just the first step. Proper bond management involves understanding the filing process, verifying your status, and meeting additional insurance obligations to keep your operation running smoothly.

Your BMC 84 bond is a continuous requirement for as long as you hold operating authority. It operates on a 12-month cycle and must be renewed without any gaps in coverage to remain compliant.

The FMCSA offers no grace periods. Even a single day without a valid bond can lead to the suspension of your operating authority, severely impacting your business.

The FMCSA Filing and Verification Process

Your surety company handles the electronic filing process directly with the FMCSA, typically submitting your bond information within one business day of approval. This streamlines the process and reduces filing errors.

Once filed, your bond usually appears in the FMCSA’s system within a week. You should always verify the filing yourself.

The verification process is free and simple. Visit the FMCSA website and use their “Company Snapshot” tool. You can search by your USDOT number, MC number, or company name. In your profile, look for the “Insurance and Authority” section to confirm your “BMC-84” or “BMC-85” filing is listed.

This transparency allows motor carriers and shippers to easily verify your bond status, which builds trust and credibility for your business.

Additional Insurance Requirements for Freight Brokers

In addition to your BMC 84 bond, the FMCSA requires other insurance coverages to create a complete protective framework. These are mandatory requirements.

Public liability insurance covers bodily injury and property damage claims. Coverage limits depend on what you transport. For non-hazardous freight in vehicles under 10,001 pounds, you need $300,000 in coverage. General freight operations typically require $750,000 to $5 million.

Cargo insurance protects against loss or damage to the freight. The FMCSA mandates minimums of $5,000 per vehicle and $10,000 per occurrence. These amounts provide essential baseline protection.

Don’t forget the Form BOC-3 filing, which designates a process agent in each state where you operate. A process agent is authorized to receive legal documents on your behalf. You can be your own agent in your home state but will need representatives in others.

For complete details, check the FMCSA insurance filing requirements page. Freight forwarders handling household goods have additional requirements, including BMC-91 or BMC-91x liability filings and BMC-34 or BMC-83 cargo insurance filings.

These insurance policies work with your BMC 84 bond to create comprehensive protection and maintain the integrity of the freight industry.

Understanding and Avoiding Claims Against Your Bond

The BMC-84 bond is a promise, and like any promise, there are consequences if it’s broken. The most common reason for a claim against your BMC-84 bond is the failure to pay a motor carrier for services rendered. If a freight broker fails to pay a motor carrier as per their contractual agreement, the motor carrier has the right to file a claim against your bond.

It’s a serious matter, as claims can have significant financial and reputational repercussions for your brokerage. While the bond provides recourse for the motor carrier, it’s crucial to remember that you, as the principal, are ultimately responsible for repaying the surety company for any valid claims paid out.

How the Claims Process Works

When a motor carrier files a claim against your BMC-84 bond, a structured process is typically followed:

- Claim Submission: The motor carrier submits a formal claim to the surety company that issued your bond, often using a specific claim submission form.

- Acknowledgment: The surety company will typically acknowledge the newly submitted claim within 48 hours.

- Surety Investigation: This is a key difference between a BMC-84 bond and a BMC-85 trust fund. For a BMC-84 bond, the surety company shares liability and thoroughly investigates the validity of the claim. They’ll review documentation, mediate with both parties, and ensure the claim is legitimate before making any payment. In contrast, a BMC-85 trust fund agreement means the trust company would simply pay and clear the claim using your collateral without much investigation.

- Resolution Timeline: Most claims are paid within 45 to 90 days of submission, assuming all documentation is in order and the claim is valid.

- Disputed Claims: If there’s a dispute between the property broker and the claimant, a court judgment may be required for the surety to issue payment against the bond. The surety will mediate and encourage resolution, but they will not pay out on a disputed claim without a clear legal directive.

- Reimbursement to Surety: If the surety company pays out on a valid claim, they will then seek full reimbursement from you, the freight broker, as per the indemnity agreement you signed when obtaining the bond.

It’s vital to understand that the BMC-84 bond is not insurance for you; it’s a guarantee for others. Any money the surety pays out on your behalf must be repaid by you.

Best Practices to Avoid Claims

Avoiding claims against your BMC-84 bond is paramount for maintaining a healthy business and a good reputation. Here are some best practices we recommend:

- Prompt Payment to Carriers: The most effective way to avoid claims is to pay all motor carriers in full and on time, as per your contractual agreements. Late or missed payments are the primary trigger for bond claims.

- Clear, Written Contracts: Always use comprehensive written contracts that clearly outline payment terms, rates, responsibilities, and dispute resolution procedures for every shipment. This leaves no room for ambiguity.

- Vetting Motor Carriers: Before hiring a motor carrier, take the time to verify their credentials, including their operating authority, insurance coverage, and safety record. This helps ensure you’re working with reliable partners.

- Accurate Record-Keeping: Maintain meticulous records of all transactions, including invoices, bills of lading, proof of delivery, and communication logs. Good records are your best defense against false or disputed claims.

- Open Communication: Foster open and transparent communication with both your shippers and motor carriers. Address any issues or concerns promptly and professionally before they escalate into formal disputes.

- Stay Compliant: Continually educate yourself on FMCSA regulations and ensure your operations are always in compliance. Operating ethically and legally minimizes your risk of claims.

Implementing these practices will not only help you avoid costly claims but also build strong, trusting relationships within the industry. Just as in construction, where proper planning and execution are key to avoiding disputes, similar principles apply to freight brokerage. For more insights into how surety bonds foster trust and accountability in various sectors, you can explore more info about construction surety bonds.

Frequently Asked Questions about the BMC-84 Bond

When it comes to securing your BMC-84 bond, we understand that freight brokers across Texas and nationwide have plenty of questions. After helping thousands of clients get bonded and operational, these are the three questions we hear most often – and the answers that matter most for your business success.

How much does a BMC-84 bond cost?

The cost is a premium, typically 1.25% to 12% of the $75,000 bond amount. For brokers with good credit and experience, rates can start as low as $938 per year. Factors like credit score, business financials, and industry experience determine your exact rate.

Your personal and business credit scores play the biggest role in determining your premium. If you’re an established brokerage with clean credit and no previous claims, you’ll land on the lower end of that range. New freight brokers or those rebuilding their credit should expect premiums closer to 5% annually – around $3,750 per year.

Business experience matters too. We’ve found that brokers with two or more years in the industry consistently qualify for better rates than brand-new operations. Your financial statements, both personal and business, also factor into the equation. The stronger your financial position, the lower your premium.

Here in Texas, we’ve helped Houston-based brokers secure rates as competitive as anywhere in the nation. Whether you’re shipping from the Port of Houston or coordinating loads across the Southwest, your location doesn’t impact your premium – your qualifications do.

Can I get a BMC-84 bond with bad credit?

Yes, obtaining a bond with bad credit is possible. While the premium will be higher, specialized programs exist to help most applicants get approved, ensuring you can meet FMCSA requirements and operate your brokerage legally.

Bad credit doesn’t mean no bond. We work with specialized carriers who understand that credit challenges don’t define your ability to run an ethical freight brokerage. You might pay a higher premium – sometimes up to 12% of the bond amount – but approval is still very achievable.

Sometimes we’ll need additional documentation to strengthen your application. This might include recent bank statements, proof of industry experience, or letters of recommendation from motor carriers you’ve worked with previously. In some cases, you may need to provide collateral equal to a percentage of the bond amount.

The key is being upfront about your credit situation from the start. Our Texas-based team has seen it all, and we’re experts at finding solutions that get you bonded and back in business. Don’t let past financial challenges keep you from pursuing your freight brokerage dreams.

How quickly can I get my bond filed with the FMCSA?

With a streamlined process, you can often get approved and have your bond filed electronically with the FMCSA the very same day you apply. This speed is crucial for getting your freight brokerage licensed and operational without delay.

Same-day service is our standard, not our exception. Once you complete our online application and we approve your bond, we handle the electronic filing directly with the FMCSA on your behalf. No paperwork delays, no waiting weeks for processing.

The FMCSA typically updates their system within about a week of our filing, meaning you can verify your bond status online shortly after approval. This fast turnaround is especially important for new brokers who need to get operational quickly, or existing brokers whose bonds are approaching expiration.

Speed matters in freight. Every day without a valid bond is a day you can’t legally arrange shipments. That’s why we’ve invested in technology and processes that eliminate bottlenecks. From Houston to the rest of the nation, we’re committed to getting you bonded and back to moving freight as quickly as possible.

Get Your Freight Broker Bond Fast with a Trusted Texas Partner

The BMC-84 bond isn’t just another piece of paperwork – it’s your ticket to operating legally as a freight broker anywhere in the United States. Whether you’re setting up shop in Houston, expanding across Texas, or launching nationwide operations, this $75,000 financial guarantee is absolutely non-negotiable. It’s your promise to the industry that you’ll operate ethically and ensure those hardworking motor carriers get paid for moving America’s freight.

Understanding the ins and outs of BMC-84 bond costs, the application process, and smart strategies to avoid claims isn’t just helpful – it’s essential for building a thriving brokerage that stands the test of time.

At BEST SURETY BOND COMPANY, we get it. The freight industry moves fast, and you can’t afford to be stuck waiting around for approvals or dealing with complicated paperwork. That’s why we’ve built our entire process around speed, affordability, and reliability. Our Texas-based team brings that local, personal touch you’d expect from a Houston neighbor, while our national reach means we can get you bonded no matter where your business takes you.

We know every day without your bond is a day you can’t legally operate, which is why we offer same-day approvals and electronic filing with the FMCSA. Our streamlined online application cuts through the red tape, and our expert agents are standing by to guide you through any questions or challenges that come up.

Fast approvals aren’t just a nice-to-have – they’re critical when you’re trying to get your brokerage up and running or renew an expiring bond. Low rates mean more money stays in your pocket to grow your business. And our expert guidance ensures you understand exactly what you’re getting and how to protect your investment.

Don’t let bonding requirements become a roadblock to your success. The freight industry needs reliable, ethical brokers, and we’re here to help you join their ranks quickly and affordably. Get your instant surety bond quote today! and let us handle the complexities while you focus on what you do best – moving freight and building relationships with carriers and shippers across the country.