Why Your Business License Depends on Having the Right Bond

A bond for business license is a type of surety bond required by government agencies before issuing certain business licenses or permits. This financial guarantee protects consumers and the government from potential damages caused by businesses that fail to comply with licensing laws and regulations.

Quick Answer for Business License Bonds:

- What it is: A three-party financial guarantee between you (Principal), the government (Obligee), and a surety company

- Who needs it: Auto dealers, contractors, collection agencies, security companies, and many other licensed professionals

- Cost: Typically 0.5% to 3% of the bond amount annually, depending on credit score

- Purpose: Protects the public from fraud, ensures regulatory compliance, and guarantees proper business conduct

- Texas requirement: Many industries must post a bond before receiving their business license

Starting a business in Texas or anywhere else often feels like navigating a maze of regulations. You’ve got your business plan ready, your location picked out, and your team assembled. But then you find that getting your business license requires something called a “surety bond.”

Don’t panic. Most business license bonds are straightforward, affordable, and can be secured quickly – often within 24 hours. The key is understanding what type of bond you need and working with the right provider who specializes in surety bonds.

Many provincial and territorial standards require commercial businesses to be bonded, and for good reason. These bonds generally cost between $200-$500 annually depending on the size and class of bond required. They serve as a safety net that protects consumers while allowing you to operate legally.

I’m Haiko de Poel, and I’ve helped thousands of business owners steer the complexities of securing the right bond for business license requirements across multiple industries. My experience in scaling businesses and understanding regulatory compliance has shown me that getting bonded doesn’t have to be complicated when you have the right guidance.

What is a Business License Bond and Why is it Required?

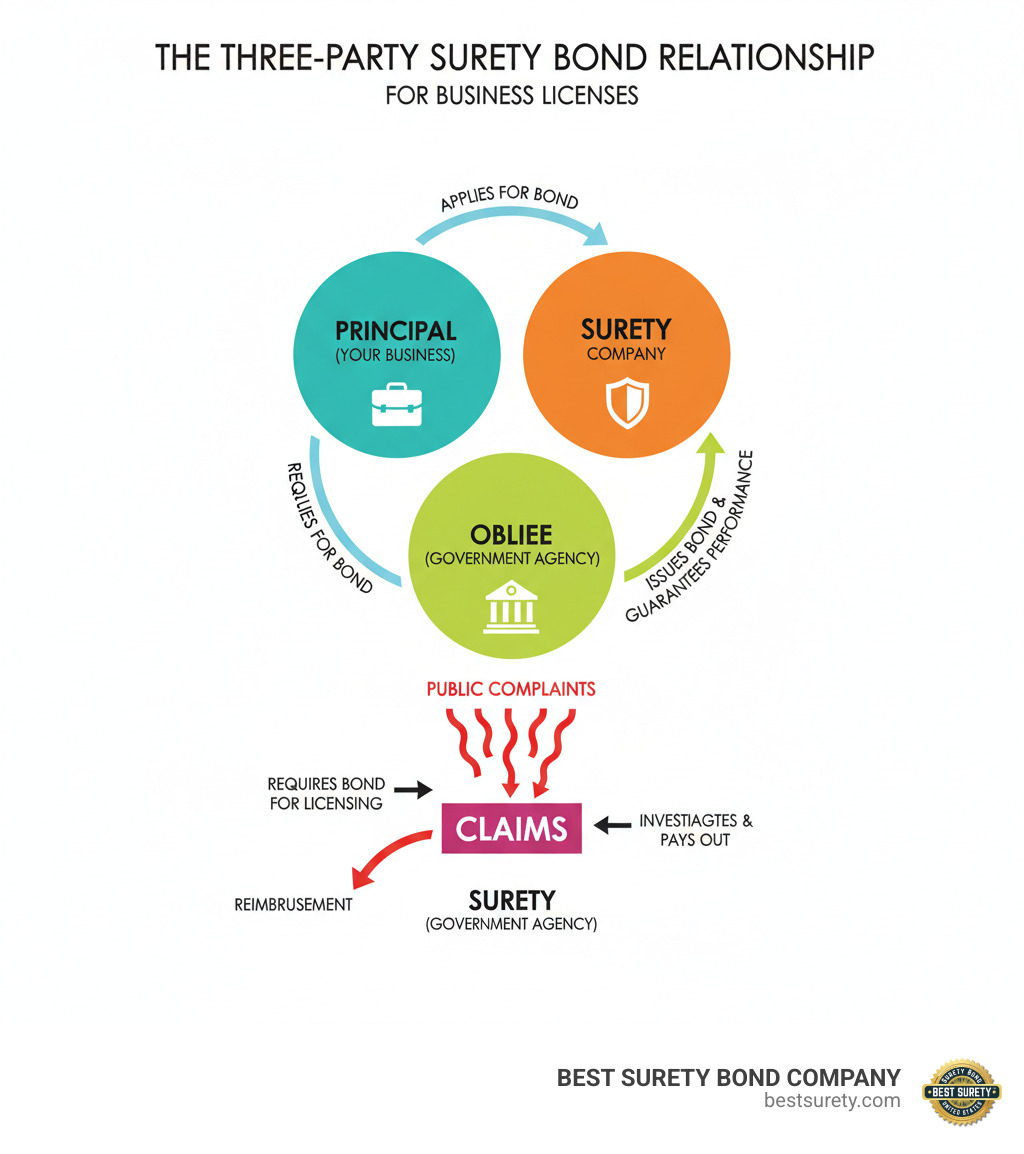

At its core, a bond for business license is a type of commercial surety bond. It’s a legally binding, three-party agreement designed to protect the public and ensure businesses operate ethically and in compliance with regulations. Think of it as a promise, backed by financial muscle, that your business will play by the rules.

Here’s how this three-party agreement works:

- The Principal: That’s you, the business owner. You’re the one seeking the license and purchasing the bond. You promise to adhere to all applicable laws and regulations.

- The Obligee: This is the government agency (federal, state, or municipal) that requires the bond for your license. They are the beneficiary of the bond, meaning they are protected if you fail to uphold your obligations. In Texas, this could be a state board, a city council, or another regulatory body.

- The Surety: This is the surety company (like us!) that issues the bond. We guarantee to the Obligee that if the Principal (you) causes financial harm due to non-compliance or unethical behavior, we will compensate the Obligee up to the bond’s penal sum.

Governments, at all levels, often require a license and permit bond for businesses that involve some risk to the public. These bonds are a prerequisite to starting certain businesses because they protect consumers by guaranteeing businesses adhere to laws and other regulations. Governments regulate businesses in areas like sales, service providers, manufacturing, or product distribution to protect the public against incompetence, misrepresentation, fraud, physical damage, or bodily harm.

The bond protects the Obligee by transferring the cost of ensuring the public is compensated for damages resulting from a licensed business breaking licensing laws to a surety bond company. It’s a crucial mechanism for consumer protection and maintaining trust in various industries.

Want to dive deeper into commercial surety? Visit our page on More info about commercial surety bonds.

Surety Bonds vs. Insurance: A Key Distinction for Your Business

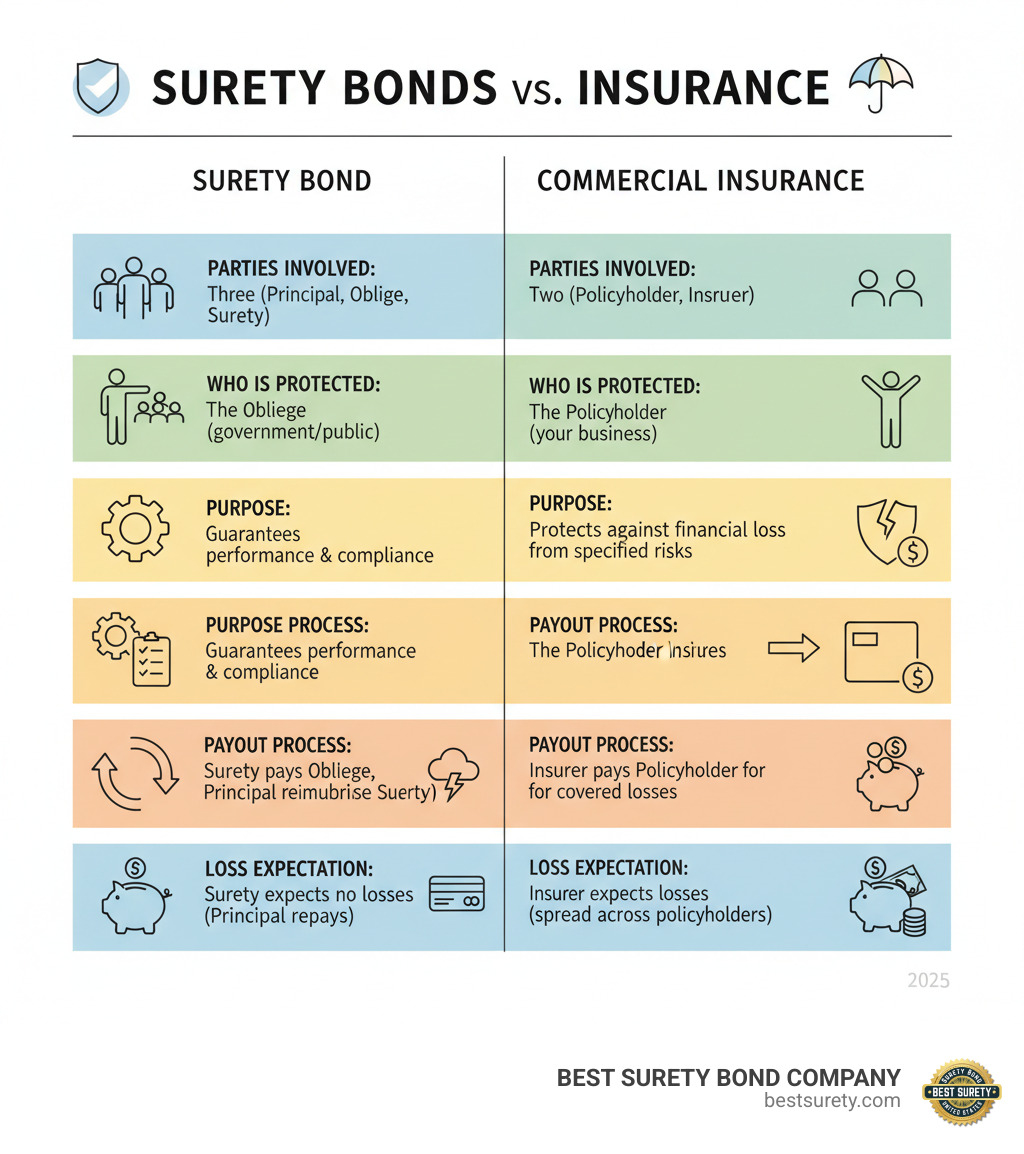

It’s a common misconception that a bond for business license is the same as business insurance. While both involve financial protection, their fundamental purpose and structure are quite different.

Here’s a simple way to look at it:

| Feature | Surety Bond | Commercial Insurance |

|---|---|---|

| Parties Involved | Three (Principal, Obligee, Surety) | Two (Policyholder, Insurer) |

| Who is Protected | The Obligee (government/public) | The Policyholder (your business) |

| Purpose | Guarantees performance & compliance | Protects against financial loss from specified risks |

| Payout Process | Surety pays Obligee, Principal reimburses Surety | Insurer pays Policyholder for covered losses |

| Loss Expectation | Surety expects no losses (Principal repays) | Insurer expects losses (spread across policyholders) |

A surety bond functions more like a line of credit or a form of credit, protecting customers from financial loss due to risks like unlawful conduct or breaches of contract. For example, if your business fails to deliver on a promised service or engages in fraudulent activity, the bond ensures the affected parties are compensated.

On the other hand, commercial insurance (like general liability, property, or workers’ compensation) protects your business from unforeseen circumstances such as property damages, accidents, theft, or other operational risks. We sometimes joke that insurance protects you from “oops,” while a bond protects the public from “uh-oh.”

Understanding this key distinction is vital for proper risk management and regulatory compliance for your business.

Who Needs a Bond for Business License and What Types are There?

If you’re wondering whether your business needs a bond for business license, the answer often depends on your industry and location. Governments, particularly at the state and municipal levels, require these bonds for businesses that operate in “high-risk” industries or those that handle public funds or sensitive consumer information. This is to safeguard the public against potential misconduct or financial harm.

Many provincial and territorial standards across North America require commercial businesses to be bonded. Here in the United States, and especially in our home state of Texas, state and municipal entities have specific requirements.

Common Industries in Texas Requiring a Bond for Business License

Texas is a thriving state with a diverse economy, and many of its industries are regulated to ensure consumer protection. If you’re operating in any of these fields in Texas, you’ll likely need a bond for business license:

- Auto Dealers: Whether you’re selling new cars, used cars, or even motorcycles, Texas requires auto dealers to be bonded to protect consumers from fraudulent sales practices.

- Contractors: From general contractors to specialized trades like electrical, HVAC, and plumbing, many construction professionals need contractor license bonds. These bonds protect government agencies and consumers from financial loss if a contractor fails to complete work or violates regulations.

- Collection Agencies: These businesses often handle sensitive financial information and are required to be bonded to protect consumers against unethical or illegal collection practices.

- Security Agencies & Private Investigators: Given the nature of their work, these professionals need bonds to ensure they operate within legal and ethical boundaries.

- Freight Brokers: If you’re arranging transportation for goods, freight brokers are often required to be bonded to ensure payment to carriers and protect shippers.

- Notary Publics: While often a smaller bond, notaries public need bonds to ensure they perform their duties faithfully and prevent financial harm due to errors or fraud.

These are just a few examples. Many other professions and businesses are subject to bonding requirements. You can check the official Texas licensing requirements for more details specific to your industry. For contractors working in Texas, we have even more specific information about Texas contractor bonds.

Types of License and Permit Bonds

While the term “bond for business license” is broad, it encompasses many specific types of bonds, each custom to a particular industry or activity:

- Contractor License Bonds: These are essential for builders, electricians, plumbers, HVAC technicians, and other trade professionals. They guarantee that contractors will adhere to building codes and contractual obligations.

- Motor Vehicle Dealer (MVD) Bonds: Required for auto dealerships, these bonds protect customers from misrepresentation, fraud, or failure to transfer titles.

- Sales Tax Bonds: For businesses that collect sales tax, these bonds guarantee that the taxes collected will be remitted to the state.

- Utility Bonds: Required by utility companies, these bonds ensure that customers pay their utility bills. They can also be required for contractors who perform work on utility infrastructure.

- Health and Medical Bonds: Suppliers of durable medical equipment (DME) often need bonds to ensure compliance with Medicare billing regulations. Nursing homes and assisted living facilities may also need bonds to guarantee proper management of patient trust funds.

- Direct Seller Bonds: These protect consumers from fraudulent sales practices by individuals or companies selling directly to consumers outside of a fixed retail location.

This list is not exhaustive, as there are literally hundreds of unique license and permit bond types. If your business requires a license or permit, there’s a good chance a bond is part of the package. We can help you find the exact bond you need. Explore more about these essential safeguards on our page dedicated to license and permit bonds.

The Fast-Track to Getting Your Bond for Business License

Getting your bond for business license doesn’t have to be a slow or complicated process. In fact, with the right partner, it can be surprisingly fast and easy. We understand that when you’re ready to get your business licensed, you don’t want to wait around. Our goal is to make the bonding process as seamless as possible, getting you bonded and ready to operate.

Many license and permit bonds are considered “quick write bonds” and can be issued the same day, often within a few hours. We pride ourselves on fast approvals and instant online quotes, especially for our Texas-based clients, ensuring you can focus on what you do best: running your business.

Step-by-Step Application Guide

We’ve streamlined the process to help you get your bond for business license efficiently:

- Determine Your Bond Requirements: The first step is to know exactly what bond your licensing authority requires. This includes the bond type, the required bond amount, and the obligee (the entity requiring the bond). We can help you identify these specific needs for Texas or any other state.

- Gather Your Information: Collect the necessary details we’ll need for your application. This usually includes basic business and personal information.

- Apply Online (or by Phone): Our user-friendly online application makes it easy to submit your request from anywhere, anytime. If you prefer, our licensed agents are always ready to assist you over the phone.

- Receive Your Quote: For many bonds, we can provide an instant online quote. For others, our team will quickly review your application and get back to you, often within an hour during business hours. Even for more complex cases, we strive for a 24-hour turnaround.

- Bond Execution: Once you accept the quote, we finalize the bond. Many quick write bonds can be issued literally within minutes through our online portal.

- Filing the Bond: We’ll provide you with the executed bond, which you then file with the appropriate licensing authority (the Obligee). We can guide you on the proper filing procedures.

Our simplified approach means you spend less time on paperwork and more time building your business.

Information Needed to Apply for Your Bond

To ensure a swift application for your bond for business license, having the right information ready can make all the difference. While requirements can vary based on the specific bond type and amount, generally, we’ll need:

- Business Name and Address: Your legal business name and physical location.

- Bond Type and Amount: The specific bond type (e.g., Motor Vehicle Dealer Bond) and the penal sum (e.g., $25,000) required by the obligee.

- Owner’s Personal Information: For most commercial surety bonds, the personal credit and financial strength of the owner(s) are key underwriting factors. This typically includes your full legal name, social security number, and address.

- Business History: Details about how long your business has been operating.

- Financial Statements (for some bonds): For larger or more complex bonds, we might request business financial statements. However, many smaller license bonds do not require extensive financial documentation.

The underwriting process for commercial surety bonds is focused on prequalification. Just like a bank wants to know you well before extending credit, we need enough information to assess the risk. Rest assured, we make this process as straightforward as possible, aiming for the lowest rates available to you.

Specialized Surety Broker vs. Insurance Broker

When seeking a bond for business license, you might wonder if your existing insurance broker can help. While some insurance brokers do offer surety bonds, there’s a significant advantage to working with a specialized surety bond broker like us.

Here’s why:

- Expertise Gap: Surety bonds are a specialized financial product, distinct from insurance. Many insurance brokers lack the deep expertise needed to properly get bonds issued, especially for unique or complex requirements. We, on the other hand, live and breathe surety bonds.

- Access to Surety Markets: Specialized brokers have established relationships with a wide network of AM Best Rated Surety Underwriters. This means we can shop around to find you the most competitive rates and terms, ensuring you get the best deal for your bond for business license. General insurance brokers might only have access to a limited number of providers.

- Streamlined Process: Because we focus solely on surety bonds, our processes are optimized for speed and efficiency. We understand the nuances of underwriting and can steer it quickly, often leading to same-day issuance for many license bonds.

- No Conflicts of Interest: An insurance broker’s primary focus is selling insurance policies. While they might see bonds as an “extra income stream,” their core competency and loyalty often lie with insurance products. Our sole focus is surety, ensuring our advice and service are entirely dedicated to your bonding needs.

Working with a dedicated surety bond broker means you benefit from expert guidance, access to multiple markets for competitive rates, and a streamlined process. We are here to simplify what can often seem like a complex requirement.

Understanding Bond Costs and the Claims Process

The cost of your bond for business license is a common question, and rightfully so! We aim for transparency and affordability. The price you pay, known as the premium, is typically a small percentage of the total bond amount (the penal sum).

What Factors Influence the Cost of Your Bond?

Several factors influence the cost of a bond for business license:

- Bond Amount: The higher the required bond amount, the higher the premium. Many government bodies only ask for small bonds under $50,000 to cover these obligations, which generally cost between $200 – $500 annually. For example, Colorado License/Permit bonds typically cost between $100 – $600, while Wisconsin License/Permit bonds typically cost between $250 – $3,000.

- Your Personal Credit Score: This is often the most significant factor. For well-qualified applicants with strong financial credentials, premiums can be as low as 0.5-1% of the bond amount annually. If your required license bond amount is $10,000, you might only pay $100 for the premium.

- Financial Strength and Business History: For larger bonds, your business’s financial health, track record, and ownership experience will be considered.

- Bond Type and Risk: Some industries are deemed higher risk than others, which can influence the premium. For bonds of a nominal dollar amount, a surety may be prepared to accept the risk with a minimum of underwriting information.

- Underwriting Requirements: While many smaller license bonds are “quick write” and don’t require extensive underwriting, some do involve a credit check or review of financial history.

We pride ourselves on offering low rates and working with you to find the most affordable premium possible. Even if you have less-than-perfect credit, don’t despair! We have programs designed to help businesses secure the bonds they need.

What Happens if a Claim is Made?

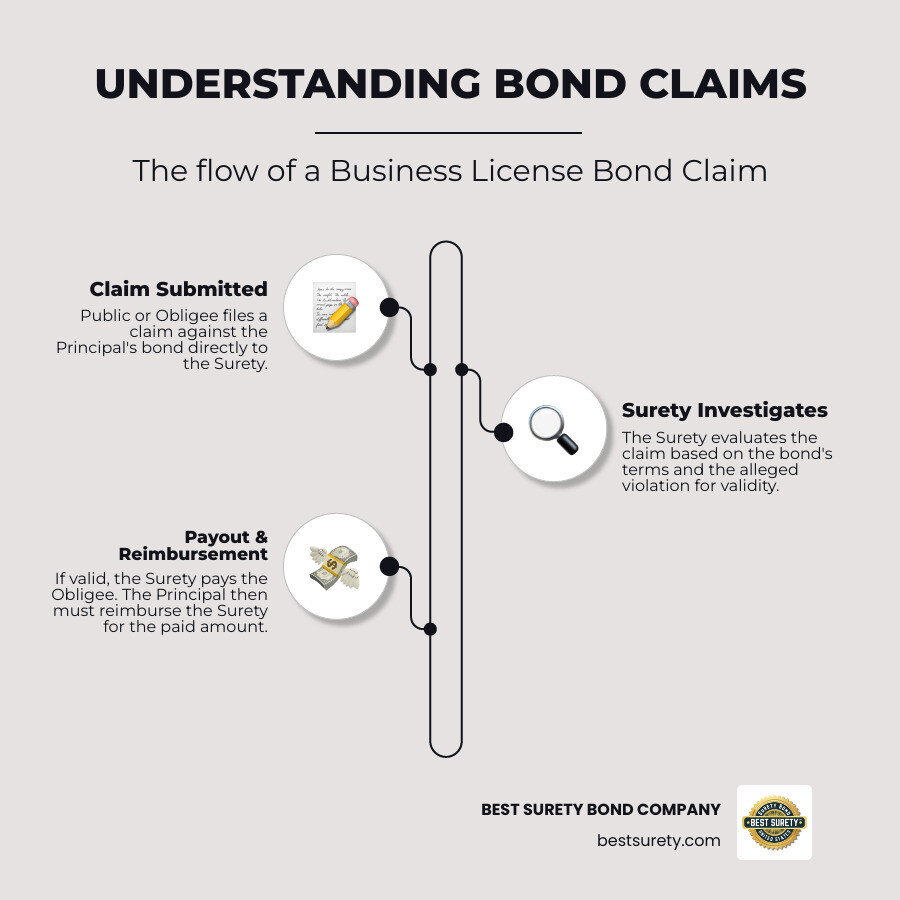

Understanding the claims process is crucial, as it highlights why a bond for business license is so important for public protection.

Here’s how it works:

- Claim Submission: If your business, as the Principal, fails to comply with the licensing laws or regulations, and this causes financial harm to a consumer or the government (the Obligee), a claim can be filed against your bond. The Obligee or the affected public submits the claim directly to us, the surety company.

- Investigation Process: Upon receiving a claim, we, as the surety, will conduct a thorough investigation. We evaluate the claim by identifying the governing ordinances, regulations, and laws, and checking the scope of your license or permit. We determine the validity of the claim based on the bond’s terms and the alleged violation.

- Valid Claim Payout: If the claim is found to be valid, we will pay the Obligee up to the penal sum of the bond to compensate for the damages. This is how the bond protects the public: by ensuring they receive restitution even if your business cannot or will not pay.

- Principal’s Reimbursement Obligation: Here’s the critical part: unlike insurance, where you typically don’t repay your insurer for a claim, with a surety bond, you, the Principal, are legally obligated to reimburse us, the surety, for any amount we pay out on a valid claim. This is a fundamental aspect of the surety agreement.

- Consequences of Non-Payment: If you fail to reimburse the surety company, you could face severe consequences, including legal action from the surety, damage to your credit, and potentially the indefinite suspension of your business license by the obligee. The bond protects the public, but the ultimate financial responsibility rests with the Principal.

A surety bond signifies your commitment to ethical business practices and compliance. It acts as a powerful deterrent against misconduct and provides a safety net for those you serve.

Frequently Asked Questions about Business License Bonds

We get a lot of questions about bond for business license requirements. Here are some of the most common inquiries we receive:

Can I get a business license bond in Texas with bad credit?

Yes, absolutely! While your personal credit score is a factor in determining the premium, having bad credit does not automatically disqualify you from getting a bond for business license. We understand that financial situations can be complex, and we work with a wide range of surety providers, including those who specialize in programs for applicants with less-than-perfect credit.

You might find that the premium (the cost of the bond) is a bit higher if you have a lower credit score, as it reflects a higher perceived risk. However, we’re dedicated to finding you the most competitive rates available, even with credit challenges. The most important step is to apply, so we can assess your specific situation and guide you through the options.

Is a business license bond the same as general liability insurance?

No, they are definitely not the same! This is a crucial distinction that many business owners confuse. As we discussed earlier, a bond for business license is a three-party agreement that protects the public (the obligee) from your business’s potential misconduct or failure to comply with regulations. You, the principal, are ultimately responsible for reimbursing the surety if a claim is paid.

General liability insurance, on the other hand, is a two-party agreement that protects your business from financial losses due to claims of bodily injury, property damage, or advertising injury caused by your operations. It’s designed to cover risks that could impact your business directly. While both are important for a responsible business, they serve different protective functions.

How long is a business license bond valid and do I need to renew it?

Most bond for business license policies are valid for a term of one year from their effective date. Yes, you will almost certainly need to renew it! Business license bonds are typically required for the entire duration that your business holds the license or permit.

This means you’ll undergo an annual renewal process. We’ll typically notify you well in advance of your bond’s expiration date to ensure continuous coverage. Maintaining an active bond is critical, as a lapse in coverage could lead to the suspension or revocation of your business license by the obligee. Some bonds are “continuous,” meaning they remain in effect until cancelled, but still require annual premium payments. We’ll make sure you understand the specific terms of your bond.

Get Bonded and Secure Your Business Today

Navigating business licenses and bonding might seem daunting, but it’s a vital step in establishing a credible and compliant business. A bond for business license is more than just a piece of paper; it’s your promise to operate ethically, legally, and responsibly, fostering consumer trust and opening doors to new opportunities.

We pride ourselves on being Houston’s trusted surety provider, with a national reach to serve clients across all 50 states. Our expertise, combined with our commitment to fast approvals and low rates, makes us the ideal partner for your bonding needs. Whether you’re a contractor in Dallas, an auto dealer in San Antonio, or a small business owner in Austin, we’re here to help you secure the bonds you need quickly and affordably.

Don’t let bonding requirements slow down your business dreams.

Get Your Free License Bond Quote Now and experience the difference of working with dedicated surety experts.