Why Understanding Bonding and Surety is Critical for Your Business

Bonding and surety might sound like complex legal jargon, but it’s actually a simple three-party promise that protects your business and gives you credibility. Here’s what you need to know:

Quick Answer for Bonding and Surety:

- What it is: A financial guarantee that you’ll fulfill your obligations

- Who’s involved: You (Principal), the entity requiring the bond (Obligee), and the bond company (Surety)

- Cost: Typically 1-10% of the bond amount annually

- Purpose: Proves you’re trustworthy and protects others if you can’t deliver

- Common types: License bonds, contractor bonds, court bonds, performance bonds

Think of it like having a trusted friend with deep pockets co-sign for you. If you can’t complete a job or meet your obligations, the surety company steps in to make things right – but you’re still responsible for paying them back.

As one industry expert put it: “Understanding personal surety is like getting a glimpse into the financial and ethical backbone of many industries.” Whether you’re a contractor in Texas needing a license bond or a business owner required to post a court bond, these agreements are everywhere in the business world.

Why does this matter for your business? Studies show that unbonded public construction projects are 10 times more likely to default than bonded ones. When defaults happen, unbonded projects cost 85% more to complete and take nearly twice as long. That’s why governments, courts, and project owners require bonds – they work.

With over two decades of industry experience, we’ve seen how bonding and surety can make or break business opportunities for contractors and entrepreneurs. Our team has helped thousands of businesses across Texas and the nation steer complex requirements, and we understand what it takes to get you bonded quickly and affordably.

What is a Surety Bond? The 3-Party Promise Explained

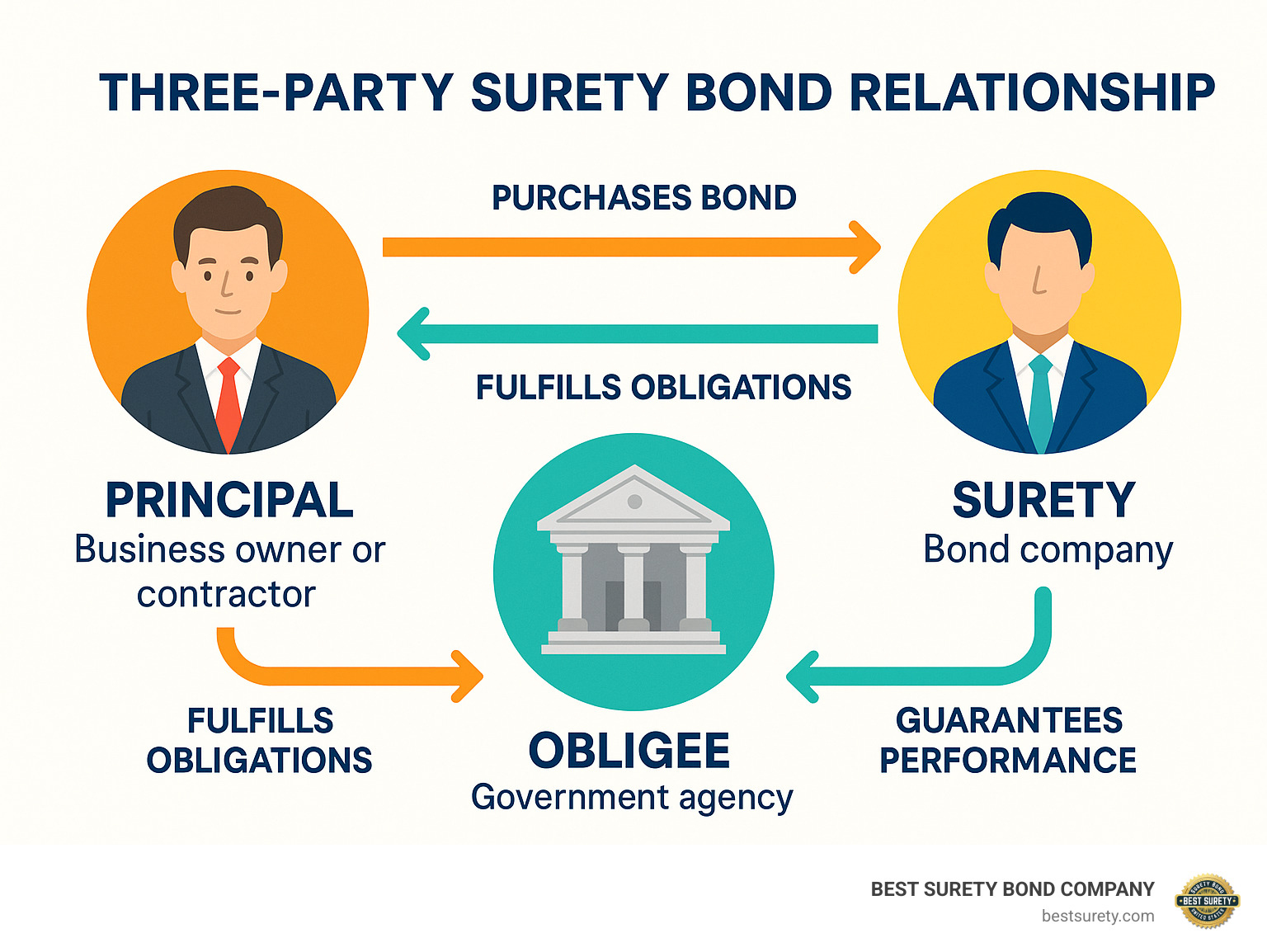

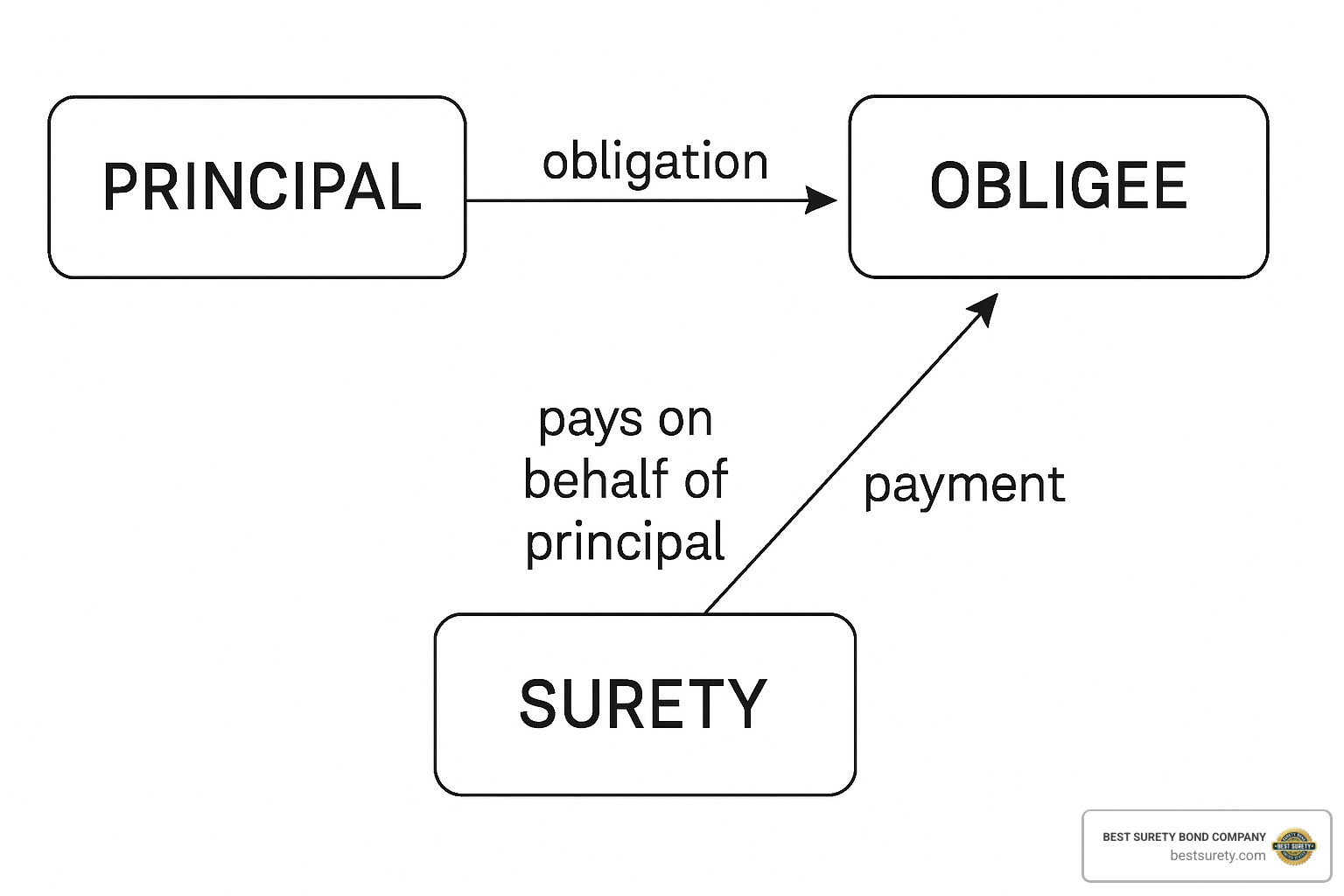

Let me break down bonding and surety in simple terms. A surety bond is a legally binding contract that creates a unique three-way promise between you, the party requiring protection, and a surety company that backs your commitment.

Think of it like this: imagine you’re asking a friend to vouch for you, but instead of just their word, they’re putting their money where their mouth is. That’s exactly what happens in bonding and surety – the surety company tells everyone “We guarantee this person will do what they promised, and if they don’t, we’ll pay to make it right.”

This financial security gives you credibility while providing peace of mind to whoever requires the bond. It’s a contractual obligation that proves you’re serious about your commitments, whether you’re bidding on a construction project in Texas or applying for a business license.

The beauty of this three-party system is that everyone has skin in the game. Here’s how each party fits into the bonding and surety relationship:

The Principal: The One Making the Promise

You’re the principal – the heart of the whole arrangement. As a business owner, contractor, or license applicant, you’re the one with the obligation to perform. Maybe you’re promising to complete a construction project, follow state regulations as an auto dealer, or properly manage someone’s estate as a court-appointed guardian.

When you buy the bond, you’re essentially saying “I will fulfill my obligations, and I’m so confident that I’m willing to have a surety company guarantee my performance.” But here’s the catch – if something goes wrong and a claim gets paid, you’re still on the hook to reimburse the surety company. It’s like having a co-signer who expects you to pay them back if they have to cover for you.

The Obligee: The One Protected by the Promise

The obligee is whoever requires the bond for their protection. This could be a government agency demanding a license bond before they’ll issue your permit, a project owner who wants a performance bond before hiring you, or a court system requiring a fiduciary bond before appointing you as an executor.

The obligee receives the guarantee and has the right to file a claim if you don’t meet your obligations. They’re essentially saying “We need proof that you’ll do what you promise, and we want financial backup in case you don’t.”

The Surety: The One Backing the Promise

The surety company is the financial institution that puts its reputation and money behind your promise. We evaluate your creditworthiness, financial strength, and ability to perform before agreeing to guarantee your obligation.

If a valid claim gets filed against your bond, the surety company will investigate and potentially pay the obligee up to the full bond amount. But unlike traditional coverage where the company absorbs the loss, the surety has the right to seek full repayment from you for any claims paid, plus associated costs and fees.

This guarantee of performance is what makes bonding and surety so powerful – it’s not just a promise, it’s a promise backed by a company with the financial strength to make things right if you can’t.

How Bonding and Surety Works: From Application to Claim

Getting bonded with BEST SURETY BOND COMPANY is a three-step sprint, not a marathon.

Step 1: Lightning-Fast Online Application

- Complete a short form with basic business data and the bond type/amount you need.

- Our Texas-tuned quote engine returns pricing in minutes for most license and permit bonds.

Step 2: Underwriting & Approval

- We apply the classic 3 C’s—Character, Capacity, Capital—to size up risk.

- Good credit scores and solid financials earn the lowest rates, but we also have carriers that specialize in challenged credit or new businesses.

- Need help? A co-signer or limited collateral can open up approval.

Step 3: Issue the Bond & Handle Claims

- Pay the premium, download your bond instantly, and file it with the obligee.

- If a claim arises, the surety investigates. Valid claims are paid up to the bond limit, then reimbursed by you under the indemnity agreement.

- Because everyone expects zero losses, most bonds never see a single claim.

From click to issued bond, standard requests are often finished the same day—exactly what Houston-area contractors and business owners need to keep projects moving.

Surety Bonds vs. Other Financial Guarantees: What’s the Real Difference?

Understanding how bonding and surety differs from other financial instruments helps clarify their unique role in business transactions. While there are several ways to provide financial guarantees, surety bonds stand apart in some important ways.

| Feature | Surety Bonds | Bank Guarantees | Letters of Credit | Cash Deposits |

|---|---|---|---|---|

| Number of Parties | Three (Principal, Obligee, Surety) | Two (Bank, Beneficiary) | Three (Applicant, Bank, Beneficiary) | Two (Depositor, Obligee) |

| Who is Protected | Obligee | Beneficiary | Beneficiary | Obligee |

| Premium/Fee Structure | Annual premium (1-10% of bond amount) | Percentage fee | Percentage fee | Full amount held |

| Loss Expectation | No losses expected | Losses anticipated | Losses anticipated | N/A |

| Recourse After Payout | Full recourse against principal | Limited recourse | Limited recourse | No recourse needed |

| Credit Requirements | Moderate to strict | Very strict | Very strict | None |

The most striking difference is how bonding and surety creates a three-party relationship. While most financial guarantees involve just two parties, surety bonds bring together you (the principal), the party requiring protection (the obligee), and the surety company. This creates a unique dynamic where everyone has skin in the game.

Another key difference is cost structure. With a cash deposit, you tie up the full amount of money – sometimes hundreds of thousands of dollars. With a surety bond, you pay a small annual premium (typically 1-10% of the bond amount) and keep your cash flow intact. That’s why smart contractors choose bonds over cash deposits whenever possible.

Who is Protected?

In bonding and surety, the obligee (the party requiring the bond) receives the protection. This might seem backwards at first – after all, you’re the one paying for the bond! But this arrangement actually works in your favor by giving you credibility and access to opportunities.

Think of it this way: when a project owner sees that you’re bonded, they know a reputable surety company has evaluated your business and decided you’re trustworthy. That’s powerful social proof that can help you win more contracts and charge premium rates.

What Happens After a Payout?

Here’s where surety bonds are truly unique, and frankly, where they get their power. When a surety company pays a claim, they have full recourse against the principal. You must repay every dollar the surety paid out, plus any legal fees and costs associated with investigating and settling the claim.

This might sound scary, but it’s actually what makes the system work so well. Because surety companies expect to be repaid, they’re motivated to work with you to prevent problems before they become claims. They’re not just writing you a check and walking away – they’re invested in your success.

This creates a strong incentive for principals to fulfill their obligations and makes surety bonds an incredibly effective risk management tool. It’s why bonded construction projects have such low default rates compared to unbonded ones.

The Main Types of Surety Bonds (And Which One You Need)

Think of bond categories as tools in a toolbox—pick the one that matches your job:

1. Contract Bonds (Construction)

- Bid Bond: Guarantees you’ll honor your winning bid.

- Performance Bond: Ensures the project is built to spec.

- Payment Bond: Protects subs and suppliers from non-payment.

- Maintenance Bond: Covers workmanship during the warranty period.

Mandatory on federal jobs over $150k (Miller Act) and most Texas public projects.

2. License & Permit Bonds

Required before a government agency issues a professional license.

- Examples: Auto dealer, contractor, electrician, plumber, notary, utility bonds.

- Guarantees you’ll follow statutes and protect consumers.

3. Court & Fiduciary Bonds

Used in legal proceedings.

- Appeal / Supersedeas Bonds keep judgments from being enforced during appeal.

- Executor, Guardian, Trustee Bonds ensure honest management of someone else’s assets.

Need specifics? Our bond services page lists every major Texas requirement with instant quotes.

Why Bonds Matter & How Much They Cost

Bonds aren’t red tape—they’re a proven safety net. A Surety & Fidelity Association study shows bonded public projects default 10× less often and cost 85 % less to finish when problems occur versus unbonded work. That reliability is why owners insist on bonds—and why being bonded helps you win jobs.

Typical Premium Range

- 1 %–10 % of the bond amount per year.

- Good credit (700+) often lands in the 0.5–2 % bracket; challenged credit runs higher.

What Drives Your Rate?

- Bond amount & type (higher risk = higher rate).

- Personal & business credit.

- Financial strength/cash flow.

- Industry experience & claims history.

Premiums are usually tax-deductible and we offer monthly or quarterly payment plans. Have credit issues? Specialized carriers and co-signers can still get you across the finish line—fast and at a fair price.

Frequently Asked Questions about Bonding and Surety

How fast can I get bonded in Texas?

For standard license bonds, you can complete the application, pay, and download your bond in under an hour. Contract and court bonds typically issue within 24–48 hours.

Can I qualify with bad credit?

Yes. We work with niche sureties that look beyond your FICO score. Expect a higher rate, but approval is still very possible—especially with a strong co-signer or partial collateral.

Is the premium paid once or every year?

Most bonds renew annually. We send reminders well ahead of time and offer flexible payment plans so your coverage never lapses.

Get Your Texas Surety Bond Today!

Speed, savings, and service—that’s the BEST SURETY promise. Our online system delivers instant quotes, and licensed Texas agents are a direct phone call away when you need human help.

Ready to lock in your bond? Get Your Free, No-Obligation Quote Now!