Why Getting Your Notary Bond Fast Matters for Your Commission

When you need to buy notary bond coverage, time is often critical. Most states require notaries to purchase and file a surety bond before they can begin performing notarial acts, and delays can mean lost income or missed deadlines.

Quick Answer – Where to Buy Your Notary Bond:

- Online providers offer instant quotes and same-day delivery

- Bond amounts range from $500 to $25,000 depending on your state

- Typical costs are $35-$55 for a 3-5 year term

- Required information: Full legal name, county, commission dates

- Filing deadline: Usually 30-90 days after commission approval

Industry data shows that hundreds of thousands of notaries have successfully ordered bonds online, with many providers offering guaranteed approval regardless of credit history. Most reputable surety agencies can issue and email your bond the same day your order is received, keeping your commissioning process on track.

A notary bond serves as a financial guarantee that protects the public from mistakes or misconduct. As one source explains: “The bond ensures that, as a Notary, you will fulfill all obligations to protect the public from financial harm resulting from any wrongdoing on your part when performing notarial duties.”

Important distinction: The bond protects the public, not you as the notary. If a claim is paid out, you’re required to reimburse the bonding company. That’s why many notaries also purchase Errors & Omissions (E&O) insurance for their own protection.

I’m Haiko de Poel, and I’ve helped thousands of business owners steer complex bonding requirements across multiple industries, including guiding notaries through the process to buy notary bond coverage quickly and affordably. My experience scaling ventures in legal services and insurance has shown me that fast, reliable bonding is essential for professionals who can’t afford delays.

Understanding the Notary Bond: Your First Step to Compliance

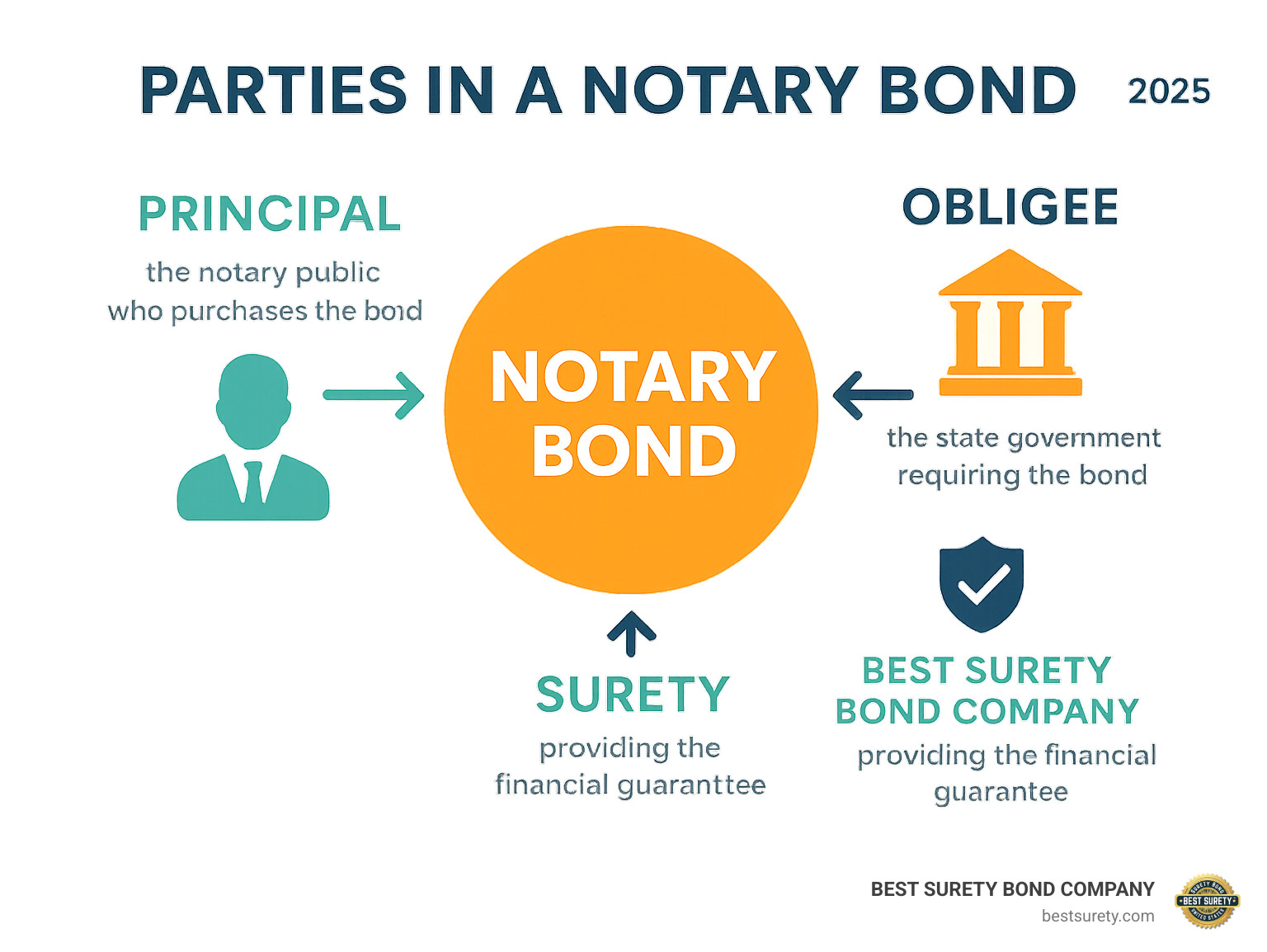

Think of a notary bond as your professional promise to the public, backed by real money. When you buy notary bond coverage, you’re entering into a unique three-party agreement that’s quite different from regular insurance. This isn’t about protecting you—it’s about protecting everyone who trusts your notarial services.

Here’s how it works: You’re the principal (the notary buying the bond), the state is the obligee (requiring the bond to protect its citizens), and the surety company is the guarantor who provides the financial backing. At BEST SURETY BOND COMPANY, we’ve seen thousands of notaries successfully steer this process, and once you understand the basics, it’s really quite straightforward.

The bond creates a financial guarantee that you’ll follow state laws and perform your notarial duties properly. If someone suffers financial harm because of your notarial misconduct, mistakes, or omissions, they can file a claim against your bond. The surety company will investigate and pay valid claims up to your bond amount.

But here’s the part that catches many new notaries off guard: you have a reimbursement obligation. If the surety pays out a claim, you’re required to pay them back every penny, plus any investigation costs. This makes a notary bond fundamentally different from insurance—it’s more like a credit facility that guarantees your performance during your commission term.

What is a Notary Bond and Why is it Required?

States require notary bonds because notaries wield significant legal authority. When you notarize a document, you’re essentially certifying someone’s identity and the authenticity of their signature. One mistake—like failing to properly verify an ID or notarizing for someone who isn’t present—can create serious financial harm for innocent people.

Your bond serves as a financial guarantee that provides several layers of protection. It ensures public protection by giving harmed parties a way to recover losses from wrongful acts. It also maintains professional standards by holding notaries accountable for their actions, helps you fulfill your state law obligations, and builds consumer confidence in notarial services.

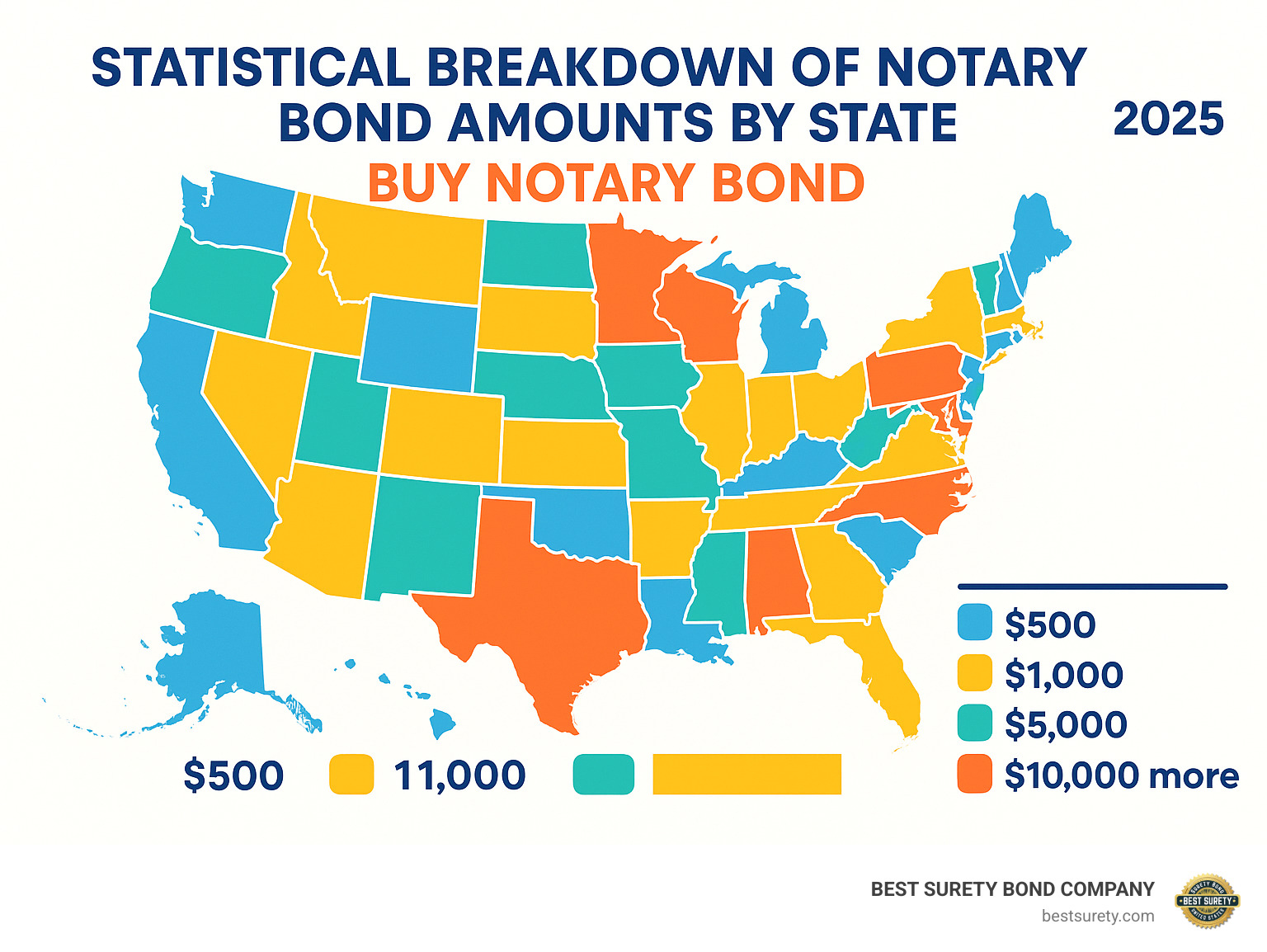

The bond amount varies dramatically by state—from as little as $500 in some states to $25,000 in others like California. This amount represents the maximum payout available for all claims combined during your entire commission term, not per incident.

Most claims arise from common scenarios: failing to properly identify a signer, notarizing documents with blank spaces, or not ensuring the signer appeared in person. More serious cases might involve notaries who participate in fraudulent schemes or deliberately ignore proper procedures.

How a Notary Bond Works

The beauty of the three-party contract system is its simplicity, even though it might seem complex at first. As the principal, you purchase the bond and promise to perform your notarial duties according to state law. The obligee (your state government) requires the bond to protect its citizens. The surety (the bond company) provides the financial guarantee that backs up your promise.

When someone files a claim against your bond, the surety company doesn’t just write a check. They conduct a thorough investigation, reviewing your notary journal, interviewing witnesses, and examining the disputed transaction. This process typically takes several weeks to months, depending on the complexity.

If the surety pays a claim, they’ll contact you immediately about repayment. You’re responsible for reimbursing them for the full claim amount plus any legal fees or investigation costs. This reimbursement obligation continues even after your commission expires if the claim relates to acts performed during your bonded period.

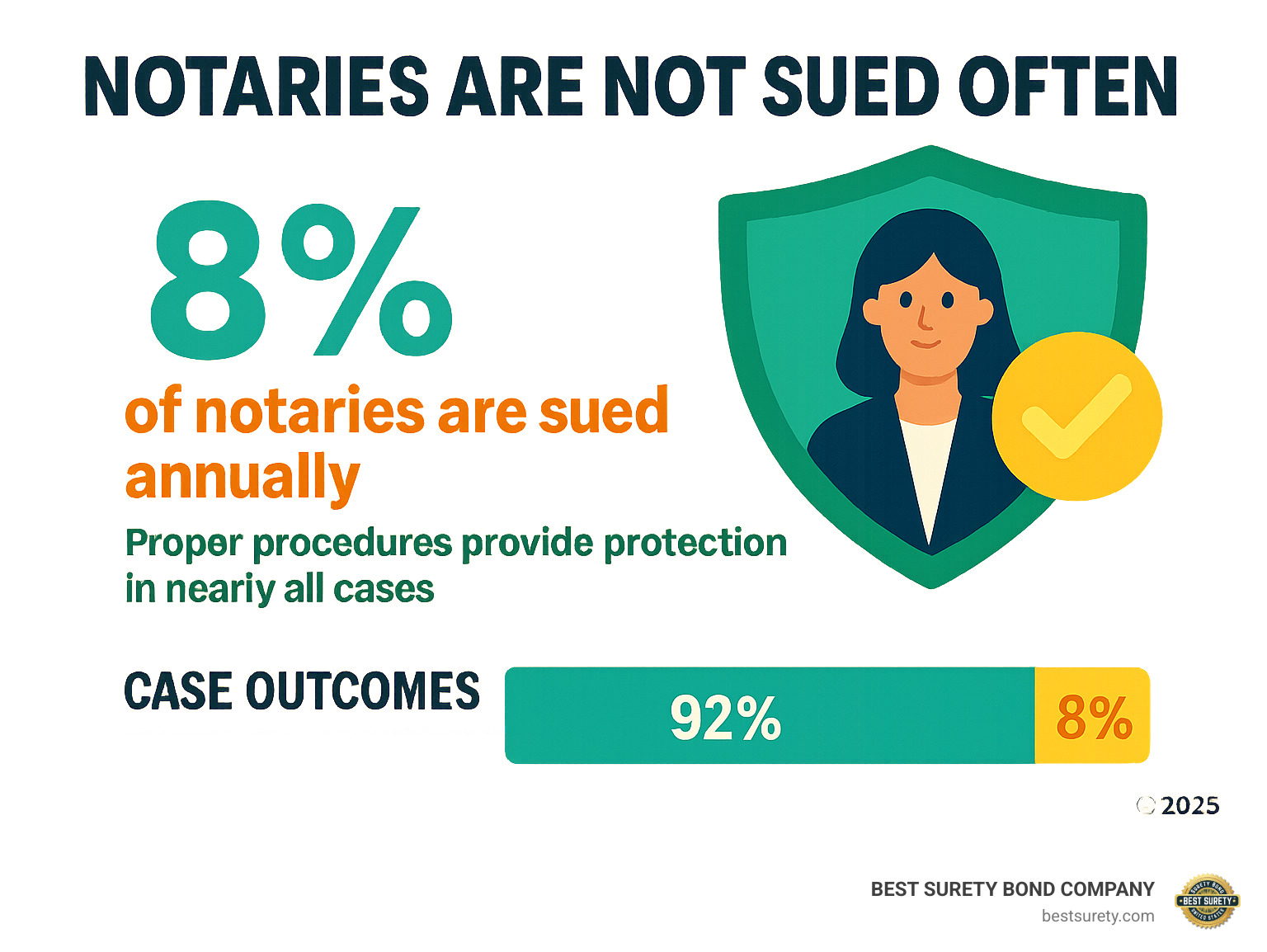

The good news? Most notaries never face a claim if they follow proper procedures, maintain detailed records, and stay current with their state’s notary laws. Your bond is there as a safety net, but careful notarial practice is your best protection.

Notary Bond: Your Essential Protection as a Notary

| Feature | Details |

|---|---|

| Who it protects | The general public and the state |

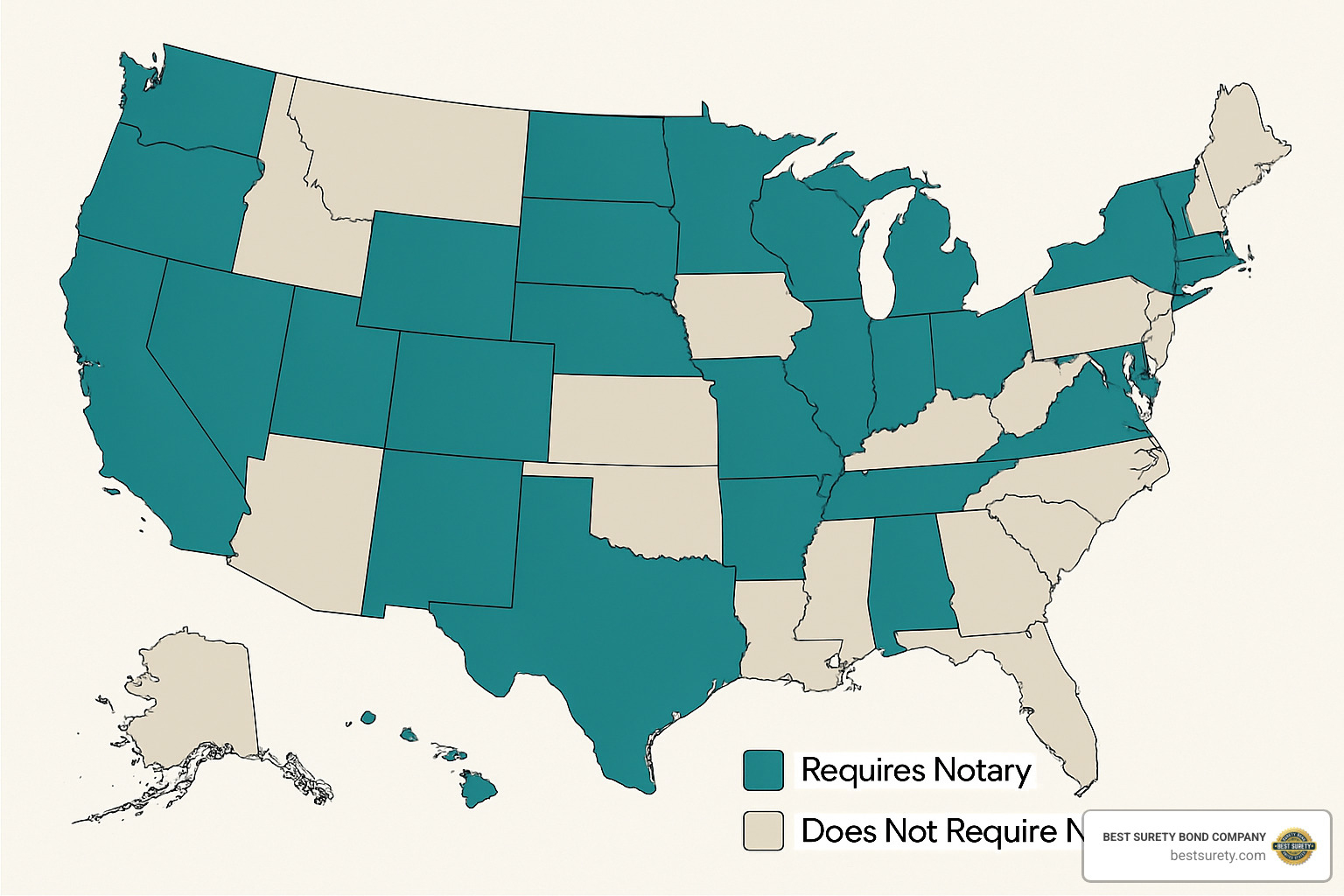

| If it’s required | Yes, in 29 states plus Washington D.C. |

| Who pays in a claim | Surety pays initially, notary reimburses |

| Coverage scope | Financial harm from notarial misconduct |

Here’s what many notaries find surprising when they buy notary bond coverage: the bond isn’t actually protecting you – it’s protecting everyone else from you. I know that sounds harsh, but understanding this distinction is crucial for your success as a notary.

The bond creates personal liability for you while providing public protection. Think of it as a safety net that catches financial harm caused by your notarial mistakes or misconduct. If someone gets hurt financially because of your actions as a notary, they can make a claim against your bond.

Required by law in 29 states plus Washington D.C., the bond ensures you’ll fulfill your obligations properly. When a claim is made, the surety company pays out first, but here’s the catch – you’re required to reimburse them for every penny they spend, including legal costs.

This is exactly why many smart notaries also purchase Errors & Omissions (E&O) insurance alongside their bond. While the bond protects the public, E&O insurance actually protects you from financial harm. It’s like having a shield for yourself while the bond acts as a guarantee for others.

Your bond remains in effect for your entire commission term, typically 4-6 years depending on your state. You cannot cancel it during this period without potentially losing your notary commission. Most states require continuous bond coverage – no gaps allowed.

Some states even allow the surety company to cancel your bond for non-payment or violations, which would automatically suspend your notary commission. This makes it essential to keep your bond in good standing throughout your entire term.

The bottom line? When you buy notary bond coverage, you’re making a commitment to perform your duties properly while providing financial assurance to the public you serve.

State-by-State Notary Bond Requirements

The landscape of notary bond requirements across America is surprisingly diverse. While you might expect a uniform approach, state laws create a patchwork of requirements that can make your head spin. Currently, 29 states plus Washington D.C. require notaries to buy notary bond coverage before they can begin their duties.

What’s fascinating is how dramatically these requirements vary. Alabama sets the bar high with a $25,000 bond amount, while Wisconsin and Wyoming require just $500 – a 50-fold difference! Most states fall somewhere in the middle, with California requiring $15,000, Texas mandating $10,000, and Florida setting the amount at $7,500.

The good news? Nearly all states align their bond terms with commission periods, typically requiring 4-year terms. This means you won’t need to worry about renewing your bond separately from your commission renewal. Kentucky stands out as particularly affordable, requiring only a $1,000 bond for the full term.

Key State Requirements:

- Alabama: $25,000 bond, 4-year term

- California: $15,000 bond, 4-year term

- Florida: $7,500 bond, 4-year term

- Texas: $10,000 bond, 4-year term

- Kentucky: $1,000 bond, 4-year term

- Wisconsin: $500 bond, 4-year term

- Wyoming: $500 bond, 4-year term

Here’s where it gets tricky: filing requirements vary just as much as bond amounts. Some states want you to file with the Secretary of State, while others require filing with your county clerk. The deadlines also differ, typically ranging from 30 to 90 days after receiving your commission approval.

These requirements aren’t set in stone either. State legislatures regularly update their laws, and we’ve seen several states increase bond amounts in recent years to keep pace with inflation and provide better public protection. That’s why it’s crucial to verify current requirements when you’re ready to buy notary bond coverage.

For the most up-to-date requirements in your specific state, check your state’s official notary handbook or Secretary of State website. Many states provide downloadable guides and FAQs that outline bond amounts, filing addresses and current deadlines.

How to Buy a Notary Bond Online: A Step-by-Step Guide

Getting your notary bond has never been easier thanks to online providers who’ve streamlined the entire process. When you need to buy notary bond coverage, you can now go from application to approved bond in just minutes, not days or weeks.

The digital revolution in bonding means you can complete everything from your home or office. Most reputable providers offer instant quotes and same-day issuance, which is perfect when you’re racing against commission deadlines.

Here’s how the process typically works: You’ll start by selecting your state from the provider’s website, since bond requirements vary by location. Next, you’ll choose your coverage options – many providers let you bundle E&O insurance with your bond for additional protection.

The application itself is straightforward. You’ll provide basic information like your legal name, county, and commission details. Then you’ll complete payment using a credit card or bank transfer. Within minutes or hours, you’ll receive your bond documents via email.

The entire process typically takes just 3-5 minutes for standard bonds. Unlike many other types of surety bonds, notary bonds require minimal underwriting since the amounts are relatively small and the risk is well-understood by surety companies.

Comparing Costs to Buy a Notary Bond

One of the pleasant surprises about notary bonds is how affordable they are. The bond premium you pay is just a small percentage of the total bond amount, making it accessible for virtually anyone entering the notary profession.

Several factors influence your bond cost. Your state of commission is the biggest factor, since different states have different bond amounts and regulatory requirements. The bond amount itself matters too – a $25,000 Alabama bond costs more than a $1,000 Kentucky bond.

Term length affects pricing, though most notary bonds are issued for 4-year terms to match commission periods. Some providers charge additional processing fees, so it’s worth comparing the total cost, not just the premium.

Here’s what you can expect to pay for guaranteed approval bonds:

A California $15,000 bond typically costs $38-$40 for the full 4-year term. A Kentucky $1,000 bond runs $34-$42 for four years. Texas $10,000 bonds usually cost $40-$50, while Alabama $25,000 bonds range from $45-$80.

What makes notary bonds unique is that most providers offer guaranteed approval regardless of credit history. This is unusual in the surety bond industry and makes notary bonds accessible to virtually anyone who meets the basic eligibility requirements.

Where to Buy Your Notary Bond for Fast Approval

When you need to buy notary bond coverage quickly, choosing the right provider makes all the difference. At BEST SURETY BOND COMPANY, we’ve built our reputation on speed and reliability, offering same-day bond issuance with instant online quotes.

Our online applications are designed for busy professionals who can’t wait weeks for approval. You’ll get instant quotes in seconds, not days, and we deliver bonds via email within hours of purchase. We work with A+ rated surety companies exclusively, so you know your bond is backed by solid financial strength.

What sets us apart is our guaranteed approval process – no credit checks for standard notary bonds. We also offer a refund guarantee if your state declines your application for any reason. Our Houston-based team has processed thousands of notary bonds across all 50 states, with particular expertise in Texas requirements.

For immediate assistance with online bond applications, our licensed agents are standing by to guide you through the process and ensure you meet all state requirements.

Information Needed for Your Bond Application

Getting your bond application right the first time is crucial when you buy notary bond coverage. Even small mistakes can delay processing or cause your state to reject your application entirely.

Accuracy is everything when it comes to your application information. Your full legal name must match your commission application exactly – even minor variations like “Bob” vs. “Robert” can cause delays. You’ll also need your county of residence, complete address, and contact information.

For commission details, you’ll need your commission start date, expiration date, and commission number if you’re renewing. The importance of accuracy cannot be overstated – the name on your bond must match your commission application perfectly.

If you’re unsure about any details, contact your state’s commissioning authority before submitting your bond application. Taking a few extra minutes to verify information can save you weeks of delays in avoiding rejection.

Filing Your Bond with the State

Filing your bond is the final step in becoming a commissioned notary, and requirements vary by state significantly. Most states require filing within 30-90 days of receiving your commission approval, though some have shorter deadlines.

Some states require filing with the Secretary of State, while others require filing with your County Clerk. A few states require filing at both levels, so check your specific requirements carefully.

Filing deadlines are strictly enforced in most states. Missing the deadline can mean starting the entire commission process over, which is both costly and time-consuming.

For Texas notaries, bonds must be filed with the Texas Secretary of State. You can find complete filing instructions and current requirements at the Texas Secretary of State Notary Information page.

Filing fees typically range from $0 to $20, depending on your state and county. Some states charge additional fees for expedited processing or certified copies of your bond, so budget accordingly when planning your commission costs.

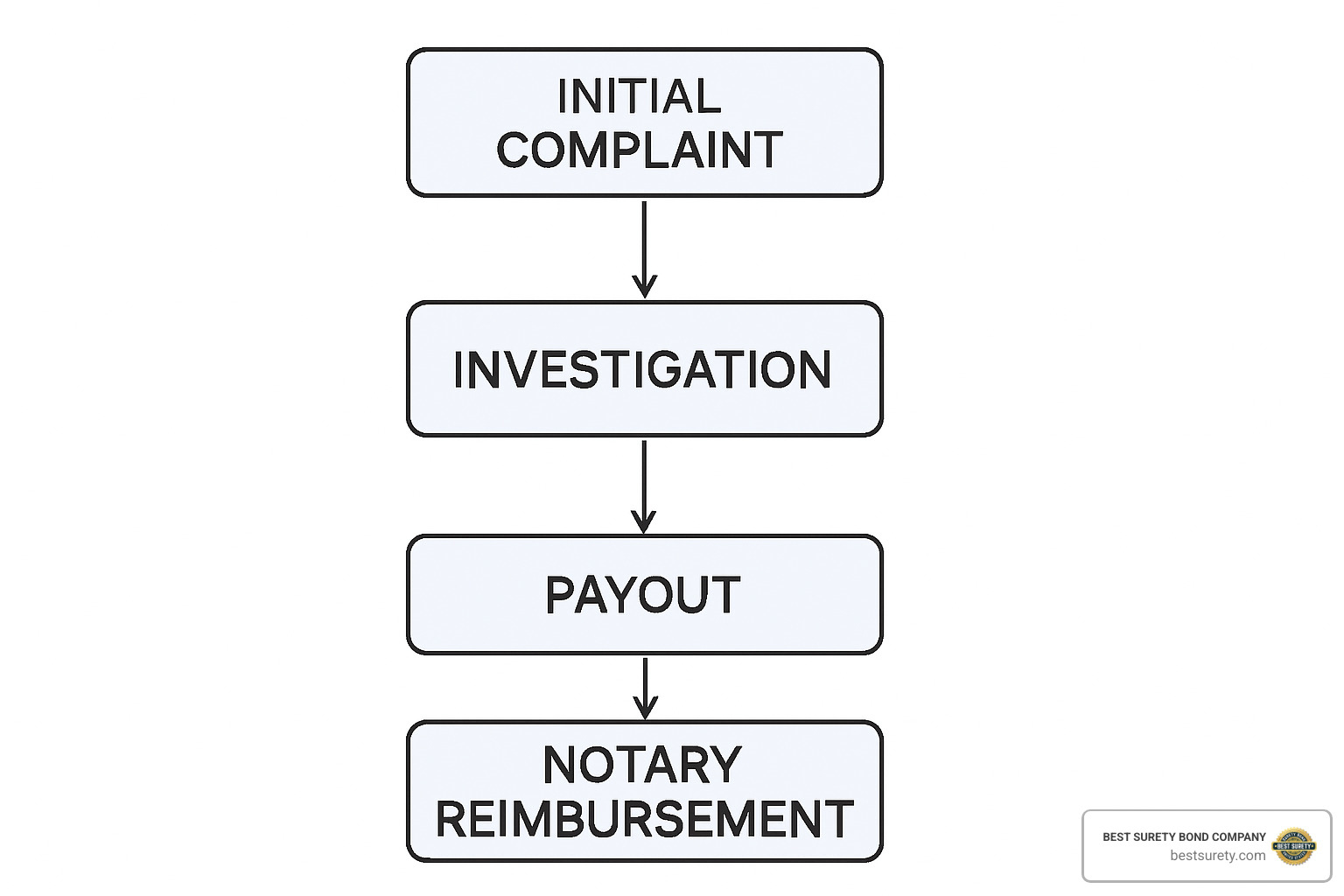

What Happens if a Claim is Made Against Your Bond?

Understanding the claims process is essential when you buy notary bond coverage, as it directly affects your financial liability and potentially your notary commission.

The Claims Process:

- Claim Filing: An injured party files a complaint with the surety company

- Investigation: The surety investigates the claim’s validity and circumstances

- Notary Contact: You’re contacted for information and documentation

- Claim Decision: The surety determines whether to pay, deny, or settle

- Payout: If valid, the surety pays the claimant up to the bond amount

- Reimbursement: You must repay the surety for all amounts paid plus costs

The investigation typically involves reviewing your notary journal, examining the disputed document, and interviewing relevant parties. The surety may request additional documentation or clarification about your notarial procedures.

Potential Consequences:

- Financial Liability: You’re responsible for reimbursing all claim payments

- Commission Suspension: Some states suspend commissions when claims are paid

- Increased Premiums: Future bond costs may increase after claims

- Legal Action: The surety may pursue legal remedies for non-payment

This is why many notaries purchase E&O insurance alongside their bond. While the bond protects the public, E&O insurance protects you from the financial consequences of honest mistakes and omissions.

Conclusion: Get Bonded Today and Notarize with Confidence

Getting your notary bond doesn’t have to be complicated or stressful. When you need to buy notary bond coverage, the right provider makes all the difference between starting your notary practice on schedule or facing frustrating delays that could cost you income and opportunities.

Throughout this guide, we’ve covered everything you need to know about notary bonds – from understanding the three-party relationship to navigating state requirements and filing procedures. The most important takeaway is that fast approval and reliable service are essential when commission deadlines are approaching.

Here’s what you should remember: notary bonds provide public protection, not personal coverage for you as the notary. You’ll need to reimburse the surety company for any claims paid out, which is why many notaries also purchase E&O insurance. Competitive costs typically range from $35-$55 for a 3-5 year term, and guaranteed approval is available from most providers regardless of your credit history.

The bonding landscape has evolved dramatically with online applications and same-day delivery becoming the new standard. At BEST SURETY BOND COMPANY, we’ve helped thousands of notaries across Texas and nationwide get bonded quickly and affordably. Our same-day issuance and A+ rated surety backing give you the confidence to serve your clients without worrying about your bond coverage.

Whether you’re commissioning in California with a $15,000 bond requirement or Kentucky with a $1,000 bond, we understand the unique challenges notaries face. Our Houston-based team knows Texas requirements inside and out, but we’re licensed to serve all 50 states with the same level of expertise and personal service.

Don’t let bond delays derail your notary career. The process is straightforward when you work with experienced professionals who understand both the technical requirements and the urgency of your situation. Reliable providers offer transparent pricing, clear explanations, and responsive support throughout the entire process.

When you have proper bond coverage in place, you can notarize with confidence knowing you’ve met all state requirements and protected the public trust. This peace of mind allows you to focus on building your practice and serving your community with the highest professional standards.

Ready to get started? Get Your Free Notary Bond Quote Today and join the thousands of notaries who trust us for their bonding needs. With our instant online quotes and same-day delivery, you’ll be ready to begin notarizing sooner than you think.

Remember: a properly bonded notary is a confident notary. When you choose the right bonding partner, you’re not just meeting a legal requirement – you’re investing in your professional success and the trust of everyone you serve.