Why Understanding Cleaning Service Insurance and Bonding Costs is Essential for Your Business

Cleaning service insurance and bonding cost can make or break your cleaning business. Here’s what you need to know about the essential financial protection every cleaning company needs:

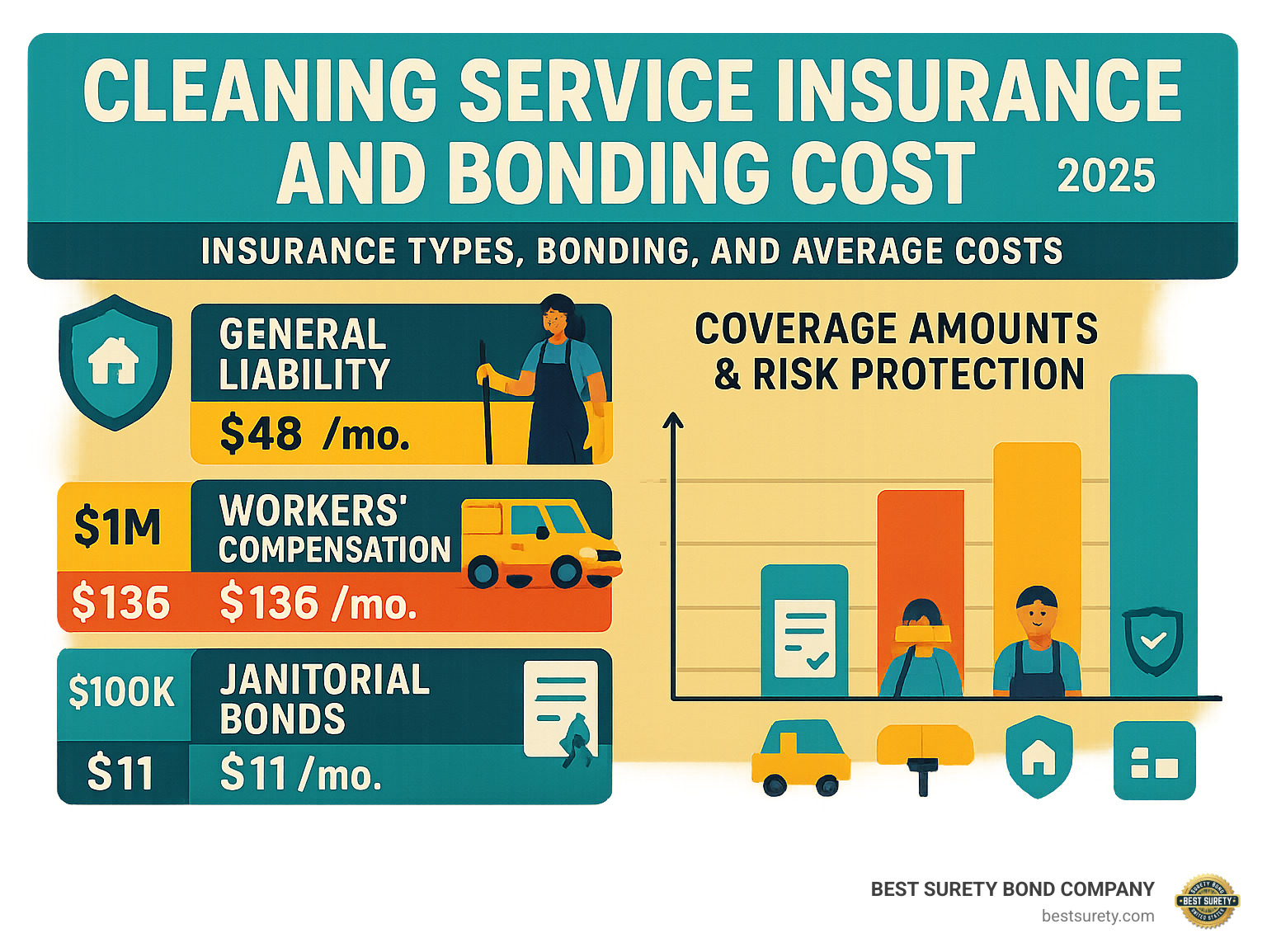

Quick Cost Overview:

- General Liability Insurance: $48/month ($580/year)

- Workers’ Compensation: $136/month ($1,627/year)

- Commercial Auto Insurance: $173/month ($2,075/year)

- Business Owner’s Policy (BOP): $76/month ($907/year)

- Janitorial Bonds: $11/month ($126/year)

Running a cleaning business means entering clients’ homes and workplaces daily. One slip on a wet floor, one broken vase, or one dishonest employee can cost you thousands – or even bankrupt your business entirely.

The harsh reality? Most commercial clients won’t even consider hiring a cleaning company that isn’t bonded and insured. It’s not just about protection – it’s about credibility and winning contracts.

But here’s the good news: proper coverage doesn’t have to break the bank. With the right knowledge, you can protect your business for less than you probably spend on cleaning supplies each month.

As someone who has helped scale businesses across multiple industries including insurance and legal services, I’ve seen how understanding cleaning service insurance and bonding cost can be the difference between a thriving cleaning business and one that closes after the first major claim. My experience in operational innovation and risk management has taught me that smart protection is always an investment, never an expense.

Why Your Cleaning Business Must Be Bonded and Insured

Running a cleaning company means more than wielding mops and vacuums — it means managing risk and proving you can be trusted inside clients’ homes and offices. Being both bonded and insured is the simplest way to do that. Insurance shields your company from expensive accidents; a bond guarantees clients are made whole if an employee steals or you fail to fulfil a contract. Together they protect your balance-sheet and your reputation.

| Purpose | Who Is Protected? | What It Covers | Claim Payout | |

|---|---|---|---|---|

| Insurance | Transfer your business risk to an insurer | Your business | Slip-and-fall injuries, property damage, lawsuits, business interruption, employee injuries | Insurer pays; you usually owe only the deductible |

| Surety Bond | Guarantee you will meet an obligation or reimburse for employee dishonesty | Your client (the obligee) | Theft, fraud, or non-performance (bond type dependent) | Surety pays client, then seeks repayment from your business |

Janitorial (Fidelity) Bonds: Trust on Paper

A janitorial bond is a low-cost fidelity bond that reimburses the client if your employee steals. Although not legally required, most commercial prospects ask for it before awarding a contract. Translation: carry a bond if you want bigger jobs and instant credibility.

Business Insurance: Your Financial Safety Net

- General Liability – covers third-party injuries or property damage (broken vase, wet-floor slip, etc.)

- Commercial Property / Tools & Equipment – replaces your gear after fire, theft or vandalism.

- Workers’ Compensation – pays medical bills and lost wages if an employee is hurt on the job.

- Commercial Auto – covers accidents in vehicles you use for work.

Bonding calms client fears; insurance keeps one mishap from sinking your company. Carrying both is the professional standard, opens doors to higher-value contracts, and proves you run a serious, reliable cleaning business.

Essential Coverage: What Types of Insurance and Bonds Do You Need?

Here’s the thing about cleaning service insurance and bonding cost – it’s not a one-size-fits-all situation. Whether you’re running a residential maid service, tackling commercial office buildings, or specializing in carpet cleaning, each type of cleaning business faces unique risks that require custom protection.

Think about it: a pressure washing company dealing with high-powered equipment and exterior surfaces faces different challenges than a medical facility cleaning crew handling sensitive environments. Understanding these differences is crucial for getting the right coverage without overpaying for protection you don’t need.

Must-Have Insurance Policies for Cleaning Companies

Let’s cut to the chase – there are certain insurance policies that every cleaning business absolutely must have, regardless of your specialty.

General Liability Insurance (CGL) is your bread and butter protection. This is what saves you when a client slips on that freshly mopped floor or when your team accidentally knocks over an expensive lamp. The numbers speak for themselves: 89% of cleaning business owners choose a $1 million per-occurrence limit with a $2 million aggregate limit. Why? Because slip-and-fall accidents and property damage claims can get expensive fast.

Workers’ Compensation Insurance isn’t optional if you have employees – it’s legally required in almost every state. When your team member strains their back moving heavy equipment or falls off a ladder during window cleaning, workers’ comp covers their medical bills and lost wages. Even in states like Texas where it’s not mandatory, skipping this coverage is a risky gamble with your business’s future. For more details on state-by-state laws, the U.S. Small Business Administration is an excellent resource.

Commercial Auto Insurance becomes essential the moment you use any vehicle for business purposes. Your personal car insurance won’t cover you if there’s an accident while you’re driving to a client’s location with a van full of cleaning supplies. This policy protects both your vehicles and covers damages to other people’s property.

Tools and Equipment Insurance might seem like a luxury until someone steals your $3,000 carpet cleaning machine from a job site. This coverage protects all your cleaning equipment – from industrial vacuums to specialized tools – whether they’re stolen, damaged, or lost. Insurance companies typically classify items under $1,500 as “tools” and anything over $1,500 as “equipment.”

For many smaller cleaning businesses, a Business Owner’s Policy (BOP) offers the best bang for your buck. It bundles general liability and commercial property insurance into one convenient package, often at a discounted rate. Many BOPs also include business interruption coverage, which can be a lifesaver if you’re forced to close temporarily due to a covered event like a fire.

Commercial Umbrella Insurance provides that extra layer of security for catastrophic claims that exceed your primary policy limits. It’s like having a safety net for your safety net – boosting coverage limits across your general liability and commercial auto policies.

The Critical Role of a Janitorial Service Bond

While insurance protects your business, a janitorial service bond protects your clients – and that distinction is crucial for winning contracts and building trust.

Employee dishonesty coverage through bonding isn’t just about protecting against theft; it’s about demonstrating your commitment to professional integrity. When you can tell potential clients you’re bonded, you’re essentially saying, “We’re so confident in our team that we’re willing to financially guarantee their honesty.”

Many commercial and government contracts won’t even consider unbonded cleaning companies. It’s not personal – it’s just good business sense from their perspective. They need assurance that if something goes wrong, they’re protected.

Certain cleaning services benefit most from bonding, especially those involving housekeeping and maid services where employees work alone in private residences with valuables present. Commercial office cleaning is another area where bonding is practically mandatory, given the sensitive information and expensive equipment in most offices.

Medical facility cleaning demands bonding due to the high-value equipment and sensitive nature of healthcare environments. Similarly, carpet cleaning services often work unsupervised in clients’ homes or businesses, making bonding essential for client peace of mind.

Window washing for high-end properties, pressure washing valuable surfaces, and vacation rental cleaning where access to guest belongings is common all benefit significantly from bonding coverage.

The bottom line? If your employees have unsupervised access to client property or handle valuable items, bonding isn’t just recommended – it’s essential for serious business growth. It’s what separates professional cleaning companies from casual operations, and clients can tell the difference.

The Ultimate Guide to Cleaning Service Insurance and Bonding Cost

How much will real protection set you back? Less than most owners expect. Below are typical premiums for small- to mid-size cleaning businesses. Your exact price will vary by state, crew size, revenue and claims history, but these figures give a solid ballpark.

Typical Monthly Premiums

- General Liability – about $48/mo ($1 M / $2 M limits). Over half of owners pay under $50.

- Workers’ Compensation – around $136/mo. Required once you hire staff in most states.

- Commercial Auto – roughly $173/mo for one small van or pickup used for work.

- Business Owner’s Policy (BOP) – bundles general liability + property for $76/mo on average and is usually cheaper than buying the two policies separately.

- Commercial Umbrella – adds an extra $1 M layer for about $67/mo.

For many small operators, a full insurance stack runs $500–$600 per year for liability only, or $2 K–$3 K annually when you add workers’ comp and auto. Compare that with the cost of a single lawsuit, and the value is obvious.

Janitorial Bond Pricing

A fidelity bond is even cheaper:

- $10,000 bond (the most common amount) – ≈ $11/mo or $126/yr.

- Higher limits ($25 K, $50 K, $100 K) scale up, but good credit often keeps the rate at 0.5 %–3 % of the bond amount.

- Small bonds usually need no credit check, so approval is near-instant.

Key Rating Factors

- Employee head-count & payroll – drives workers’ comp and bond cost.

- Services offered – pressure washing or medical-facility cleaning carries more risk than basic residential maid service.

- Claims history – clean record = lower premium.

- Equipment & vehicle value – higher replacement cost means higher property or auto premiums.

- Location – state workers’-comp rules and local claim trends affect price.

Knowing these factors lets you tweak coverage (or safety procedures) to keep premiums as low as possible while still meeting contract requirements and protecting your business.

How to Get Covered and Save Money

Securing the right insurance and bonding for our cleaning business doesn’t have to be complicated or expensive. In fact, with smart strategies and a streamlined process, we can get comprehensive coverage quickly and efficiently, often saving money in the process.

5 Smart Ways to Save on Your Premiums

Here are our top tips for managing cleaning service insurance and bonding cost effectively:

- Bundle Policies (Opt for a BOP): For small, low-risk cleaning businesses, a Business Owner’s Policy (BOP) is a fantastic way to save. It bundles general liability and commercial property insurance, often including business interruption coverage, at a lower rate than purchasing these policies individually.

- Pay Annually: Most insurance providers offer a discount if we pay our premiums annually rather than monthly. It might be a larger upfront cost, but it can lead to significant savings over the year.

- Increase Deductibles: Choosing a higher deductible on our policies means we’ll pay more out-of-pocket if we have a claim, but in return, our regular premiums will be lower. This strategy is best if we have a strong emergency fund and a low likelihood of frequent claims.

- Implement a Safety Program: Proactive risk management can directly impact our premiums. By having a robust safety program for our employees (e.g., training on chemical handling and disposal, providing proper safety gear like gloves and masks, safe lifting techniques), we reduce the likelihood of accidents and claims. Fewer claims signal lower risk to insurers, potentially leading to lower rates.

- Shop Around for Quotes: This is perhaps the most impactful way to save. Every insurer calculates premiums slightly differently, so comparing quotes from multiple providers is essential. Don’t settle for the first quote we receive. We should use online platforms that allow us to compare custom quotes efficiently. Maintaining a clean claims history also helps keep our rates low.

A Simple 3-Step Process to Get Bonded and Insured

Getting the necessary insurance and bonding for our cleaning business is a straightforward process, especially with online resources and dedicated support.

Step 1: Assess Your Risks and Requirements.

Before we even think about quotes, we need to understand what our business does, who our clients are, and what potential risks we face.

- Identify Services: Are we residential, commercial, or both? Do we use specialized equipment or chemicals?

- Employee Count: How many employees do we have? This directly impacts workers’ compensation needs and bond limits.

- Client Needs: Do our target clients (e.g., commercial contracts, government agencies) require specific bond amounts or insurance coverage? We should always research requirements for our cleaning business, checking with city, county, state regulations, and even specific client contracts or landlords.

- Location Specifics: Are there any unique requirements in our operating area, especially in Texas?

Step 2: Gather Business Information.

To get accurate quotes, we’ll need to provide some basic information about our business:

- Our legal business name and address.

- Employer Identification Number (EIN).

- Number of employees and their roles.

- Annual revenue projections.

- Our claims history (if any).

- Details about our vehicles and equipment.

Step 3: Apply Online for Instant Quotes and Fast Approval.

Once we have our information ready, the application process is fast and convenient:

- Online Application: We can complete a simple online application form. This allows us to get free, custom quotes from top-rated providers for all the policies we need, including general liability, workers’ comp, commercial auto, and janitorial bonds.

- Compare and Choose: Review the quotes we receive. Look at coverage limits, deductibles, and premiums. Our goal is to find the best balance of protection and affordability.

- Purchase and Confirmation: Once we select our policies, we can pay the premiums to begin coverage. Many cleaning business owners can begin coverage in less than 24 hours. For bonds, we offer fast approvals and same-day issuance, ensuring we’re bonded in minutes, not days! We will receive a certificate of insurance (COI) for our insurance policies and official confirmation for our bond, which we can then provide to clients as proof of coverage.

By following these steps, we can efficiently obtain the necessary cleaning service insurance and bonding, ensuring our business is protected and ready to thrive.

Frequently Asked Questions about Cleaning Service Protection

We get it – wading through insurance and bonding can feel a bit like navigating a maze! It’s totally normal to have questions. That’s why we’ve put together answers to some of the most common inquiries we hear from cleaning business owners like you. Let’s clear up any confusion and help you feel confident in your business’s protection.

What’s the real difference between being bonded and insured?

This is probably the most common question we get, and for good reason! Many people use “bonded and insured” together, but they actually do very different jobs. Think of it this way:

Insurance is all about protecting your business. It steps in to cover financial losses that happen due to accidents, property damage you cause, or liability claims. For example, if one of your team members accidentally knocks over an expensive vase while cleaning a client’s home, your general liability insurance would help cover the cost of replacing it and any legal fees if things went that far. It’s your financial shield against unexpected events.

A bond, specifically a janitorial bond, is designed to protect your client. It’s a promise that if one of your employees acts dishonestly – like stealing from a client’s property – the client will be reimbursed for their loss. It gives your clients a huge sense of security. But here’s the key difference: if a bond does pay out a claim, your business is typically required to pay that money back to the surety company. The bond isn’t an insurance policy for your own mistakes; it’s a guarantee of your honesty and integrity to your clients. It shows you stand behind your team.

Do I need workers’ compensation if I’m a solo cleaner?

That’s a smart question! Generally, state laws say you only have to get workers’ compensation insurance if you have employees. So, if you’re a one-person cleaning show with no one else on your payroll, you might not be legally required to carry it.

However, we strongly recommend it, even for solo cleaners. Why? Because your personal health insurance might not cover injuries that happen while you’re working. Imagine you slip on a wet floor, strain your back lifting equipment, or get a chemical burn on the job. Workers’ compensation would step in to cover your medical bills and even provide lost wages if you can’t work. It’s a small investment that protects your financial well-being and peace of mind, especially if you’re in a state like Texas where it’s not mandated for solo operators but still a very wise choice.

How much bond coverage do I actually need?

The amount of bond coverage you need really depends on your clients and the types of properties you clean. There’s no single perfect number, but we can give you a good idea based on what’s common:

For residential homes or smaller commercial offices, a bond amount between $10,000 to $25,000 is usually more than enough and widely accepted. In fact, over half of cleaning professionals choose a janitorial bond worth $10,000, which is often sufficient for these types of clients.

However, if you’re aiming for larger commercial contracts, government jobs, or cleaning high-value properties like medical facilities, banks, or corporate offices, clients might ask for a much higher bond. We’re talking $50,000, $100,000, or even more. These clients often have specific requirements to protect their significant assets.

The best rule of thumb? Always check the contract requirements with each new client or when bidding on a new job. If they ask for proof of bonding, simply ask if they have a specific coverage limit in mind. It’s always better to have a slightly higher bond than what’s strictly necessary – it gives your clients maximum confidence and shows your professionalism. When you’re considering your overall cleaning service insurance and bonding cost, a bond is a truly affordable way to build immense trust and open doors to bigger contracts.

Secure Your Business and Build Trust Today

In the vibrant, competitive world of cleaning services, being bonded and insured isn’t just a suggestion; it’s truly the bedrock of a successful and trustworthy business. We’ve journeyed through how understanding cleaning service insurance and bonding cost empowers you to make smart choices that safeguard your hard-earned assets and pave the way for a brighter future.

Think of it this way: comprehensive coverage is your superhero shield. It’s there to protect you from unexpected slip-and-fall accidents with general liability insurance. It also ensures your clients are protected from employee dishonesty with a strong janitorial bond. This means those unforeseen bumps in the road won’t turn into financial disasters, leaving you free to focus on what you do best: delivering sparkling clean results and happy clients.

But it’s more than just financial protection. The true magic of being bonded and insured lies in the incredible trust and credibility it builds. It’s a clear, powerful signal to every potential client that you are professional, responsible, and absolutely committed to their peace of mind. This deep commitment often opens doors to more lucrative contracts and helps you build those lasting, loyal client relationships that are the backbone of any thriving business.

And here’s the best part: this crucial protection is truly a low-cost investment for the immense peace of mind it provides. Here at BEST SURETY BOND COMPANY, we’re experts at making this process fast, affordable, and incredibly straightforward. Whether you’re right here in Houston, across Texas, or anywhere nationwide, we offer lightning-fast approvals, incredibly low rates, and a seamless online experience. We specialize in janitorial bonds, but we also offer online quotes for other essential services like license & permit bonds, contract bonds, court bonds, and performance bonds. We’re dedicated to giving you the fastest turnaround in the industry and the most affordable rates for small businesses and contractors, all backed by our authority and credibility as licensed agents ready to help you every step of the way.

So, why leave your cleaning business vulnerable to unnecessary risks? Take that proactive step today to protect your livelihood and build unshakeable client confidence.

Get your fast, low-cost janitorial bond quote online now. It’s quick, easy, and quite simply, the smartest move you can make for your growing cleaning business.