Why Your Colorado Auto Dealer Bond is the Key to Legal Operations

A Colorado auto dealer bond is a mandatory $50,000 surety bond required by state law for anyone selling three or more vehicles per year in Colorado. Here’s what you need to know:

Quick Facts:

- Bond Amount: $50,000 for dealers, $15,000 for salespersons, $5,000 for small trailer dealers

- Cost: Typically 1-3% of bond amount annually ($250-$1,500 for good credit)

- Purpose: Protects consumers from dealer fraud and ensures tax compliance

- Required By: Colorado Department of Revenue Motor Vehicle Dealer Board

- Legal Basis: Colorado Revised Statutes 44-20-112

Who Needs It:

- New and used car dealers

- Powersports vehicle dealers

- Wholesale dealers and auction dealers

- Individual salespersons (separate $15,000 bond)

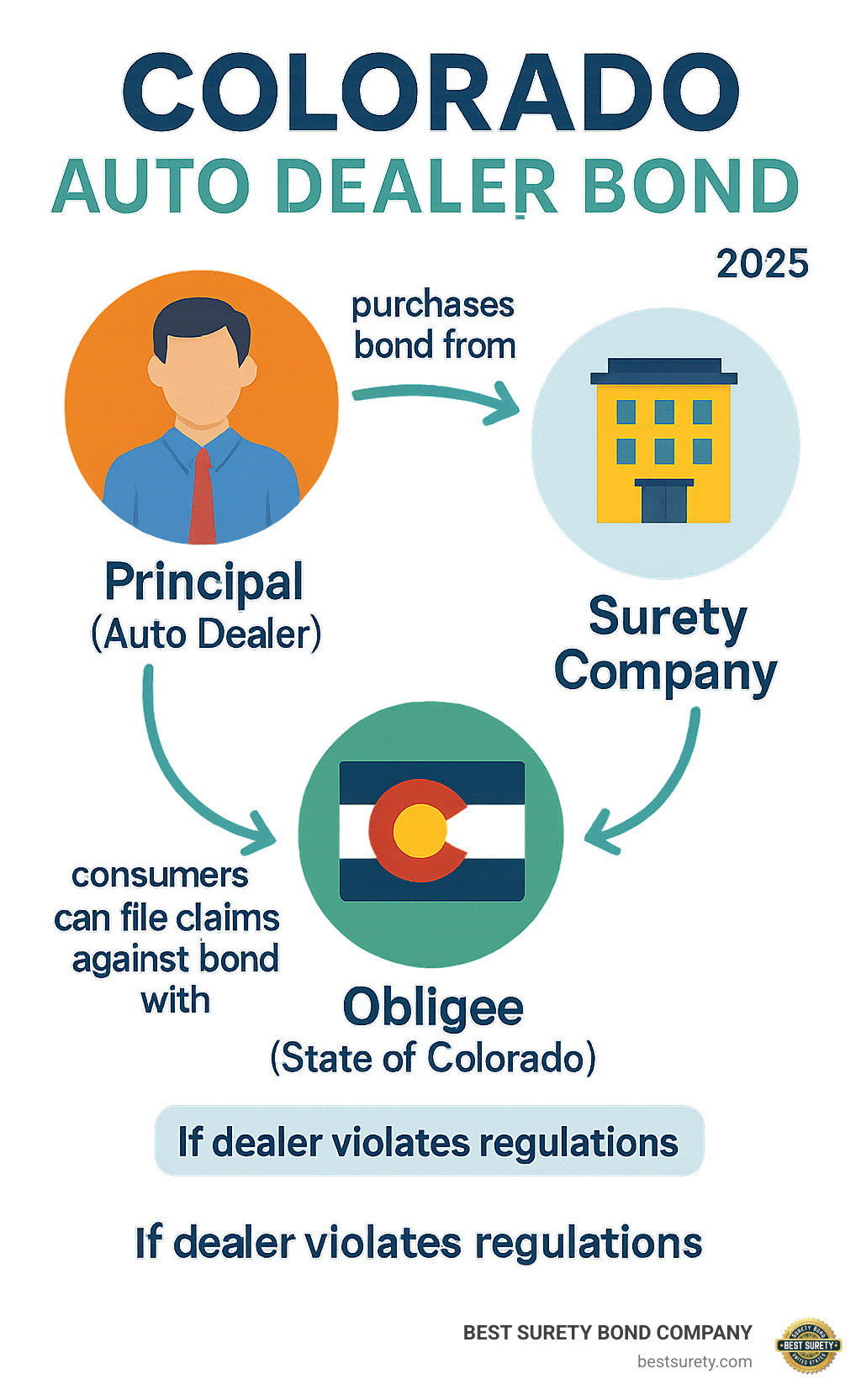

The bond works as a three-party agreement between you (the dealer), the state of Colorado, and a surety company. If you violate licensing laws or harm consumers, the bond pays claims up to the bond amount – but you’re responsible for repaying the surety company.

Getting bonded might seem complex, but it’s actually straightforward when you understand the requirements. The process typically takes 1-2 days once you submit your application, and many dealers with good credit can get approved instantly online.

What makes this tricky is that Colorado has some of the strictest dealer licensing requirements in the nation. You need a minimum net worth of $100,000, a credit score of 701 or higher, and must pass both pre-licensing education and a mastery exam. Miss any detail, and your application gets delayed or denied.

I’m Haiko de Poel, and I’ve helped thousands of business owners steer complex licensing requirements including Colorado auto dealer bonds throughout my two decades in business development and regulatory compliance. This guide will walk you through everything you need to know to get bonded quickly and avoid costly mistakes.

What is a Colorado Auto Dealer Bond and Why is it Required?

Think of a Colorado auto dealer bond as your business’s promise to play by the rules – backed by real money. It’s a special type of surety bond that creates a three-way partnership between you (the dealer), the state of Colorado, and a surety company like Best Surety Bond Company.

Here’s what makes this bond different from regular insurance: it’s not protecting you from losses. Instead, it’s protecting your customers and the state from any mistakes or violations you might make in your business operations.

The bond requirement comes straight from Colorado Revised Statutes 44-20-112, which says you absolutely must have this financial guarantee before you can get your dealer license. The Motor Vehicle Dealer Board through Colorado’s Auto Industry Division makes sure everyone follows this rule.

When you get bonded, you’re essentially saying “If I mess up and harm someone, there’s money available to make it right.” But here’s the catch – if the surety company has to pay out a claim because of something you did wrong, you’re on the hook to pay them back every penny, plus interest and fees.

The Purpose of the Bond: Protecting the Public

Your Colorado auto dealer bond exists for one main reason: keeping consumers safe from financial harm when they buy vehicles from you.

Colorado lawmakers know that buying a car is often the second-largest purchase people make (after their homes), so they want to make sure customers have somewhere to turn if things go wrong. The bond covers situations where dealers cause financial damage through misrepresentation, fraud, or simply failing to follow proper business practices.

The most common problems that trigger bond claims include vehicle title issues where dealers sell cars without clear ownership, unpaid liens on trade-in vehicles that create legal headaches for buyers, and dealers who collect deposits but never deliver the promised vehicle.

The bond also guarantees you’ll pay your taxes and fees to the state on time. If you forget to remit sales tax or other required payments, Colorado can file a claim against your bond to recover what you owe.

The Legal Framework Behind the Requirement

Colorado didn’t just randomly decide to require dealer bonds – this requirement is part of a carefully designed system to maintain public trust in the automotive industry. The state recognizes that when people buy cars, they’re making major financial decisions that affect their daily lives and family budgets.

The Colorado Government Auto Dealer Business Regulations Bill gives the Motor Vehicle Dealer Board real teeth to investigate complaints, issue licenses, and take disciplinary action against dealers who break the rules. The bond requirement ensures that even if a dealer goes out of business or can’t pay damages, consumers still have a way to recover their losses.

This legal framework creates accountability throughout the industry. When dealers know their bond can be claimed against, they’re much more likely to follow proper procedures for title transfers, vehicle inspections, and customer communications.

Who Needs a Bond and What are the Required Amounts?

Understanding who needs a Colorado auto dealer bond comes down to Colorado’s “prima facie evidence” rule. If you sell three or more motor vehicles (or ten or more powersports vehicles) in a calendar year, the state presumes you’re in the business and requires licensing and bonding. The bond amounts vary significantly based on what type of vehicles you’re selling and whether you’re a business or individual salesperson.

The good news is that Colorado keeps things relatively straightforward – there are really just three main bond amounts you need to know about, and most dealers fall into the standard $50,000 category.

Motor Vehicle Dealers and Wholesalers

Most auto dealers in Colorado need the standard $50,000 bond. This applies whether you’re selling brand new vehicles fresh from the factory or well-loved used cars with character. The state doesn’t differentiate between new vehicle dealers and used vehicle dealers when it comes to bond amounts – they both carry the same financial responsibility to consumers.

Powersports dealers also fall into this $50,000 category, covering everything from motorcycles and ATVs to recreational vehicles. If you’re planning to sell that mix of cars and motorcycles, you’ll still need just one $50,000 bond.

Wholesalers and wholesale auction dealers might think they’d get a break since they’re selling primarily to other dealers rather than consumers, but Colorado requires the same $50,000 bond. The state recognizes that even wholesale transactions can impact consumers down the line.

Business disposal dealers – those who sell vehicles on behalf of businesses – also need the full $50,000 bond. This makes sense since they’re still handling consumer transactions, just with a different business model.

Motor Vehicle and Powersports Salespersons

Here’s where it gets interesting: individual salespersons working for licensed dealers must get their own $15,000 bond using form DR 2831. This isn’t optional – every person employed by a dealership to sell vehicles needs this bond, whether they’re working full-time, part-time, or purely on commission.

The salesperson bond protects consumers from individual employee misconduct that might not be covered under the dealer’s main bond. Think of it as a second layer of protection. If a salesperson commits fraud or violates regulations in their individual capacity, consumers have recourse through the salesperson’s personal bond.

This requirement catches many new dealers off guard. They budget for their own $50,000 Colorado auto dealer bond but forget that each salesperson needs their own smaller bond. Factor this into your staffing costs from the beginning.

Exception: Small Trailer Dealers

If you’re exclusively selling small trailers weighing less than 2,000 pounds, you only need a $5,000 bond. This reduced requirement makes sense – small trailer sales typically involve lower dollar amounts and carry less risk for consumers.

This exception is perfect for businesses selling utility trailers, small boat trailers, or lightweight cargo trailers. However, if you sell even one vehicle or larger trailer, you’ll need the full $50,000 bond, so don’t try to squeeze into this category if you don’t truly qualify.

The beauty of Colorado’s system is its clarity. Once you know what you’re selling and how you’re selling it, determining your bond amount is straightforward. Most dealers need $50,000, salespersons need $15,000, and small trailer dealers need $5,000.

The Cost of Your Colorado Auto Dealer Bond

Here’s the good news about your Colorado auto dealer bond cost: you don’t pay the full $50,000 bond amount. Instead, you pay an annual premium that’s just a small percentage of the bond amount – typically between 1% and 10% depending on your qualifications.

Think of it like insurance for your dealership. The premium is what you pay to keep the bond active, while the $50,000 represents the maximum amount the surety company will pay out if there’s a valid claim against you.

Factors That Determine Your Premium

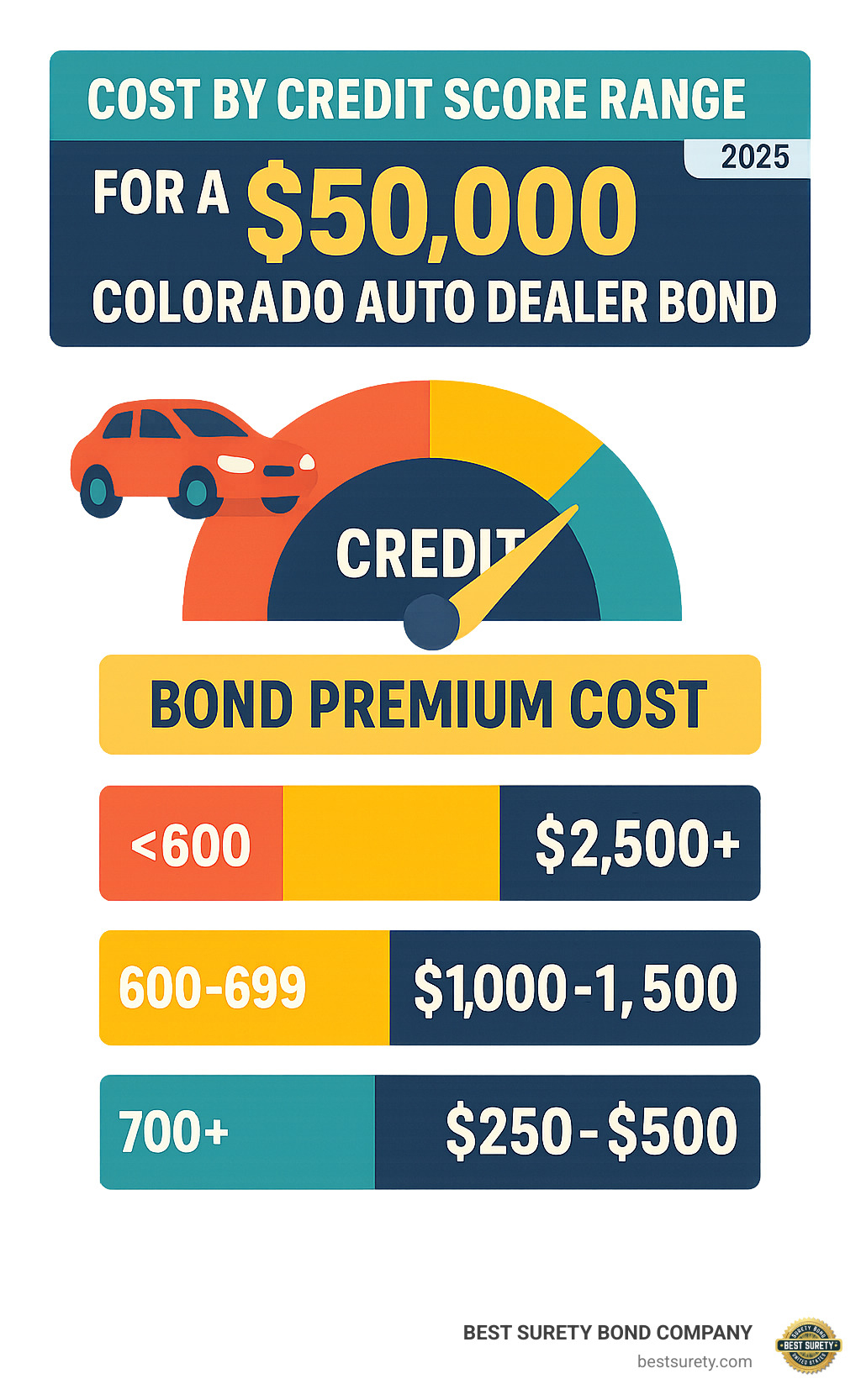

Your personal credit score is the biggest factor in determining your premium. It’s not just about whether you qualify – it dramatically affects how much you’ll pay. Dealers with excellent credit often pay less than $500 annually, while those with poor credit might pay several thousand dollars for the same bond.

Your financial strength also matters significantly. Since Colorado requires dealers to maintain a minimum net worth of $100,000, surety companies review your financial statements to assess risk. Stronger financials typically translate to lower premiums because you’re seen as more likely to honor your obligations.

Business experience in the automotive industry can work in your favor. If you’ve successfully operated dealerships before without bond claims or regulatory issues, many surety companies will offer preferential pricing. They know experienced dealers understand the regulations and are less likely to make costly mistakes.

The surety company also considers industry risk factors and any previous claims history you might have. Even claims from other states or different types of bonds can affect your Colorado auto dealer bond premium.

How Much Does a $50,000 Colorado Auto Dealer Bond Cost?

The reality is that most qualified dealers pay far less than they expect. If you have good credit (700+), you’ll typically pay between $250 to $500 annually for your $50,000 bond. That breaks down to just $25 to $42 per month – less than most people spend on their phone bill.

For dealers with fair credit (660-699), expect annual premiums between $300 to $750. If your credit score falls in the 626-659 range, you’re looking at $375 to $1,000 annually. Even with poor credit (600-625), many dealers can still get bonded for $750 to $1,500 per year.

| Credit Score Range | Annual Premium | Monthly Premium |

|---|---|---|

| 700+ | $250 – $500 | $25 – $42 |

| 660-699 | $300 – $750 | $30 – $63 |

| 626-659 | $375 – $1,000 | $38 – $83 |

| 600-625 | $750 – $1,500 | $75 – $125 |

| 580-599 | $1,500 – $2,500 | $150 – $208 |

| 550-579 | $2,500 – $3,000 | $250 – $292 |

| Below 550 | $3,000 – $5,000 | $292 – $417 |

For salesperson bonds ($15,000), you’ll pay proportionally less – often starting around $100 annually with good credit. Small trailer dealer bonds ($5,000) typically cost between $100 to $175 per year.

Many surety companies offer monthly payment plans to help with cash flow, especially when you’re starting a new dealership and managing multiple startup costs. At BEST SURETY BOND COMPANY, we understand that every dollar matters when you’re getting your business off the ground, which is why we offer flexible payment options and work to get you the lowest possible rate for your situation.

A Step-by-Step Guide to Getting Your License and Bond

Getting your Colorado auto dealer bond and license feels daunting until you see the process broken into three clear milestones. Follow these condensed steps and most applicants can secure their bond in 1-2 days and complete the entire licensing package inside 60 days.

Step 1: Confirm You Meet Colorado’s Pre-Qualification Rules

- Financial strength – Prove a personal net worth of $100,000+ and a minimum Experian VantageScore 4.0 credit score of 701.

- Background check – Submit fingerprints through the Colorado Bureau of Investigation. Felonies involving fraud, theft, or motor-vehicle crimes in the last 10 years can disqualify you.

- Education – Finish the Pre-Licensing Education and pass the Auto Industry Mastery Exam.

- Location – Lease or own a permanent lot, meet zoning rules, display required signage, and maintain posted business hours (minimum 4 continuous hours, 3 days a week).

Step 2: Secure Your Colorado Auto Dealer Bond

Applying online with a specialist such as BEST SURETY BOND COMPANY is the fastest route. Provide your business name, address, license type, and basic financials. Dealers with good credit commonly receive instant approval and an emailed copy of bond form DR 2830 the same day.

Key points to remember:

- The bond must list all legal and “doing-business-as” names exactly as they appear on your license application.

- The surety’s attorney-in-fact must sign and attach a Power of Attorney.

- Keep the original bond with wet signatures for the application packet.

Payment options include ACH, credit card, or monthly financing—helpful when your cash is tied up in inventory and facility upgrades.

Step 3: Assemble and Mail the License Packet

Use the Dealer/Wholesaler Application Checklist to avoid omissions. At minimum you’ll submit:

- Form DR 2109 – Dealer/Wholesaler Application

- Owner Addendums for each owner/officer

- Pre-Licensing Education certificate + Mastery Exam affidavit

- Original $50,000 surety bond DR 2830

- Financial Statement DR 2114 and supporting docs

- Place of Business Affidavit DR 2044 + photos of lot and sign

- Certificate of Good Standing, Articles of Organization/Incorporation, and trade-name filings (if applicable)

- Fees – currently $959 for a new dealer license plus $39.50 fingerprint fee (salesperson license is $231)

Mail the complete packet to:

Colorado Department of Revenue – Auto Industry Division

1881 Pierce St., #112

Lakewood, CO 80214

Applications are processed in the order received, so an error pushes you to the back of the queue. Triple-check every signature, date, and form number before sealing the envelope.

That’s it—three steps. Meet the financial/education requirements, secure your bond, and mail a bullet-proof packet. Follow them exactly and you’ll be selling vehicles legally in Colorado much sooner than you think.

Renewals and Avoiding Claims on Your Bond

Running a successful dealership means treating your Colorado auto dealer bond like routine maintenance—renew it on time and keep it spotless.

Renewing Your License and Bond

- License – Expires June 30 every year, no matter when it was issued. Renewal fee: $782 (dealer/wholesaler) or $178 (salesperson).

- Bond – Most sureties bill 30-60 days before the bond term ends. A quick credit review may adjust your premium up or down.

- If the bond lapses, your license becomes invalid immediately—no sales, no exceptions. Set calendar reminders and opt-in for auto-renewal with your surety.

How to Steer Clear of Bond Claims

- Titles first – Never sell a unit without clear title. Pay off liens on trade-ins immediately.

- Accurate advertising – Colorado watches pricing and “as-is” disclosures closely; misrepresentation sparks complaints fast.

- Tax compliance – Remit sales-tax proceeds when due; the state can file against your bond for unpaid taxes.

- Employee oversight – Each salesperson needs their own $15,000 bond. Train staff on paperwork, ethical sales, and complaint handling.

- Document everything – Contracts, disclosures, customer conversations. Good files protect you during an investigation.

Any claim the surety pays comes out of your pocket. Prevent problems upfront and your bond will remain a simple, low-cost license requirement—not an expensive liability.

Frequently Asked Questions about the Colorado Auto Dealer Bond

When I talk to dealers about getting their Colorado auto dealer bond, the same questions come up again and again. Let me address the most common concerns that might be on your mind too.

How much does a $50,000 Colorado auto dealer bond cost?

Here’s what catches most people off guard – you don’t pay anywhere near $50,000 for your bond. The actual cost is just a small percentage of that amount, typically ranging from $250 to $5,000 annually depending on your credit score and financial strength.

If you have excellent credit (700 or higher), you’re looking at premiums starting around $250-$500 per year – that’s less than $42 per month for many dealers. Even with fair credit in the 600s, most dealers pay between $500-$1,500 annually.

The premium is calculated as a percentage of the bond amount, not the full face value. Think of it like insurance – you pay a small annual fee for the protection, not the entire coverage amount upfront.

Can I get a Colorado auto dealer bond with bad credit?

Absolutely – and this is one of the most important things I want you to understand. Bad credit doesn’t disqualify you from getting bonded. It just means you’ll pay higher premiums while you work on improving your credit situation.

Many surety companies, including BEST SURETY BOND COMPANY, specialize in helping dealers with credit challenges. Your options typically include higher premium rates (usually 5-10% of the bond amount), monthly payment plans to help with cash flow, and sometimes collateral requirements for very challenging credit situations.

The key is being upfront about your credit situation. Surety companies would rather work with honest applicants who have credit challenges than find problems later in the process.

What’s the difference between a dealer bond and a salesperson bond?

This question comes up because Colorado requires both types of bonds, and it can get confusing. The main differences are pretty straightforward once you understand the purpose of each.

Dealer bonds are $50,000 and cover your entire dealership operation. This bond protects consumers from any violations or fraud committed by your business as a whole. It’s required for your dealer license and covers all aspects of your dealership operations.

Salesperson bonds are $15,000 and cover individual employees who sell vehicles. Each salesperson working for your dealership needs their own bond, which protects consumers from individual employee misconduct that might not be covered under your dealer bond.

The scope is different too – your dealer bond covers business-level issues like failing to pay taxes or transfer titles properly, while salesperson bonds cover individual sales activities and personal misconduct by employees.

Both bonds serve the same basic purpose of protecting consumers, but they work together to provide comprehensive coverage for different aspects of your operation.

Get Your Colorado Dealer Bond with Confidence

Getting your Colorado auto dealer bond is actually more straightforward than most people think. Yes, Colorado has some of the strictest dealer licensing requirements in the country, but when you break it down into manageable steps, the process becomes much less intimidating.

The key is starting with your bond early in the licensing process. Many dealers make the mistake of waiting until the last minute, only to find that their credit needs work or their documentation isn’t quite right. By getting your bond secured first, you eliminate one of the biggest potential roadblocks to your license approval.

Here’s the reality: If you meet Colorado’s basic requirements – that $100,000 net worth, credit score of 701+, and clean background – getting bonded can happen in as little as 24 hours. Even if your credit isn’t perfect, experienced surety companies have programs specifically designed for dealers with credit challenges.

At BEST SURETY BOND COMPANY, we’ve streamlined the entire process because we understand that time is money when you’re trying to get your dealership up and running. Our online application takes just minutes to complete, and we offer same-day approvals for qualified applicants. More importantly, we know exactly what Colorado’s Motor Vehicle Dealer Board is looking for in bond documentation.

The documentation piece is crucial. Colorado’s licensing checklist is extensive, and missing even one small detail can delay your application by weeks. But when you work with a surety company that specializes in Colorado dealer bonds, they’ll make sure your bond form DR 2830 is filled out correctly, properly notarized, and includes all the required signatures and power of attorney documentation.

Payment flexibility matters too, especially for new dealers managing startup costs. We offer monthly payment plans that can reduce your initial cash outlay from thousands of dollars to just a few hundred. This helps preserve your working capital for inventory, facility improvements, and other essential business expenses.

Your Colorado auto dealer bond isn’t just a regulatory hurdle – it’s actually a competitive advantage. When customers see that you’re properly licensed and bonded, it builds trust and credibility. It shows you’re committed to ethical business practices and consumer protection.

The bonding process also helps you understand Colorado’s regulatory framework better. The questions you’ll answer and documentation you’ll provide give you a solid foundation for maintaining compliance throughout your business operations.

Ready to take the next step? Get Bonded Today and find how fast and affordable getting your Colorado dealer bond can be. Our licensed agents understand Colorado’s requirements inside and out, and we’re here to guide you through every step of the process.

Your dealership dreams are closer than you think – let’s get you bonded and on the road to success in Colorado’s automotive industry.