Why Contractor Bond Costs Matter for Your Business

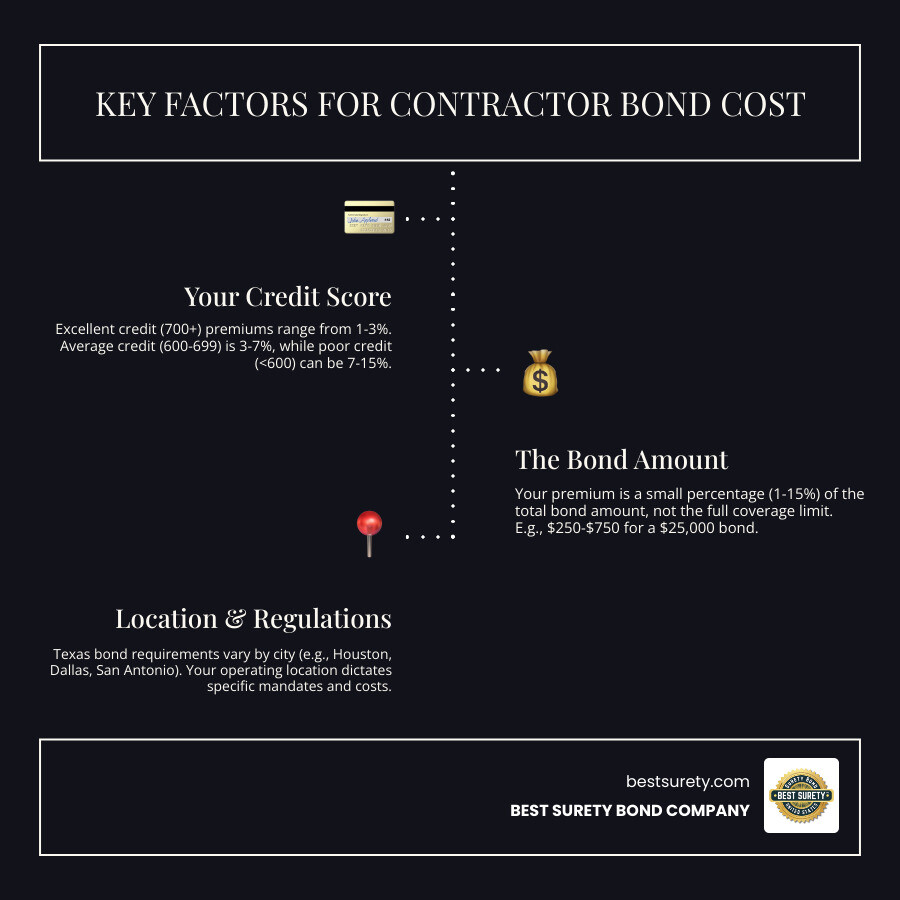

Understanding contractors bond cost is crucial for any construction professional looking to get licensed and legally operate their business. The cost typically ranges from 1% to 15% of the total bond amount, with most qualified contractors paying between 1.5% to 3% annually.

Quick Answer – Contractors Bond Cost Breakdown:

- Excellent Credit (700+): 1-3% of bond amount annually

- Average Credit (600-699): 3-7% of bond amount annually

- Poor Credit (Below 600): 7-15% of bond amount annually

- Example: A $10,000 bond costs $100-$300/year for good credit

- Factors: Credit score, bond type, location, and business experience

Most contractors are surprised to learn that the bond cost (called the “premium”) is just a small percentage of the total bond amount. For instance, if you need a $25,000 contractor license bond, you won’t pay $25,000 – you’ll typically pay between $250 to $750 per year depending on your qualifications.

The confusion around bond pricing often stems from not understanding the difference between the bond amount (the coverage limit that protects the public) and the bond premium (what you actually pay). This distinction is critical for budgeting your business expenses accurately.

In Texas, contractor bond requirements vary significantly by city and county. While there’s no statewide bonding requirement for all contractors, cities like Houston, Dallas, and San Antonio each have specific bond mandates for different types of construction work. This localized approach means your contractors bond cost can vary depending on where you plan to operate.

I’m Haiko de Poel, and I’ve helped hundreds of contractors steer the complexities of contractors bond cost and surety requirements across multiple industries over the past two decades. My experience in scaling businesses has shown me that understanding these costs upfront is essential for sustainable growth in the construction industry.

What is a Contractor Bond and Why is it Required?

Understanding contractors bond cost starts with knowing what you’re actually paying for. A contractor bond isn’t insurance that protects you – it’s a financial safety net that protects your clients and the public from your potential mistakes or failures.

Think of a contractor bond as a three-party promise. You’re the principal (the contractor who needs the bond). The obligee is whoever requires the bond – usually a government agency, city, or sometimes a project owner. The surety is the company that backs your promise with their financial guarantee.

Here’s where it gets interesting: unlike your truck insurance that covers your losses, a contractor bond covers everyone else’s losses if you mess up. If you fail to complete a job, violate building codes, or cause damage to a client’s property, they can file a claim against your bond for compensation.

Why do cities and states require these bonds? It’s all about public protection. When you get a contractor’s license, you’re essentially getting permission to work on other people’s most valuable assets – their homes and businesses. The bond ensures there’s financial recourse if things go wrong.

In Texas, bond requirements vary dramatically by location. While there’s no statewide mandate for all contractors, cities like Houston, Dallas, and San Antonio each have their own specific requirements. For example, Houston requires storm water quality bonds for certain projects, as outlined in their Houston Public Works: Storm Water Quality (SWQ) Permit Information.

The consequences of skipping this requirement are serious. Operating without a required bond can result in license suspension, hefty fines, and legal trouble. The Texas government code makes it clear that regulatory compliance isn’t optional – it’s the law.

What makes this different from insurance is the recourse aspect. If someone files a successful claim against your bond, you’re responsible for paying the surety company back every penny they paid out, plus interest and fees. This creates a strong incentive to maintain high professional standards.

The good news? Most contractors never have claims filed against their bonds because they do quality work and follow the rules. The bond is simply your ticket to legal operation and a way to demonstrate financial responsibility to potential clients.

For more detailed information about different types of required bonds and their specific costs, check out our comprehensive guide on license and permit bonds.

The Core Difference: Bond Amount vs. Your Actual Bond Cost

Here’s where many contractors get confused, and honestly, it’s completely understandable. When you first hear about needing a “$25,000 contractor bond,” your heart might skip a beat thinking you need to write a check for twenty-five grand. Take a deep breath – that’s not how it works at all.

The bond amount – sometimes called the penal sum – is the maximum dollar amount that provides financial protection to the public if something goes wrong with your work. Think of it as the coverage limit. If you need a $25,000 contractor license bond, that means the surety company guarantees up to $25,000 in coverage for any valid claims against you.

But here’s the key part: your actual contractors bond cost is just a small percentage of that bond amount. This is called the bond premium, and it’s typically just 1% to 10% of the total bond amount per year. So for that $25,000 bond, you’re probably looking at paying somewhere between $250 to $2,500 annually, depending on factors like your credit score and the type of work you do.

Let me put this in perspective with a simple cost example. If you have excellent credit and need a $10,000 license bond in Texas, your annual premium might be just $100 to $300. That’s less than most contractors spend on coffee in a month, but it provides crucial financial protection that keeps you legally compliant and your clients protected.

The bond amount is set by whoever requires the bond – usually a city, county, or state agency. They determine how much coverage they want based on the potential risk of your work. Your job is simply to pay the much smaller premium to get that coverage in place.

Think of it like car insurance. Your policy might cover $100,000 in damages, but you don’t pay $100,000 for that coverage – you pay a manageable monthly or annual premium. The same principle applies to contractor bonds, making this essential business requirement much more affordable than it initially appears.

Calculating Your Contractors Bond Cost: What Factors Matter?

When you’re trying to figure out your exact contractors bond cost, it’s not as simple as looking up a price in a catalog. Several important factors come together to determine what you’ll actually pay, and understanding these can help you budget more effectively for your business.

The surety company goes through what’s called an underwriting process – essentially a comprehensive risk assessment – to determine your premium rate. Think of it like applying for a loan, where the lender evaluates your creditworthiness, but instead of lending money, the surety company is providing a financial guarantee on your behalf.

How Your Credit Score Impacts Your Contractors Bond Cost

Your personal credit score is hands down the biggest factor in determining your contractors bond cost. It makes sense when you think about it – the surety company is essentially vouching for you financially, so they want to know you’re reliable with money.

Excellent credit (700 and above) puts you in the sweet spot. You’re seen as low-risk, which means you’ll qualify for the best rates available. We’re talking as low as 1% of the total bond amount. So if you need a $10,000 contractor bond and have excellent credit, you might pay just $100 for the entire year.

Average credit (600-699) means you’ll pay a bit more, typically between 3% and 7% of the bond amount. It’s still very manageable for most contractors, and you won’t have trouble getting approved.

Poor credit (below 600) doesn’t mean you’re out of luck, but it does mean higher costs. You might pay anywhere from 7% to 15% of the bond amount. The good news? We specialize in helping contractors with all types of credit situations, and we have programs specifically designed for high-risk applicants.

Here’s how this plays out in real dollars for a typical $25,000 contractor bond:

| Credit Score Range | Estimated Annual Premium for a $25,000 Bond |

|---|---|

| Excellent (700+) | $250 – $750 |

| Average (600-699) | $750 – $1,250 |

| Poor (Below 600) | $1,250 – $3,750+ |

Don’t worry about the credit check affecting your score – surety bond credit pulls are typically soft inquiries that won’t ding your credit rating.

The Role of State and Local Regulations in Texas

Here’s where things get interesting, especially if you’re working in Texas. Unlike some states that have a single, statewide contractor licensing system, Texas takes a more localized approach. This means your contractors bond cost can vary significantly depending on exactly where you plan to work.

The state of Texas doesn’t require all contractors to have a state-level license bond. Instead, individual cities and counties set their own rules. This creates a patchwork of requirements that can be confusing but also means you might only need bonding in specific areas.

Houston has its own set of requirements, including specific bonds for things like storm water quality permits. You can find detailed information about Houston Public Works Storm Water Quality (SWQ) Permit Information if you’re working on projects that might need this type of bonding.

Dallas and San Antonio each have their own municipal requirements that might be completely different from Houston’s. A contractor working in multiple Texas cities might need several different bonds, each with its own cost structure.

Specialty trades like electricians, plumbers, and HVAC contractors often have state-level licensing through agencies like the Texas Department of Licensing and Regulation (TDLR). These come with their own bond requirements that are separate from any city-level bonds you might need.

The bond amounts can vary wildly too. One city might require a $5,000 bond (costing around $100 annually), while another might mandate a $75,000 bond (costing several hundred dollars per year). This directly impacts your bottom line, especially if you’re working across multiple jurisdictions.

We’ve helped hundreds of Texas contractors steer these complex local requirements. For more specific information about Texas bonding requirements, check out our detailed guide on Texas contractor bonds.

Different Bond Types and Their Varying Costs

Not all contractor bonds are created equal, and the type you need will significantly impact your contractors bond cost. Let’s break down the main categories you’re likely to encounter.

License and permit bonds are the bread and butter of contractor bonding. These are what most people think of when they hear “contractor bond.” They’re required by licensing authorities to ensure you follow regulations and maintain your license. The cost typically ranges from 1% to 5% of the bond amount, with smaller bonds often starting around $100.

Construction bonds are a whole different animal. These are project-specific and often required for larger construction jobs, especially public works projects. They include bid bonds (which guarantee you’ll enter into a contract if your bid is accepted), performance bonds (which guarantee you’ll complete the project as specified), and payment bonds (which guarantee you’ll pay your subcontractors and suppliers).

Bid bonds are unique because they’re often issued at a flat rate of around $100 per contract, regardless of the project size. Performance and payment bonds, however, typically cost 2.5% to 3% of the bond amount for qualified applicants. So if you’re bonding a $100,000 project, you might pay around $3,000 for combined performance and payment bonds.

For more detailed information about these specialized bonds, visit our construction surety bonds page.

Commercial surety bonds cover a broader range of business needs beyond just contractor licensing. These might include things like notary bonds, freight broker bonds, or customs bonds, depending on your business activities. You can explore our full range of commercial surety bonds to see what might apply to your situation.

The key takeaway is that each bond type has its own risk profile and cost structure. A simple license bond might cost you $100 per year, while bonding a major construction project could cost thousands. Understanding which bonds you need – and when you need them – is crucial for accurate business planning.

How to Secure the Best Rates and Get Bonded Fast

Getting the right contractor bond quickly while securing the best possible contractors bond cost doesn’t have to be a headache. After helping thousands of contractors across Texas and nationwide, I’ve learned that the key is knowing where to look and how to present yourself as a low-risk applicant.

The beauty of working with a national agency like us is that we can shop multiple surety markets on your behalf. Instead of calling around to different companies and filling out multiple applications, we handle the legwork. Our relationships with top-rated surety providers mean we can present your application to the company most likely to offer you the best rate based on your specific situation.

Online applications have revolutionized how contractors get bonded. Gone are the days of waiting weeks for approval. With our streamlined digital process, many contractors receive instant quotes and can be approved the same day they apply. For standard license bonds, you might even get your bond certificate within minutes of completing payment.

Your financial history and business experience play crucial roles in securing favorable rates. Even if your credit isn’t perfect, being transparent about your situation and demonstrating your commitment to your trade can work in your favor. We specialize in working with contractors across the credit spectrum, including those who’ve been turned down elsewhere.

Premium financing options can make larger bond amounts more manageable for your cash flow. Instead of paying the entire premium upfront, you can often spread the cost over monthly payments. This is particularly helpful for construction contractors who need multiple bonds or higher bond amounts.

Finding the Lowest Contractors Bond Cost

The secret to minimizing your contractors bond cost lies in understanding how the system works and positioning yourself as an attractive risk to underwriters. Having worked with contractors from Houston to Dallas and beyond, I’ve seen how small preparation steps can save hundreds or even thousands of dollars annually.

Shopping rates effectively means more than just comparing numbers. Different surety companies specialize in different types of risks and bond amounts. What might be expensive with one company could be competitively priced with another. That’s why our multi-market approach gives you a significant advantage.

The application process itself is straightforward when you know what to expect. You’ll need your business information, the specific bond type and amount required, and some basic financial details. For most license and permit bonds, the process takes just a few minutes online. Larger contract bonds might require additional documentation, but we guide you through every step.

Required documentation typically includes your business license information, the obligee’s requirements, and sometimes financial statements for larger bonds. Having this information ready speeds up the entire process and helps ensure accurate pricing from the start.

Quick approval is our specialty, especially for Texas contractors who need to meet tight deadlines. Whether you’re in Houston dealing with city permit requirements or anywhere else in Texas facing local bonding mandates, we understand the urgency. Our same-day approval process means you can often get bonded and back to work without missing a beat.

The key is working with a company that understands both the fast service contractors need and the low rates that keep your business profitable. That’s exactly what we deliver at BEST SURETY BOND COMPANY.

Frequently Asked Questions about Contractor Bond Costs

Over my years helping contractors steer the bonding process, I’ve heard the same questions countless times. Let me address the most common concerns about contractors bond cost so you can move forward with confidence.

How much does a typical $10,000 contractor bond cost?

Here’s the good news – a $10,000 contractor bond is much more affordable than most people expect. If you have excellent credit, you could pay as little as $100 for a one-year term. That’s just 1% of the total bond amount!

For most qualified contractors, the premium typically falls between 1% to 3% of the bond amount. This means you’ll likely pay somewhere between $100 and $300 annually for that $10,000 bond. This small annual payment gives you access to work that might bring in tens of thousands of dollars in revenue.

The key factor here is your credit score and overall financial profile. The stronger your credit, the closer you’ll get to that minimum 1% rate.

Can I get a contractor bond in Texas with bad credit?

Absolutely! Don’t let past financial challenges stop you from pursuing your contracting business in Texas. While it’s true that contractors bond cost will be higher with poor credit – typically between 5% to 15% of the bond amount – we specialize in finding solutions for contractors across the entire credit spectrum.

We work with multiple surety companies that offer specialized bad credit programs specifically designed for high-risk applicants. These programs recognize that credit scores don’t always reflect your current ability to fulfill your professional obligations. Whether you’re working in Houston, Dallas, San Antonio, or any other Texas city, we can help you get the bonding you need to operate legally.

Even at the higher premium rates, getting bonded is usually a smart investment. The ability to bid on projects and maintain your license typically generates far more revenue than the additional cost of the bond premium.

Are there any hidden fees associated with contractor bonds?

This is one of my favorite questions to answer because the answer is simple: No hidden fees, period. When we quote you a premium price, that’s exactly what you’ll pay for the entire term of your bond.

Your quoted contractors bond cost covers everything – the underwriting process, bond issuance, and even filing with the obligee when required. We believe in complete transparency because trust is the foundation of any good business relationship.

Some contractors worry about renewal fees or processing charges, but with a reputable surety provider like us, what you see is what you get. This straightforward approach has helped us build lasting relationships with contractors throughout Texas and across the nation.

If you’re ready to get started, most bonds can be issued the same day with our streamlined online process. No surprises, no hidden costs – just fast, affordable bonding solutions.

Get Your Instant Contractor Bond Quote Today

Now that you understand how contractors bond cost works and what factors influence your premium, it’s time to take action. The key factors we’ve covered—your credit score, bond type, and location-specific regulations—all play a role in determining your final cost, but the most important step is getting started.

Here in Texas, we’ve seen countless contractors put off getting bonded because they’re worried about the cost or complexity. The truth is, most contractors are pleasantly surprised by how affordable and straightforward the process actually is. Whether you’re working on a project in Houston that requires compliance with specific city ordinances, or you’re expanding your business to Dallas or San Antonio, we understand the local requirements that affect your contractors bond cost.

At BEST SURETY BOND COMPANY, we’ve built our reputation on two simple promises: fast approvals and low rates. Our Texas-based team of licensed agents knows the ins and outs of local regulations, from Houston’s Storm Water Quality permits to the varying bond requirements across different Texas municipalities. But our expertise doesn’t stop at the state line—we’re licensed to write bonds in all 50 states, giving you the flexibility to grow your business wherever opportunities arise.

The beauty of our online application process is its simplicity. You can get an instant quote in minutes, often with same-day approval and electronic delivery of your bond. No more waiting weeks for paperwork to process or wondering if you’re getting a competitive rate. Our system connects you with multiple surety markets automatically, ensuring you get the lowest available premium without the hassle of shopping around yourself.

We know that as a contractor, your time is valuable and your cash flow matters. That’s why we’ve streamlined everything to be as efficient as possible. From the moment you submit your application to the time your bond is filed with the obligee, we handle the details so you can focus on what you do best—building and growing your business.

Ready to see exactly what your contractors bond cost will be? Don’t let uncertainty hold you back from the work you want to pursue.

Get Bonded Today with an Instant Online Approval!