Why Getting a Court Bond Online is Revolutionizing Legal Compliance

Getting a court bond online transforms how you meet legal obligations. Instead of spending days visiting offices and waiting on paperwork, you can now secure most court bonds with just a few clicks from your computer or phone.

Quick Answer: How to Get a Court Bond Online

- Determine your bond type – judicial (appeal, injunction) or fiduciary (executor, guardianship)

- Gather required information – court case number, bond amount, personal/business details

- Get an instant quote – takes 2-3 minutes with a soft credit pull

- Apply and pay online – secure digital process with same-day issuance

- Receive your bond – digital delivery, ready for court filing

Court bonds are surety bonds that guarantee you’ll fulfill a court-ordered obligation. Whether you’re appealing a decision, serving as an executor of an estate, or acting as a guardian, courts require these financial guarantees to protect all parties involved. As one satisfied customer noted: “Cannot believe how easy the process was. This company is the gold standard in customer service and efficiency.”

The digital revolution in court bonds means faster approvals, lower costs, and 24/7 availability. Today’s online platforms offer instant quotes and same-day bond issuance, a stark contrast to traditional methods that often took weeks.

I’m Haiko de Poel. With two decades in fintech and legal services, I’ve seen how court bond online platforms remove the frustrating delays of traditional methods. My experience has shown me how digital solutions simplify complex legal requirements for thousands of clients.

What Are Court Bonds and Why Are They Required?

A court bond online is a financial promise that protects everyone involved in a legal case. It guarantees you will fulfill the court’s requirements, with money set aside to cover any damages if you fail to do so.

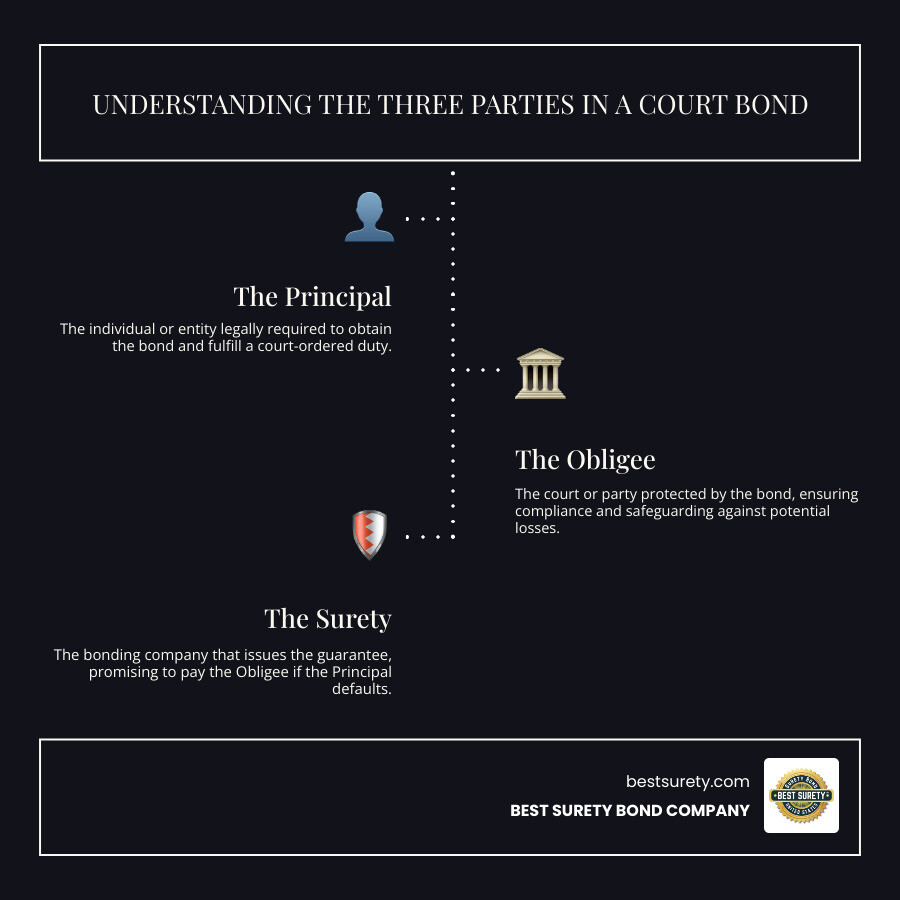

Court bonds are surety bonds that create a safety net for the legal system. They involve three parties: you (the Principal) who needs the bond, the court (the Obligee) that requires it, and the surety company that backs your promise. It’s like having a financial co-signer who vouches for your reliability.

But why do courts insist on these bonds? The answer is to protect people’s interests and ensure the legal system runs smoothly.

Courts require bonds to verify your credibility and financial responsibility when you’re given certain legal privileges. Whether you’re appealing a judgment in Houston’s state courts or managing an estate, these bonds serve as your financial reputation on paper.

The bonds are essential for fulfilling court-appointed duties like serving as an executor or guardian. They ensure you’ll handle these serious responsibilities ethically. If you’re managing an inheritance or a minor’s finances, the bond protects those vulnerable parties.

Risk reduction is another major reason courts demand these guarantees. Legal disputes often involve significant money. If a court allows you to take an action—like seizing assets—a bond protects the other party if that action turns out to be wrongful.

Most importantly, bonds ensure compliance with court orders because there are real financial consequences for breaking your promises. This motivates everyone to follow through on their legal obligations.

These protections are used throughout state courts across Texas and the entire United States, as well as in federal court proceedings. Whether you’re dealing with complex business litigation or family estate matters, court bonds provide the trust and security that keeps our legal system functioning fairly.

For a deeper understanding of how these financial instruments work, explore our comprehensive guide on understanding court bonds.

The Main Types of Court Bonds Explained

To get the right court bond online quickly, you must know which type you need. Court bonds fall into two main categories, each serving a different purpose in the legal system.

Judicial Bonds are required during litigation to protect parties from potential financial losses. Because court outcomes are unpredictable, these bonds often have stricter underwriting and qualification requirements.

Fiduciary and Probate Bonds serve a different but equally important purpose. These bonds ensure that people appointed to manage others’ affairs—like handling an estate or caring for someone who can’t manage on their own—do their job honestly. They’re all about protecting vulnerable people and ensuring proper asset management.

The distinction matters because it affects your approval process and premium costs. Judicial bonds often require more extensive underwriting, while fiduciary bonds focus more on your character and responsibility.

Common Judicial Bonds

Judicial bonds cover a wide range of court-related situations. Appeal Bonds let you delay paying a judgment while you challenge it, guaranteeing payment if your appeal fails. Injunction Bonds protect defendants from damages if a court-ordered injunction proves unnecessary.

Replevin Bonds are used to reclaim property before a lawsuit concludes, ensuring the defendant gets it back if they win. Bail Bonds guarantee a defendant will appear in court after being released.

Release of Lien Bonds help property owners move forward with projects when a mechanic’s lien is disputed. Plaintiff’s Attachment Bonds protect defendants by guaranteeing compensation if a plaintiff’s seizure of their property was wrongful.

Common Fiduciary & Probate Bonds

Fiduciary bonds are all about trust. Executor Bonds ensure an estate is settled according to the deceased’s wishes. Guardianship Bonds protect minors or incapacitated adults by guaranteeing their guardian will manage their affairs honestly.

Custodian Bonds work similarly, ensuring faithful management of someone else’s assets. VA Fiduciary Bonds allow a trusted person to manage a veteran’s benefits when they cannot.

Trustee Bonds guarantee that trustees fulfill their court-ordered duties, from managing a trust to handling a property sale. These bonds provide peace of mind, knowing there’s financial backing if something goes wrong.

Whether you’re dealing with complex estate matters in Houston or managing litigation nationwide, these bonds provide essential protection. While court bonds are our focus here, many of these same principles apply to other business guarantees—you can explore more about how we help protect businesses with commercial surety bonds.

How to Get a Court Bond Online: A Step-by-Step Guide

Securing a court bond online eliminates the long waits and office visits of the past. When facing tight court deadlines in Houston or anywhere nationwide, our streamlined digital service provides the instant quotes and fast approvals you need. What once took weeks can now be completed in hours, sometimes even minutes, allowing you to focus on your legal matters instead of paperwork.

Step 1: Gather Necessary Information for Your Court Bond Online

Before you apply, take a few minutes to collect the necessary information. Having everything ready makes the process smooth and efficient.

Your court case number is essential for identifying your legal proceeding. You’ll also need the bond amount required, which is stated in your court order. Our licensed agents are always available to help interpret these documents if needed.

For personal information, have your full legal name, contact details, and social security number ready. If applying for probate bonds, gather estate details like asset and liability information. For appeal bonds, especially larger ones, you may need business financials like financial statements.

Having these details organized means you can complete your application quickly, avoiding delays when working against court deadlines.

Step 2: Apply and Get Your Free Quote

This is where the convenience of getting a court bond online truly stands out. Our online quote tool transforms a once-complicated process into something remarkably simple.

Our 2-minute application is designed to capture essential information without overwhelming you. Most applicants can complete it in about two minutes and receive a free, no-obligation quote almost instantly for many bond types.

We typically use a soft credit pull to check eligibility and determine rates without impacting your credit score. This reflects our commitment to making the process as painless as possible.

Our fast surety bond approval is backed by efficient underwriting that considers your specific situation. We know court deadlines don’t wait, so we’ve streamlined every step to get you covered quickly. While exploring options, you might also find it helpful to learn about our other services, such as license permit bonds.

Step 3: Purchase and Receive Your Bond

Once you receive your quote and decide to proceed, purchasing and receiving your bond is simple. Our secure online payment system accepts various payment methods for your convenience.

After your purchase, we provide digital bond delivery, typically via email, so you can access your documents immediately. For many court bond online applications, we offer same-day issuance, ensuring you can meet even the most urgent court deadlines.

When it comes to filing with the court, we provide clear guidance on how to properly submit your bond. In many jurisdictions, including various Texas e-filing systems, you can submit your bond electronically for even faster processing.

This digital-first approach means you spend less time on logistics and more time on your legal proceedings.

Understanding the Cost and Underwriting Process

The cost of a court bond online, called the premium, is a small percentage of the total bond amount required by the court. Understanding how this premium is calculated helps you budget and avoid surprises. It’s the fee you pay for the surety company’s financial guarantee of your performance.

The premium percentage varies based on several key factors evaluated during underwriting. This assessment determines the risk involved in backing your promise to the court. Your credit score plays a significant role, along with your financial stability and the specifics of your case.

Judicial bonds often require more intensive underwriting because court outcomes can be unpredictable. For example, when appealing a $100,000 judgment, the surety company must carefully evaluate if you can honor that obligation if your appeal fails.

Factors Influencing Your Court Bond Online Cost

The cost of your court bond online depends on several interconnected factors. As the nation’s largest volume bond producer, we’ve seen how different circumstances affect pricing across thousands of cases.

Probate bond cost is primarily determined by your personal credit history, though the estate’s complexity and size also matter. A straightforward estate typically costs less to bond than a complex one with disputed assets.

Appeal bond cost focuses heavily on your financial strength. The surety needs confidence that you can pay the original judgment if your appeal doesn’t succeed. We review financial statements, cash flow, and overall stability to set the premium.

Guardianship bond cost considers both your credit score and character. Since you’ll be managing assets for vulnerable individuals, the underwriting process evaluates your trustworthiness and experience.

| Bond Type | Primary Cost Factors | Additional Considerations |

|---|---|---|

| Probate | Personal credit history of the applicant | Complexity and size of the estate, specific court requirements |

| Appeal | Financial strength and stability of the business/individual | Likelihood of success on appeal, collateral requirements |

| Guardianship | Personal credit history and character of the applicant | Value of assets being managed, number of wards |

The bond amount itself significantly impacts your premium. A $10,000 guardianship bond will cost considerably less than a $500,000 appeal bond, even with identical credit scores.

The Role of a Surety Agent

Our experienced, licensed surety agents act as your advocates, turning a confusing process into a straightforward path to getting bonded.

Expert guidance means having someone who understands the intricate requirements of Texas courts and federal proceedings nationwide. When a Houston probate court requires specific language in your bond, our agents know exactly what’s needed.

Navigating requirements is simpler with professional help. Court bond rules vary between jurisdictions, and our team stays current with these variations to ensure your bond is accepted on the first submission.

Finding the best rates is where our volume and relationships benefit you. Because we handle more court bonds than most providers, we can negotiate better rates with our surety partners, often resulting in lower premiums for you, especially when you need a court bond online quickly.

Our agents provide the personal touch that online-only services can’t match. While the process is digital, having a real person to call makes all the difference. Our licensed agents are ready to guide you through every step.

This personalized approach extends beyond court bonds to all our services, including construction surety bonds, ensuring you have comprehensive support for any bonding needs.

The Mechanics of a Court Bond: Parties, Breaches, and Guarantees

A court bond online works through a simple three-party agreement that forms the backbone of this financial guarantee system.

The Principal is you—the person or business required by the court to get the bond. You’re the one who needs to prove you’ll fulfill your court-ordered duties.

The Obligee is typically the court itself or the party being protected by the bond. They set the terms and decide what needs to be guaranteed.

The Surety is our company—the one issuing the bond and providing the financial backing. We vouch for you, telling the court, “If the Principal doesn’t meet their obligation, we’ll cover the financial consequences.”

When you secure your bond, you’ll sign an indemnity agreement. This is your promise to reimburse us if we have to pay out on a claim because you didn’t meet your obligations. You are responsible for making things right.

What Happens if a Bond is Breached?

A bond breach, or forfeiture, occurs when the Principal fails to meet the court-ordered obligations covered by the bond. Understanding this process is key.

For example, if someone released on a bail bond doesn’t show up for court, that breach triggers the claim process. Here’s how it unfolds:

First, the court or protected party files a claim against the bond. Our team then conducts a thorough investigation to determine if the claim is valid and if the bond terms were violated.

If we determine the claim is legitimate, we’ll pay the obligee up to the full bond amount. The indemnity agreement you signed then activates the Principal’s liability to the surety. You become responsible for reimbursing us for the full amount we paid out, plus any legal fees or expenses incurred.

The financial consequences of non-compliance can be significant, which is why we encourage clients to fully understand their obligations before proceeding. This ensures everyone takes their court-ordered responsibilities seriously.

Guarantees and Security of Online Transactions

When you get your court bond online with us, you get convenience backed by rock-solid guarantees that provide confidence in the process.

Our bond acceptance guarantee is simple: your bond will be accepted by the court, or we’ll refund your payment completely. We know what courts require and stand behind our work. If your bond doesn’t meet the court’s specifications, that’s on us, not you.

We also offer a comprehensive money-back guarantee because we believe in the quality of our service. This is a real commitment that protects you if something goes wrong on our end.

Security is crucial when sharing sensitive information online. Our secure platforms use advanced data encryption to protect every piece of information you share. From application to payment, everything is safeguarded with bank-level security.

As a fully licensed surety provider authorized to issue bonds in all 50 states, including Texas, our legitimacy as an online provider is unquestionable. Every transaction is legally compliant and recognized by courts nationwide. We are established professionals with a verifiable track record.

Don’t just take our word for it. Our customers consistently praise our security and straightforward process. You can see our customer reviews to hear directly from people who’ve successfully steerd the court bond online process with our help.

Frequently Asked Questions about Online Court Bonds

If you’re new to getting a court bond online, you likely have questions. We’ve helped thousands of clients through this process, and here are the answers to the most common questions we hear.

How long does it take to get a court bond online?

The speed of getting your court bond online is a major advantage over traditional methods. With us, you can typically get quotes in minutes using our streamlined online application. No more waiting days to find out your bond’s cost.

For many bond types, we offer same-day issuance, delivering your bond digitally within hours of your application. This is especially helpful for tight court deadlines. Our fast approvals come from a refined underwriting process and strong relationships with top-rated surety companies.

The exact timing depends on your bond type, but most clients are surprised by how quickly they can get bonded.

Can I get a court bond in Texas for a federal case?

Absolutely. We handle this regularly. Whether your case is in a state court in Texas or involves federal proceedings anywhere in the country, we have you covered.

We’re licensed in all 50 states, so you can count on us for a bond in Harris County District Court in Houston, a federal appeals court, or any other jurisdiction. Our national coverage and deep understanding of Texas legal requirements make us uniquely positioned to help with both state and federal cases.

Our clients appreciate having one trusted provider for bonds across different court systems.

What if I have bad credit?

Don’t worry—bad credit doesn’t automatically disqualify you from getting a bond. We understand that credit challenges happen and shouldn’t prevent you from fulfilling your legal obligations.

While you might face a higher premium, we have programs and surety partners designed to work with various credit profiles. Our expert agents are skilled at finding creative solutions and will explore every available option for you.

The key is to be upfront about your credit situation. This allows us to match you with the right surety company from the start. We’ve successfully bonded many clients who thought their credit would be a deal-breaker, so it’s always worth a conversation with our team.

Get Your Court Bond with Confidence and Speed

The legal world moves fast, and your bond needs shouldn’t slow you down. For tight deadlines in a Houston court or nationwide, getting your court bond online is the most straightforward and reliable solution.

Speed is everything when court deadlines loom. Our process is built for rapid turnaround, from instant quotes to digital bond delivery. Many clients receive same-day issuance, ensuring you never miss a critical deadline.

Convenience meets reliability on our 24/7 online platform. Apply, get approved, and receive your bond from anywhere, eliminating the need for office visits.

Affordability matters, especially with mounting legal costs. As the nation’s largest volume bond producer, we leverage our market position to secure the most competitive rates available, keeping more money in your pocket.

Our Houston-based experts understand Texas court requirements inside and out, while our national reach equips us to handle federal cases and proceedings in any state. You get the best of both worlds: local knowledge and nationwide capability.

The difference is our commitment to technology and human support. Our online platform handles the heavy lifting, but our licensed agents are always available for guidance.

Ready to experience the fastest, most affordable way to secure your court bond? Don’t let bureaucracy delay your legal proceedings. Get your free, no-obligation quote from BEST SURETY BOND COMPANY today and get bonded with confidence. Your case deserves the speed and reliability that only comes from working with true bonding experts.