Why Employee Dishonesty Poses a Critical Threat to Your Business

An employee dishonesty bond is a type of surety bond that protects your business from financial losses caused by employee theft, fraud, embezzlement, and other dishonest acts. Here’s what you need to know:

What it covers:

- Theft of money, property, or securities by employees

- Forgery and embezzlement

- Unauthorized wire transfers

- Computer fraud and cybercrimes

What it costs:

- Typically 1-3% of the total bond amount

- A $50,000 bond might cost $500-$1,500 annually

Who needs it:

- Any business with employees who handle money or valuable assets

- Companies required by contracts or clients

- Businesses wanting extra protection against internal theft

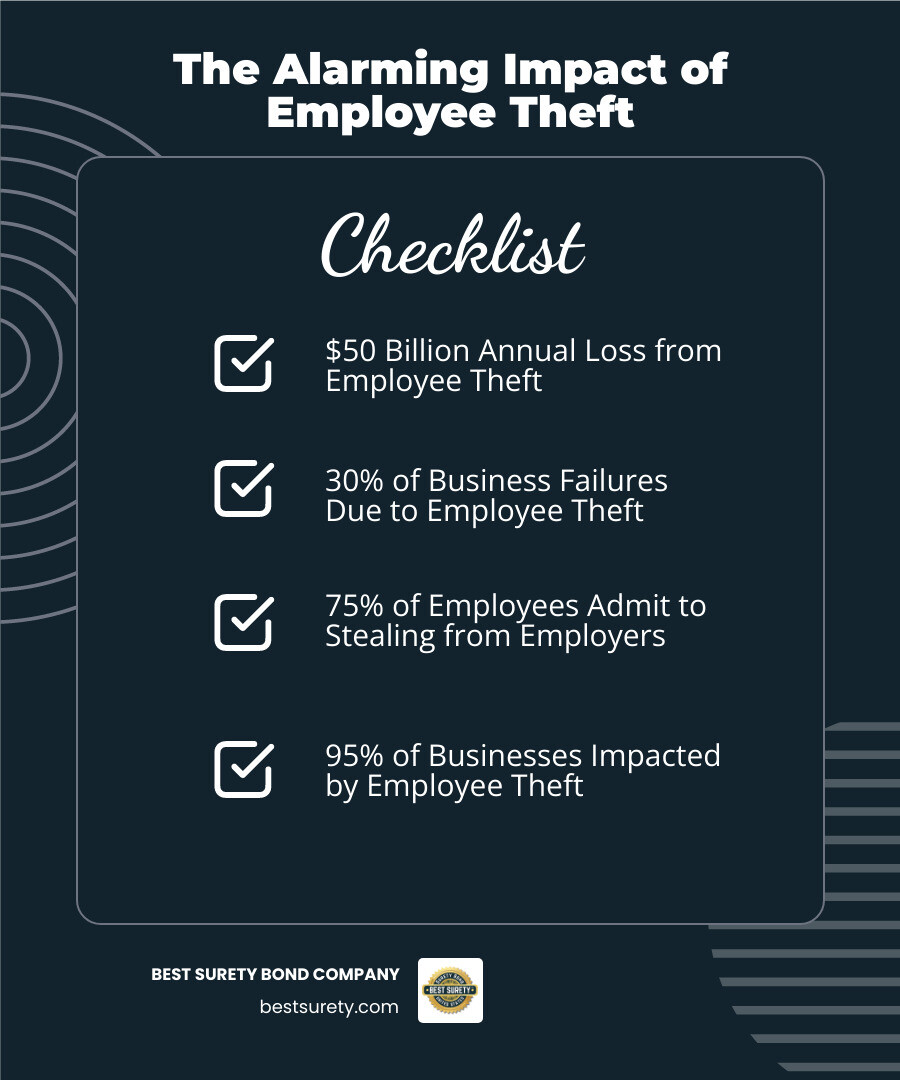

The statistics are sobering. Businesses lose an estimated $50 billion per year from employee theft, and the U.S. Department of Commerce reports that 30 percent of business failures are caused by employee theft. Even more alarming, three out of four employees admit to stealing from their employers at least once.

For Texas business owners, these aren’t just numbers – they represent real threats that can destroy years of hard work overnight. Small businesses are particularly vulnerable because a single dishonest employee can cause financial damage that’s impossible to recover from.

I’m Haiko de Poel, and through my work scaling businesses across insurance, fintech, and risk management sectors, I’ve seen how employee dishonesty bonds serve as essential safety nets for growing companies. My experience helping businesses steer complex insurance and bonding requirements has shown me that the right protection can mean the difference between surviving employee theft and closing your doors forever.

Simple guide to employee dishonesty bond terms:

What is an Employee Dishonesty Bond and What Does It Cover?

Think of an employee dishonesty bond as your business’s financial bodyguard against internal threats. While you trust your employees, this specialized protection ensures that one dishonest act won’t destroy everything you’ve built. Also known as a fidelity bond or employee theft bond, it’s designed specifically to reimburse your company when employees steal, embezzle, or commit fraud.

Here’s what many Texas business owners don’t realize: your regular business insurance probably won’t help if an employee robs you blind. Commercial property insurance typically covers theft by outsiders but excludes employee theft entirely. Professional liability insurance also won’t touch dishonest acts by your staff. That’s exactly why an employee dishonesty bond exists – to fill this critical gap in your protection.

Covered Losses and Common Exclusions

An employee dishonesty bond casts a wide net when it comes to protecting your business from internal theft and fraud. The coverage includes money theft from registers, safes, or bank accounts, property theft of merchandise or equipment, and securities theft involving stocks, bonds, or valuable papers.

When employees get creative with their dishonesty, the bond still has you covered. Forgery and alteration of checks or financial documents, embezzlement of funds entrusted to their care, and unauthorized wire transfers from company accounts all fall under protection. Modern coverage also extends to credit card fraud using company cards and computer fraud where employees manipulate systems to steal or transfer funds.

What makes these bonds particularly valuable is their flexibility in defining “employee.” Beyond your regular W-2 staff, coverage often extends to temporary workers, seasonal laborers, contract employees, volunteers (crucial for nonprofits), and even board members or trustees.

However, the bond won’t cover everything. Owner theft isn’t protected since these bonds protect businesses from employees, not from themselves. Losses by non-employees, employees with known theft histories that you hired anyway, and indirect losses like lost future income or business interruption are excluded. Simple accounting errors don’t count either – the bond only covers intentional dishonest acts, not mistakes or negligence.

Some bonds require employee conviction before paying claims, while others may exclude external data breaches or vandalism without theft intent. Understanding these boundaries helps set proper expectations for your coverage.

The Staggering Financial Impact of Employee Theft

The numbers tell a sobering story that every Texas business owner needs to hear. Businesses lose an estimated $50 billion per year to employee theft according to U.S. Department of Commerce statistics. Even more alarming, 30 percent of business failures are caused by employee theft – meaning nearly one in three businesses that close their doors do so because of internal dishonesty.

The scope of this problem is truly staggering. Three out of four employees admit to stealing from their employers at least once, and 95% of businesses have been hurt by employee theft. These aren’t just statistics – they represent real threats facing your Houston, Dallas, or Austin business every single day.

Small businesses face the greatest vulnerability because they often lack the robust internal controls and deep financial reserves of larger corporations. A single act of embezzlement by a trusted employee can drain cash flow, destroy reputations, and push a thriving business into bankruptcy. For Texas entrepreneurs who’ve poured their hearts and savings into building something meaningful, an employee dishonesty bond isn’t optional insurance – it’s essential protection that can mean the difference between surviving employee theft and losing everything overnight.

Key Differences: Employee Dishonesty Bond vs. Other Bond Coverages

When you’re shopping for business protection, surety bonds can feel overwhelming. You’ll encounter various types of bonds, each serving different purposes and protecting different parties. While they all share the same basic structure—a three-party agreement between you, the surety company, and whoever requires the bond—understanding their unique roles is crucial for Texas business owners who want comprehensive protection.

The good news? Once you understand the key differences, choosing the right coverage becomes much clearer. Let’s break down how an employee dishonesty bond compares to other common bond types, so you can make informed decisions for your business.

Employee Dishonesty Bond vs. Business Service Bond

This comparison trips up many business owners, and it’s easy to see why. Both bonds deal with employee theft, but they protect completely different parties—and understanding this distinction could save your business thousands of dollars.

An employee dishonesty bond is all about protecting your business from your own employees’ dishonest acts. When your employee steals cash from the register, embezzles money from company accounts, or walks off with inventory, this bond covers your losses. The claim payment goes directly to your business, helping you recover financially from the betrayal.

A business service bond (sometimes called a janitorial bond) flips this protection around. It protects your clients from theft or damage your employees might commit while working on client property. Picture this: you run a cleaning service in Houston, and one of your employees steals a client’s expensive watch during a house call. The business service bond would compensate your client for their loss. However, here’s the catch—the surety company typically expects you to reimburse them for any claims they pay out.

The location of the theft often determines which bond applies. Employee dishonesty bonds typically cover theft that happens on your business premises or involves your company’s assets, while business service bonds cover incidents at client locations. For service businesses like janitorial companies, in-home care providers, or mobile repair services, carrying both types of bonds often makes the most sense.

Many Texas service businesses find this dual coverage especially valuable when working with high-end clients or in affluent areas like River Oaks in Houston or Westlake in Austin, where client assets may be particularly valuable.

Employee Dishonesty Bond vs. ERISA Bond

Here’s another area where business owners often get confused, and the stakes are particularly high because federal law is involved. While both fall under the fidelity bond umbrella, an employee dishonesty bond and an ERISA bond serve completely different purposes.

An ERISA bond is federally mandated protection for businesses that sponsor employee retirement plans like 401(k)s or pension plans. The purpose is crystal clear: protect your employees’ retirement money from fraudulent or dishonest acts by anyone who handles plan funds. This isn’t optional coverage—it’s required by the U.S. Department of Labor.

The contrasts are significant. Your employee dishonesty bond protects your business assets from employee theft, while an ERISA bond protects your employees’ retirement plan assets from mishandling by fiduciaries. An employee dishonesty bond is typically recommended but not legally required, whereas ERISA bonds are federally mandated for most retirement plans.

Coverage focus differs dramatically too. Your employee dishonesty bond covers theft of company money, property, and securities, while ERISA bonds specifically target misappropriation or embezzlement of retirement plan funds. The financial structure varies as well—employee dishonesty bonds typically include deductibles, but ERISA bonds cannot have deductibles and must cover at least 10% of plan assets, up to $500,000 for most plans.

The consequences of getting ERISA bonds wrong are severe. Insufficient or expired ERISA coverage can trigger Department of Labor audits and significant penalties that could devastate your business. The federal government takes retirement plan protection seriously, as outlined in their comprehensive guide: Protect Your Employee Benefit Plan With an ERISA Fidelity Bond.

For Texas businesses with retirement plans, staying compliant with ERISA bonding requirements isn’t just good practice—it’s essential for avoiding federal penalties and protecting your employees’ financial futures.

How to Get an Employee Dishonesty Bond: A Simple Guide

Getting an employee dishonesty bond for your Texas business shouldn’t feel like navigating a maze. At BEST SURETY BOND COMPANY, we’ve made the entire process refreshingly straightforward – whether you’re running a small shop in Houston or managing operations across the state. Our Texas-based experts combine the personal touch you’d expect from a local company with the digital convenience that gets you bonded fast.

The beauty of working with experienced surety professionals is that we handle the complexity behind the scenes, so you can focus on what you do best – running your business.

Factors That Influence Your Bond Cost

Here’s the good news: employee dishonesty bonds are surprisingly affordable. Most businesses pay just 1-3% of their total coverage amount annually. That means a $50,000 bond might only cost you $500-$1,500 per year – a small price for significant peace of mind. Some smaller bonds can start as low as $100 annually.

Your specific premium depends on several key factors that surety companies use for their risk assessment. The coverage amount you choose has the biggest impact – naturally, a $100,000 bond costs more than a $25,000 one. We’ll help you find that sweet spot where you have adequate protection without overpaying.

The number of employees on your team also matters. If you’re a small business with fewer than five employees, you’ll typically see lower rates. Larger teams may need custom pricing, but our relationships with A-rated surety companies help us negotiate competitive rates regardless of your size.

Your business type plays a role too. Companies handling lots of cash or sensitive financial data might see slightly higher premiums, while service businesses with minimal cash handling often qualify for the lowest rates. Your credit score and overall financial health can influence pricing, especially for larger bond amounts, but don’t worry – we work with surety companies that consider the whole picture, not just credit scores.

What many business owners don’t realize is that having strong internal controls can actually lower your premium. Things like regular audits, background checks, and clear financial procedures show surety companies you’re serious about preventing theft.

The Quick and Easy Application Process

We’ve streamlined getting your employee dishonesty bond down to a science. Our online application takes just minutes to complete – no lengthy forms or confusing jargon. You’ll get an instant quote for most standard bonds right on your screen.

Once you’re ready to move forward, we can often provide same-day issuance. That’s not marketing speak – we genuinely prioritize fast approvals because we know you need protection now, not next week. Your bond gets delivered digitally via email, ready to print or forward to whoever needs it.

The whole process involves minimal paperwork – we’ve eliminated the usual bureaucratic headaches. Our licensed agents provide Houston-based support even as we serve clients nationwide, so you get that personal touch along with digital efficiency.

What sets us apart is combining human expertise with modern convenience. If you have questions or need guidance choosing the right coverage amount, our surety experts are just a phone call away. We’re not just processing applications – we’re helping you make informed decisions about protecting your business.

Understanding the Claims Process

While we hope you’ll never need to file a claim, understanding the process gives you confidence in your coverage. If you find a financial loss due to employee dishonesty, quick action is crucial.

Notifying the surety company promptly is your first step – most bonds require notification within 30 to 60 days of finding the loss. Don’t wait and wonder; immediate notification protects your claim rights.

You’ll need to provide proof of loss through detailed documentation. This includes financial records, audit reports, police reports, and any evidence supporting your claim. The more thorough your documentation, the smoother the process goes.

The surety company conducts an investigation to verify your claim. They’ll review your documentation and may interview relevant parties. Some bonds require the dishonest employee to be legally prosecuted or even convicted before paying claims – this employee conviction requirement ensures claims are based on verified criminal activity.

Once the investigation confirms a valid claim within your bond’s coverage, you’ll receive financial compensation up to your bond amount. The surety company stands behind their commitment to make you whole after employee dishonesty.

Your employee dishonesty bond exists to protect you. By following the claims process carefully and cooperating fully with the surety company, you ensure your business can recover and move forward after experiencing employee theft.

Beyond the Bond: Proactive Steps to Prevent Employee Theft

While an employee dishonesty bond provides an invaluable financial safety net, think of it as your business’s insurance policy – you hope you’ll never need it, but you’ll be grateful it’s there if the worst happens. The real key to protecting your business lies in building a fortress of internal controls that makes employee theft difficult, detectable, and frankly, not worth the risk.

Prevention is always your first and best line of defense. A well-designed system of checks and balances doesn’t just protect your assets – it also protects honest employees from false accusations and creates a culture of transparency that everyone can feel good about.

Internal Controls and Prevention Strategies

Creating a theft-resistant workplace starts with understanding that most employee dishonesty happens when three conditions align: opportunity, pressure, and rationalization. Your job as a business owner is to eliminate as many opportunities as possible while building a workplace culture that reduces pressure and makes rationalization nearly impossible.

Thorough background checks form the foundation of your prevention strategy. Before bringing anyone into your team, especially those who’ll handle money or valuable assets, conduct comprehensive criminal history checks, verify previous employment, and actually call those references. Yes, it takes time, but finding a pattern of financial misconduct before hiring is infinitely better than finding it after a theft.

Segregation of duties might sound like corporate jargon, but it’s really just common sense applied systematically. Never let one person control an entire financial process from start to finish. The employee who handles cash deposits shouldn’t be the same person reconciling bank statements. The person who approves expenses shouldn’t also be cutting the checks. This isn’t about not trusting your team – it’s about creating a system that protects everyone.

Regular audits serve as both a deterrent and an early warning system. When employees know that financial records and inventory are regularly scrutinized, the temptation to “borrow” money or merchandise decreases significantly. Mix up your audit schedule so it’s unpredictable, and don’t forget to audit the small stuff – sometimes the biggest red flags show up in petty cash discrepancies.

Clear financial policies eliminate the gray areas where dishonesty can hide. Put your cash handling procedures, expense reporting requirements, and asset management rules in writing. Make sure every employee understands not just what the rules are, but why they exist. When people understand that these policies protect the business that provides their livelihood, compliance becomes a team effort.

Consider implementing mandatory vacations for employees in sensitive financial positions. This might seem counterintuitive, but many embezzlement schemes require the perpetrator’s constant presence to maintain the illusion that everything is normal. When someone is forced to step away for an extended period, irregularities often surface quickly.

Requiring countersignatures for checks above a certain threshold – maybe $500 or $1,000 depending on your business size – adds a crucial approval layer. Similarly, having someone independent reconcile your bank accounts creates an automatic check on anyone handling deposits and withdrawals.

Don’t overlook the power of inventory management systems and basic security measures like cameras and secure access points. These tools serve double duty: they deter theft and provide evidence if you need to file a claim on your employee dishonesty bond.

Perhaps most importantly, foster a positive work culture where employees feel valued and fairly compensated. People who feel respected and see a future with your company are far less likely to jeopardize their position through dishonest acts. Open communication, fair treatment, and recognition of good work create an environment where theft becomes not just risky, but genuinely unthinkable for most team members.

Finally, be prepared to legally prosecute employees involved in theft. This sends a clear message that dishonest behavior has serious consequences, and it’s often a requirement for your bond claim to be processed. It’s never pleasant, but consistency in enforcement protects your entire team.

By weaving these prevention strategies together with the financial protection of your employee dishonesty bond, you’re creating a comprehensive shield around your business. The goal isn’t to create a workplace of suspicion, but rather one of transparency and accountability where honest employees can thrive and dishonest behavior simply can’t take root.

Frequently Asked Questions about Employee Dishonesty Bonds

After helping thousands of Texas businesses secure the right protection, we’ve heard just about every question you can imagine about employee dishonesty bonds. Let me share the answers to the ones that come up most often – chances are, you’re wondering about some of these same things.

What’s the main difference between an employee dishonesty bond and a business service bond?

This is hands down our most common question, and I completely understand the confusion! The key difference comes down to who gets protected.

An employee dishonesty bond is like a shield for your business. When your employee steals from your cash register, embezzles from your company accounts, or walks off with your inventory, this bond reimburses you for those losses. You’re the one who gets the check from the surety company.

A business service bond flips that around completely. It protects your customers when your employees are working at their locations. Think about it this way: if you run a cleaning service in Houston and your employee steals jewelry from a client’s home, the business service bond pays the client, not you. Then you typically have to pay the surety company back.

Many service businesses – especially those sending employees into homes or offices – find it smart to carry both types of bonds for complete peace of mind.

Can I get coverage for volunteers or independent contractors?

Absolutely! This is especially important for Texas nonprofits and businesses that rely heavily on contract workers. Modern employee dishonesty bonds have evolved to cover much more than just your traditional W-2 employees.

Most bonds can be extended to include volunteers (crucial if you’re running a nonprofit), board members and trustees, and even independent contractors (those 1099 workers). This flexibility is a game-changer because these individuals often have access to your assets but might not be covered under your regular insurance policies.

Just keep in mind that when we’re calculating your bond cost, we’ll need to include independent contractors in your total employee count. It’s a small detail that makes a big difference in getting you the right coverage.

Is an employee dishonesty bond legally required in Texas?

For most Texas businesses, an employee dishonesty bond isn’t required by state law – it’s not like a license bond that you absolutely must have to operate legally. However, that doesn’t mean you won’t need one.

Here’s where it gets interesting: while Texas doesn’t mandate it, your clients might. We see this all the time with service-based businesses, contractors handling sensitive materials, or companies managing client assets. A client might require you to carry an employee dishonesty bond as part of your contract terms.

Even when it’s not required by anyone, getting one is simply smart business. With employee theft costing businesses $50 billion annually nationwide, protecting yourself is just good sense – especially when the coverage is so affordable compared to the potential losses.

Secure Your Business and Your Future Today

Employee theft isn’t just a statistic you read about in business journals – it’s a $50 billion annual threat that could be lurking in your own workplace right now. The reality is stark: 30 percent of business failures stem from employee dishonesty, and the chances are high that your business will face this challenge at some point.

But here’s the empowering truth: you don’t have to be another casualty in these sobering statistics.

An employee dishonesty bond represents more than just another insurance policy – it’s your business’s financial lifeline when the unthinkable happens. While your standard commercial insurance policies leave you exposed to internal theft, this specialized protection fills that critical gap, ensuring your years of hard work won’t vanish overnight because of one dishonest employee.

At BEST SURETY BOND COMPANY, we’ve made it our mission to protect Texas businesses from Houston’s busy commercial districts to small towns across the Lone Star State, and we extend that same commitment nationwide. We understand that when you need an employee dishonesty bond, you need it fast, affordable, and without the runaround that larger, impersonal companies often provide.

Our Texas-based experts combine the personal touch you’d expect from a local company with the efficiency of modern technology. We’re talking fast approvals, same-day issuance, and rates that won’t strain your budget. Our licensed agents aren’t just order-takers – they’re your partners in understanding exactly what protection your business needs.

The cost of waiting could be devastating. The cost of protection? Often less than what you spend on office coffee each month. Don’t let employee theft become the reason your business becomes part of that unfortunate 30 percent statistic.

Your business deserves essential protection that’s both affordable and reliable. Take control of your company’s future today.

Get Your Instant Employee Dishonesty Bond Quote Now