Why Every Texas Business Owner Needs to Understand Financial Guarantee Bonds

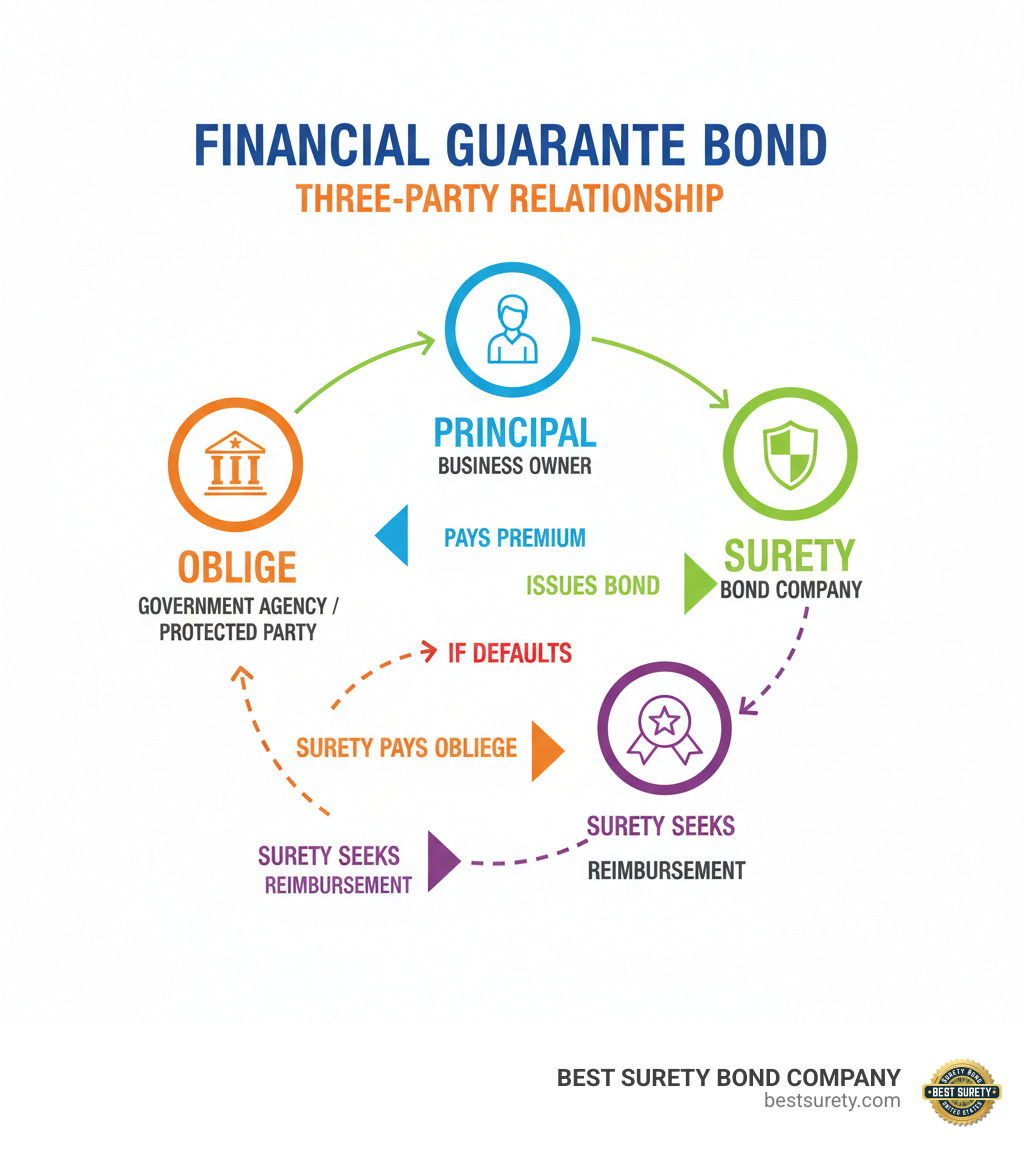

A financial guarantee bond is a three-party agreement that guarantees one party (the principal) will make full and timely payments to another party (the obligee). If the principal fails to pay, a surety company steps in to cover the obligation—up to the bond amount—and then seeks reimbursement from the principal.

Quick Answer: What is a Financial Guarantee Bond?

- Purpose: Guarantees payment of financial obligations like taxes, leases, or contractual fees.

- Three Parties: Principal (your business), Obligee (entity requiring the bond), and Surety (the bond company).

- How It Works: If you fail to pay, the surety covers it, but you must reimburse them.

- Common Types: Sales tax bonds, freight broker bonds, utility bonds, and alcohol tax bonds.

- Cost: Typically 2% to 10% of the bond amount annually, based on credit and risk.

- Not Insurance: You are ultimately responsible for all claims paid by the surety.

Financial guarantee bonds are used across industries in Texas. Freight brokers in Houston need them to operate legally, auto dealers in Dallas must post them for licensing, and contractors in Austin use them to guarantee tax payments. These bonds protect government agencies and business partners from financial loss if you don’t meet your obligations.

Unlike traditional insurance, a financial guarantee bond doesn’t transfer risk away from you. It’s more like a credit line backed by a surety company. If a claim is filed, the surety pays the obligee but then comes to you for full repayment.

At Best Surety, we are seasoned experts with years of experience helping businesses across Texas steer complex bonding requirements. We’ve guided countless business owners through the financial guarantee bond process, ensuring they understand their obligations and secure the right coverage quickly and affordably.

What is a Financial Guarantee Bond and How Does it Work?

A financial guarantee bond is a legally binding promise backed by a surety company. It guarantees a third party that you’ll meet a specific financial obligation. If you can’t, the surety steps in to cover the payment, then turns to you for repayment. When a government agency or business partner in Texas asks for this bond, they want a safety net to protect them from financial loss. Think of it as a financial seal of approval that lets you operate legally, bid on contracts, and build trust with partners.

The Core Parties and Their Obligations

Every financial guarantee bond involves three key players:

- The Principal: This is you or your business. You’re the one making the financial commitment and are responsible for paying the bond premium.

- The Obligee: This is the entity requiring the bond, usually a government agency like the Texas Comptroller of Public Accounts. They are protected by the bond and can file a claim if you fail to pay.

- The Surety: This is us, the bond company. We issue the bond and provide the financial guarantee to the obligee. We vouch for you, but if we have to pay a claim, you are legally required to reimburse us under the indemnity agreement you sign.

Financial Guarantee Bond vs. Traditional Insurance

This is a crucial distinction. Traditional insurance (like liability or property coverage) transfers risk from you to the insurer. You pay premiums, and if a covered loss occurs, the insurance company pays without expecting reimbursement.

A financial guarantee bond is different. The premium you pay is for the use of the surety’s creditworthiness, not to cover a potential loss. The risk always remains with you. If the surety pays a claim on your behalf, it’s treated like a loan. You are required to repay the surety for every dollar paid out, plus any associated costs. This is why your credit history is a key factor in the underwriting process.

What Happens in Case of a Default?

Let’s say your Houston business has a bond guaranteeing sales tax payments and you miss a deadline.

- The Obligee Files a Claim: The Texas Comptroller notifies us, your surety, that you’ve failed to remit the taxes.

- We Investigate: Our claims team verifies the claim’s legitimacy and confirms it falls within the bond’s terms.

- We Pay if Valid: Once confirmed, we pay the Texas Comptroller up to the bond amount. Our guarantee to the obligee is absolute.

- You Reimburse Us: The indemnity agreement requires you to repay us for the full amount we paid, plus any legal or administrative fees. The best strategy is to avoid this by staying on top of your obligations and communicating proactively if you face challenges.

Types of Financial Guarantee Bonds and Who Needs Them

If you’re running a business in Texas, you’ll likely encounter situations where you need to prove you’ll meet your financial promises. A financial guarantee bond is the tool for this, demonstrating your business is trustworthy and financially responsible. These bonds are not just red tape; they are a smart way to secure licenses, win contracts, and build credibility.

Whether you’re guaranteeing tax payments or securing a business license, there’s a specific bond for your situation. Understanding which bonds apply to your industry can save you time, money, and legal headaches.

Common Types of Financial Guarantee Bonds

The term “financial guarantee bond” covers several specific bond types, all designed to guarantee financial obligations:

- Sales Tax Bonds: Required by the Texas Comptroller to guarantee you’ll remit collected sales taxes. Essential for many retail and service businesses.

- Alcohol Tax Bonds: Guarantee payment of excise taxes for businesses like breweries, distributors, or liquor stores in Austin, Houston, and across the state.

- Utility Bonds: Required by utility companies to guarantee payment for high-consumption services like electricity, water, or gas.

- Freight Broker (BMC-84) Bonds: A $75,000 federal requirement for freight brokers to ensure timely payment to motor carriers and shippers.

- Lottery Bonds: For businesses selling state lottery tickets, ensuring proper handling and remittance of funds to the Texas Lottery Commission.

- Mortgage Broker Bonds: Protect consumers by guaranteeing ethical handling of client funds.

- Union Wage and Welfare Bonds: Guarantee that contractors pay all wages and benefits required by union agreements.

Learn more about commercial bonds

Industries in Texas That Commonly Require These Bonds

Financial guarantee bonds are integral to Texas’s diverse economy:

- Transportation & Logistics: Freight brokers in Houston and across Texas need BMC-84 bonds to comply with federal law.

- Retail & Hospitality: Businesses from Dallas department stores to San Antonio restaurants may need sales tax bonds. Those serving alcohol also require alcohol tax bonds.

- Construction: While known for performance bonds, contractors may need financial guarantee bonds for tax payments or to meet union wage requirements.

- Financial Services: Mortgage brokers throughout Texas must be bonded to maintain their licenses and protect consumers.

- Utility-Intensive Businesses: Large manufacturing plants or data centers may need utility bonds to secure service.

‘Financial Guarantee’ vs. ‘Financial Guaranty’: A Key Distinction

This spelling difference is important in the surety world. “Financial guarantee” (with an “e”) refers to the bonds we’ve been discussing, which guarantee payment of obligations like taxes or fees. Underwriters classify these as higher risk because they cover direct financial payouts, which can lead to higher premiums.

“Financial guaranty” (with a “y”) refers to a different product that guarantees repayment of loans. Due to regulations like New York’s Appleton Rule, U.S. surety companies are generally prohibited from issuing these for private borrowers. This rule prevents insurers from taking on pure credit risks similar to banks. So, while your Houston business can get a financial guarantee bond for taxes, you can’t get a “financial guaranty bond” to back a business loan.

Getting Your Financial Guarantee Bond in Texas: Process and Cost

Securing a financial guarantee bond for your Texas business should be fast and straightforward. At Best Surety, we’ve streamlined the process to get you bonded quickly so you can focus on running your business, whether you’re in Houston, Dallas, or anywhere in between.

How to Get Your Financial Guarantee Bond Fast

We know time is money. Here’s our efficient, same-day process:

- Assess Your Needs: Identify the bond type and amount required by the obligee (the entity requesting the bond). If you’re unsure, our licensed agents can clarify your specific Texas requirements.

- Apply Online in Minutes: Our user-friendly online application is quick and asks only for essential information. No confusing jargon or unnecessary paperwork.

- Receive Your Quote: Our system provides an instant quote for many common bonds. We leverage our strong surety relationships to offer the lowest possible rates.

- Pay the Premium: Once you approve the quote, you can pay your premium securely online. We offer flexible payment options, including interest-free plans for larger premiums.

- Get Bonded Same-Day: For most financial guarantee bonds, we issue your bond documents the same day, often within minutes. You’ll be ready to file with your obligee and get back to business.

What Factors Influence the Cost of a Financial Guarantee Bond?

The cost, or premium, is a small percentage of the total bond amount, typically paid annually. Several factors determine your rate:

- Bond Amount: A larger bond amount will have a higher premium in dollar terms.

- Personal Credit Score: A strong credit history is the best indicator of financial responsibility and results in the lowest rates, often 1% to 3% of the bond amount.

- Business Financials: For larger bonds, a strong balance sheet and healthy cash flow can help lower your premium.

- Industry and Bond Type: Some industries and bond types carry higher inherent risk. Bonds that guarantee direct financial payments, like tax bonds, may have slightly higher rates than other commercial bonds.

Overall, financial guarantee bonds typically cost between 2% to 10% of the bond amount annually. We work to secure the most competitive rates in the Texas market.

Can You Get Bonded with Bad Credit in Houston?

Yes, it’s often possible. While good credit secures the best rates, having a lower score doesn’t automatically disqualify you. We offer bad credit programs designed to help business owners in Houston and across Texas get the financial guarantee bond they need.

The trade-off is a higher premium, typically ranging from 5% to 15% of the bond amount, to offset the increased risk. You may also be asked for additional financial information. The key is to work with an experienced agency like Best Surety. We have the expertise and market access to find a solution, even with credit challenges. Don’t let past financial issues stop your business—contact us to explore your options.

Managing Your Bond and Avoiding Claims

Once you have your financial guarantee bond, the goal is to never use it. A claim-free history demonstrates reliability, builds trust in the Texas business community, and helps you secure better rates in the future. Avoiding claims comes down to organization, proactive communication, and fulfilling your commitments.

Best Practices for Avoiding Claims

Follow these practical steps to keep your bond claim-free:

- Understand Your Obligations: Read your financial guarantee bond and any related contracts carefully. Know exactly what you’re guaranteeing, what payments are due, and when. If anything is unclear, ask us before a problem arises.

- Communicate Proactively: If you anticipate trouble meeting a deadline, contact the obligee immediately. A proactive conversation can often prevent a claim, whereas silence almost guarantees one.

- Pay Taxes and Fees on Time: For tax-related bonds, this is your top priority. Use calendar reminders or automated payments to ensure you remit all funds to the Texas Comptroller or other agencies on schedule.

- Keep Meticulous Records: Good bookkeeping is your best defense. Detailed financial records help you track obligations and provide crucial evidence if a claim is ever disputed. For a Houston freight broker, this means documenting every carrier payment.

- Fulfill All Contractual Duties: Ensure you are meeting all terms of your contracts, as financial claims can sometimes arise from broader performance issues.

Understanding the Legal Framework and Your Obligations

Financial guarantee bonds are rooted in a legal framework designed to protect the public and ensure compliance. Understanding this context is key for any Texas business owner.

These bonds are often mandated by government regulations. For example, the FMCSA requires a $75,000 bond for freight brokers, and the Texas Comptroller may require a sales tax bond for businesses with past compliance issues. These laws are not optional.

Beyond regulations, bonds are vital for securing contracts and building trust. Showing a potential partner you are bonded demonstrates financial responsibility, which can be a significant advantage in competitive markets like Houston. It acts as a third-party endorsement of your credibility.

For many professions, a financial guarantee bond is a prerequisite for licensing. You simply cannot operate legally in Texas without it. This makes bonding a fundamental step for starting or growing a business. While programs like the SBA’s Surety Bond Guarantee Agreement primarily target contract bonds, they show how government agencies recognize the importance of surety in helping businesses succeed.

Frequently Asked Questions about Financial Guarantee Bonds

We talk to Texas business owners every day and know the financial guarantee bond process can raise questions. Here are the most common ones we hear, with straight answers to help you move forward.

How long does it take to get a financial guarantee bond?

In many cases, you can get your financial guarantee bond the same day you apply. Our streamlined online process is built for speed. For common Texas license and permit bonds with straightforward applications, we can often issue your bond within minutes. More complex bonds may take a few days, but our team works quickly because we know delays cost you money.

What’s the difference between a financial guarantee bond and a performance bond?

This is an important distinction. A financial guarantee bond ensures you make specific payments, like taxes to the Texas Comptroller or payments to carriers if you’re a Houston-based freight broker. It’s all about meeting financial obligations.

A performance bond, common in the construction industry, guarantees you will complete a project according to the contract. If a contractor defaults, the bond provides funds to finish the job. One guarantees payment, the other guarantees work completion. Explore contract bonds to learn more.

Does a credit check for a surety bond affect my score?

No. When you apply for a financial guarantee bond with us, we run a “soft inquiry.” Unlike a hard inquiry for a loan, a soft inquiry is only visible to you and does not impact your credit score. We use it solely to assess risk and determine your premium rate. You can get a quote from us with confidence, knowing it won’t hurt your credit.

Conclusion

As you now know, a financial guarantee bond is more than a requirement—it’s an investment in your business’s credibility. It demonstrates to partners, clients, and Texas state agencies that you are serious about your financial commitments. Whether you’re a freight broker in Houston, a retailer in Dallas, or a contractor in Austin, being bonded opens doors and builds the trust necessary for long-term growth.

At Best Surety, our mission is to make the bonding process fast, affordable, and hassle-free. We combine the expertise of Texas-based specialists with the speed of modern technology to deliver fast approvals, low rates, and reliable service.

We’ve bonded thousands of businesses across Texas and the nation, and we’re ready to help you. Our licensed agents understand the local market and have the national reach to handle any bonding need. Don’t let bonding requirements slow you down. Partner with a surety provider who values your time and budget.

Get Your Free, No-Obligation Quote Today!