Your No-Nonsense Guide to Surety Bond Costs in Texas

The straight answer to how much do surety bonds cost in texas is this:

Texas Surety Bond Cost Quick Reference:

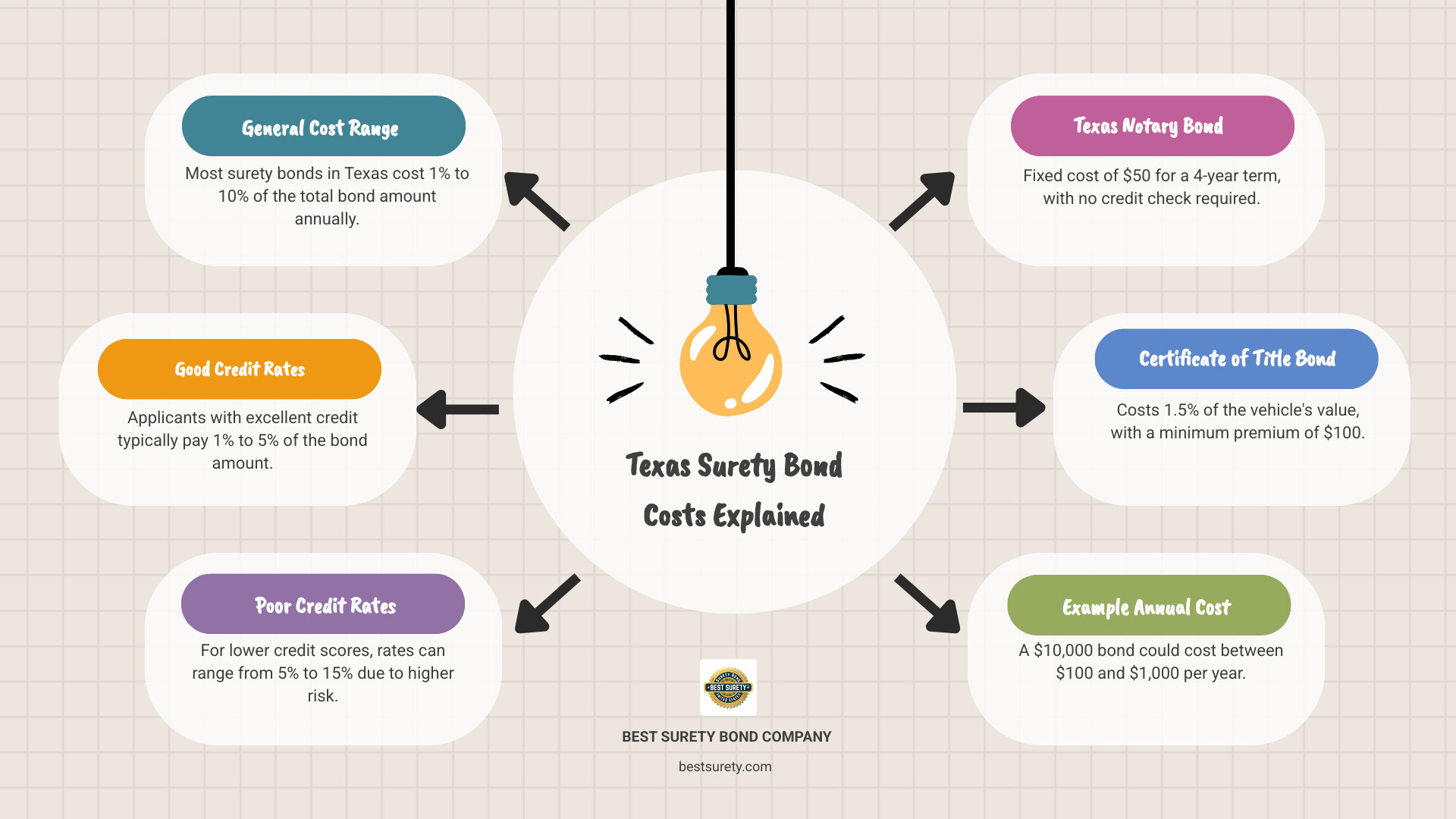

- Most bonds: 1% to 10% of the bond amount

- Good credit: Typically 1% to 5%

- Poor credit: Usually 5% to 15%

- Texas Notary Bond: Fixed $50 for 4 years

- Certificate of Title Bond: 1.5% of vehicle value ($100 minimum)

- Example: A $10,000 bond costs between $100 and $1,000 annually

The cost for a contractor license, notary, or certificate of title bond isn’t as scary as it might seem. The bond amount (e.g., $25,000) is the coverage limit, not what you pay. You only pay a small percentage, the premium. The biggest factors affecting your cost are your credit score, the bond type, and the bond amount. Some bonds have fixed rates, while others require underwriting.

I’m Haiko de Poel. With two decades of experience in insurance and financial services, I’ve worked extensively with surety bond pricing. I understand how much do surety bonds cost in texas and what drives those costs for local businesses.

What is a Surety Bond and Why is it Required in Texas?

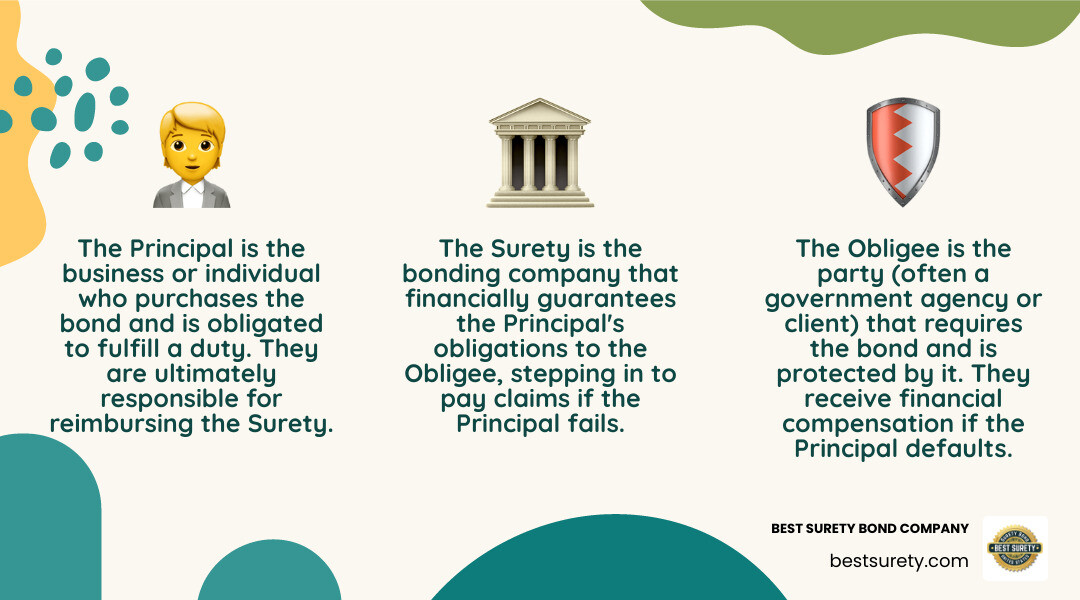

A surety bond is a financial guarantee. It’s a three-party agreement where a business (the Principal) makes a promise to another party (the Obligee). If the Principal fails, the surety company (the Surety) compensates the Obligee for losses up to the bond amount. The Principal must then reimburse the Surety. It’s like a line of credit protecting the public, not insurance for the Principal.

In Texas, state agencies, licensing boards, and courts require bonds to protect the public from financial harm or malpractice. A surety bond is often a mandatory step to getting a license or permit, ensuring you adhere to state laws and ethical standards.

The legal framework is in the [INSURANCE CODE CHAPTER 3503. SURETY BONDS AND RELATED INSTRUMENTS ](https://statutes.capitol.texas.gov/Docs/IN/htm/IN.3503.htm). This code outlines requirements for surety companies and how claims are handled. Texas uses over 150 types of surety bonds for professions from auto dealers to contractors, all serving to ensure financial protection and compliance.

The #1 Misconception: Bond Amount vs. Bond Cost (Premium)

This is a crucial point. When you hear about a “$50,000 surety bond,” that number is the bond amount (or “penal sum”). This is the maximum financial protection available to the Obligee if a claim is upheld.

The bond cost, or premium, is the actual fee you pay. This premium is a small percentage of the total bond amount. You do not pay the full bond amount upfront. For example, on a $10,000 bond with a 1% premium rate, you would pay $100, not $10,000.

Most premiums are paid upfront for the bond term (typically one year). This payment covers the surety’s risk and administrative costs. While the bond amount is your potential liability, the premium is the price of the financial guarantee.

How Much Do Surety Bonds Cost in Texas? The Real Numbers

Regarding how much do surety bonds cost in texas, most premiums are 1% to 10% of the total bond amount. A $25,000 bond typically costs between $250 and $2,500 annually, not the full $25,000.

The exact percentage depends on several factors, with your credit score being the biggest driver. With solid credit, you’ll land on the lower end of that range, sometimes as low as 0.5%. If your credit is poor, you’ll pay more, but it’s still affordable.

Our process is fast and transparent. For most standard bonds, you can get an instant quote online in minutes. Once approved, we can often issue your bond the same day.

Key Factors That Determine Your Final Bond Price

Underwriters assess your application to determine the likelihood of a claim. Understanding these straightforward factors can help you get the best rate.

Your personal credit score carries the most weight for license and permit bonds. It’s a key indicator of your financial reliability. A strong credit score tells the surety you’re reliable, which means lower premiums.

The bond type matters just as much. A Texas Notary bond is low-risk with a fixed rate. In contrast, a large construction performance bond requires a much deeper financial review due to the higher stakes.

Your bond amount affects the dollar cost of your premium. A $50,000 bond costs more than a $10,000 bond, but larger amounts sometimes qualify for better percentage rates.

For bigger bonds, your industry experience and business financials are crucial. For a contractor bond, years of successful projects and solid financial statements can significantly reduce your premium.

Here’s how credit scores typically impact your annual premium costs:

| Bond Amount | Excellent Credit (0.5-3%) | Average Credit (3-5%) | Poor Credit (5-10%+) |

|---|---|---|---|

| $10,000 | $50 – $300 | $300 – $500 | $500 – $1,000+ |

| $25,000 | $125 – $750 | $750 – $1,250 | $1,250 – $2,500+ |

| $50,000 | $250 – $1,500 | $1,500 – $2,500 | $2,500 – $5,000+ |

How Your Credit Score Impacts the Cost of a Surety Bond in Texas

Your credit score is the foundation of your bond price. We run a soft credit pull (which doesn’t affect your score) to assess your financial history and predict your reliability.

If you have strong credit (a score above 675), you’ll qualify for our standard market rates from 0.5% to 4% of the bond amount. Your clean financial history shows you’re a low-risk client, and we pass those savings to you.

With lower credit scores, you’ll fall into our high-risk category with rates from 5% to 15%. While the percentage is higher, the cost is still a fraction of the total bond coverage.

If you’re improving your score, providing additional financial statements or a resume showing extensive industry experience can help offset credit issues and secure better rates.

Can You Get a Surety Bond in Texas with Bad Credit?

Yes! Bad credit doesn’t prevent you from getting a bond. Our specialized bad credit programs are designed for these situations, and we approve 99% of applicants, even with credit challenges.

For many smaller bonds, credit isn’t a factor. The Texas Certificate of Title bond, for amounts up to $15,000, requires no credit check. You’ll pay the standard 1.5% rate regardless of your credit history.

When credit is a factor, you’ll likely pay a higher premium, often in the 5% to 15% range. The important thing is you’ll get bonded and can operate your business legally.

Collateral requirements are rare for standard surety bonds. We might ask for it on very large bonds or in extreme credit situations, but for most applications, your signature is all we need. Our focus is on finding solutions, not creating barriers.

Common Texas Surety Bonds and Their Typical Costs

Understanding how much do surety bonds cost in texas is clearer with real-world examples of the many bonds required for Texas businesses. These bonds, for professions from notaries to contractors, have different pricing structures. Some have fixed costs, while others have variable costs based on a percentage of the bond amount and your risk factors. Let’s review the most common Texas bonds and their costs.

Fixed-Rate Bonds: The Texas Notary Bond

The Texas Notary bond is one of the most straightforward surety bonds available. To become a notary public in Texas, you need a $10,000 surety bond for your 4-year commission. It protects the public from financial loss due to notarial errors or misconduct.

The cost is a flat $50 for the full four-year term. There is no credit check or complex underwriting. The application is simple: complete a form, pay $50, and we issue your bond immediately. You’ll file it with the Texas Secretary of State Notary Information office with your other commission paperwork.

Percentage-Based Bonds: The Texas Certificate of Title Bond

If you need to register a vehicle without proper title documentation, Texas requires a Certificate of Title Bond (or bonded title). The cost calculation here is more mathematical but still straightforward.

The bond amount is 1.5 times your vehicle’s value, and the premium is 1.5% of that vehicle value. There’s a $100 minimum premium. For a $5,000 car, the bond amount is $7,500, but the premium is the $100 minimum, not the calculated $75.

For vehicles valued up to $15,000, no credit check is required, and we can issue these bonds instantly online.

Warning: The Texas DMV Bonded Title Process is strict. They reject bonds with minor errors. We must see your DMV paperwork before issuing the bond to avoid errors. Post-issuance changes often cost $50, so getting it right initially saves money and time.

Underwritten Bonds: The Texas Motor Vehicle Dealer Bond

Surety bonds for auto dealerships are different. The Texas Motor Vehicle Dealer Bond requires a $50,000 bond amount and full underwriting. The Texas Department of Motor Vehicles mandates this bond to protect consumers from fraud or non-compliance.

Your premium will typically range between 1% and 5% of the $50,000 bond amount, meaning a cost of $500 to $2,500 annually. Your specific rate depends on your financial strength, credit, and business experience. A dealer with excellent credit might pay $500, while one with credit challenges could pay $2,500 or more.

The underwriting process examines your personal and business financials and industry experience. This ensures you have the financial foundation to run a successful business and avoid claims. Working with experienced agents makes a difference here, as we know what underwriters look for and can help position your application for the best rate.

Your 4-Step Guide to Getting a Texas Surety Bond Fast

Getting a Texas surety bond doesn’t have to be a nightmare. We’ve streamlined the process so you can get bonded quickly and focus on your business. Our online system handles everything from application to issuance, often in just minutes for common bonds. You’ll know the cost upfront and can often get bonded the same day you apply, with no surprises about how much do surety bonds cost in texas.

Step 1: Gather Your Information and Apply Online

First, confirm exactly what you need. The requesting agency (the “Obligee”) will provide the required bond type and bond amount. Confirm these details with them to save time.

Our online application is straightforward. You’ll need your business name, personal information, the bond type, and obligee details. The form is simple, with no legal jargon. For most license and permit bonds, that’s all we need. For larger bonds, we might ask for financial statements or a summary of your industry experience. We’ll guide you on what’s needed for your specific bond. Having your information ready allows you to complete the application in minutes.

Step 2: Receive Your Instant Quote and Pay Your Premium

Once you apply, our system instantly calculates your premium based on the bond type, amount, and your risk profile. For most standard bonds, you’ll see your real-time quote in seconds. Your quote is final and has no obligation. Review it and decide when you’re ready. If you’re happy with the price, you can pay your premium securely online.

For larger premiums, we offer premium financing options. This typically involves a 30-40% down payment with the rest paid over 4-6 months. This helps manage cash flow while getting bonded immediately. Once your payment processes, our fast approval system means you’re bonded right away.

Step 3: Sign and File Your Bond with the Correct Texas Agency

After payment, we email you a digital copy of your bond and ship the original hard copy.

Filing your bond correctly is critical. Each bond type goes to a different agency, and errors can cause delays. Notary bonds go to the Texas Secretary of State, while motor vehicle dealer and certificate of title bonds go to the Texas Department of Motor Vehicles. Contractor license bonds usually go to city or county offices.

We provide clear filing instructions, including the obligee address. Some agencies offer e-filing options. Agencies like the Texas DMV are picky, so double-check all details against their requirements.

Step 4: Understanding Bond Renewals and How They Affect Your Cost

Most surety bonds have specific terms, usually one year (the Texas Notary bond lasts four years). We’ll send a renewal notice as your expiration date approaches to prevent a lapse in coverage.

For non-underwritten bonds, renewal is simple: just pay the premium for the next term. For underwritten bonds, we might need to re-evaluate your credit or financial situation through re-underwriting.

This can work in your favor. Improved credit or stronger business finances can lead to lower premiums at renewal. Conversely, if your credit has declined, your rate might increase.

Keep in mind: surety bond premiums are non-refundable once issued. The surety’s guarantee covers the entire term, so premiums are non-refundable even if your needs change. This is standard industry practice. The goal is maintaining compliance, and we’ll help make your renewal process smooth.

Frequently Asked Questions About Texas Surety Bond Costs

Here are straight answers to the questions we hear most often about how much surety bonds cost in Texas.

Are surety bond premiums in Texas refundable?

No, surety bond premiums are not refundable once issued. This is true even if your business plans change or you no longer need the bond. When we issue your bond, we are providing a financial guarantee for the entire bond term. This guarantee exists regardless of claims or changes to your business. This is standard practice across the entire surety industry because the premium compensates the surety for taking on that risk from day one.

How long does it take to get a surety bond in Texas?

This is an area where we excel. For instant issue bonds, you can be bonded in minutes. For common bonds like the Texas Notary bond or Certificate of Title bonds under $15,000, the online process is fast: apply, get a quote, pay, and receive your bond documents by email.

For underwritten bonds, such as larger contractor or motor vehicle dealer bonds, approval typically takes 24 to 48 hours. However, our streamlined process makes same-day service possible for many complex bonds if your paperwork is ready.

Is there a minimum cost for a surety bond in Texas?

Yes, there is a minimum premium. This covers the administrative costs of processing the application, running credit checks, and issuing the bond, even for small premium calculations.

Most standard license and permit bonds have a minimum premium of around $100. The Texas Certificate of Title Bond specifically has a $100 minimum premium. For example, if a car’s value results in a calculated $60 premium, you’ll pay the $100 minimum.

The Texas Notary bond is an exception: it’s a flat $50 for the four-year term, with no credit check.

Get Your Exact Texas Surety Bond Quote Today

Now that you know how much do surety bonds cost in Texas, don’t wait. Whether you need a $50 notary bond or a complex contractor bond, we offer the fastest approvals and lowest rates.

What makes us different? We answer our phones. Our licensed Texas agents know the local market, from Houston to the smallest county. We’ve helped thousands of Texas businesses get bonded quickly and affordably, and we’re ready to help you.

The process is simple. Get your free, no-obligation quote online in minutes. Many bonds qualify for instant approval, so you can get your bond certificate today without waiting or paperwork.

We know you need to get bonded to work, so we’ve streamlined everything to get you bonded today. Our same-day service is our standard.

Ready to see your cost? Our instant online approval system is available 24/7. You’ll see your exact premium before paying. Our premium financing options for larger bonds can make any amount fit your budget.

Don’t let bonding requirements slow your business down. Get Your Free, No-Obligation Quote Now and join thousands of satisfied customers who chose the BEST SURETY BOND COMPANY. Your bond is just a click away.