What is a Notary Bond and Why Do You Need One?

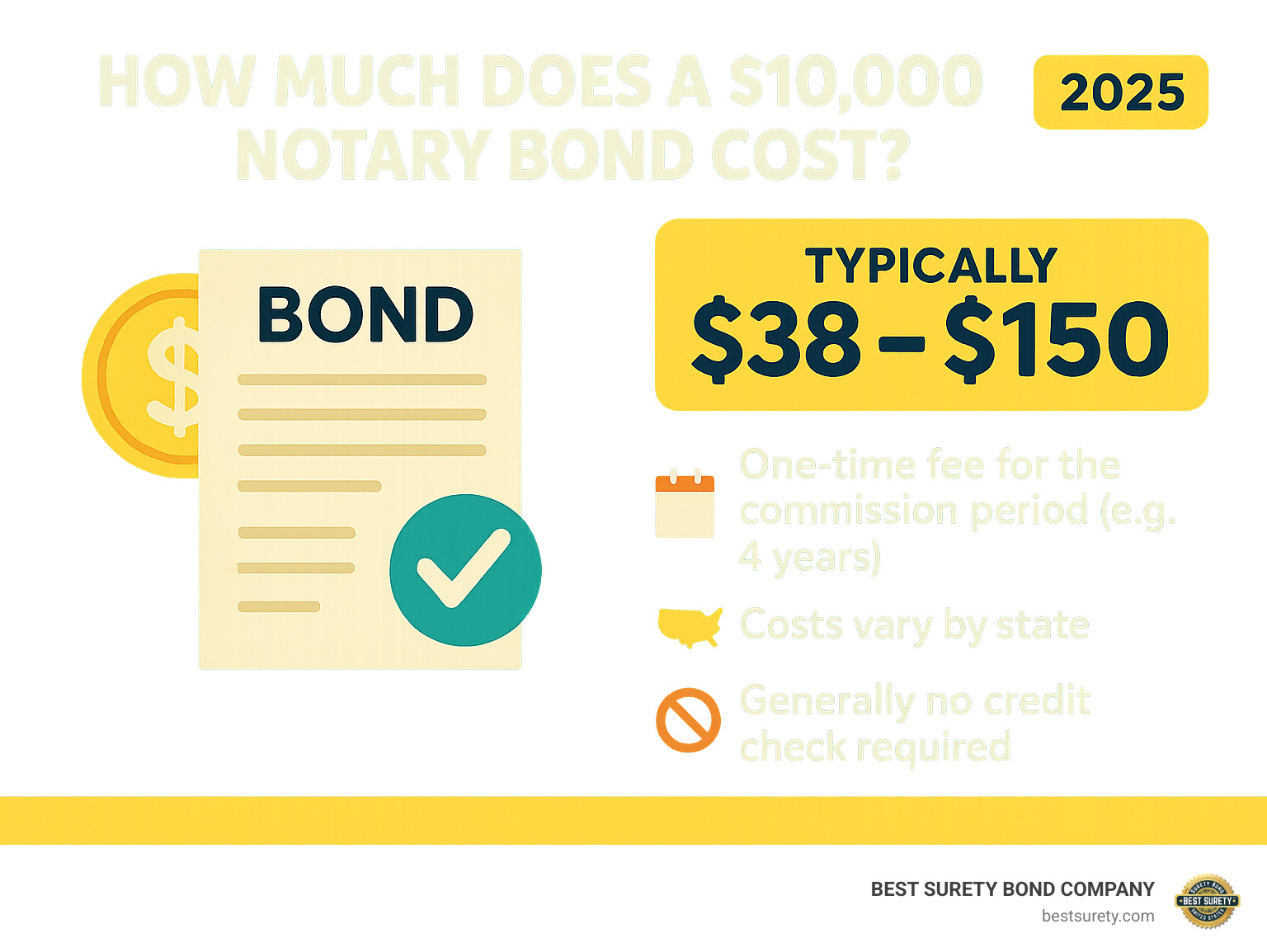

How much does a $10000 notary bond cost? For most states, a $10,000 notary bond typically costs between $38 and $150 for the entire commission period. This is usually a one-time payment that covers you for several years, often 4, 5, or 6 years, depending on your state’s requirements. This makes it a very affordable and crucial step in becoming a notary.

Becoming a notary public means taking on an important role: you act as an impartial witness for important documents, helping to prevent fraud. But with this responsibility comes a legal requirement in many states: getting a notary bond.

A notary bond isn’t insurance for you. Instead, it’s a financial guarantee that protects the public. If you make a mistake or act improperly while notarizing documents, causing financial harm to someone, the bond provides a way for that person to recover their losses. It ensures public trust in your notarial acts.

As an expert in the field of surety bonds, including how much does a $10000 notary bond cost, I’ve spent two decades scaling high-impact ventures and simplifying complex financial topics for business owners like you. I know you need clear answers without the jargon.

A notary bond is a three-party agreement, a bit like a safety net with three key players:

- The Principal: That’s you, the notary public. You’re the one promising to perform your duties ethically and lawfully.

- The Obligee: This is the party requiring the bond, usually the state or the public you serve. They are the beneficiaries of the bond, protected from your potential errors or misconduct.

- The Surety: That’s us, the surety bond company. We back your promise, guaranteeing to the obligee that if you cause financial harm due to your notarial acts, we will pay out claims up to the bond amount.

This arrangement ensures that the public is always protected, building trust in the notarial process nationwide.

The Purpose: Protecting the Public

The primary purpose of a notary bond is straightforward: to safeguard the general public against financial loss. Notaries are entrusted with significant legal authority, acting as impartial witnesses to crucial document signings. If, through error, omission, or even misconduct, a notary causes financial harm to a member of the public, the notary bond steps in.

Imagine a scenario where a notary improperly notarizes a real estate deed, leading to disputes over property ownership or financial losses for one of the parties involved. In such a case, the injured party can make a claim against the notary’s bond. If the claim is found valid, the bond ensures that the financial losses are covered up to the bond amount.

This bond is a vital tool for legal compliance and upholding ethical duties within the notary profession. It provides a layer of financial protection for consumers, ensuring that even if a notary makes a mistake, there’s a mechanism for restitution. It’s about maintaining the integrity of important transactions and building public trust in the notarial process. For instance, in our home state, Texas law states that a notary is personally liable for negligence or fraud committed in their official duties, highlighting the critical role this bond plays in consumer protection.

Is a Notary Bond the Same as Insurance?

This is a common question, and it’s super important to understand the distinction: a notary bond is not the same as insurance for the notary. This is a crucial insight that often gets misunderstood.

Think of it this way:

-

A Notary Bond protects the public: As we discussed, the bond is there to compensate any person who suffers financial loss due to your errors or improper conduct as a notary. If a valid claim is paid out by the surety company (us!), you, the notary (the principal), are ultimately responsible for reimbursing the surety company for that amount. Yes, that’s right – the bond is a guarantee, and if it pays out, it’s essentially a loan that you must repay. It’s like your personal promise backed by our financial strength.

-

Errors & Omissions (E&O) Insurance protects the notary: This is where the protection for you comes in. E&O insurance is a type of professional liability insurance that covers your legal expenses and damages if you’re sued for an unintentional mistake or omission while performing your notarial duties. Unlike the bond, if a claim is covered by your E&O policy, you typically don’t have to repay the insurance company. It’s your personal financial safety net.

So, while both deal with financial protection related to your notarial acts, their beneficiaries are different. The bond protects the public, fulfilling a state requirement, while E&O insurance protects you from personal financial liability. E&O insurance is an optional coverage, but as we’ll discuss, it’s a highly recommended one.

So, How Much Does a $10,000 Notary Bond Cost, Really?

Alright, let’s get to the brass tacks! You’re probably wondering, \”how much does a $10000 notary bond cost in real dollars and cents?\” The great news is that the premium for a $10,000 notary bond is incredibly affordable, especially when you consider it covers you for several years.

The Key Difference: Notary Bonds vs. Errors & Omissions (E&O) Insurance

We’ve talked quite a bit about notary bonds, and it’s a super important topic! But there’s another piece of the puzzle that often gets confused with the bond: Errors & Omissions (E&O) insurance. Understanding the difference between these two is absolutely crucial for any notary public. Think of it as knowing who’s got your back, and who else’s back you’re covering!

You see, while both are about protection, they protect different people. Let’s break it down simply.

First, there’s your Notary Bond. This is like your public promise, a financial guarantee that protects the people you serve. If, by some unfortunate chance, you make a mistake or act improperly during your notarial duties that causes someone financial harm, your bond is there to help them recover their losses. It’s a consumer protection tool, pure and simple. But here’s the kicker, and it’s a big one: if a valid claim is paid out from your bond by us (the surety company), you are ultimately obligated to reimburse us for that amount. It’s like we’re vouching for you, but if we have to pay on your behalf, you pay us back. So, while it’s a safety net for the public, it’s not your personal financial safety net.

Now, let’s talk about Errors & Omissions (E&O) Insurance. This is where your personal protection comes in! Think of E&O as your very own shield. It’s a type of professional liability insurance specifically designed for notaries. If someone sues you because of an unintentional error, omission, or negligence while you were notarizing, your E&O policy steps in. It covers your legal defense costs, settlements, or judgments, all up to your policy limit. And here’s the best part: unlike the bond, if your E&O policy pays out, you typically don’t have to reimburse the insurance company. It’s truly your financial safeguard.

So, to sum it up: your notary bond protects the public and is a state requirement, ensuring trust in the notarial process. Your E&O insurance protects you from personal financial liability, offering vital peace of mind.

Why E&O Insurance is a Smart Investment for Notaries

Given this clear distinction, you can probably see why E&O insurance isn’t just an “extra” – it’s a genuinely smart, and we’d even say essential, investment for any notary public.

First off, it offers crucial personal liability protection. As a notary, you could face unlimited personal financial liability for errors or misconduct in many states. This means your hard-earned personal assets – like your savings or even your home – could be at risk if a claim against you is successful. E&O insurance acts as a financial shield, protecting those assets by covering the financial repercussions of a lawsuit.

Even if you’ve done everything perfectly, defending yourself against a lawsuit can be incredibly expensive. This is where E&O truly shines, as it typically covers your legal fees. These costs can add up quickly, regardless of whether you’re found at fault or not. And let’s be honest, we’re all human! Unintentional mistakes can happen – maybe you accidentally miss a signature, improperly identify someone, or make a tiny clerical error that leads to big financial consequences for a client. E&O insurance provides that vital buffer, handling those honest, yet potentially costly, mistakes.

While your notary bond is a legal requirement in most states, E&O insurance is generally not legally required. However, considering the potential for unlimited personal liability, it’s highly recommended by industry experts as a best practice. The cost is surprisingly low for the peace of mind it provides; for example, a $10,000 E&O policy might cost as little as $35 for a 4-year term. That’s a tiny price to pay for such significant protection of your personal finances.

While your bond ensures the public is protected, E&O insurance makes sure you are protected. It’s a crucial layer of professional liability protection that allows you to perform your important duties with confidence, knowing you have a strong financial safeguard in place.

How to Get Your $10,000 Notary Bond in 3 Simple Steps

Getting your $10,000 notary bond doesn’t have to be a complicated or time-consuming process. We’ve streamlined it to be as fast and convenient as possible, ensuring you can get your bond quickly and get back to preparing for your notary commission. Our goal is to provide instant online approval and same-day issuance whenever possible.

The entire process can be completed online in just minutes, and you’ll have your bond documents delivered digitally right to your inbox. Here’s exactly how simple it is to get your bond with us:

Step 1: Complete a Quick Online Application

Forget endless paperwork and long waits. Our online application is designed for speed and simplicity, asking only for the essential information needed to issue your bond. You’ll typically only need to provide basic personal information such as your name, address, phone number, and the county where you’ll be commissioned.

Here’s the great news we shared earlier: for most $10,000 notary bonds, there’s no credit check required. This significantly speeds up the application process and means your bond premium will be a low, flat rate, regardless of your credit history. The whole form takes just a few minutes to fill out, making it one of the quickest steps in your notary journey.

Step 2: Pay the Low, One-Time Premium

Once you’ve completed your application, you’ll instantly see your affordable, one-time premium displayed on screen. You can securely pay online using any major credit card or electronic payment method, and in most cases, your purchase is processed immediately.

This means you’ll receive your digital bond documents immediately, often within minutes via email. No waiting days or weeks for mail delivery. We pride ourselves on offering the most competitive notary bond prices in the industry, paired with the fastest delivery. When you’re wondering how much does a $10000 notary bond cost, you’re looking at that same low, flat rate we discussed earlier – typically between $38 and $150 for your entire commission term.

Step 3: File Your Bond with the State

After you’ve secured your bond, the final crucial step is to file it with the appropriate state authority. This is typically your state’s Secretary of State office or your county clerk, depending on your state’s specific requirements.

Your bond documents will come with clear filing instructions showing exactly how and where to file in your state. It’s essential to file your bond within the timeframe specified by your state – often within 30 to 45 days of receiving your commission packet – to ensure your commission becomes effective and you can legally begin notarizing documents.

Some states may require a physical bond with an embossed seal, which we can provide via mail, while others accept digital copies. This step formally links your bond to your notary commission, completing a vital requirement for your official duties. For more details on the general requirements for various professional licenses, you can refer to our resources on license and permit bonds.

The entire process, from application to filing, typically takes less than a week, with most of that time spent waiting for your state to process the filing. Our part – getting you bonded – happens in minutes.

Frequently Asked Questions About Notary Bond Costs

We get it – you probably have a few more questions about the practical side of notary bonds, especially when it comes to costs and what happens after you get bonded. Let’s walk through the most common questions we hear from notaries just like you.

What happens if a claim is made against my notary bond?

Nobody likes to think about this scenario, but it’s important to understand what would happen if someone files a claim against your notary bond. The good news is that claims against notary bonds are relatively rare, but here’s what the process looks like:

First, we’ll conduct a thorough investigation of the claim. This isn’t a quick rubber-stamp process – we take these seriously and will look at all the evidence, including your notary journal records and any documentation related to the alleged incident. Your cooperation during this investigation is crucial and required.

If we determine the claim is valid and falls within the scope of your bond coverage, we’ll pay the financially injured party up to your bond amount – that’s $10,000 for the bonds we’re discussing. But here’s the part that catches some notaries off guard: you’re responsible for repaying us for any amount we pay out, plus any legal costs we incur defending the claim.

This is why we always emphasize that the notary bond protects the public, not you personally. It’s essentially a guarantee backed by our financial strength, but you’re ultimately on the hook through what’s called an indemnity agreement that you sign when getting bonded.

Additionally, most states require us to notify the commissioning authority (like your Secretary of State) when a claim is paid. Depending on your state’s laws, this could potentially impact your commission status until you can address the situation or post a new bond.

How much does a $10,000 notary bond cost to renew?

Here’s some great news: how much does a $10000 notary bond cost to renew is typically the same as what you paid initially. Since most notary bonds use flat-rate pricing and don’t involve credit checks, your renewal premium should be very similar to your original cost.

You’ll usually need to renew your bond when your notary commission comes up for renewal, which varies by state but is commonly every 4 years. For example, if you paid $40 for your initial 4-year bond in Texas, you can expect to pay around $40 again for renewal.

The only things that might change your renewal cost would be if there was a significant change in state regulations (which is pretty rare for notary bonds) or if a claim was paid from your bond during the previous term. But for most notaries who perform their duties properly, the renewal process is straightforward and affordable.

We make sure the renewal process is just as quick and easy as your first purchase, so you can maintain your commission without any interruption in service.

Can I get a notary bond with a poor credit history?

Absolutely! This is one of the best things about notary bonds, and it’s something that sets them apart from many other types of surety bonds. Your credit history typically won’t affect your ability to get bonded or change the price you pay.

Most $10,000 notary bonds are considered low-risk by surety companies, which means they’re offered at a flat rate for virtually everyone. While other types of surety bonds might see premiums range from 1% to 10% or more of the bond amount based on credit scores, notary bonds are generally accessible to everyone at the same low price.

We pride ourselves on high approval rates and believe that past financial challenges shouldn’t prevent you from pursuing your notary career. So if you’ve been worried about your credit score holding you back, you can breathe easy when it comes to getting your notary bond. The application process remains simple, fast, and affordable regardless of your credit history.

This no credit check policy for most notary bonds is just another way we make the bonding process as accessible and stress-free as possible for aspiring notaries.

Get Your Affordable Notary Bond Today

So, by now, you’ve seen that the answer to “how much does a $10000 notary bond cost” is surprisingly simple and incredibly affordable. It’s often just a small, one-time payment that covers you for several years. This modest investment is truly a crucial step in fulfilling your state’s requirements and, most importantly, protecting the public you’re here to serve.

At BEST SURETY BOND COMPANY, we believe getting your notary bond should be as easy and quick as possible. We understand you need an affordable solution that doesn’t add stress to your journey to becoming a notary. That’s why we’ve combined warm, human service with cutting-edge digital convenience to give you the fastest turnaround in the industry.

Whether you’re starting your notary career in Houston, Dallas, or anywhere else across Texas, or in any other state, we’ve got you covered. We’re proud to be licensed in all 50 states, ready to provide you with the lowest rates and expert guidance every step of the way. Our goal is to make sure you get your bond with fast approvals and instant online approval, often allowing for same-day issuance.

Don’t let the bonding process hold you back from your notary commission. We’re here to make it simple, transparent, and incredibly quick. You’re just a few clicks away from securing this essential piece of your notary puzzle.

Get Your Instant Online Approval Now