Why Payment Bond Costs Matter to Your Bottom Line

How much does a payment bond cost is one of the most common questions contractors ask when bidding on construction projects. Here’s the quick answer:

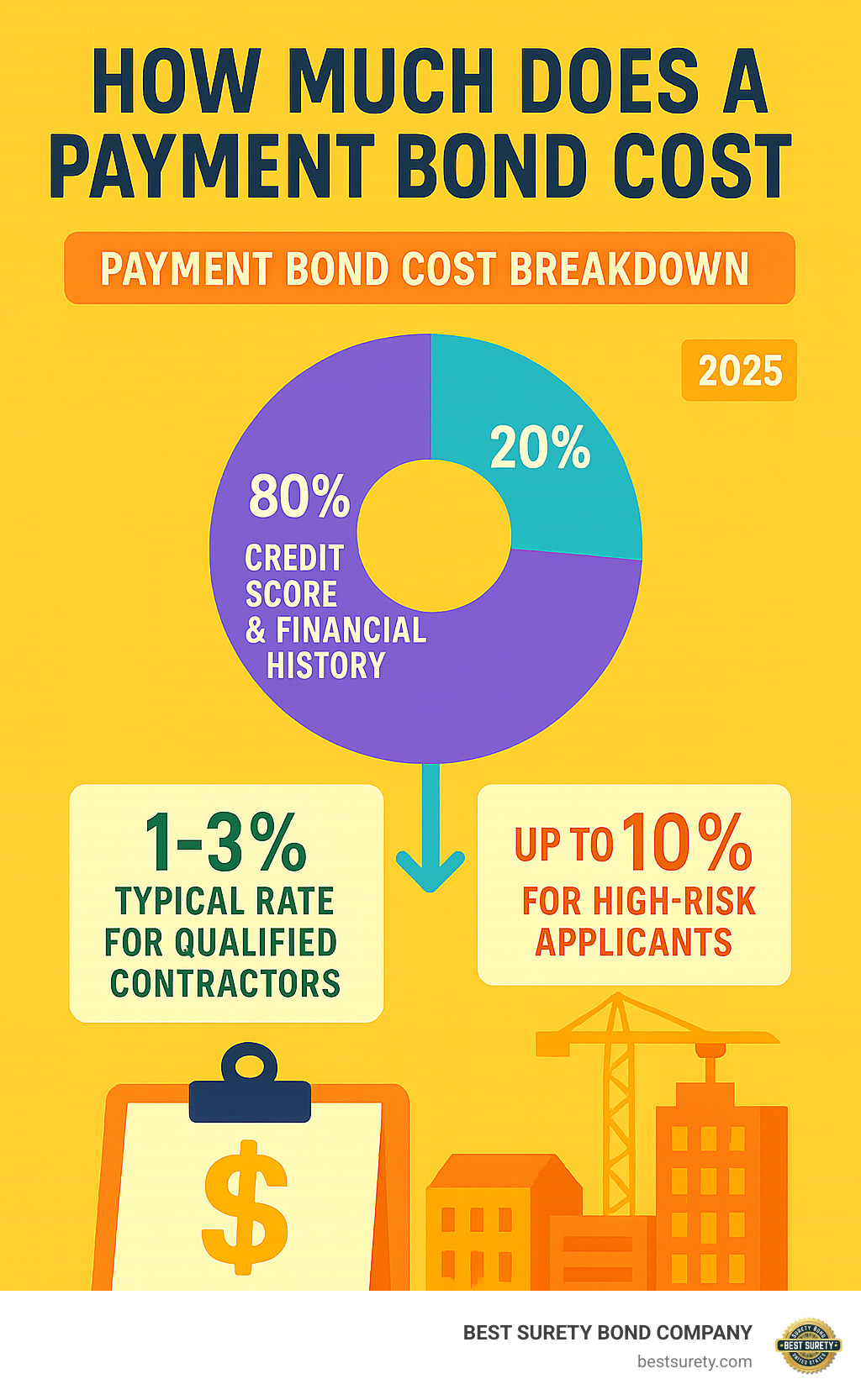

Payment Bond Cost Overview:

- Standard Rate: 1-3% of the total contract value

- With Good Credit: As low as 0.5-1% for qualified contractors

- With Poor Credit: Up to 10% of the contract amount

- Combined with Performance Bond: Usually one premium for both bonds

- Example: A $100,000 contract typically costs $1,000-$3,000 in bond premiums

Payment bonds guarantee that subcontractors, suppliers, and laborers get paid on construction projects. They’re required by law on federal projects over $100,000 under the Miller Act, and many state and private projects also require them.

The actual cost depends on your credit score, financial strength, experience, and project specifics. Most contractors pay between 1-3% of their contract value, but rates can vary significantly based on your risk profile. Understanding these costs can make or break a project bid, and this guide provides insight into the bonding process that affects thousands of contractors daily.

Understanding the Basics: What is a Payment Bond?

A payment bond is a type of surety bond that guarantees subcontractors, laborers, and material suppliers will be paid for the work and materials they provide on a construction project. It acts as a financial safety net for everyone down the supply chain, ensuring that even if the general contractor faces financial difficulties, the people who supplied labor and materials will be compensated.

This three-party agreement involves:

- The Principal: You, the contractor, who purchases the bond.

- The Obligee: The project owner who requires the bond for protection.

- The Surety: The bond company, like us at BEST SURETY BOND COMPANY, who issues the bond and guarantees payment.

Payment Bonds vs. Performance Bonds

While often issued together, payment and performance bonds serve distinct purposes. A performance bond ensures the job gets done, while a payment bond ensures the bills get paid.

A performance bond guarantees project completion according to the contract. If a contractor fails to complete the work, the surety steps in to find a new contractor or compensate the owner for the cost to finish the project.

A payment bond, on the other hand, guarantees payment to your subcontractors, material suppliers, and laborers. If you fail to pay them, the surety covers those costs. This protects the project owner indirectly by preventing liens from being filed against their property.

Why Payment Bonds Are Required

Payment bonds are often a legal necessity. The federal Miller Act mandates them for public projects over $100,000 to protect taxpayer funds and ensure all parties are paid. Most states have similar “Little Miller Acts” for state and local projects. Since mechanic’s liens can’t be placed on public property, payment bonds provide an essential legal path for subcontractors and suppliers to secure payment.

On private projects, while not always legally required, owners and lenders frequently mandate payment bonds. They offer crucial protection against financial risk by preventing mechanic’s liens, which can halt a project and complicate financing. For a project owner, requiring a bond also signals that the contractor is credible and financially stable.

How Much Does a Payment Bond Cost? The Core Calculation

To figure out how much does a payment bond cost, you need to understand the premium. The premium is the fee you pay the surety company, calculated as a percentage of the total contract price. It is not the full bond amount. This percentage, or premium rate, is determined by the surety’s underwriting process, where they assess the risk of guaranteeing your obligations.

Typical Premium Rates and Cost Examples

For contractors with strong financials, excellent credit, and a solid work history, payment bond premium rates are favorable. Our research shows that payment bonds usually cost about 1-3% of the contract amount for qualified applicants. For exceptionally strong profiles, rates can be as low as 0.5%.

However, for contractors with poor credit or limited experience, rates can be significantly higher, climbing to as much as 10% of the bond amount to reflect the increased risk.

Here are some examples of how much does a payment bond cost at different values and rates:

| Contract Price | Premium Rate (1%) | Premium Rate (2%) | Premium Rate (3%) |

|---|---|---|---|

| $100,000 | $1,000 | $2,000 | $3,000 |

| $500,000 | $5,000 | $10,000 | $15,000 |

| $1,000,000 | $10,000 | $20,000 | $30,000 |

As you can see, even a small percentage translates to a significant cost on larger projects, which is why understanding the factors that influence your rate is crucial.

Are Payment and Performance Bonds Priced Together?

In most cases, if a project requires both a performance bond and a payment bond, they are issued together for a single premium. This means you don’t pay extra for the payment bond; the combined cost covers both guarantees.

This combined pricing is standard in the surety industry. The surety assesses the overall risk and issues one bond form covering both project completion and payment to suppliers. This streamlined approach is more cost-effective than purchasing each bond separately. When you get a quote for a “contract bond,” it typically includes both performance and payment coverage under one premium.

Key Factors That Determine Your Payment Bond Premium

Your premium rate isn’t pulled out of thin air. A surety company’s underwriting process assesses your risk profile to determine how much does a payment bond cost for you. The more confidence the surety has in your ability to complete projects and pay your bills, the lower your premium will be.

Your Financial Profile: The “Three C’s” of Surety

At the heart of every surety decision are the “Three C’s”: Credit, Capacity, and Character. These elements provide a complete picture of your business.

Your credit score is a primary factor, often driving up to 80% of your bond cost. Underwriters focus on your personal credit; a score of 700 or higher typically qualifies for the best rates, as it shows you manage financial obligations responsibly.

Capacity is your business’s financial health and operational ability. Sureties analyze your balance sheets, cash flow, and working capital. Strong, CPA-prepared statements are crucial, as audited or reviewed financials demonstrate stability and can significantly lower your rate.

Character is measured by your track record and experience. A history of successfully completed projects shows reliability and competence. Each project finished on time and on budget builds trust with the surety, leading to better rates.

Project and Contract Specifics

Beyond your qualifications, project details also play a significant role in determining how much does a payment bond cost.

The contract size and type are major considerations. Larger or more complex projects involve greater risk. However, many sureties use a tiered or sliding scale rate structure where the percentage rate decreases as the contract value increases.

Project duration also matters. Most bonds account for durations up to 12 months. If your project is expected to last longer than 12-24 months, you may face a time completion surcharge, often around 1% per month after the initial period.

Finally, specific contract terms can increase your premium. Extended warranty periods or design-build responsibilities, where you handle both design and construction, inherently carry more risk for the surety and can increase costs.

Navigating Special Scenarios and Additional Costs

While the core calculation is a good starting point, certain situations can alter your final payment bond cost. Understanding these scenarios and potential fees is key to accurate budgeting.

How to Get a Payment Bond with Bad Credit

It is possible to get a payment bond with bad credit, but you should expect to pay a higher premium, potentially up to 10% of the bond amount. A lower credit score signals higher risk to the surety, which may also require collateral (cash or other assets) to secure the bond.

For small businesses or newer contractors who don’t meet standard credit requirements, The SBA Surety Bond Guarantee Program can be a valuable resource. This program helps you qualify by guaranteeing a portion of the bond to the surety. While there is a fee (currently 0.6% of the contract amount), it can open doors to projects you otherwise couldn’t bond. At BEST SURETY BOND COMPANY, we work to find solutions for a wide range of financial profiles.

How much does a payment bond cost with potential surcharges?

Several additional fees can affect how much does a payment bond cost. Be aware of these to prevent unexpected expenses:

- Overrun Premiums: If the final contract price increases due to change orders, you will owe additional premium on the increased amount.

- Design-Build Surcharges: Contracts where you are responsible for both design and construction carry more risk and often have a premium surcharge of 20% to 50%.

- Funds Control Fees: For some higher-risk applicants, a third-party funds control company may be required to manage payments. Their services typically charge 0.75% to 1.00% of the contract price.

- Escrow Fees: In certain situations, an escrow account might be required, adding 1-1.5% to the bond cost, plus a setup fee.

- Time Completion Surcharge: As mentioned, projects extending beyond the initial 12-month period may incur a surcharge, often around 1% per month for the extension.

Who Ultimately Pays for the Payment Bond?

While the contractor (the principal) pays the bond premium to the surety company, this cost is a standard job expense. This means the cost of the payment bond is almost always included in your total bid price for the project. So, although you write the check, the project owner (the obligee) indirectly pays for the bond as part of the overall project cost.

Actionable Steps to Lower Your Payment Bond Costs

While some factors influencing how much does a payment bond cost are fixed, you can take proactive steps to improve your rates over time. This is an investment in your business’s future profitability.

-

Improve Your Personal Credit Score: Since personal credit can drive up to 80% of your bond cost, this is your biggest lever for savings. Pay bills on time, keep credit balances low, and check your report for errors. Improving your score from the 600s to 700+ can significantly cut your premium.

-

Maintain Strong, Organized Financials: Work with a construction-savvy CPA to prepare professional financial statements. CPA-prepared statements, especially reviewed or audited ones, give sureties confidence in your financial stability, which translates to better rates.

-

Build a Solid Track Record: Every project you complete on time and on budget strengthens your bonding profile. Sureties value a history of successful projects because it demonstrates reliability and competence, leading to better rates on future bonds.

-

Present a Clean Application: Submitting an accurate and complete application can positively impact your rate. It signals professionalism and reduces the surety’s administrative burden, streamlining the underwriting process.

-

Work with an Expert Bond Agent: This is where the right partner matters. At BEST SURETY BOND COMPANY, we have relationships with multiple surety markets. We can present your qualifications in the best light and guide your application to the surety offering the most competitive rate for your profile.

Reducing how much does a payment bond cost is about positioning your business for long-term success. Contractors who invest in their credit, maintain strong financials, and build solid track records consistently get the best rates and highest bonding capacities.

Frequently Asked Questions about Payment Bond Costs

Do private construction projects require payment bonds?

While not legally mandated like on public projects, most private project owners, developers, and lenders still require payment bonds. They do this to protect their investment. A payment bond prevents subcontractors and suppliers from filing mechanic’s liens against the property if they go unpaid. These liens can halt a project and make it impossible to sell or refinance. For this reason, the cost of a payment bond is a standard expense in most private construction contracts.

Do payment bonds need to be renewed, and what are the associated costs?

For a single construction project, the payment bond premium is a one-time fee covering the contract’s original duration (typically up to 12 months). A renewal premium, or time completion surcharge, is only required if the project extends beyond that timeframe. This additional cost is usually around 1% per month for the extended period, calculated on a pro-rated basis.

How much does a payment bond cost if the contract price changes?

Your final bond premium is based on the final contract price. If the price increases due to change orders (an “overrun”), you will owe an additional premium on that increased amount. Conversely, if the contract price decreases (an “underrun”), you are typically entitled to a partial refund of the premium. This system ensures you only pay for the actual coverage needed for the project.

Get Your Fast, Affordable Payment Bond Today

Understanding how much does a payment bond cost is the foundation for smart bidding. The good news is that your payment bond cost is a manageable expense, typically 1-3% of your contract value for qualified contractors.

The key takeaways are straightforward: maintain strong personal credit, keep your business financials professionally prepared, and build a solid track record of completed projects. These are your most powerful tools for securing competitive rates.

At BEST SURETY BOND COMPANY, our mission is to provide fast, low-cost payment bonds for contractors across Texas and nationwide. We offer instant online quotes and same-day approvals because we know time is money. Our licensed agents leverage relationships with multiple surety markets to find you the best rates.

Whether you’re a Houston contractor or a builder expanding nationwide, we combine local Texas expertise with national authority to get you bonded quickly and affordably.

Don’t let uncertainty about how much does a payment bond cost hold you back. Get your instant, no-obligation quote and find how affordable bonding can be with the right partner.

https://bestsurety.com/services/