Understanding the True Cost of Business Protection

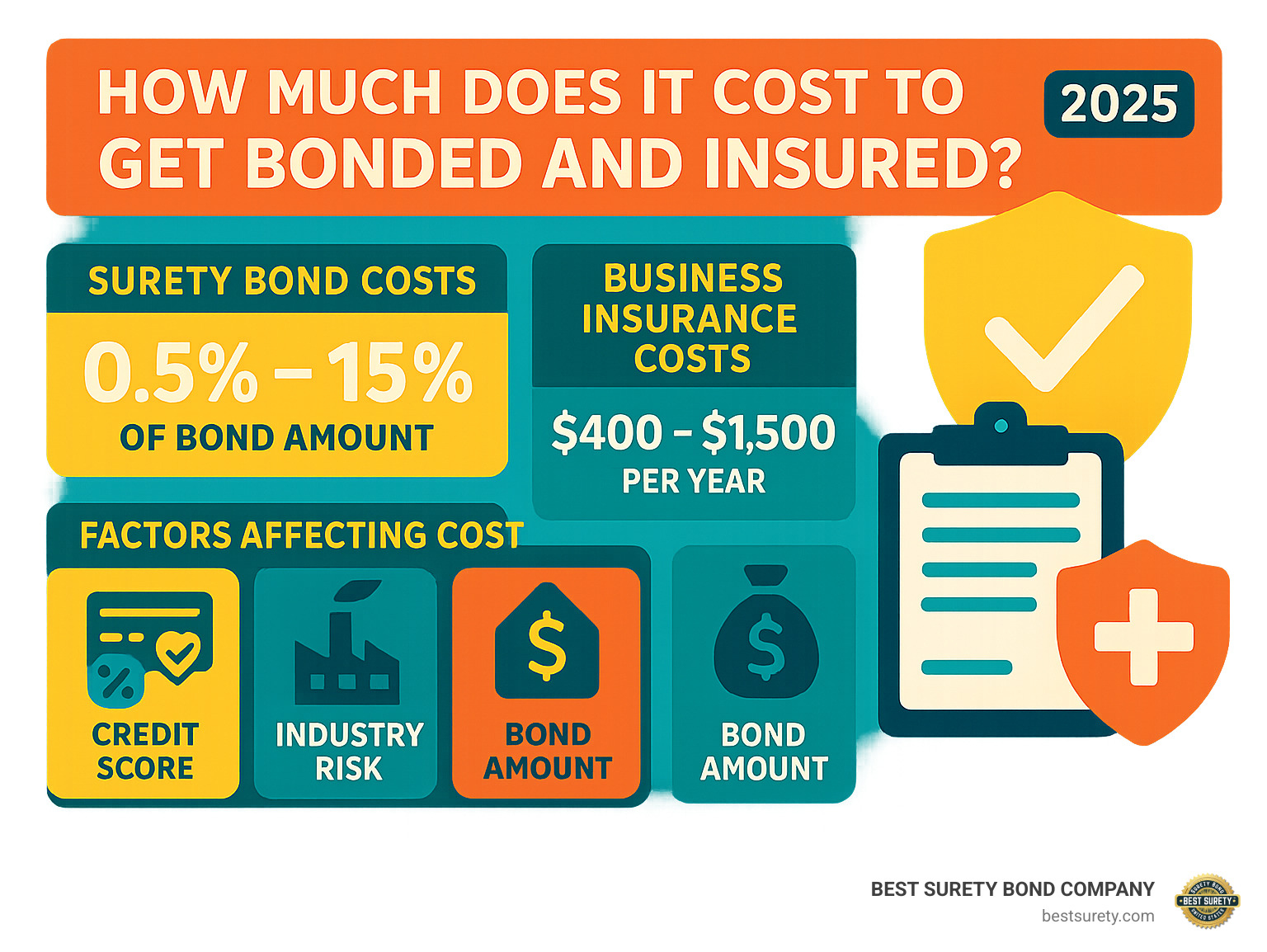

How much does it cost to get bonded and insured? It’s a common question from business owners in Texas and beyond. While the answer depends on several key factors, here’s a quick overview of what you can expect:

Quick Cost Overview:

- Surety Bonds: 0.5% to 15% of the bond amount annually

- General Liability Insurance: $400-$1,500 per year for small businesses

- Combined Protection: Most small businesses pay $1,000-$3,000 annually

| Credit Score | $10,000 Bond Cost | $25,000 Bond Cost | Business Insurance |

|---|---|---|---|

| Excellent (750+) | $50-$300 | $125-$750 | $400-$800/year |

| Good (650-749) | $300-$500 | $750-$1,250 | $600-$1,200/year |

| Poor (Below 650) | $500-$1,500 | $1,250-$3,750 | $800-$1,500/year |

Being bonded protects your clients if you fail to meet your obligations. Being insured protects your business from accidents and lawsuits. Most businesses need both to operate legally and build client trust.

The cost varies based on your credit score, industry, bond amount, and coverage needs. For example, construction contractors typically pay more than office-based businesses. Texas state requirements also influence pricing for specific license and permit bonds.

I’m Haiko de Poel. With over two decades of experience in financial protection, I’ve helped businesses save thousands by understanding their bonding and insurance costs. My background provides a unique insight into securing the right coverage at the best price.

How much does it cost to get bonded and insured word roundup:

Bonded vs. Insured: Understanding Your Business Protection

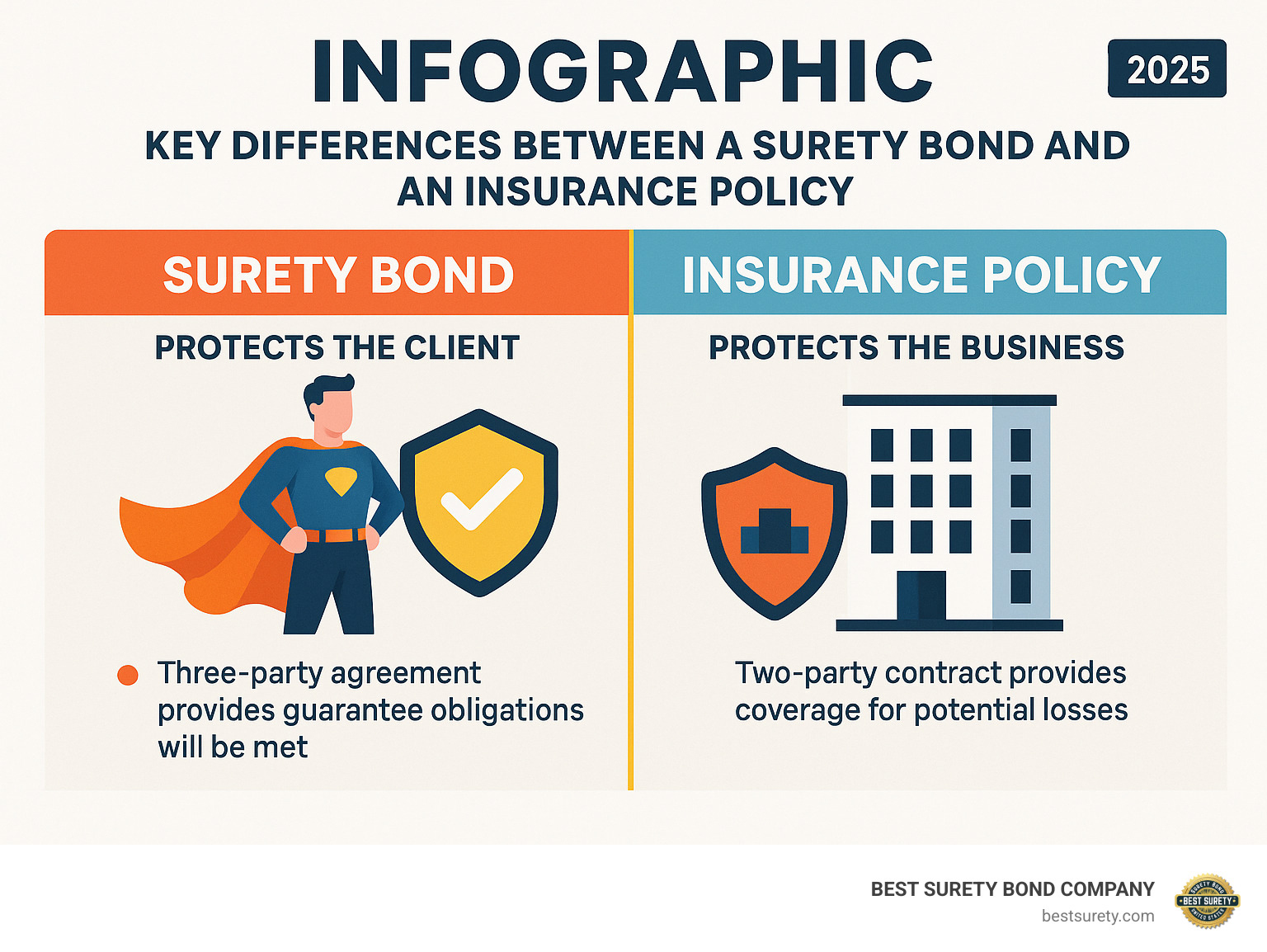

The phrase “bonded and insured” signifies comprehensive business protection, but bonds and insurance serve distinct purposes. Insurance protects your business from unforeseen losses, while a bond protects your clients from your failure to meet obligations.

A surety bond is a three-party contract involving:

- The Principal: Your business, purchasing the bond.

- The Obligee: The client or government entity requiring the bond.

- The Surety: The bond provider (like us) guaranteeing your obligations.

A surety bond is a financial guarantee. If your business fails to perform its duties, the obligee can file a claim. The surety pays the claim, and your business must then reimburse the surety. It functions like a line of credit, not a traditional insurance policy.

Business insurance, in contrast, is a two-party contract between your business and the insurer. It protects your business from financial losses due to events like accidents, property damage, or lawsuits. The insurance company pays for covered events up to your policy limits.

In short, a bond protects your clients, while insurance protects your business. Both are vital for a complete risk management strategy.

Why Both Are Crucial for Your Small Business

Being both bonded and insured is essential for client trust, contractual obligations, legal compliance, and creating a complete financial safety net.

First, client trust is paramount. Being bonded and insured signals professionalism and reliability, making clients feel secure. For businesses working in homes, like cleaning services or contractors, a bond provides peace of mind against potential employee theft, enhancing your reputation.

Second, contractual and legal requirements often mandate both. Many commercial clients and government agencies require bonds before awarding a contract, especially in construction. Additionally, many states, including Texas, require specific license bonds for businesses like auto dealers and contractors to operate legally. Most states also mandate workers’ compensation insurance for businesses with employees. Failure to comply can lead to fines and legal penalties.

Finally, having both provides a comprehensive financial safety net. Insurance protects your business from the unexpected, while a bond ensures you honor your commitments. Together, they shield your business from potentially catastrophic financial losses, allowing you to operate with confidence. We are local experts in Texas, serving all Texas counties, and are licensed in all 50 states to help you steer these specific risks and obligations.

For a deeper dive into the specifics, check out our guide on Understanding Surety Bonds and Insurance for Your Business.

How Much Does It Cost to Get Bonded and Insured in Texas and Surrounding Areas?

When asking, “how much does it cost to get bonded and insured?”, remember there’s no single answer. Costs vary based on your business type, location (including Texas-specific requirements), and financial standing. Here’s a breakdown of what to expect.

Typical Surety Bond Costs

A surety bond’s cost is the surety bond premium, a percentage of the total bond amount. This premium rate typically ranges from 0.5% to 15% annually, depending on your credit score, bond type, and industry risk.

Here are some common examples:

- A $10,000 bond can cost as little as $50 annually with excellent credit, or up to $1,500 with poor credit. Most businesses with good credit pay $100 to $300 per year.

- A $25,000 bond generally ranges from $125 to $3,750 annually. A strong credit score (675+ FICO) can secure a rate of 0.5-3% ($125-$750).

- A $100,000 bond for an applicant with a FICO score over 650 might cost 0.75% to 2.5% ($750 to $2,500) annually.

Your credit score is a primary factor. This table shows how it can influence the annual premium for a $25,000 bond:

| Credit Score Range | Estimated Annual Premium for a $25,000 Bond |

|---|---|

| Excellent (675+) | $125 – $750 (0.5% – 3%) |

| Good (600-675) | $750 – $1,250 (3% – 5%) |

| Poor (Below 600) | $1,250 – $2,500 (5% – 10%) |

Want to dive deeper? Our guide on Factors Affecting the Cost of Surety Bonds has more details.

License & Permit Bonds

Many Texas businesses need license & permit bonds to comply with state and local rules. For low-risk industries with good credit, these bonds can be very affordable, starting at $50 to $100 per year. Some, like notary bonds, are often “instant issue” at a set price.

In Texas, contractor licensing is often handled at the city or county level. A Texas Contractor License Bond in a city like Houston or Dallas might be set at $25,000, with the cost depending on your financial standing. Another common requirement is the Auto Dealer Bond, which can cost between $250 to $5,000 annually for a standard $50,000 bond, based on your credit.

Contract & Performance Bonds

For construction or large projects, contract & performance bonds are essential. These bonds guarantee work will be completed as agreed. The cost is typically 1% to 5% of the total contract value. For a $500,000 construction contract, a 2% premium would be $10,000. These bonds include:

- Bid Bonds: Assure you’ll sign the contract if your bid is chosen.

- Payment Bonds: Ensure subcontractors and suppliers are paid.

- Performance Bonds: Guarantee the project will be completed per the contract terms.

These bonds are crucial for contractors across Texas, from Austin to San Antonio, helping them qualify for larger contracts and support their business growth.

Common Business Insurance Costs

Here’s a look at typical annual costs for common types of business insurance:

- General Liability Insurance: Protects against claims of injury or property damage. Costs for small businesses range from $400 to $1,500.

- Workers’ Compensation Insurance: Required in Texas for most businesses with employees, it covers on-the-job injuries. Costs vary based on payroll and industry risk.

- Professional Liability Insurance (E&O): Protects service-based businesses from claims of negligence. Costs can range from $500 to $2,000+.

- Commercial Auto Insurance: Covers company-owned vehicles. A must-have if your business uses them.

Your policy limits and deductibles also affect your premiums. Higher limits mean more protection but higher costs. It’s about finding the right balance.

For more on insurance types and costs, see our guide on The Different Types of Business Insurance and Their Costs.

Key Factors That Determine Your Premium Rates

Understanding the factors underwriters use to calculate your premium can help you anticipate and manage your costs. It’s all about assessing your business’s risk and reliability.

How Your Credit Score Impacts Bond and Insurance Costs

Your credit score is the most significant factor determining your premium. For a surety, which guarantees your financial responsibility, your credit history is a primary indicator of risk. A strong score (usually 650 FICO or higher) signals financial stability and leads to lower rates, often 0.5% to 4% of the bond amount.

During the underwriting process, we review your personal and business credit to ensure you can reimburse the surety if a claim is made against your bond. The difference between excellent and poor credit can mean paying 1% versus 15% of the bond amount annually.

If your credit is less than perfect, you can still get bonded. We offer bad credit options, though premiums will be higher to reflect the increased risk. These high-risk premiums are necessary because the surety takes on more risk. At BEST SURETY BOND COMPANY, we work to find the most affordable rates for every applicant. Providing collateral or using a co-signer with stronger credit can also help lower your costs.

The Role of Industry, Experience, and Business Financials

Beyond credit, your industry and business history significantly impact your costs. Some industries, like construction, are inherently riskier due to large project values and higher chances of accidents, leading to higher premiums. A construction company might pay a higher percentage for a bond, while a lower-risk janitorial service could pay as little as 1% of the bond’s value.

Your years in business and experience also matter. An established business with a clean track record and no prior bond claims is less risky than a startup. For larger contract bonds, underwriters will also review your business financials, such as cash flow and balance sheets, to confirm you can manage large projects. A history of claims on past bonds or insurance policies will increase your premiums.

How Bond Amount and State Regulations Influence the Final Price

The total bond coverage amount directly influences your cost, as your premium is a percentage of this figure. A $50,000 bond will cost more than a $10,000 bond, all else being equal.

Texas requirements and local regulations dictate the specific bond amounts needed for different professions. For example, auto dealer bond amounts can vary, and local Texas notary bonds often have a set, affordable price without a credit check due to the low bond amount. We serve all Texas counties and stay current on these specific requirements to ensure our clients are compliant and receive the best possible rates.

Actionable Steps to Lower Your Bonding and Insurance Costs

You can actively lower how much it costs to get bonded and insured. By taking a few strategic steps, you can secure better rates without sacrificing protection.

Improve Your Financial Profile

Your financial health is a key factor for underwriters. To present yourself as a low-risk applicant, focus on these areas:

- Pay Bills On Time: A consistent history of on-time payments is the fastest way to improve your credit score.

- Reduce Debt: Lowering your debt-to-income ratio demonstrates financial stability.

- Check Credit Reports: Regularly review your reports for errors and dispute any inaccuracies.

- Maintain Healthy Cash Flow: Strong business financials prove you can meet your obligations.

These steps show financial discipline, which translates directly into savings. For more strategies, explore our guide on How to Save Money on Business Insurance and Surety Bonds.

Choose the Right Coverage and Terms

Making smart choices about your coverage can also lead to substantial savings. It’s all about being precise and proactive.

- Select the Correct Bond Type: Applying for the right bond ensures you meet requirements without unnecessary costs. Our experts can help you identify the exact bond you need based on Texas state or local regulations.

- Avoid Over-Insuring: Work with a professional to assess your true risks and tailor policies to your operations. Don’t pay for coverage you don’t need.

- Ask About Multi-Year Discounts: Some surety bonds offer significant savings if you purchase a policy for several years upfront, locking in a lower rate.

- Shop Around for the Best Rates: Don’t settle for the first quote. At BEST SURETY BOND COMPANY, we provide competitive rates for small businesses and contractors across Texas, ensuring you find the best value.

Frequently Asked Questions About Bonding and Insurance Costs

We know you have questions, and we’re here to provide clear, straightforward answers.

What is the average cost of being bonded and insured for a small business?

For a small business, the combined annual cost to be bonded and insured typically ranges from $1,000 to $3,000. This varies by industry, location, and coverage needs. For example, a bond premium might be 1% to 15% of the bond amount, while general liability insurance can be $400-$1,500.

A small cleaning business in Houston might pay $125 annually for a $10,000 janitorial bond, plus around $580 for general liability and $1,627 for workers’ compensation. The total is approximately $2,332 per year—a worthwhile investment in client trust and financial security.

Can I get a surety bond in Texas with bad credit?

Yes, you can absolutely get a surety bond in Texas with bad credit. While a lower credit score results in a higher premium rate (e.g., 10-15% of the bond amount vs. 1-3% for good credit), it doesn’t disqualify you.

We offer specialized bad credit programs to help applicants with less-than-perfect credit. In some cases, providing collateral or using a co-signer with strong credit can help you secure a better rate. Our goal is to find you the best possible price, regardless of your credit history.

What is the application process for getting bonded and insured?

Our process is designed to be simple and efficient. We blend digital convenience with expert guidance to get you covered quickly.

- Determine Your Needs: We’ll help you identify the specific bond type and amount required by Texas state or local authorities, along with the right insurance policies for your business.

- Complete the Application: Fill out a simple online form with basic business and financial information. For larger contract bonds, you may need to provide documents like financial statements or proof of experience.

- Get Your Quote: For many bonds, you’ll receive an instant online quote. For more complex needs, we’ll provide a customized quote quickly.

- Pay and File: Once you accept the quote and pay the premium, we provide same-day issuance for many bonds. You’ll receive your bond document to file with the obligee. Our process is built for fast approvals and low rates.

Get Your Fast, Affordable Texas Surety Bond Today

Now that you understand how much it costs to get bonded and insured, you know it’s a vital investment. Proper coverage is the key to protecting your business, building client trust, ensuring compliance, and achieving financial security.

At BEST SURETY BOND COMPANY, we make getting the right protection simple, clear, and affordable. Whether you’re a contractor in Houston needing a performance bond or a small business in Dallas requiring a license bond, we have you covered. We combine the speed of fast approvals and online quotes with the local expertise you expect from a trusted Texas-based provider. While our roots are in the Lone Star State, we proudly serve businesses nationwide.

Don’t let uncertainty about costs hold your business back. Get properly protected, fully compliant, and ready for success.

Ready to take the next step? We’re here to help.