Why Understanding the Bonding Process is Critical for Your Business

Wondering how to get bonded? Many business owners need bonds for licensing, contracts, or to build customer trust. The good news is that getting bonded is simpler than you think.

Quick Answer: How to Get Bonded in 3 Steps

- Identify your bond type – Determine what specific bond you need (license, contract, or commercial)

- Apply with a surety company – Provide business information, financial statements, and personal details

- Pay your premium and receive your bond – Most bonds are issued within 24 hours

Being bonded means your business has a surety bond, a three-party financial guarantee protecting your customers if you fail to meet your obligations. Unlike insurance, which protects your business, a surety bond protects the people you serve.

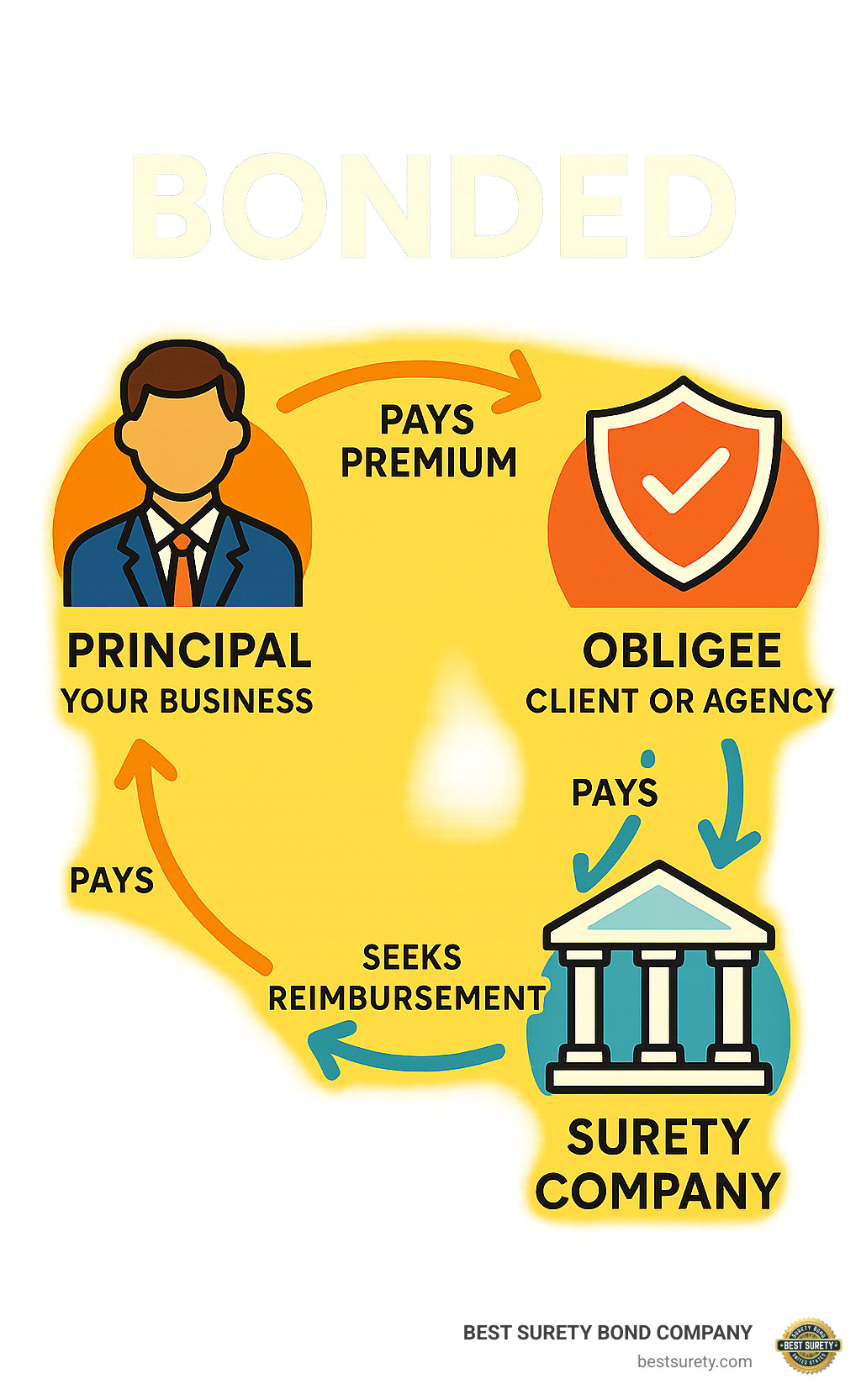

The process involves three parties: your business (the principal), the entity requiring the bond (the obligee), and the surety company backing the guarantee. Being bonded shows customers they’re protected from financial loss, building trust and opening doors to new opportunities.

Many industries require bonding by law. Auto dealers need surety bonds to get licensed, and general contractors must be bonded for most government projects. Cleaning services often get bonded voluntarily because commercial clients demand it.

The cost to get bonded is typically 0.5% to 15% of the total bond amount, with most small business bonds costing $100-$500 annually for $10,000 in coverage. Your exact rate depends on your credit score, financial stability, and industry risk.

I’m Haiko de Poel. Through my work in the insurance, legal, and financial sectors, I’ve helped thousands of business owners steer how to get bonded. Understanding the process upfront saves businesses time and money when they need coverage fast.

How to get bonded basics:

What Does It Mean to Be Bonded?

Being ‘bonded’ means your company has a surety bond, a financial promise that tells clients you stand by your word. It’s a financial safety net that builds trust.

It’s a legally binding, three-party promise involving:

- The Principal: That’s you! Your business is the one seeking the bond and promising to deliver on an obligation.

- The Obligee: This is the client or government agency that requires the bond. They’re the party being protected. For example, if you’re an auto dealer, the Texas Department of Motor Vehicles is an obligee.

- The Surety: That’s us – a surety bond company like BEST SURETY BOND COMPANY! We guarantee that you, the Principal, will fulfill your obligations. If you can’t, the Surety steps in to pay the Obligee, up to the bond amount.

How does it work? You (the Principal) pay a premium to the Surety. The Surety then issues a bond to the Obligee, guaranteeing you’ll fulfill your obligation. If you fail and the Obligee files a claim, the Surety pays them. However, unlike insurance, the Surety then seeks reimbursement from you. It’s like a line of credit backing your promises.

This is why clients require bonds—it protects them. Being bonded shows clients you’re reliable and financially accountable. It provides a clear path for financial recovery if issues arise, making you a more appealing choice than competitors. It’s a competitive advantage and often a legal requirement, helping you land better projects and build trust.

The Key Features of Surety Bonds

To clearly illustrate the distinct nature of surety bonds, let’s compare them to traditional insurance:

| Factor | Surety Bond | Traditional Insurance |

|---|---|---|

| Who is Protected | The Customer / Obligee | The Insured (your business) |

| Number of Parties | 3 (Principal, Obligee, Surety) | 2 (Insured, Insurer) |

| Purpose | Guarantees performance or compliance | Protects against financial loss due to covered risks |

| Premium Basis | Risk of the Principal’s default | Risk of a covered event occurring |

| Claim Payout | Surety pays Obligee, then seeks reimbursement from Principal | Insurer pays Insured (or third party), no reimbursement |

Common Types of Bonds Your Business Might Need

The world of surety bonds is varied. While all are financial guarantees, different situations require different bonds. Knowing which type your business needs is a key step in learning how to get bonded. Let’s explore the most common types.

Fidelity Bonds are unique because they protect your business from losses caused by employee dishonesty, like theft or fraud. For instance, if a cleaning service employee steals from a client, a fidelity bond can cover the loss. The Federal Bonding Program even helps employers hire at-risk job seekers by covering their fidelity bond for the first six months.

Commercial Bonds are a broad category required for licenses, permits, or to ensure compliance with regulations. Many governments require them for businesses to operate legally. We help businesses across Texas and nationwide secure these bonds quickly.

Commercial Surety Bonds

These bonds are often a must-have to operate legally in certain professions and show you’re committed to protecting the public.

- License & Permit Bonds: Required for businesses that need a special license or permit, assuring the licensing authority you’ll follow industry regulations.

- Auto Dealer Bonds: In Texas and many other states, you need an auto dealer bond to sell cars. This protects buyers from fraudulent dealership practices.

- Notary Bonds: Notaries Public are required to be bonded to protect the public from errors or misconduct.

- Janitorial Service Bonds: While not legally required, these bonds are a commercial necessity for cleaning businesses. They build client trust by protecting against employee theft. A typical $10,000 bond is affordable, with most businesses paying $100-$150 annually.

- Contractor License Bonds: Many states and cities require contractors to be bonded, ensuring they follow building codes and complete projects as agreed.

Contract Surety Bonds

For contractors on large or government projects, Contract Surety Bonds are vital. They assure the project owner that the work will be completed correctly.

- Bid Bond: Guarantees that if you win a bid, you’ll sign the contract and provide the required performance and payment bonds.

- Performance Bond: Promises you’ll complete the project according to the contract’s terms. If you can’t, the surety ensures the project is finished.

- Payment Bond: Ensures your subcontractors, laborers, and suppliers get paid, preventing liens on the project.

- Maintenance Bond: Guarantees you’ll fix any defects in materials or workmanship for a set period after project completion.

Choosing the right bond is key, and understanding these common types is a great start on your journey to how to get bonded. We’re here to help you find the perfect fit for your business.

How to Get Bonded: A Step-by-Step Guide

Getting bonded doesn’t have to be complicated or time-consuming. At BEST SURETY BOND COMPANY, we’ve streamlined the entire process to help Texas businesses and contractors nationwide get the coverage they need quickly and affordably. Most of our clients receive fast approval with same-day issuance, often getting their bonds in less than 24 hours.

The key to a smooth bonding experience is understanding exactly what you need and having your information ready. Let me walk you through our proven three-step process that has helped thousands of businesses successfully get bonded.

Step 1: Identify Your Specific Bonding Requirement

Before you can move forward, you need to know exactly what type of bond you’re looking for. This might seem obvious, but it’s where many business owners get stuck.

Start by determining your bond type. Are you looking for a license bond to operate your auto dealership in Houston? A performance bond for a construction project? Or maybe a commercial bond for your cleaning service? Each serves a different purpose and has different requirements.

Next, identify the obligee – that’s the entity requiring the bond. This could be the Texas Department of Motor Vehicles, your local city permitting office, a federal agency, or even a private client. The obligee will specify exactly what type of bond they need and for how much.

Speaking of amounts, you’ll need to confirm the required bond amount. Bonds are issued for specific dollar amounts like $10,000, $50,000, or $1 million. Don’t guess at this number – the obligee determines it based on the potential risk involved.

Finally, always check your state and local regulations. Requirements can vary significantly between Texas counties, and what works in Houston might be different in Dallas. Your local licensing board or industry association can provide the exact specifications you need to meet.

Step 2: Gather Your Information and Documentation

Once you know what bond you need, it’s time to prepare your application materials. Being organized at this stage will save you time and help us process your application faster.

For larger or more complex bonds, we’ll need your business financial statements – things like balance sheets and income statements. If your company is newer and hasn’t been operating for a full year yet, don’t worry. We can often work with a formal management statement instead of traditional financial forms.

We’ll also need personal financial statements from business owners who hold at least 5% of the company, including their spouses if married. This typically means a personal financial statement prepared by a CPA, but we can guide you through what’s needed.

Basic business owner information is always required – full names, addresses, Social Security Numbers, dates of birth, and details about your business structure. If you have co-owners with 5% or more of the business, we’ll need their information too.

For contract bonds specifically, we’ll need detailed project information including the contract value, project type, and obligee details. The more specific you can be, the better we can serve you.

We conduct thorough background checks as part of our underwriting process, including criminal records and business references. Here’s the thing – honesty and transparency about your financial history make everything go smoother. If there are past issues, it’s better to discuss them upfront than have them finded later.

Step 3: How to Get Bonded with a Fast and Simple Application

With your requirements identified and documentation ready, you’re prepared to apply. We’ve designed multiple ways to make this as convenient as possible for you.

For many common license and permit bonds, you can apply online directly through our website. Our digital process takes just a few minutes and often provides instant quotes and approval. It’s perfect for straightforward bonds where speed matters most.

If you prefer working with a person or have a more complex bonding need, speak with one of our agents. Our Texas-based experts understand local requirements and can provide personalized guidance. We believe in combining human service with digital convenience.

During our underwriting process, we evaluate what the surety industry calls the “3 C’s”: Character (your reputation and history of fulfilling obligations), Capacity (your ability to perform the work based on experience and resources), and Capital (your financial strength and liquidity).

Your credit score plays a significant role in determining your premium rate. Strong credit typically means lower costs, while challenged credit might result in higher premiums but doesn’t automatically disqualify you from getting bonded.

We also review your financial history to ensure you have the means to reimburse the surety if a claim occurs. For contract bonds, your experience and track record of successfully completing similar projects becomes especially important.

Once approved, we issue your legal bond document with all the specific conditions and coverage amounts clearly spelled out. Here’s a pro tip: avoid trying to bundle bonding and insurance purchases at the same time or with the same provider. This often causes delays and extra costs. As dedicated surety bond experts, we focus solely on getting your bonding done efficiently and cost-effectively.

The entire process is designed around one goal – getting you bonded quickly so you can focus on running your business. Most of our clients are surprised by how straightforward it really is once they know what to expect.

Understanding Bond Costs and Eligibility

It’s completely natural to wonder, “How much does it cost to get bonded?” This is one of the most frequent questions we hear from business owners like you! While the exact answer depends on a few things, we want you to know that BEST SURETY BOND COMPANY is dedicated to offering the most competitive rates in Texas and across the country. We make getting bonded as affordable and straightforward as possible.

How Much Does It Cost to Get Bonded?

The cost of your surety bond, which we call the premium, is usually a small fraction of the bond’s total value. Think of it as an annual fee you pay to keep that financial guarantee in place. Generally, this premium can range anywhere from 0.5% to 15% of the bond’s full amount.

For many small businesses, a common bond amount is $10,000. For this, the annual premium often falls between $100 and $500. While your overall costs for business protection (like bundling bonding and insurance) can vary, the bond itself is typically very budget-friendly.

What goes into calculating your specific premium rate? Several factors come into play:

- First, the Bond Amount itself. A higher bond amount naturally means a higher premium.

- Your Credit Score is incredibly important. A strong credit history shows financial responsibility and usually open ups the lowest rates. If your credit isn’t perfect, don’t worry, it’s still possible to get bonded, but your premium might be a bit higher.

- Your overall Financial Stability, both for your business and personally, also plays a big role.

- The Bond Type matters too, as some bonds carry more inherent risk for the surety company.

- The Industry Risk of your specific field can influence the price. Industries with a higher chance of claims might see slightly higher rates.

- Lastly, your Claim History – if you’ve had claims against a bond before, it could affect your current premium.

We pride ourselves on offering instant online quotes and working hard to secure the very best surety bond rates for you. Our goal is to ensure bonding is accessible for businesses of every size.

What Factors Affect Your Bondability?

Beyond just the cost, it’s helpful to understand what makes a business “bondable” in the eyes of a surety company. Our expert underwriters look at what we call the “3 C’s of Surety” when reviewing your application:

- Character: This is all about your integrity, your reputation, and your commitment to doing what you say you will. We look at your personal and business credit history, any past bankruptcies, judgments, or even criminal records. While a past issue doesn’t automatically disqualify you, being upfront and honest about your background is crucial. Bonding companies do thorough background checks.

- Capacity: This evaluates your ability to actually do the work or fulfill the obligation the bond covers. It includes your experience in your industry, how well your business is organized, the equipment you have, and the expertise of your management team. For contractors, showing a strong history of successfully completed projects and keeping accurate records of your ongoing work is super important.

- Capital: This assesses your financial health and how much cash you have available. Our underwriters review your financial statements – like balance sheets and income statements – along with bank statements to get a clear picture of your overall financial stability. It’s a good idea to update your financial records every 3 to 6 months, especially if you have an ongoing Bond Facility, to show continuous strength.

If you’re ever looking for a list of approved surety companies for federal contracts, the Treasury Department provides one right here: List of surety companies that can offer bonds on federal contracts. But for fast, low-cost surety bonds custom to your Texas or nationwide needs, BEST SURETY BOND COMPANY is definitely your go-to expert.

Frequently Asked Questions about Getting Bonded

We get a lot of questions about how to get bonded, and we’re here to provide clear, straightforward answers. Our goal is to make the process as easy to understand as possible, so you can get back to running your business!

Can I get a surety bond with bad credit?

Yes, absolutely! It is often possible to get bonded even if your credit isn’t perfect. We understand that financial bumps happen, and we believe every business deserves the chance to succeed.

While it’s true that your credit rating can influence the price you pay for a bond – meaning higher premiums for weaker credit – we specialize in finding solutions. We work with various programs designed specifically to help businesses with challenging financial histories. These might include specialized “high-risk” bond programs or options with slightly higher premium rates.

The most important thing is to be open and honest about your financial situation. Transparency allows us to explore all the best possible options for your unique needs and help you secure the bond required.

How long does a bond last and do I need to renew it?

The length of time a bond is active really depends on its type and what it’s for. There isn’t a single answer, but we can break it down for you.

Many common bonds, like most license and permit bonds, are issued for a one-year term. Think of it like a yearly subscription – they need to be renewed annually to stay active. Don’t worry, we’ll send you friendly reminders to make sure your coverage stays continuous and you never miss a beat!

Then there are continuous bonds, which stay in effect indefinitely. They remain valid until either the surety company or the entity requiring the bond decides to cancel it, or until you, as the principal, have completely fulfilled all your obligations.

For contractors, project-specific bonds (like bid, performance, and payment bonds) are different. These are tied directly to a particular project. They typically expire once the project is finished, accepted by the client, and all the contractual promises have been met.

And sometimes, there are very specific bonds, like a California bonded title, which might have a set term, such as a 3-year period, after which it simply expires and doesn’t need to be renewed.

Understanding your specific bond’s term and any renewal requirements is crucial for staying compliant. We’re here to guide you through all these ongoing requirements every step of the way.

How quickly can I get my surety bond?

Speed is one of our top priorities here at BEST SURETY BOND COMPANY! We know that when you need a bond, you often need it now.

For many common bonds, especially most license and permit bonds, we’ve streamlined the process for lightning-fast approval. You can often get instant online quotes and even same-day issuance. Imagine, many cleaning business owners, for example, can get their coverage started in less than 24 hours. Our online application process is designed to be super quick, sometimes taking as little as 2 minutes!

However, the timeline can vary a little depending on how complex your bond is:

- Simple Bonds: These are often approved and issued almost instantly online, getting you covered with minimal fuss.

- More Complex Bonds: For larger contract bonds or those that require a bit more in-depth review, the underwriting process might take a few days. This usually depends on how quickly you can provide all the necessary paperwork and the overall complexity of the project.

But rest assured, whether it’s a simple license bond or a more intricate contract bond, we combine the convenience of digital tools with the expertise of our licensed agents. This allows us to provide some of the fastest turnaround times in the industry. If you need a contractor surety bond same day, or require fast surety bond approval for your license, we are truly equipped to deliver!

Get Your Business Covered Today

So, you’ve learned all about how to get bonded and why it’s such a game-changer for your business. It truly is a crucial step! Getting bonded isn’t just about ticking a box; it’s about building serious trust, staying perfectly legal, and giving your business a real edge over the competition. No matter if you’re a busy contractor, an auto dealer helping folks find their dream car, a diligent notary, or even running a sparkling cleaning service, having the right surety bond can swing open new doors and forge stronger, more confident relationships with everyone you work with.

That’s where we come in! At BEST SURETY BOND COMPANY, we’re proud to be Houston’s go-to surety provider. But don’t let our Texas roots fool you – we’ve got a national reach and are fully licensed to help businesses in all 50 states. We believe in combining friendly, local expertise with the authority of a nationwide leader. What does that mean for you? It means fast approvals, incredibly low rates, and truly exceptional human service. We’ve helped over 10,000 clients get bonded, earning a solid BBB Accreditation and a reputation for being the most affordable choice for small businesses and contractors alike.

Don’t let the idea of getting bonded feel like a hurdle. It doesn’t have to be complicated! Our team of licensed agents is ready and waiting to help you steer all the requirements. We’ll make sure you get the exact coverage you need, quickly and without any fuss. Ready to boost your business’s credibility and open up new opportunities?

Get Bonded Today with Our Fast Online Approval