Why Getting Your Business Bonded and Insured Is Critical for Success

Learning how to get business insurance and bonding is essential for protecting your company and open uping new opportunities. Here’s the quick process:

Fast-Track Steps:

- Research your needs – Check state/local requirements and client contracts

- Get business insurance – General liability, commercial auto, workers’ comp

- Apply for surety bonds – Use a specialized surety agency, not general insurance agents

- Submit documentation – Financial statements, bond application, indemnity agreement

- Pay and receive bonds – Most bonds approved same-day to one week

The numbers don’t lie: 2 out of 3 companies go out of business after a major loss if they don’t have business interruption insurance. Meanwhile, getting bonded opens doors to government contracts and builds instant credibility with clients who see that “Licensed, Bonded & Insured” badge.

But here’s what most business owners get wrong – they think bonds and insurance are the same thing. They’re not. Insurance protects your business from unexpected costs like accidents or lawsuits. Surety bonds protect your clients by guaranteeing you’ll complete your work or they get compensated up to the bond amount.

Whether you’re a contractor in Houston needing a license bond or an auto dealer requiring a permit bond, the process is simpler than you think when you know the right steps.

I’m Haiko de Poel, and with over two decades of experience in insurance and business development, I’ve guided countless entrepreneurs through getting bonded and insured. I specialize in creating systems that protect and grow businesses nationwide.

Bonding vs. Insurance: Understanding the Key Differences

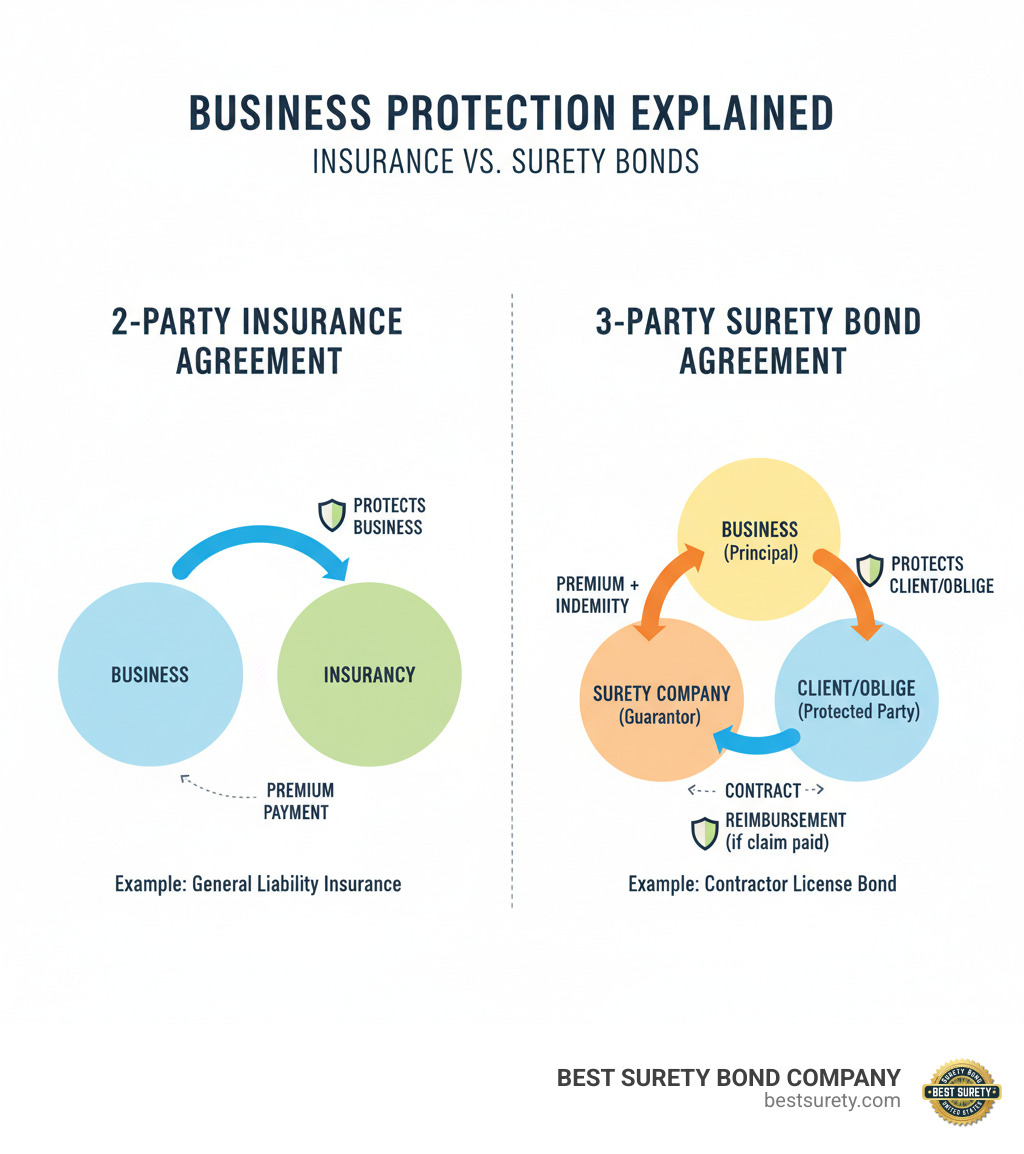

Here’s the truth that trips up most business owners: bonding and insurance aren’t the same thing. They’re both essential safety nets, but they protect completely different people in completely different ways.

Think of it like this – insurance is your personal bodyguard, while bonding is your promise keeper.

A surety bond is a three-way agreement between you (the principal), your client (the obligee), and the surety company. It’s a financial guarantee that you’ll fulfill your obligations. If you fail, the surety company compensates your client, but you must pay the surety company back. It functions like a line of credit that backs your word.

Business insurance is a two-party agreement between you and the insurance company. When an accident or disaster occurs, your insurer pays the claim without expecting reimbursement (beyond your deductible). It’s true risk transfer, shifting potential losses away from your business.

| Feature | Surety Bond | Business Insurance |

|---|---|---|

| Parties Involved | 3 (Principal, Obligee, Surety) | 2 (Insured, Insurer) |

| Who it Protects | The client, customer, or public (the obligee) | Your business |

| Purpose | Guarantees performance, compliance, or honesty | Protects against financial losses (accidents, lawsuits) |

| Repayment | Principal (you) must repay the surety for claims paid | No repayment expected from the insured for claims paid |

| Nature | Financial guarantee / line of credit | Risk transfer / protection for your assets |

The distinction matters when you’re figuring out how to get business insurance and bonding. You need both, but for different reasons. For a deeper dive, check out our commercial surety bonds page. The SBA puts it simply: business insurance protects you from unexpected costs.

How Surety Bonds Protect Clients and Businesses

Surety bonds are trust builders. They give clients confidence and give you credibility.

Client protection is the primary benefit. If a bonded contractor abandons a job, the bond provides financial recourse for the homeowner, ensuring the project is completed or losses are compensated. This creates powerful contractor accountability, as the risk of a bond claim encourages professional and ethical behavior.

For your business, being bonded signals credibility and professionalism. The “Licensed, Bonded & Insured” badge shows clients you’re serious about your obligations. It also opens doors to larger projects, as many government agencies and corporations require bonds. Bonds also serve as a fraud prevention tool by ensuring compliance with industry regulations.

How Business Insurance Protects Your Company

While bonds protect your reputation, business insurance protects your bottom line.

Asset protection (commercial property insurance) covers your physical assets like buildings and equipment from fire, theft, or natural disasters.

Liability coverage (general liability) protects you from costs related to accidents, like a customer injury or property damage. A single incident could be financially devastating without it. This includes lawsuit defense, handling legal fees even for frivolous claims.

Business interruption insurance is vital. It covers lost income and expenses if you’re forced to close temporarily. Without it, 2 out of 3 companies fail after a major loss.

In Texas, workers’ compensation is legally required for most businesses with employees. It covers medical bills and lost wages for on-the-job injuries, protecting both your workers and your business.

Why Your Small Business Needs to Be Bonded and Insured

For small businesses in Texas, especially in competitive markets like Houston, knowing how to get business insurance and bonding is key to growth and protection. It transforms you from a startup into a trusted partner who wins big contracts.

The “Licensed, Bonded & Insured” badge instantly signals professionalism and reliability, showing clients you stand behind your work.

Being bonded and insured makes it easier to win contracts, especially government projects in Texas that mandate bonding. It builds immediate customer trust, meets legal requirements to avoid fines, and provides a risk management advantage over uninsured competitors. It radiates professionalism.

How to Determine if Your Business Needs a Surety Bond

Figuring out if you need a surety bond is straightforward. The requirements typically come from one of four sources.

Industry regulations often mandate bonds for businesses like auto dealers, freight brokers, and collection agencies as part of the licensing process to ensure consumer protection.

State and local laws, particularly for contractors, impose bonding rules. Requirements in Houston can differ from Dallas, and our Texas-based experts can help you steer these local nuances.

Client contracts often require bonds even if not legally mandated. For example, large clients may require janitorial service bonds to ensure accountability.

Project requirements, especially for public works and large construction bids, will explicitly state the required bond types and amounts (e.g., bid, performance, and payment bonds).

When you’re unsure, simply ask the obligee—the entity requiring the bond. Whether it’s a state licensing board, city permitting office, or potential client, they can tell you exactly what type and amount of bond you need. For more detailed guidance on licensing requirements, check out our comprehensive resource: More info about license and permit bonds.

Common Types of Businesses Required to Be Bonded

Certain industries have bonding woven into their DNA to protect consumers and ensure compliance.

Construction contractors frequently need bid, performance, and payment bonds for public and private projects.

Auto dealers in Texas, from Dallas to Austin, need motor vehicle dealer bonds to protect consumers and ensure ethical transactions.

Janitorial services gain immense client trust with bonds that protect against employee theft. It’s an affordable way to stand out, with costs starting at just $125 annually.

Notaries public need bonds to protect the public from errors. Freight brokers require BMC-84 bonds to ensure they fulfill financial obligations. Collection agencies must be bonded to protect consumers from unethical practices.

The pattern is clear: if your business handles other people’s money, works on their property, or operates in a regulated industry, bonding requirements probably apply.

A Step-by-Step Guide on How to Get Business Insurance and Bonding

Learning how to get business insurance and bonding is a manageable process. For contractors in Houston or any small business owner in Texas, this roadmap will get you protected and ready to grow.

Step 1: Researching Your Insurance and Bonding Needs

Before applying, research your specific needs to avoid wasting time and money.

Identify the obligee (the entity requiring the bond), such as a state board in Austin or the City of Houston. They will specify the required bond type and amount.

Determine the bond type. Whether it’s a license and permit bond for compliance or a contract bond for a construction bid, getting the right one is crucial.

The bond amount is set by the obligee and is non-negotiable. It represents the maximum payout for a claim.

In Texas, state and local requirements vary. The TDLR sets many state rules, but cities like Houston have their own ordinances, especially for contractors. We can help you steer these.

Simultaneously, assess your insurance needs. Consider risks from employees, company vehicles, and customer visits. For businesses dealing with legal proceedings, you might need specialized bonds – check out More info about understanding court bonds for detailed guidance.

Step 2: A Practical Guide on How to Get Business Insurance

Getting business insurance builds a fortress around your company. Key coverages include:

- General Liability: Covers third-party injuries and property damage.

- Commercial Auto: Required for any business-use vehicles.

- Workers’ Compensation: Legally required in Texas if you have employees; covers on-the-job injuries.

- Professional Liability (E&O): Protects against claims of negligence or mistakes in your services.

- Commercial Property: Covers physical assets like your building and equipment.

- Business Interruption: Replaces lost income if a covered event forces you to close. Crucially, two out of three companies fail after a major loss without it.

To find an agent and compare quotes, seek an agent who knows your industry. Get multiple quotes and compare coverage levels, not just the price.

Step 3: The Fast-Track on How to Get Business Insurance and Bonding with a Surety

Getting a surety bond should be fast and straightforward with the right team.

Our most important advice: work with a specialized surety agency. General insurance agents lack the expertise and underwriter relationships to secure the best rates and service. Don’t bundle bonds with a general agent for convenience—you’ll likely face higher premiums and delays.

The fastest way to get bonded is to apply online. Our simple application takes minutes and provides an instant quote for most common license and permit bonds.

Our instant quote and underwriting process provides immediate feedback. Simple bonds are often approved instantly, while complex bonds are reviewed by an underwriter who assesses your credit, financials, and industry risk.

Your creditworthiness is a key factor, but don’t worry if it’s not perfect. We have programs for businesses with challenging credit because we believe every legitimate business deserves to be bonded.

Upon approval, you’ll sign an indemnity agreement. This formalizes your responsibility to repay the surety company for any claims paid out on your behalf. This is why a bond is a form of credit, not insurance.

Fast approval and issuance is our specialty. We issue many bonds the same day, especially license and permit bonds for Texas businesses. Even complex contract bonds are typically issued within a few days because we know speed is critical.

Whether you’re in Houston, Dallas, or anywhere in Texas, we combine digital convenience with human expertise to make bonding painless. For more information, visit our page on More info about small business bonds.

Navigating Surety Bonds: Types, Costs, and Key Industries

Understanding surety bonds is key to getting how to get business insurance and bonding right. They are strategic tools that open opportunities, and knowing the right type and cost is crucial.

Like insurance policies, each bond serves a specific purpose. For a Houston contractor or a Dallas cleaning service, the right bond provides a competitive edge.

Common Types of Surety Bonds for Small Businesses

Most small businesses will encounter one of these four bond types:

License & Permit Bonds: The most common type, required for licensing in many industries like auto sales and contracting. They guarantee you’ll follow state and local regulations.

Contract Bonds: Essential for construction and government projects. This category includes Bid Bonds (guaranteeing you’ll take the job), Performance Bonds (guaranteeing you’ll complete it), and Payment Bonds (guaranteeing subcontractors get paid). For detailed information, check out More info about construction surety bonds.

Janitorial Service Bonds: While not always required by law, these bonds build client trust by protecting them against theft. This gives you a powerful edge when competing for commercial contracts.

Fidelity Bonds: These protect your business from employee theft or dishonesty. They are a form of insurance, crucial for any business handling cash or valuable assets.

What Factors Influence the Cost of a Surety Bond?

Surety bond costs are calculated based on risk. Understanding these factors can help you get the best rates.

Credit Score: This is the biggest factor. A strong score means a lower premium, but we have programs for businesses with less-than-perfect credit.

Bond Type and Amount: Costs vary widely. A small notary bond might be $50, while a large construction bond can cost thousands. Higher risk and coverage amount mean a higher premium.

Industry and Financials: High-risk industries pay more. For large bonds, your business’s financial history will also be reviewed.

Texas Bond Rates: As local experts, we leverage our relationships to guarantee the lowest rates in Texas.

For perspective, surety bond costs for cleaning businesses start at just $125 annually. This makes bonding an affordable way to open doors to more business. Processing time varies; simple bonds are often approved same-day, while complex ones take a few days to a week.

Frequently Asked Questions about Business Insurance and Bonding

We love getting questions about how to get business insurance and bonding – it shows you’re taking the right steps to protect and grow your business! These are the questions that come up most often.

How long does it take to get a surety bond?

Getting bonded is faster than you think. For common license and permit bonds, we offer instant quotes and same-day approval. You can apply online and receive your bond within hours.

For complex bonds (e.g., construction or court bonds), it takes a few days to a week. Our process is streamlined for speed because we know your time is valuable.

The key is working with a specialized surety agency like us, not a general insurance agent who lacks the urgency and underwriter relationships.

What is the difference between a surety bond and a fidelity bond?

This is a common point of confusion. A surety bond is a three-party agreement protecting your clients and the public. It guarantees your promises, and if a claim is paid, you must reimburse the surety company. It’s a form of credit.

A fidelity bond is a two-party insurance policy that protects your business from employee dishonesty or theft. If an employee steals, the fidelity bond covers your losses, and you don’t have to pay it back. It’s true insurance.

So, a surety bond protects others from your business, while a fidelity bond protects your business from internal threats. For a deeper dive, Investopedia has a comprehensive explanation.

Can I get a surety bond with bad credit?

Yes. While good credit gets you better rates, bad credit doesn’t automatically disqualify you. This is a common concern we help business owners overcome.

We have programs for high-risk applicants. You may pay a higher premium, but you can still get the bond you need to operate legally and win contracts.

Being upfront about your situation helps. Many clients improve their rates over time as their credit improves.

The bottom line: don’t let bad credit stop you from applying. We’ve helped countless Texas businesses get bonded and can likely help you too.

Conclusion: Secure Your Business and Open up Growth

Mastering how to get business insurance and bonding is about building an unshakeable foundation for your business. Understanding that insurance protects your business while surety bonds protect your clients is the secret to sustainable growth.

This combination gives you a powerful competitive advantage. Being fully protected and bondable builds confidence and attracts serious clients. In Texas’s booming economy, from Houston to Austin, this protection is essential for survival and success.

Being properly bonded and insured opens doors to government contracts and high-value commercial clients. It proves you’re a serious, reliable partner.

At BEST SURETY BOND COMPANY, we’ve made it our mission to be your trusted partner in this journey. As your Texas-based experts with national reach, we’ve perfected the art of combining genuine human service with digital convenience. Whether you need license and permit bonds, contract bonds, court bonds, or performance bonds, we deliver the industry’s fastest approvals at the lowest rates – guaranteed.

We’ve helped thousands of businesses nationwide, from Houston contractors to others across the country, steer bonding with speed and affordability. Our clients agree: we make it effortless.

Your business deserves protection, credibility, and the competitive edge that comes with being properly bonded and insured. Don’t let another day pass wondering “what if” – take action now. Get your instant, no-obligation quote today and find just how straightforward it is to secure your business’s future.