Why Securing an Indemnity Bond Online is Your Fastest Path to Business Protection

Indemnity bond online applications have revolutionized how businesses secure financial protection. For a Houston contractor bidding on a project or a Texas auto dealer needing licensing, getting bonded digitally means faster approvals, clear pricing, and 24/7 convenience.

Quick Answer: How to Get an Indemnity Bond Online

- Identify your bond type – License, permit, contract, or court bond

- Apply online – Complete a simple digital application (3-5 minutes)

- Get instant quote – Receive pricing based on bond amount and credit

- Pay and receive bond – Same-day digital delivery for most bond types

- Submit to obligee – File with the requiring agency or court

An indemnity bond is a three-party financial guarantee. It protects the obligee (the party requiring the bond) from loss if the principal (you) fails to meet obligations. Unlike insurance, which protects you, an indemnity bond protects others from you, holding you financially responsible for claims.

The digital bonding process eliminates paper applications, long waits, and unclear pricing. Most license and permit bonds are issued instantly online, while contract bonds over $25,000 typically receive same-day underwriting.

As Haiko de Poel, I’ve scaled multiple fintech and insurance ventures, streamlining indemnity bond online processes for business owners nationwide. My experience shows how technology turns complex bonding requirements into simple, fast solutions.

What is an Indemnity Bond and How Does It Work?

As a contractor in Houston bidding on a major project, you need to provide assurance you’ll deliver. An indemnity bond online is your digital path to that crucial financial guarantee, opening doors and building trust.

An indemnity bond creates a three-party agreement that acts as a safety net. When you secure one, you’re promising to fulfill your obligations, with a trusted company backing you up to make things right if you don’t.

While often used interchangeably with “surety bond,” an indemnity bond specifically highlights your duty to reimburse the surety for any paid claims. It’s not insurance protecting you; it’s a financial guarantee protecting others from your potential actions, keeping you accountable.

The claim process is straightforward. If a claim is filed, the surety investigates. If valid, the surety pays the affected party. However, the principal’s liability means you must reimburse the surety for the full amount plus costs. This structure ensures protection while maintaining accountability.

Understanding this difference from traditional insurance clarifies why indemnity bonds are so valuable. For a deeper dive, check out our guide on commercial surety bonds.

The Three Parties Involved

Every indemnity bond involves three essential players.

The Principal – That’s you, the business owner or contractor needing the bond. You commit to fulfilling specific obligations, like completing a project or following regulations. When you apply for an indemnity bond online, you accept this responsibility.

The Obligee is the party requiring protection, such as a government agency, project owner, or court. They require a bond to ensure they’ll be compensated if you fail to meet your obligations.

The Surety – Companies like BEST SURETY BOND COMPANY provide the financial backing. We evaluate your credit and business history, then put our financial strength behind your commitments, demonstrating your credibility to obligees in Texas and beyond.

The Role of the Indemnity Agreement

The indemnity agreement is a legal contract detailing what happens if a claim is filed against your bond.

When you sign it, you make a reimbursement obligation to the surety. It’s a legally binding promise stating that if the surety pays a claim due to your actions, you will pay them back in full, including any associated costs.

The hold harmless clause is a key part of this agreement. You promise to shield the surety from any financial harm related to your bond, covering not just the claim amount but also legal fees and investigation costs.

This structure keeps the bonding market accessible. Because principals accept ultimate responsibility, sureties can offer competitive premiums and fast approvals, especially for indemnity bond online applications.

Common Types and When They Are Required

In Texas, indemnity bonds online are a common requirement for businesses. From Houston construction sites to statewide licensing offices, these financial guarantees are essential for legal and competitive operation.

Understanding when these bonds are required helps you plan ahead. Whether you’re a contractor bidding on a project or opening an auto dealership in Houston, knowing your bonding needs early lets you secure your indemnity bond online quickly and avoid costly delays.

Texas bonding requirements vary by county, but most fall into three main categories. Whether for professional licensing, contractual obligations, or court proceedings, getting bonded online is easier and more affordable than ever.

License & Permit Bonds

If you’re starting a business in a regulated profession, you’ll likely need a license or permit bond. These bonds guarantee to a government agency, like the Texas Department of Licensing and Regulation (TDLR), that you’ll operate ethically and follow all laws.

Auto dealers across Texas need an auto dealer bond to protect consumers from fraud. While we service all states with auto dealer bonds, Texas dealers benefit from our local expertise and same-day service.

Contractors often need a license bond guaranteeing they will adhere to building codes, pay subcontractors, and honor warranties. Our contractor license bonds help Texas contractors stay compliant.

Mortgage brokers also require bonds to protect clients from dishonest or negligent practices during the loan process.

Most license and permit bonds can be issued instantly online, letting you focus on your business.

Construction & Contract Bonds

The construction industry relies on trust, and indemnity bonds online provide the financial backing project owners need to award contracts confidently.

Performance bonds guarantee you’ll complete a project according to the contract’s terms and timeline. If you fail to finish the work, the surety ensures the project is completed. Learn more about how performance bonds boost your credibility.

Bid bonds are used during the bidding phase to show project owners you are serious about your bid and will enter the contract if selected. Our bid bonds help level the playing field.

Supply bonds protect against delivery failures by guaranteeing suppliers will provide materials as promised. For more details, see our guide on understanding supply surety bonds.

Court & Fiduciary Bonds

Courts require these bonds to ensure duties involving others’ assets are handled properly.

Probate bonds protect an estate when an executor or administrator is appointed to manage a deceased person’s affairs.

Guardian bonds are required when you’re appointed to manage the financial affairs of a minor or an incapacitated adult, protecting their assets from mismanagement.

Appeal bonds guarantee that if your appeal of a court decision fails, you will pay the original judgment plus any additional costs.

These situations can be stressful. Our team specializes in understanding court bonds and can guide you through the process with expertise.

The Cost of Securing an Indemnity Bond

What does an indemnity bond online cost? The good news is that bond premiums are more affordable than many business owners expect. With an indemnity bond, you’re essentially renting the surety’s financial strength to back your promises.

Your premium is a percentage of the total bond amount, typically an annual fee. Most qualified applicants pay 1-4% of the bond amount, with rates from 0.5% to 15% depending on risk factors. The premium is non-refundable once the bond is issued and filed.

For example, a $25,000 contractor license bond for an applicant with good credit might cost between $250-$1,000 annually. Smaller bonds are even more manageable. A $20,000 Public Insurance Adjuster Bond in California costs just $100 for one year, while a $10,000 City of Indianapolis Contractor Bond is $175 for two years, both with no credit check.

We offer low-cost surety bonds with the best rates guaranteed. Our high-volume relationships with surety markets allow us to find the most competitive pricing for your bond, whether you’re in Houston, elsewhere in Texas, or nationwide.

Key Factors That Influence Your Premium

Several factors influence your premium cost. Your credit score is often the most significant, especially for bonds under $50,000. A strong credit score signals lower risk and results in a lower premium.

For larger bonds, sureties review your financial strength, including business and personal financial statements. A solid balance sheet can reduce your premium and increase your bonding capacity.

Your business history and experience also play a role. An experienced contractor is seen as less risky than a startup. The specific bond type and amount also directly influence the price.

State regulations can affect pricing, which is why our Texas-based expertise is an advantage for navigating local requirements from Houston to smaller towns.

Can You Get a Bond with Bad Credit?

Yes! Past credit challenges don’t have to stop you from getting bonded. While lower credit scores usually mean higher premiums, often in the 5-10% range or more, obtaining a bond is still possible.

We specialize in bad credit bond programs through our network of surety partners who look beyond just a credit score. Life events like a divorce or medical bills happen, and we understand that.

We review your complete financial picture and explore options like collateral or co-signers. Being upfront about your situation allows us to find the right surety partner and an affordable solution.

Getting your indemnity bond online shouldn’t be derailed by credit issues. Our licensed agents understand the Texas market and national requirements and will work to get you bonded.

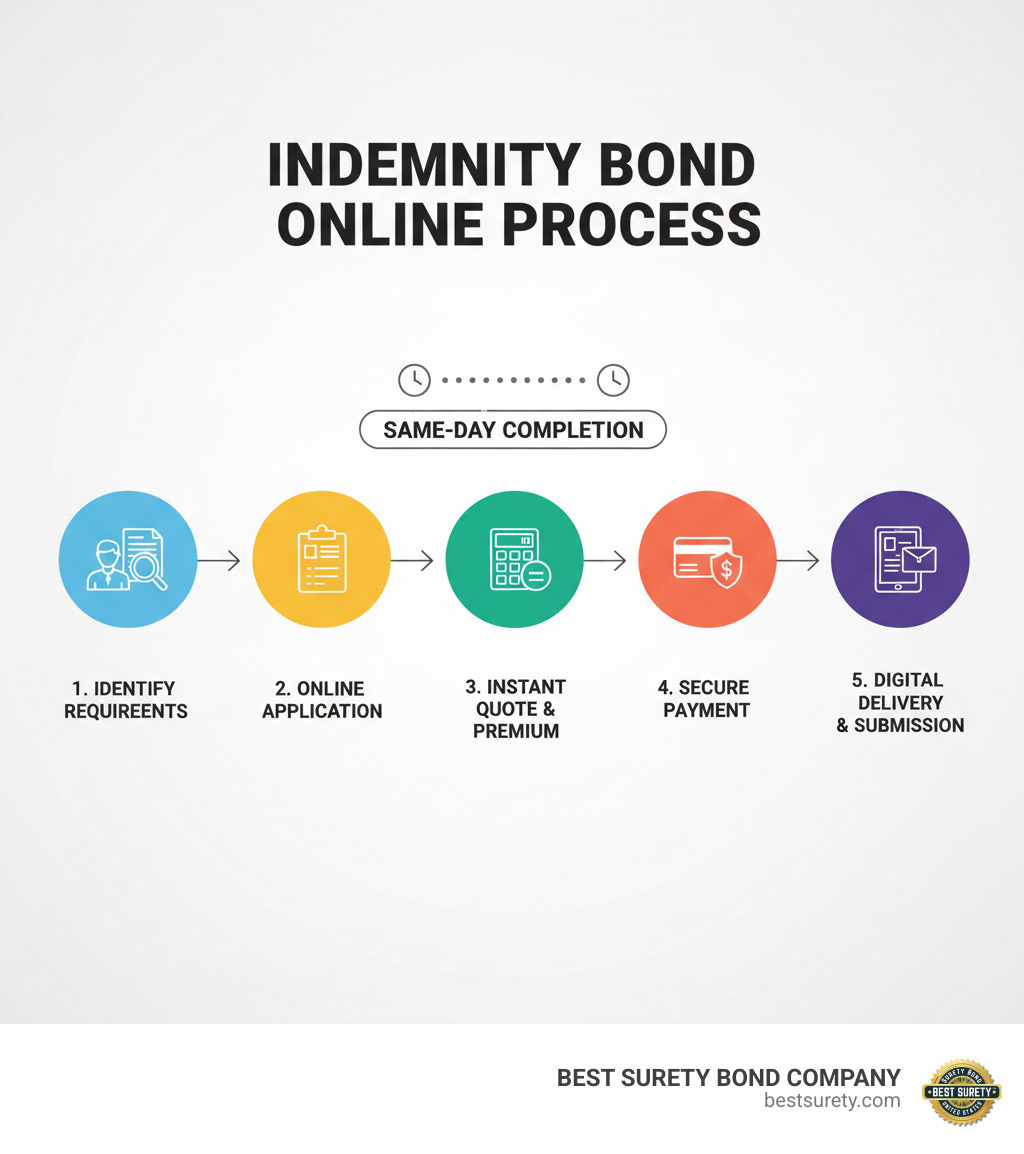

How to Get an Indemnity Bond Online: A Step-by-Step Guide

Getting your indemnity bond online is fast and easy. Forget long waits and paperwork. Our digital process provides fast approvals and instant quotes, all from your computer or phone. Whether you’re a Houston contractor on a deadline or a Texas business needing same-day compliance, our platform is built for speed.

The entire process takes just minutes for most license and permit bonds, with even complex contract bonds often processed the same day. We know time is money, so we’ve eliminated the hassles that slow down bond applications.

Step 1: Identify Your Bond Requirement

Before applying, gather key information from the obligee (the entity requiring the bond). You need to know the specific bond type required, such as a contractor license bond or a performance bond.

The bond amount is also crucial; this is the maximum financial guarantee. The obligee will specify the exact coverage needed. You’ll also need the obligee’s complete name and address for the bond form.

Some obligees have special requirements. For Texas contractors on public projects, specific state regulations might affect bond terms. Our team knows these Texas-specific requirements and can help you steer any local complexities.

Step 2: How to Apply for an Indemnity Bond Online

With your requirements ready, applying for your indemnity bond online is simple. Our online application form guides you through the process.

You’ll provide personal details (name, address, SSN for credit verification) and business information (company name, address, tax ID, industry). Our system uses bank-level security to protect your data.

For larger or underwritten bonds, we may request additional financial details, like business or personal financial statements. However, many smaller license and permit bonds don’t require extensive documentation, making the process even faster.

Finally, you’ll enter the obligee details you gathered. Our system verifies this information to ensure your bond is formatted correctly. Most applicants finish in under five minutes.

Step 3: How Long Does It Take to Get an Indemnity Bond Online?

The speed of digital bonding is a major advantage. For many common license and permit bonds, we offer instant issue bonds that are approved and delivered within minutes. These instant-issue bonds are perfect for tight deadlines.

Underwritten bonds, like larger contract bonds, take slightly longer but still receive same-day service in most cases. Our underwriters review these applications within hours, not days.

Once approved, you’ll receive your bond via digital delivery, often as a verified e-bond ready for immediate submission. You can download, print, or forward your bond documents instantly, giving you full control.

This speed is especially valuable for Houston-area contractors and Texas businesses facing last-minute bonding needs. Our system is built to ensure getting bonded doesn’t slow you down.

Frequently Asked Questions about Indemnity Bonds

Indemnity bonds can seem complex, but you’re not alone with your questions. We’ve helped thousands of clients in Texas and nationwide, and the same concerns arise frequently. Here are answers to the most common questions to help you move forward with confidence.

What’s the difference between an indemnity bond and an insurance policy?

This is a crucial distinction to understand before getting your indemnity bond online. While both offer financial protection, they work differently.

An indemnity bond is a three-party promise protecting another party (the obligee) from your failure to perform. The surety backs your promise, but if we pay a claim, you are legally required to reimburse us in full.

Insurance is a two-party contract that protects you. You transfer risk to the insurer, and if a covered loss occurs, they pay the claim. You typically don’t owe them anything back beyond your deductible.

In short: an indemnity bond protects others from you, while insurance protects you.

What happens if a claim is filed against my bond?

Knowing the process can reduce anxiety. If someone files a claim against your bond, here’s what happens.

First, we conduct a thorough investigation. Our claims team reviews all contracts and communications to understand the facts. This protects everyone by ensuring only valid claims proceed.

If the claim is legitimate, we pay the obligee promptly. This is a key benefit of being bonded—it ensures the injured party is compensated quickly.

However, your indemnity agreement requires you to reimburse us for the full amount paid, plus any investigation or legal fees. This is a legal obligation you accepted when you got bonded.

Most claims can be avoided with clear communication and by fulfilling your commitments. Cooperating with the investigation often leads to the best outcome.

Can I get an indemnity bond for my business in Houston, Texas?

Yes, and you’re in the right place. As a Texas-based surety provider with deep Houston roots, we have extensive experience helping local businesses steer bond requirements.

Our Houston expertise extends throughout Texas. We know the specific bond requirements for different counties and have relationships with agencies across the state. From small permit bonds to large construction projects, we have Texas businesses covered.

Our reach isn’t limited to Texas. We’re licensed in all 50 states, so we can help if your business expands or you need bonds for projects nationwide. Texas contractors may find our information on Texas contractor bonds especially useful.

Working with a local provider gives you personalized service from people who understand your market, combined with the efficiency of our online platform. We’re invested in helping Texas businesses succeed.

Get Bonded Today with Confidence

Securing your indemnity bond online is a straightforward step toward business success when you partner with the right company. Bonds do more than meet requirements; they ensure compliance, boost your credibility, and show your commitment to professional standards.

When a client sees you’re bonded, they know you’re serious about your business and have taken steps to guarantee your work and protect their interests. This is a powerful advantage in a competitive market.

As a trusted Texas-based provider with national reach, BEST SURETY BOND COMPANY makes bonding simple and affordable. We’ve helped thousands of businesses in Houston and across Texas get bonded without the headaches of slow approvals or paperwork. Our fast, affordable online bonding solutions blend local expertise with the convenience of digital efficiency.

We understand that every bond requirement is urgent. Whether you’re a Houston contractor who just won a project or a small business owner needing to renew a license, we know time matters. That’s why our systems deliver instant quotes and same-day service.

Our licensed agents understand Texas regulations, and our national licensing means we can help wherever your business operates. From Houston’s energy sector to construction projects across the state, we’ve bonded it all.

Ready to secure your peace of mind? Don’t let bond requirements slow your momentum. Get Bonded Today and get your instant quote in minutes. Our streamlined process means you can get from application to approved bond faster than you ever thought possible.