Why Finding a License Bond Near Me Matters for Your Business

Getting a license bond near me is essential for businesses and contractors who need to comply with local regulations quickly and affordably. Here’s what you need to know:

Quick Answer for License Bond Near Me:

- What it is: A financial guarantee required by government agencies to protect consumers

- Cost: Typically 1-10% of the bond amount (often starting at $90/year)

- Speed: Many bonds issued same-day or within 24 hours

- Where to get: Licensed surety providers (local or online) in all 50 states

- Requirements: Basic business info, credit check, and application

Whether you’re a contractor in Texas, an auto dealer in Florida, or a notary in California, you likely need a license bond to operate legally. These bonds aren’t insurance – they’re three-party agreements that guarantee you’ll follow the rules and protect your customers if you don’t.

The good news? Getting bonded has never been easier. As research shows, “Cannot believe how easy the process was. This company is the gold standard in customer service and efficiency” – a sentiment echoed by thousands of business owners who’ve steerd this process successfully.

Why act fast? Operating without a required bond can result in fines, license suspension, or being shut down entirely. The cost of delay far exceeds the small premium you’ll pay for protection.

I’m Haiko de Poel, and I’ve helped scale multiple insurance and legal service companies, giving me deep insight into the surety bond industry and what makes finding a license bond near me both challenging and critical for business success. Let me walk you through everything you need to know to get bonded quickly and affordably.

What is a License Bond and Why is it Required?

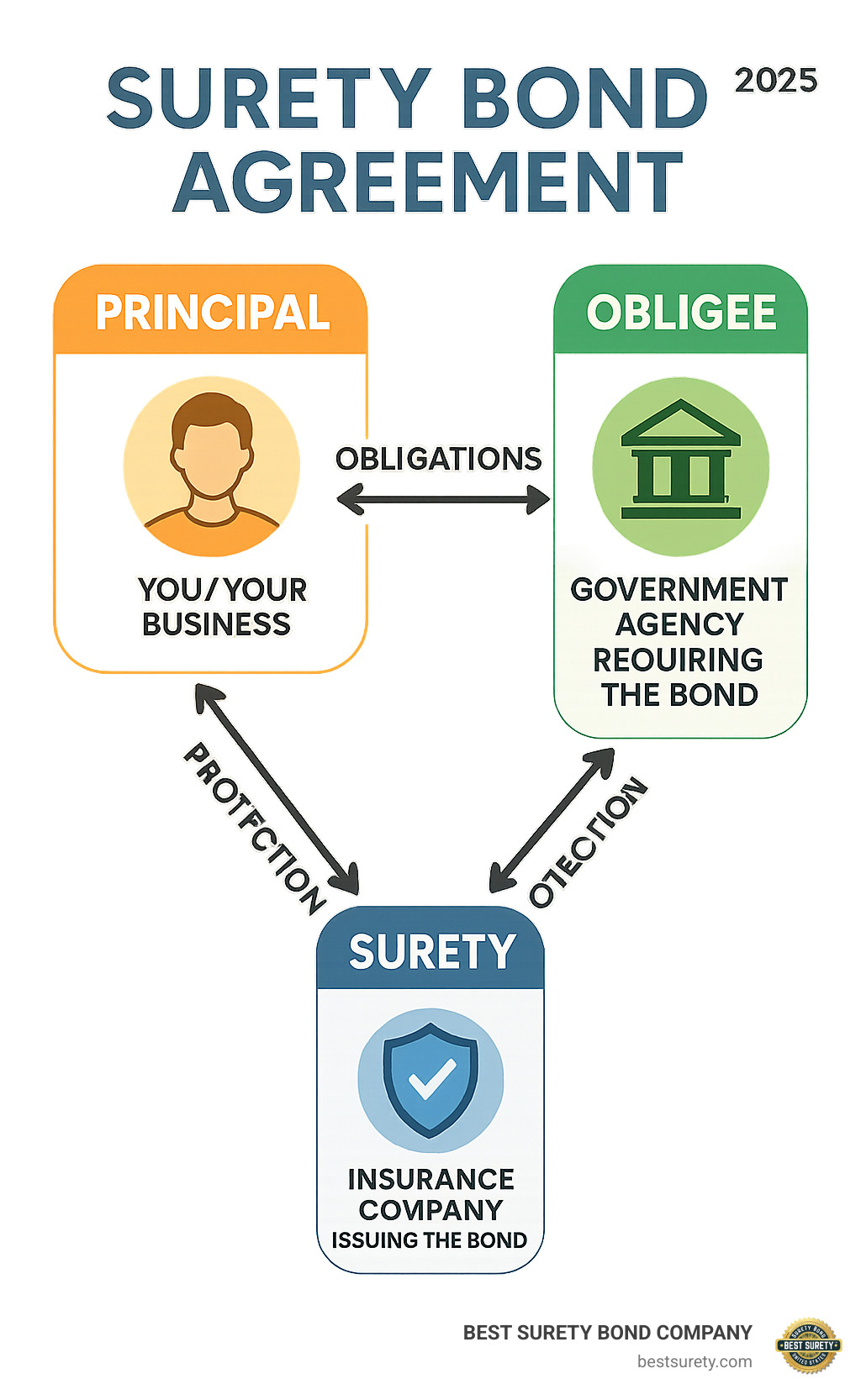

Think of a license bond as your business’s written promise to follow the rules—backed by real money. It is a three-party agreement between:

- Principal: you or your company

- Obligee: the city, county, or state agency issuing your license

- Surety: the insurance carrier that guarantees your promise

If you break the regulations tied to your license, the surety pays valid claims up to the bond amount, then collects that money back from you. Because you reimburse the surety, a bond is not the same as insurance.

Want a quick primer? See the Surety bond entry on Wikipedia.

The Purpose of a License and Permit Bond

Government agencies use bonds to:

- Protect the public from fraud or negligence

- Guarantee you finish the job—or refund what’s owed

- Screen out unqualified applicants during licensing

- Build customer confidence (anyone can verify you’re bonded)

Penalties for Operating Without a Required Bond

Skipping a mandatory bond can end your business fast:

- Four-figure fines or criminal charges

- Suspension or revocation of your professional license

- Inability to pull permits or bid on projects

- Personal liability for damages that a bond would have covered

- Lasting reputational damage with clients and regulators

If your ordinance or industry handbook calls for a bond, secure one before you open your doors.

Which Businesses and Professions Typically Need a License Bond?

More than 25,000 bond forms exist nationwide, but they fall into a few familiar buckets. If your work touches public safety, consumer money, or regulated paperwork, assume you need to be bonded.

Commonly bonded professions

- Building & specialty contractors

- Motor-vehicle (auto) dealers

- Notary publics

- Mortgage & loan brokers

- Freight brokers & transport firms

- Insurance or real-estate brokers

- Janitorial, utility, or security service providers

Below are the two bond classes we quote most often for Texas clients.

Contractor License Bonds

Cities and states rarely issue a building permit unless the contractor files a bond—often $10,000 to $50,000 depending on the trade. Premiums run 1–3 % for good credit. Learn more on our services page.

Motor Vehicle Dealer Bonds

Forty-eight states, including Texas, obligate car dealers to carry a bond (commonly $25,000–$100,000) that protects buyers from title problems or misrepresentation. Good credit can drop the premium to 1 %.

Other Popular License & Permit Bonds

Notaries, mortgage originators, freight brokers ($75,000 federal requirement), and many niche trades all rely on bonds. Whatever the form, we can usually approve it the same business day.

How is the Cost of a License Bond Determined?

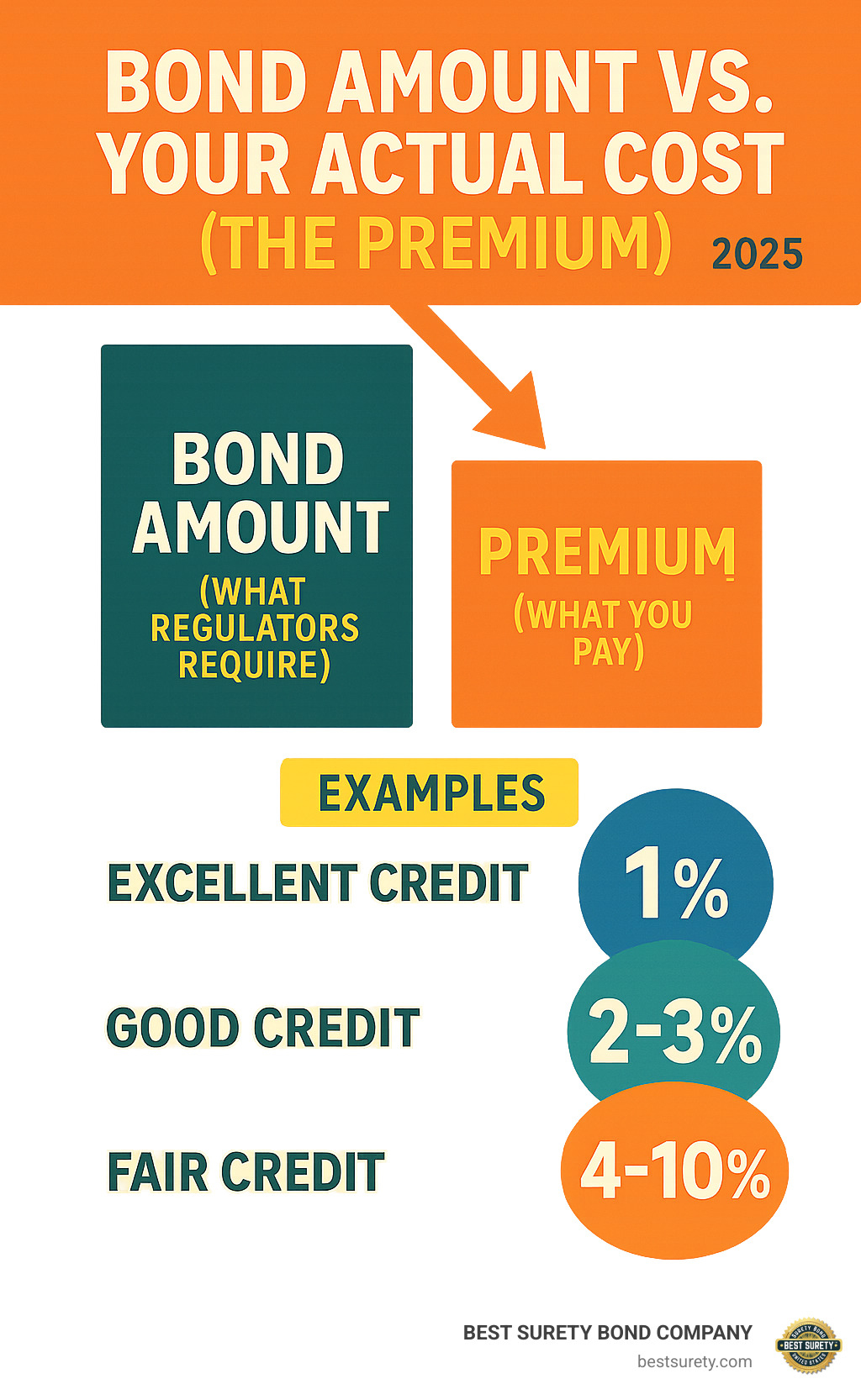

Understanding bond costs is crucial for budgeting and making informed decisions about your surety provider. The cost of a license bond – called the premium – is calculated as a small percentage of the total bond coverage amount, typically ranging from 0.5% to 10% of the bond amount.

The bond amount is not the same as the bond cost. The bond amount represents the total security available for potential claims, while the premium is the much smaller fee you pay to the surety company. For example, a $50,000 bond might cost only $500 per year (1% of the bond amount).

Research shows that for applicants with strong credit, most bond rates fall between 0.5% and 4% of the bond amount. This means rates can be as low as 1% of the total bond amount, or even as low as $90 per year for smaller bonds.

Key Factors That Influence Your Bond Premium

Several factors determine your final premium rate, with risk being the primary consideration:

Credit Score Impact: Your credit score offers a clear overview of your financial history and is often the most significant factor in pricing. Some bonds are priced directly based on credit score brackets, with excellent credit potentially qualifying you for rates as low as 1% of the bond amount.

Personal and Business Financials: Underwriters review your assets, debt-to-income ratio, and overall financial stability. Strong financials can significantly reduce your premium rates.

Bond Type and Risk Level: Different bond types carry different risk profiles. Lower-risk bonds typically have lower premiums, while higher-risk bonds may require more thorough underwriting and higher rates.

Industry Experience: Demonstrating relevant experience in your field can reduce perceived risk and potentially lower your premium. A resume showing industry expertise can be valuable during underwriting.

Bond Term Length: Some providers offer discounts for multi-year terms, helping reduce your annual cost.

Claims History: Previous claims against your bonds can increase future premiums, as they indicate higher risk to the surety company.

The good news is that many providers approve 99% of applicants, even those with less-than-perfect credit. While bad credit may result in higher rates, specialized programs exist to help get you bonded at competitive prices.

Bond Amount vs. Your Actual Cost (The Premium)

This distinction often confuses new applicants, but it’s crucial to understand:

Bond Amount: This is the maximum amount the surety will pay out if a valid claim is made against your bond. It’s set by the regulatory agency requiring the bond and represents the total coverage available.

Premium: This is what you actually pay – a small percentage of the bond amount. The premium is earned by the surety company whether or not any claims are made against your bond.

For example:

- A $10,000 contractor bond might cost between $100-$300 annually

- A $50,000 auto dealer bond might cost $500-$2,500 annually

- A $100,000 freight broker bond might cost $1,000-$5,000 annually

The premium is nonrefundable once the bond is issued, as it represents the cost of the financial guarantee provided by the surety company. This is similar to how you can’t get a refund on car insurance premiums even if you never file a claim.

The Step-by-Step Process for Obtaining a License Bond

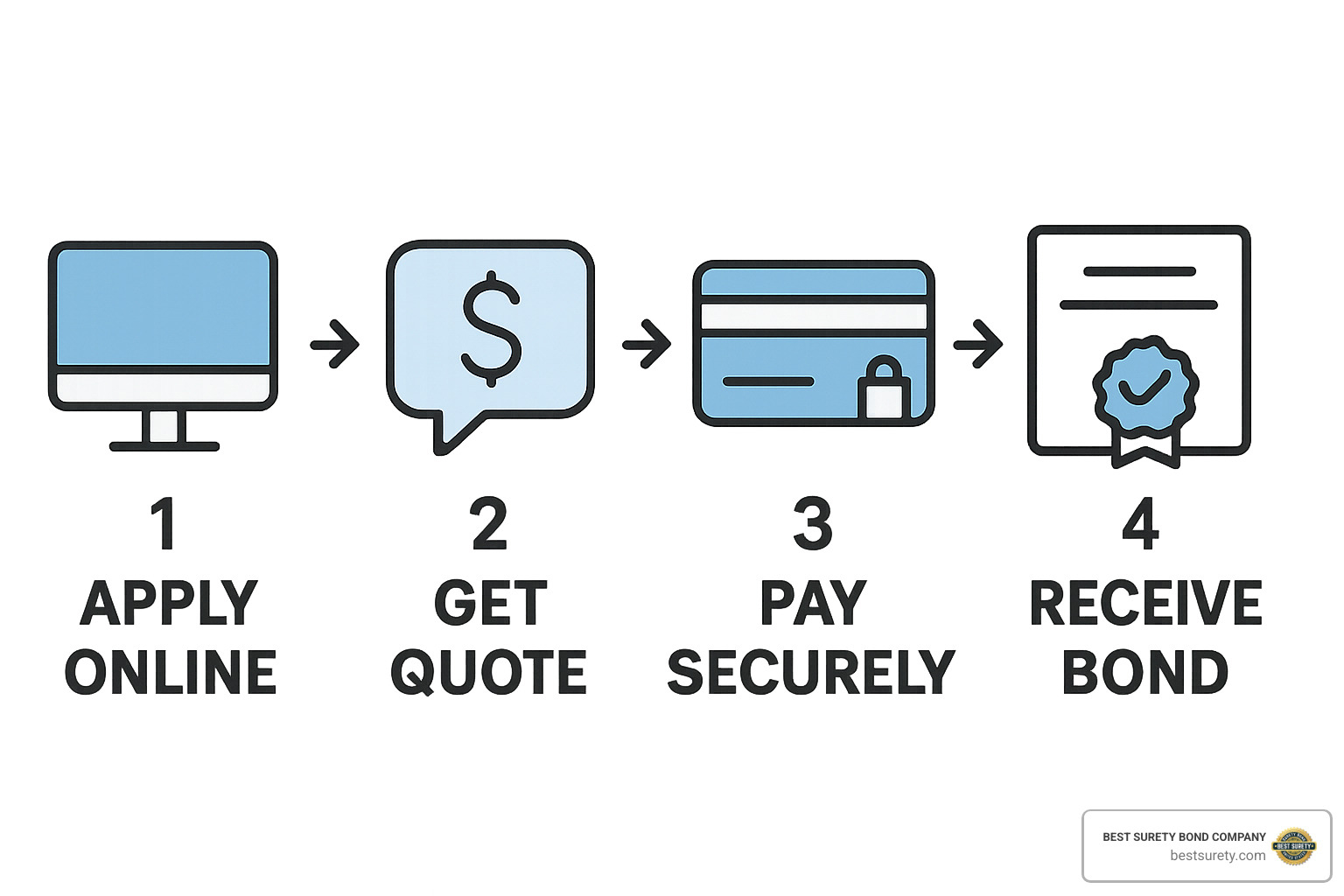

Our online platform turns a task that once took weeks into a same-day affair.

- Apply (≈5 min). Enter basic business and owner details plus the bond amount listed on your licensing paperwork.

- Get a Quote (instantly or within an hour). Automated underwriting checks your credit and returns a firm premium—no obligation, no cost.

- Pay Securely. Check out online with a card or ACH. Premium financing is available for larger bonds.

- Receive Your Bond. We email a PDF immediately and, when the obligee needs an original, overnight the sealed document.

Most Texas license bonds land in your inbox within 10–15 minutes; even complex, high-amount bonds rarely take more than 24 hours.

How to Find a License Bond Near Me: Local vs. Online Providers

When you search “license bond near me” you’ll see two paths: visit a local agent or use an online platform. Both can work—pick the option that matches your priorities.

Choosing a Local Agent

- Face-to-face guidance on city or county quirks

- Relationships with local inspectors and clerks

- Personal service for first-time or unusual applications

The trade-off: local agents often work with fewer surety markets, which can mean higher premiums or slower turnaround.

Benefits of an Online Provider

- Quotes and issuance 24/7—no office visit needed

- Ability to shop dozens of surety carriers for the lowest rate

- Digital delivery for urgent permit or license deadlines

- National reach paired with state-specific expertise

At BEST SURETY BOND COMPANY you get the best of both worlds: Texas-based agents backed by a nationwide network of sureties. Whether you prefer a phone call, a storefront visit, or an online checkout, we’ll get you bonded—fast and affordably.

Frequently Asked Questions about License Bonds

How quickly can I get a license bond?

The speed of getting a license bond near me has improved dramatically in recent years. Many license and permit bonds can be quoted, purchased, and issued the same day, with some providers offering even faster service for urgent situations.

For instant issue bonds, the entire process can take just a few minutes online. You’ll receive a digital copy of your bond immediately after payment, allowing you to meet regulatory requirements without delay.

The timeline depends on several key factors. Instant issue bonds require no underwriting and can be processed in minutes through automated systems. Standard bonds typically take 1-24 hours depending on the complexity of your application and credit review. Complex bonds requiring extensive documentation may take 2-3 business days, though this is less common for most license bonds.

Research shows that bonds can be delivered as fast as 24 hours if underwriting goes smoothly and all required documents are present. Many providers now offer same-day results on almost all license bonds, making it possible to get bonded quickly even when you’re facing tight deadlines or unexpected regulatory requirements.

Can I get a license bond with bad credit?

Yes, you can absolutely get a license bond even with a poor credit history. While your premium may be higher to reflect the increased risk, many specialized surety providers have programs specifically designed to help applicants with less-than-perfect credit get the bond they need to operate their business.

The surety bond industry has evolved to serve all types of applicants. Specialized programs exist for higher-risk applicants, often with rates that are still reasonable for most businesses. Collateral-backed bonds can reduce risk for the surety company, potentially lowering your premium even with poor credit.

If your credit is particularly challenging, consider bringing in a co-signer with stronger credit to help improve your rates. Many business owners also find that their bond rates improve over time as their credit score gradually improves and they establish a positive claims history.

The encouraging news is that many providers approve 99% of applicants regardless of credit score. While rates may be higher for those with poor credit, the key is working with a provider who specializes in helping all types of applicants get bonded rather than turning them away.

Is a license bond the same as business insurance?

No, a license bond and business insurance are completely different financial instruments that serve different purposes, though many business owners initially confuse them.

A license bond is a three-party agreement that protects your customers and the public from financial harm if you fail to follow laws and regulations. If someone makes a claim against your bond, you’re ultimately responsible for reimbursing the surety company for any money they pay out. The bond is required by government agencies for regulatory compliance, and the premium is typically 1-10% of the bond amount.

General liability insurance is a two-party agreement that protects your business from claims of property damage or bodily injury. When the insurance company pays a covered claim, you don’t have to reimburse them – that’s what you pay premiums for. You purchase insurance voluntarily to protect your business assets, and premiums are based on coverage limits and risk factors.

Think of a license bond as a guarantee that you’ll follow the rules and treat customers fairly. Insurance, on the other hand, protects you from accidents and unforeseen events that could happen despite your best efforts.

Most businesses need both types of protection to operate safely and legally. The bond satisfies regulatory requirements and builds customer trust, while insurance protects your business from liability claims that could otherwise be financially devastating.

Get Your Texas License Bond with Confidence

Hey there, Texas business owner! Whether you’re a contractor laying foundations in Houston or an auto dealer selling dreams in Dallas, we know you’ve got a lot on your plate. And if you’re looking for a license bond near me, you probably want it fast, easy, and affordable, right?

That’s exactly what we’re all about here at BEST SURETY BOND COMPANY. We’ve got deep Texas roots, so we understand our local rules, but we also have national reach to get you the best options. This means we can handle your bonding needs quickly and affordably, no matter where you are in the Lone Star State.

We pride ourselves on making getting bonded surprisingly simple. Think of us as your go-to for speedy approvals (often same-day!), rates that won’t break the bank (we shop around for you among multiple surety markets!), and expert guidance from folks who really know their stuff about Texas regulations and requirements.

Our streamlined process takes the headache out of getting bonded. Seriously, no jumping through hoops here! We work with businesses of all sizes and credit profiles, ensuring you get the bond you need to operate legally and keep your business thriving. Choosing the right provider means choosing peace of mind, and that’s what we deliver.

So, don’t let a bonding requirement put the brakes on your business. With our quick process and friendly experts by your side, you can get back to doing what you do best – running your awesome business!

Ready to get bonded? Get Your Free Bond Quote Today! and find out why thousands of Texas businesses trust us for their surety bond needs.