Why Your Lost Financial Document Needs a Surety Bond

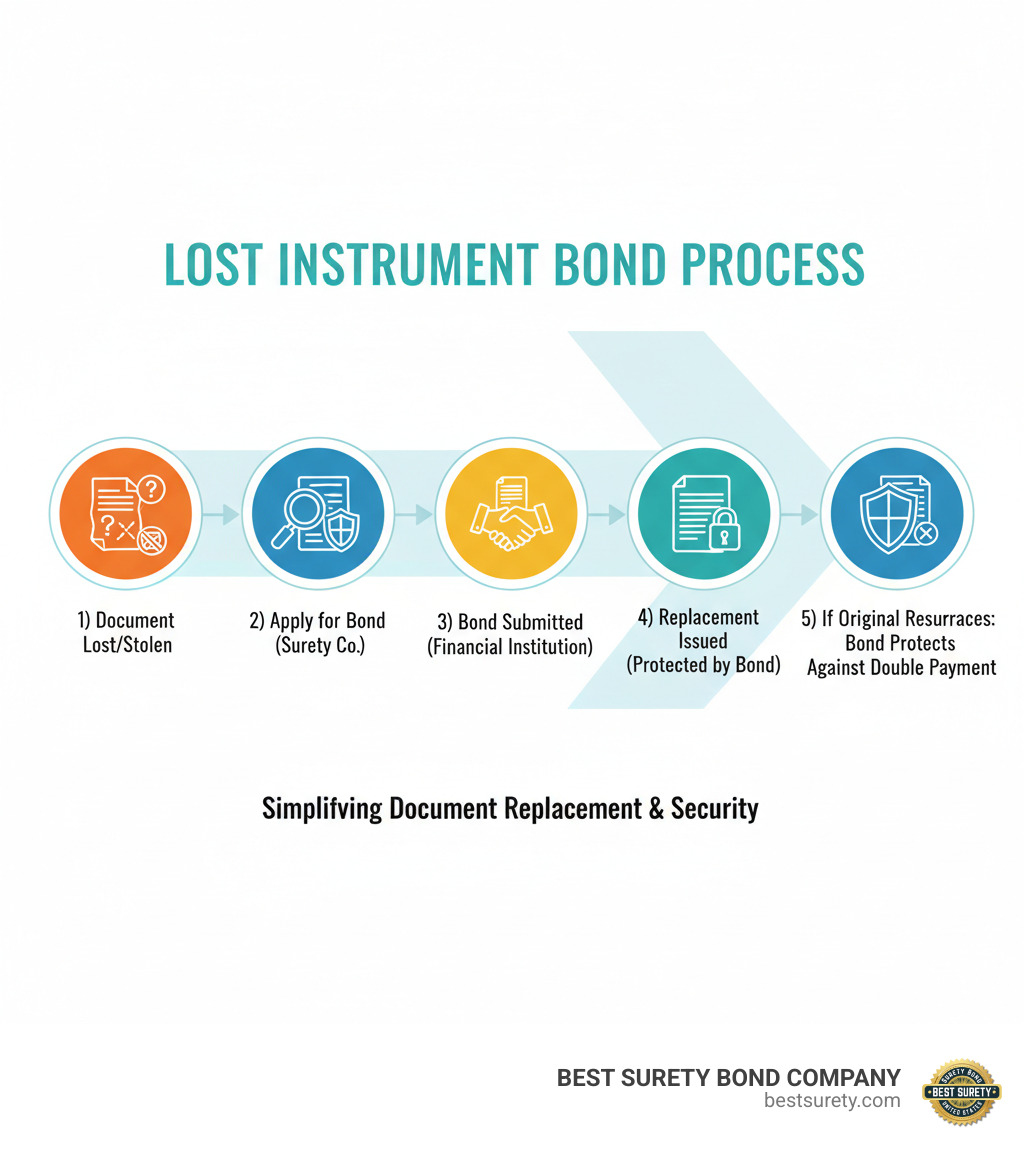

A Lost instrument bond is a type of surety bond required by financial institutions when you need to replace a lost, stolen, or destroyed financial document—like a stock certificate or cashier’s check. It protects the issuer from financial loss if both the original and the duplicate documents are cashed, a risk known as double redemption. Without this bond, most banks and transfer agents will not issue a replacement.

Quick Facts:

- Purpose: Protects the issuer from loss if both the original and duplicate documents are redeemed.

- Cost: Typically 1-5% of the bond amount, with a $100 minimum for bonds under $5,000.

- Bond Amount: Usually 1.5 times the value of the lost instrument.

- Term: Generally one year and non-cancellable.

- Common Uses: Stock certificates, cashier’s checks, promissory notes, property deeds.

The process is straightforward. You apply for the bond, pay a small premium based on the document’s value and your credit, and submit it to the institution requesting the replacement. In Texas and across the country, this is standard procedure for replacing valuable financial instruments.

I’m Haiko de Poel. With my experience in fintech, insurance, and legal services, I’ve helped countless individuals and businesses steer complex bonding requirements. My focus is on making these processes simple and accessible for everyone.

What is a Lost Instrument Bond and Why Is It Needed?

When a valuable financial document like a stock certificate or cashier’s check is lost, your first step is to request a replacement. However, the issuing institution won’t provide a new one without protection against a scenario called double redemption—where both the original and the replacement document are cashed. The institution would be liable for paying twice, a risk they are unwilling to take.

A lost instrument bond provides that protection. It’s a specialized surety bond where a surety company guarantees the financial institution that if a loss occurs from double redemption, the surety will cover it. For you, it means you can get your replacement document. For the issuer, it’s essential protection that shields them from serious liability.

Without this bond, most banks, transfer agents, and corporations will refuse to issue a duplicate. The bond creates a three-way agreement of trust that makes the replacement process possible, giving peace of mind to you and the issuer.

Common Scenarios Requiring a Bond

Many situations require a lost instrument bond due to the high stakes involved with financial documents.

- Lost stock certificates: Before a transfer agent issues new certificates for lost or inherited shares, they will require a bond to protect the company.

- Misplaced cashier’s checks: As these are guaranteed payments, a bank needs assurance it won’t pay out the same check twice.

- Stolen promissory notes: The person who owes you money needs protection from having to pay both the original and a replacement note.

- Lost property deeds: In certain situations, a bond may be required to establish a clear title and prevent fraudulent claims.

- Missing life insurance policies: Insurance companies often require a bond before issuing a duplicate policy document, especially if it has cash value.

- Lost savings bonds: The issuing institution will typically need a bond before providing replacements for misplaced physical certificates.

Any valuable document that could cause financial harm to the issuer if duplicated will likely need a lost instrument bond. This protection falls under the broader category of commercial surety bonds that help manage financial risks.

What Financial Instruments Are Covered?

A wide range of documents can be covered by a lost instrument bond. If it represents money, ownership, or a financial claim, it likely qualifies.

- Stock and bond certificates: Includes common stock, corporate bonds, and municipal bonds. Learn more about replacing lost share certificates.

- Cashier’s checks and money orders: These are guaranteed funds, making their loss a significant concern for banks.

- Promissory notes and deeds of trust: These legal instruments create binding obligations, and a bond helps prove the claim if the document is lost.

- Certificates of deposit (CDs): Physical certificates for time-deposit accounts may require a bond for replacement.

- Warehouse receipts: These documents prove ownership of stored goods and are vital in commerce.

- Life insurance policies: The physical contract may require a bond for replacement, especially policies with cash value.

- Vehicle titles: Often handled through a specialized “bonded title” process, which is a type of lost instrument bond.

The principle is simple: if duplicating a lost document creates financial risk for the issuer, you’ll need a lost instrument bond. Whether you’re in Houston or anywhere in Texas, these bonds make replacement possible.

How a Lost Instrument Bond Works: The Three-Party Agreement

A lost instrument bond is a straightforward agreement between three parties, creating a safety net when a financial document goes missing. Understanding these roles clarifies the process and why it’s the standard solution for replacing lost instruments.

The Key Players: Principal, Obligee, and Surety

Every lost instrument bond involves three parties:

-

The Principal: This is you—the person or business who lost the document and is purchasing the bond. As the principal, you sign an indemnity agreement, promising to reimburse the surety for any claims paid.

-

The Obligee: This is the financial institution (bank, transfer agent, corporation) that issued the lost document. They require the bond as protection before issuing a duplicate and are the beneficiary of the bond’s guarantee.

-

The Surety: This is the surety company, like Best Surety, that issues the bond. The surety provides a financial guarantee to the obligee, promising to cover any loss from a duplicate instrument. In exchange, the principal pays a premium.

This three-party agreement creates the trust needed to make the replacement process work.

The Guarantee: Protecting the Issuer

The lost instrument bond provides a concrete financial guarantee to the institution that issued your lost document. If the original instrument resurfaces and is redeemed—creating a double redemption—the obligee can file a claim against your bond.

The surety company then pays the obligee for their financial loss, up to the full bond amount. This indemnification protects the issuer from economic harm. However, this is not like traditional insurance. Based on the indemnity agreement you signed, the surety will then seek reimbursement from you, the principal. You are ultimately responsible for making the surety whole.

This is why a lost instrument bond guarantees protection for all parties. The obligee gets peace of mind, and you get your replacement document.

What Happens if the Original Document Reappears?

If you find the original document after receiving a replacement, you must return it immediately to the surety company for proper disposal. This is a requirement of the bond agreement and prevents any future attempts to redeem it.

If the original is found and someone cashes it, whether by mistake or fraud, the obligee can file a claim against your bond. The surety would pay the obligee to cover the loss, and you would then be required to reimburse the surety under the indemnity agreement.

Honesty is critical throughout this process. Be truthful about the circumstances of the loss when you apply, and surrender the original if it is found. The financial consequences of not doing so can be significant. Our team can help you get bonded quickly and affordably, walking you through every step.

The Cost of Protection: Premiums and Bond Types

The cost of a lost instrument bond is typically affordable. The bond amount is usually set at 1.5 times the value of your lost instrument to account for potential interest, dividends, or market fluctuations. For a lost stock certificate worth $10,000, the institution would likely require a $15,000 bond.

Your premium—what you actually pay—is a small percentage of that bond amount, typically 1% to 5%. For instruments valued under $5,000, there is often a minimum premium of $100. A common rate is about $20 for every $1,000 of the lost instrument’s value.

Your credit score is a significant factor. Clients with strong credit usually secure lower rates, sometimes 1-2%. If your credit is less than perfect, we can still help. We work with a wide network of underwriters to find competitive rates for applicants with challenging credit histories, ensuring you can still get your bond approved quickly and affordably.

Understanding the Cost of a Lost Instrument Bond

Several factors determine your lost instrument bond premium.

- Bond Value: The starting point is the bond amount (1.5x the instrument’s value). A higher value means a higher premium.

- Creditworthiness: A strong credit history demonstrates financial reliability and results in a lower premium. We review your personal credit score as part of our underwriting.

- Risk Assessment: Underwriters evaluate the circumstances of the loss and the type of instrument. A cashier’s check may carry different risk considerations than a stock certificate with a stop transfer order.

For smaller bond amounts, approval can happen in hours. For larger bonds (over $20,000), we may need additional financial documentation. For example, a $10,000 bond might cost just $100 at a 1% rate. A bond for a $50,000 lost promissory note might cost around $1,000 (a 2% rate).

As a Texas-based company serving Houston, San Antonio, Austin, and Dallas, we offer some of the most competitive rates for low-cost surety bonds nationwide.

Fixed Penalty vs. Open Penalty: What’s the Difference?

Not all lost instrument bonds are the same. The type you need depends on whether your lost document has a fixed or fluctuating value.

Fixed penalty bonds are for instruments with a set value, like a certified check or a CD. The bond amount is calculated once and remains constant, making the surety’s liability predictable and the bond more affordable.

Open penalty bonds are for instruments with a fluctuating value, like common stocks or mutual funds. An open penalty bond accounts for this variability, meaning the surety’s potential liability can increase if the market value rises. This higher risk for the surety means these bonds require more careful underwriting and may have slightly higher premiums.

| Feature | Fixed Penalty Bond | Open Penalty Bond |

|---|---|---|

| Best For | Instruments with a set value | Instruments with a fluctuating value |

| Examples | Certified Checks, Debentures, CDs, Cashier’s Checks | Common Stocks, Mutual Funds, Corporate Bonds |

| Bond Value | Stays the same throughout the bond term | Can change with market value, making the surety’s liability variable |

| Risk Level | Lower for the surety due to predictable liability | Higher for the surety due to unpredictable, potentially increasing liability |

We’ll help you determine the right bond type for your situation to ensure a smooth process.

How to Get Your Lost Instrument Bond Fast in Texas

When you’ve lost a valuable financial document, time is critical. We’ve designed our application process to be fast and straightforward, with same-day issuance available for most lost instrument bonds. Whether you’re in Houston, Dallas, or anywhere else in Texas, you’ll benefit from our local expertise and efficient service, which extends nationwide.

Step 1: Gather Required Documentation

To process your lost instrument bond quickly, gather a few key documents before you apply.

- Affidavit of Loss: A sworn, notarized statement explaining the circumstances of the loss (e.g., misplaced, stolen, destroyed).

- Details of the Lost Instrument: The more specific, the better. Include the issuer’s name, certificate or check numbers, issue date, and exact value.

- Value Verification: For instruments with fluctuating values like stocks, provide a recent brokerage statement or current market price.

- Financial Information: For larger bonds (typically over $20,000), we may request financial details to assess your application and offer the best rate.

Having these documents ready ensures a fast approval. We can also assist with other bonding needs, from court bonds to commercial surety requirements.

Step 2: Apply for Your Lost Instrument Bond

Applying is simple. Our online application is available 24/7 and often provides an instant quote and approval within hours for straightforward cases.

If you prefer personal assistance, our licensed agents are available by phone to walk you through the process and answer your questions.

Our underwriting team will review your information to assess risk and determine your premium. We work hard to offer low-cost premiums, typically 1-5% of the bond amount, with a $100 minimum. We have options available even for those with less-than-perfect credit.

Step 3: Sign and Submit Your Bond

Once your application is approved and the premium is paid, we’ll prepare your lost instrument bond documents, usually within 24 hours.

As the principal, you must sign the bond documents to formalize the agreement. Then, you will submit the original bond to the obligee—the financial institution requiring it. They need this original document on file to protect themselves from double redemption risk.

Be sure to make a copy for your records before sending it. With the bond submitted, the obligee can issue your replacement instrument, and you can move forward without the stress of a lost document.

Frequently Asked Questions about Lost Instrument Bonds

Here are answers to the most common questions we receive about lost instrument bonds from clients in Texas and across the nation.

How long does a lost instrument bond remain in effect?

Most lost instrument bonds are in effect for one year. This term covers the period of highest risk for the financial institution. These bonds are generally non-cancellable and do not require renewal, as the risk of the original document surfacing diminishes significantly over time. In rare cases, an obligee may require a multi-year bond, but a one-year term is standard.

How do lost instrument bonds differ from other surety bonds?

A lost instrument bond is a specialized type of commercial surety bond with a very specific purpose: to protect an institution from double redemption when replacing a lost financial document. This sets it apart from other bonds.

- Purpose: Unlike license & permit bonds that guarantee regulatory compliance or construction surety bonds that ensure project completion, a lost instrument bond covers a single, narrow risk.

- Risk Profile: The risk is confined to the potential cashing of a duplicate document, not ongoing business operations or performance.

- Parties Involved: The obligee is always the original issuer of the document, and the principal is the one who lost it, creating a consistent structure.

- Term: The typical one-year, non-renewable term is unique, as many other surety bonds require annual renewal.

Can I get a bond in Texas with bad credit?

Yes, you can get a lost instrument bond in Texas even with bad credit. While a lower credit score often results in a higher premium due to the increased risk for the surety, it does not automatically disqualify you.

We take a comprehensive approach to underwriting, considering the full picture beyond just your credit score. We work with a network of underwriters who specialize in high-risk applicants and explore every option to get you bonded.

Whether you’re in Houston, Dallas, or anywhere else, we encourage you to apply. We will be upfront about your premium and work to find the most affordable solution for your situation. Don’t let credit concerns stop you from replacing your valuable document.

Get Bonded and Back to Business

A lost financial document doesn’t have to be a major setback. A lost instrument bond is a fast, practical solution that protects the issuer and allows you to get a replacement document without delay. Whether it’s a stock certificate, cashier’s check, or any other valuable document, this bond is your path to resolution.

At BEST SURETY BOND COMPANY, we simplify this process. Our Texas-based team offers local expertise to clients in Houston, Dallas, San Antonio, and Austin, and our national licensing allows us to serve all 50 states.

We are committed to speed and affordability. Our instant online approval system provides quotes in minutes, and our competitive rates—starting at 1% or a $100 minimum—ensure you get the protection you need at a low cost. With fast approvals and same-day issuance, we help you move forward with confidence.

Don’t let a lost document disrupt your finances. The solution is simple, and we’re here to make it even easier.

Get Bonded Today and secure your lost instrument bond quickly and affordably. Our licensed agents are ready to help.