Why Every Missouri Auto Dealer Needs a Surety Bond

A missouri auto dealer bond is a state-required financial guarantee that protects consumers by ensuring dealers follow all state laws when selling vehicles, trailers, boats, or powersports equipment.

Key Missouri Auto Dealer Bond Requirements:

- Bond Amount: $50,000 (increased from $25,000 in 2018)

- Who Needs It: Dealers selling 8+ vehicles or 6+ trailers/boats annually

- Cost: Starting at $225 annually (0.5-10% of bond amount based on credit)

- Required By: Missouri Department of Revenue, Motor Vehicle Bureau

- Coverage: Protects against fraud, misrepresentation, and dealer misconduct

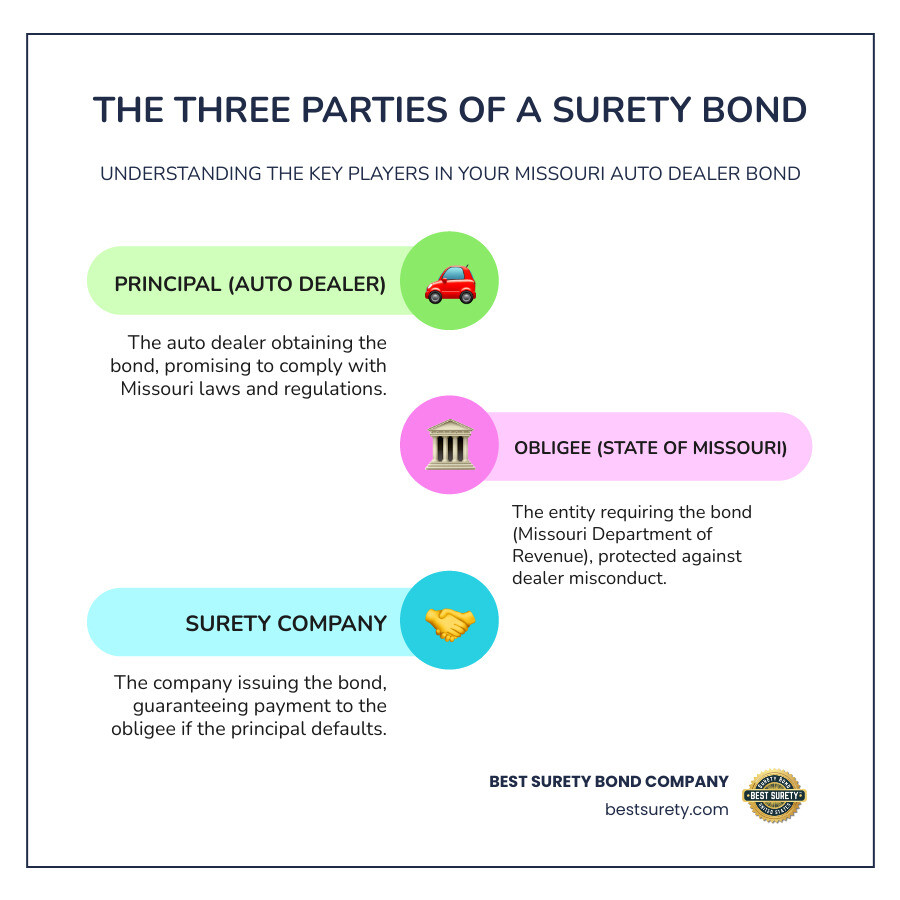

The bond is a three-party agreement between you (the dealer), the state, and a surety company. If you violate state laws, claims can be filed against your bond for consumer compensation. The bond covers issues like odometer tampering, failure to transfer titles, unpaid sales taxes, and fraudulent sales practices.

Missouri Senate Bill 707 doubled the bond amount in 2018 to strengthen these protections, giving consumers better financial recourse. As an expert in surety bonds, I’ve helped countless dealers get their missouri auto dealer bond with clear, actionable guidance, avoiding bureaucratic confusion.

Find more about missouri auto dealer bond:

Understanding the Missouri Auto Dealer Bond Requirement

To start selling vehicles in Missouri, a missouri auto dealer bond is essential. The Missouri Department of Revenue’s Motor Vehicle Bureau requires this bond as a cornerstone of consumer protection. It’s not just paperwork; it’s your promise to operate an honest, ethical business that follows all state laws, building trust with your customers.

The bond creates a safety net for consumers against fraud and levels the playing field for legitimate dealers. The legal basis is found in Missouri Revised Statutes Section 301.560, which mandates a corporate surety bond or an irrevocable letter of credit for legal operation. State law compliance is mandatory, making this bond your ticket to doing business in Missouri.

Who Needs a Missouri Auto Dealer Bond?

The missouri auto dealer bond requirement applies broadly to ensure public accountability. You’ll need this bond if you sell new or used cars, but it also extends to powersport dealers (motorcycles, ATVs), boat dealers, and trailer dealers. The rule also covers wholesale dealers, franchise dealers, and both public and wholesale motor vehicle auctions.

The key thresholds for licensing and bonding are based on sales volume. You need a bond if you are selling 8+ vehicles in a calendar year. For those dealing in trailers, boats, or powersports equipment, the threshold is selling 6+ trailers/boats annually. These rules are designed to regulate commercial operations serving the public.

What is the Required Bond Amount?

Your missouri auto dealer bond must be for $50,000. This amount was increased from $25,000 by Missouri Senate Bill 707 in 2018 to strengthen consumer protections in the automotive market.

While $50,000 is standard, a $100,000 bond may be required for dealers using delayed title delivery (transferring ownership within 30 days post-delivery) or for special event motor vehicle auctions. This higher amount offers greater protection during these specific transactions. The increased bond amount provides more meaningful financial recourse for consumers when problems arise.

How the Bond Protects the Public

A missouri auto dealer bond is a financial safety net for the public, not insurance for your business. It provides financial recourse for consumers who have been harmed by a dealer’s misconduct. If you violate state laws, a consumer can file a claim against your bond to seek compensation.

The bond offers protection against common issues like misrepresentation of a vehicle’s condition, odometer tampering, and failure to transfer title correctly. It also covers problems related to unpaid sales tax that could affect the buyer. This protection gives consumers confidence that they have a path to recovery if something goes wrong.

The bond is a guarantee of compliance with all state laws. It creates accountability, ensuring consumers are protected and that all dealers operate under the same high standards. This fosters trust and professionalism throughout the industry.

The Cost and Fast Application Process

Getting your missouri auto dealer bond is fast, easy, and affordable. Unlike what many dealers expect, you don’t pay the full $50,000 bond amount. You only pay a small percentage called a premium, making the bond very affordable.

Our streamlined online application removes the usual headaches. We offer same-day approval for most applicants, with bonds often issued in hours, not days. We’ve built our process for speed because we know you’re eager to get your dealership licensed and running.

How Much Does a Missouri Auto Dealer Bond Cost?

The cost of a missouri auto dealer bond is an affordable premium, typically 0.5% to 10% of the $50,000 bond amount annually. Your final rate depends on several factors.

Your credit score is the primary factor. With good credit (650+), expect rates from 0.75% to 2%, meaning an annual premium of $375 to $1,000. We offer competitive rates starting as low as $225 annually, with monthly payment options from around $22/month.

Your business financials and industry experience also influence the price; experienced dealers often secure lower rates. We shop multiple surety markets to find you the best rate, rewarding quality businesses with affordable bonding.

Navigating the Application for Your Missouri Auto Dealer Bond

Applying for your missouri auto dealer bond is simple with our user-friendly online process.

- Apply Online: Complete our secure application in minutes from any device. We just need basic info like your business name and dealer license number.

- Get an Instant Quote: Our system shops multiple surety markets to generate your best quote instantly.

- Pay Securely: Accept your quote and pay through our secure system.

- Receive Your Bond: We offer digital bond delivery via email, often within minutes of payment. No waiting for snail mail.

This fast turnaround means you can apply in the morning and have your bond ready for state submission the same day. We’re ready to help you get bonded quickly.

Submitting Your Bond to the State

Once you receive your missouri auto dealer bond, submit it to the Missouri Department of Revenue, Motor Vehicle Bureau, Dealer Licensing Section. Missouri offers a convenient MyDMV online portal for digital submission, which is the fastest method.

If you need to mail a physical copy, send the original signed bond form to:

Missouri Department of Revenue

Motor Vehicle Bureau, Dealer Licensing Section

PO Box 43

Jefferson City, MO 65105-0043

Always check the latest submission requirements on the Missouri Department of Revenue website. A correct submission keeps your licensing process on track.

Other Key Requirements for Your Missouri Dealer License

Your missouri auto dealer bond is a crucial piece of the licensing puzzle, but there are other requirements outlined in the Missouri Dealer and Business Operating Manual.

Mastering these additional requirements ensures your dealership starts smoothly and stays compliant.

Business & Location Requirements

Missouri has specific requirements for your dealership’s physical location to ensure professionalism and legitimacy.

- Place of Business: You need an established place of business in a commercially zoned area. It must be a permanently enclosed structure used exclusively for your dealership.

- Display Lot: Your lot must be organized and accessible to properly showcase your inventory.

- Business Sign: A permanent business sign with letters at least six inches high is required.

- Business Hours: You must be open at least 20 hours per week over four days, between 6 AM and 10 PM, Monday-Saturday. These hours must be posted.

- Inspection & Photo: Expect a law enforcement inspection of your premises. You must also submit a business photograph of your building, lot, and sign with your application.

Paperwork and Background Checks

Attention to detail during the paperwork phase prevents delays. Key documents include:

- Application: Complete Form DOR-4682, the official dealer license application.

- Business Registration: Register your business name with the Missouri Secretary of State. Ensure the name exactly matches your bond and license application to avoid delays.

- Background Check: All owners must pass a criminal background check via the MACHS system.

- Garage Liability Insurance: You must have this insurance to cover business operations. It complements your surety bond, which protects consumers.

- Educational Seminar: First-time used auto dealer applicants must complete an approved dealer educational seminar.

License Renewal and Bond Expiration

Your Missouri dealer license is valid from January 1st to December 31st and must be renewed annually. To avoid penalties, submit your renewal application before October 30th. Renewing between October 30th and December 31st incurs a $25 late penalty, which increases to $50 after December 31st.

Your missouri auto dealer bond is a continuous bond, meaning it remains active until canceled. This simplifies your license renewal, as the bond coverage continues without interruption. We help manage your bond renewal to ensure you maintain continuous coverage and avoid any compliance issues.

Frequently Asked Questions about the Missouri Auto Dealer Bond

Got questions about your missouri auto dealer bond? You’re in good company! Let’s explore some of the most common ones.

What happens if I operate without a Missouri auto dealer bond?

Operating a dealership in Missouri without a missouri auto dealer bond is illegal and has serious consequences. The Missouri Department of Revenue will reject your license application or renewal without a valid bond. Existing dealers face license suspension or revocation.

Beyond losing your license, you can face hefty fines and penalties for non-compliance. Any sales made without a license and bond are illegal, opening you to civil lawsuits and potential criminal charges. Operating without a bond also damages your business reputation and destroys consumer trust. It’s a risk that isn’t worth taking, as it puts your entire business in jeopardy.

How long does it take to get a Missouri auto dealer bond?

We’ve streamlined the process to get your missouri auto dealer bond with industry-leading speed. You can get an instant, free quote online in minutes. Most applicants receive same-day approval.

Once approved and paid, your official missouri auto dealer bond is delivered digitally via email, often within minutes. This means you can apply for your bond and have it ready for state submission the same day. Our goal is to get you compliant and back to business without delay.

Can I get a Missouri auto dealer bond with bad credit?

Yes, you can absolutely get a missouri auto dealer bond with bad credit. While a lower credit score typically results in a higher premium (rates can range from 2.5% to 10% or more, compared to 0.75% to 2% for good credit), it rarely prevents you from getting bonded.

We work with surety partners who specialize in bad credit programs. Underwriters also consider other factors like your industry experience and business financials, which can help offset a lower credit score. We are committed to exploring every option to find you the most competitive rate available for your situation. Don’t let credit concerns stop you from applying for a free quote.

Get Your Missouri Dealer Bond with Confidence

Securing your missouri auto dealer bond shouldn’t be a frustrating wait. At Best Surety Bond Company, we make the process straightforward and fast.

We’ve built our operation on speed, affordability, and reliability. Our licensed agents combine industry expertise with digital convenience to get you bonded quickly. We’re committed to making bonding accessible for all dealers, from seasoned pros to new entrepreneurs.

Licensed in all 50 states, we understand Missouri’s specific requirements and leverage our national experience to get you the best rates. Our approach is simple: fast approvals, low rates, and genuine support. We’ve helped thousands of dealers get bonded without hidden fees or confusing jargon.

Ready to take the next step with confidence? Your Missouri dealership is waiting.

Get Your Free Missouri Dealer Bond Quote Today!