Locating Your Notary Public Surety Bond Near You

If you’re searching for a notary public surety bond near me, you need it fast and affordably. For notaries in Houston, Dallas, San Antonio, Austin, and across Texas, the most efficient way to secure a bond is through a reputable online surety bond provider.

Quick Answer: How to Get Your Notary Public Surety Bond

- Online Providers: Companies like BEST SURETY BOND COMPANY offer instant online application and digital delivery for notary public surety bonds, serving customers throughout Texas and nationwide.

- Speed: Most notary bonds can be issued and delivered digitally within minutes, eliminating the need for a physical ‘near me’ location search.

- Cost: Online providers typically offer competitive pricing and transparent fees, ensuring you get the best rate without hassle.

This guide simplifies the process of getting a notary bond, explaining what it is, why it’s required, and how to obtain one with ease. Our goal is to make navigating regulatory requirements straightforward for every professional.

Terms related to notary public surety bond near me:

First, What is a Notary Surety Bond?

When you’re searching for a notary public surety bond near me, you’re looking for a financial guarantee required by the state. A notary surety bond is a financial safety net for the public, ensuring you perform your duties honestly and according to state law.

It’s a three-party agreement between you (the Principal), the state (the Obligee, representing the public), and a bonding company like BEST SURETY BOND COMPANY (the Surety). The bond guarantees that if you make a mistake or act dishonestly, causing a financial loss, the public can file a claim for compensation.

Crucially, the bond protects the public, not you. If the surety company pays a claim, you are legally required to reimburse them. This system ensures that the public is protected and maintains trust in the notarization process.

Notary Bond vs. Errors & Omissions (E&O) Insurance: A Critical Difference

It’s vital to understand the difference between a notary bond and Errors & Omissions (E&O) insurance. They serve completely different purposes.

| Feature | Notary Surety Bond | Errors & Omissions (E&O) Insurance |

|---|---|---|

| Who it Protects | The Public (consumers, the state) | The Notary Public (you!) |

| Is it Required? | Yes, mandated by most states | No, optional but highly recommended |

| Who Pays a Claim? | Surety pays the harmed party, then the Notary repays the Surety | Insurance company pays for your legal defense and damages |

| Purpose | Guarantees compliance with state law; financial recourse for public | Protects notary from personal liability for mistakes, errors, or omissions |

The bond is state-mandated protection for your clients. E&O insurance is optional protection for your personal finances. For any serious notary in Houston, Dallas, or anywhere in Texas, having both is smart business. The bond is required, and E&O insurance protects you from honest mistakes that can be costly.

Who Does the Notary Bond Protect?

To be perfectly clear: your notary bond protects the public, not you. Every person who uses your services is protected by this bond.

For example, if you fail to properly verify a signer’s identity on a property deed and it turns out to be a forgery, the rightful owner could lose their property. They could then file a claim against your bond. The surety company would investigate, and if you were found to be at fault, they would pay the harmed party up to the bond amount. However, you would then be required to repay that amount to the surety company. The bond ensures the victim is compensated quickly, but the financial responsibility ultimately remains with you.

Notary Bond Requirements: A Look at Texas and Other States

Notary bond requirements vary significantly from state to state. While the goal of protecting the public is universal, the specific bond amounts and terms differ. At BEST SURETY BOND COMPANY, we are experts in these requirements nationwide, with a special focus on our home state of Texas.

Texas Notary Bond Requirements

To become a notary public in Texas, you must obtain a $10,000 surety bond for a four-year term, which aligns with your notary commission period. These rules are set by the Texas Secretary of State.

In addition to the bond, Texas notary applicants must:

- Be at least 18 years old

- Be a legal resident of Texas

- Have no conviction for a felony or a crime of moral turpitude

- Be able to read and write English

Once you have your bond and meet these requirements, you’re ready to serve your community.

How Texas Compares to Other States

While Texas requires a $10,000 bond, other states have different amounts. For instance, if you need a notary public surety bond near me in California, the requirement is a $15,000 bond. Florida requires a $7,500 bond, and Pennsylvania matches Texas at $10,000. Some states are lower, like Alaska ($2,500) or Wisconsin ($500), with most terms lasting four years.

These differences highlight the importance of knowing your state’s specific rules. As a provider licensed in all 50 states, BEST SURETY BOND COMPANY can guide you through the unique requirements wherever you are. For the most current and precise details, it’s always best to consult official government sources, such as your state’s Secretary of State office. They are the final authority on all requirements.

How to Find a Notary Public Surety Bond Near Me

Finding a notary public surety bond near me is fastest and most cost-effective through an online provider. You don’t need to search for a local brick-and-mortar office.

At BEST SURETY BOND COMPANY, we’ve streamlined the process to be simple and accessible 24/7. Whether you’re in Houston, Dallas, San Antonio, Austin, or anywhere in Texas and beyond, our online platform delivers your bond within minutes.

Our focus is on:

- Speed and convenience: Instant online applications and digital delivery.

- Cost savings: Competitive pricing with transparent fees.

- Accessibility: 24/7 access to our platform from any location.

This digital approach makes us your true notary public surety bond near me provider, regardless of your physical location.

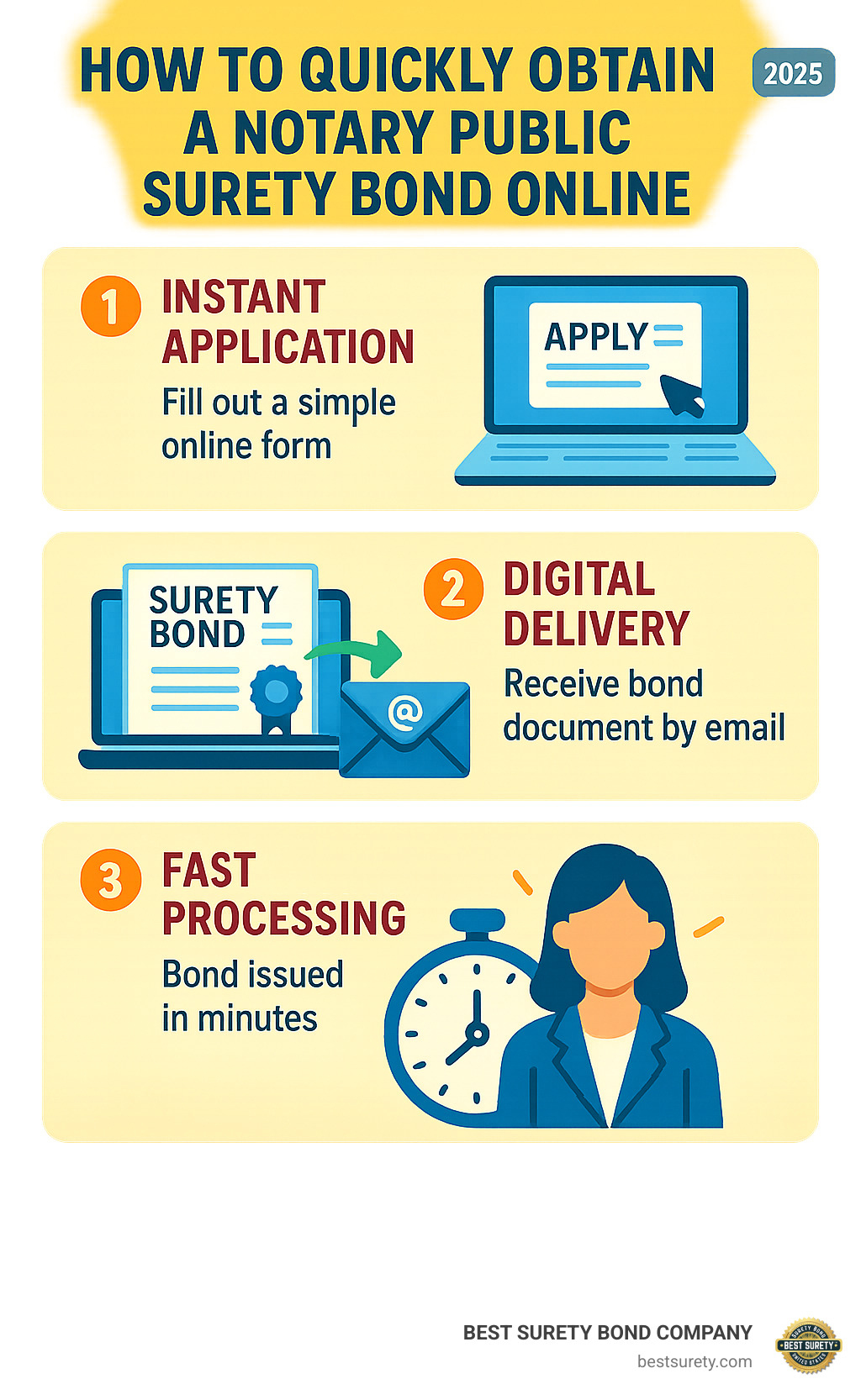

Getting Your Bond Instantly Online

Our online process is designed for maximum speed. Here’s how it works:

- Simple Application: Our online form takes just minutes to complete. We only ask for essential information like your name, address, county, and commission dates.

- Instant Digital Delivery: After payment, your official bond documents are emailed to you almost instantly. This digital copy is often sufficient for immediate filing.

- Expedited Shipping (if needed): Some states, like California, require an original bond with a “wet ink” signature for final filing. We offer expedited shipping options (Next Day, Two Day, or Three Day) to get your physical bond to you quickly.

Our service is available to notaries in Houston, Dallas, San Antonio, Austin, all of Texas, and nationwide.

What to Look for in a Surety Bond Provider

Choosing a surety provider is an important decision. Here’s what sets a top-tier provider like BEST SURETY BOND COMPANY apart:

- State Licensed: Ensure the provider is licensed in your state. We are licensed in all 50 states.

- National Reach: A provider with national authority understands varying state requirements.

- Positive Reviews and Reputation: Look for strong testimonials. We are proud of our “BBB Accredited” status and having bonded over 10,000 clients.

- Fast Service: Speed is critical. We offer “Fast approvals,” “Same-day issuance,” and “Instant quotes.”

- Clear Communication and Pricing: Transparency is key. We provide “Low-cost surety bonds” and “Best rates guaranteed.”

- Human Service + Digital Convenience: We combine our easy-to-use digital platform with access to “Licensed agents ready to help.”

Choosing the right provider ensures a smooth, affordable, and reliable bonding experience.

The 3-Step Process: From Purchase to Filing Your Bond

Getting your notary public surety bond near me is a straightforward journey. At BEST SURETY BOND COMPANY, we’ve simplified it into three easy steps designed for quick turnaround and full state compliance.

This simple process ensures you meet your legal obligations efficiently, so you can get commissioned and start your work without delay.

Step 1: Purchase Your State-Required Notary Bond

The first step is easy with our user-friendly online platform. You can purchase your notary bond quickly and securely from any device.

To purchase your bond, we’ll need key information, including your full legal name (as it will appear on your commission), your address, the county of your principal place of business, and your notary commission dates.

After you enter this information and complete the secure payment, your bond is issued almost instantly. We make this step seamless for all Texas notaries—whether in Houston, Dallas, San Antonio, or Austin—and for notaries nationwide, offering the “lowest rates in Texas” and beyond.

Step 2: Receive and File Your Bond & Oath of Office

After purchasing your bond, you must file it with the appropriate state or county office, usually along with your Oath of Office.

This step has strict deadlines. In California, for example, you have only 30 days from your commission date to file your bond and oath with the county clerk. Missing this deadline can void your commission, forcing you to reapply and get a new bond. To avoid delays, consider submitting your documents in person.

The process generally involves:

- Receiving your official bond document (digitally or by mail).

- Taking your Oath of Office before an authorized official.

- Filing both the signed Oath and the original surety bond with the correct county clerk.

We provide the necessary documents, but timely filing is your responsibility. Always check your state’s official filing instructions and deadlines.

Step 3: Renewing Your Notary Public Surety Bond Near Me

Your notary public surety bond near me must be renewed to keep your commission active. Notary bonds are typically issued for a 4-year term to coincide with your commission period.

The renewal process with us is simple:

- Renewal Invoice: We send a reminder and renewal invoice before your bond expires.

- New Bond Form: Once payment is processed, a new surety bond form is issued and sent to you.

- Continuous Coverage: Renewing your bond before it expires is essential to ensure there is no gap in your coverage, which is required to perform notarial acts.

BEST SURETY BOND COMPANY sends timely reminders to ensure you never miss a renewal deadline, helping you maintain your commission with ease.

Understanding Claims and Your Responsibilities

It’s important to understand what happens if a claim is made against your notary bond. Knowing the process helps you manage your responsibilities as a notary.

If a claim arises, the surety company investigates it thoroughly. We will contact you to get your side of the story. The notary bond protects the public. If a claim is found to be valid and a payment is made, you, the notary, are financially responsible for reimbursing the surety company for the full amount. This reimbursement obligation underscores the importance of performing your duties with diligence and integrity.

Best Practices to Avoid Claims

The best way to handle a claim is to prevent it from happening. Following key best practices can significantly reduce your risk and protect you from liability.

Follow these tips to stay safe:

- Keep a detailed journal: This is your best defense. Maintain a complete record of every notarial act, including the date, type of act, signer’s name, ID used, and any fees. This journal is an indisputable record.

- Properly verify signer identity: Insist that signers appear in person. Use only state-approved identification methods, like a government-issued photo ID, personal knowledge, or credible witnesses.

- Never notarize incomplete documents: Ensure all blanks in a document are filled in before you apply your seal. Notarizing an incomplete document can lead to fraud and liability.

- Remain impartial: You must be a disinterested party. Avoid notarizing for close family or in any situation where you have a financial or personal interest.

- Avoid giving legal advice: Your role is to witness signatures and verify identity, not to act as an attorney. If asked for legal advice, suggest they consult a lawyer.

- Stay informed: Notary laws can change. It is your responsibility to stay current with your state’s regulations.

By following these practices, you protect yourself financially and uphold the integrity of the notary profession.

Frequently Asked Questions about Notary Bonds

Here are answers to the most common questions we receive from notaries in Texas and across the country.

How much does a notary bond cost?

Notary bonds are very affordable. You pay a one-time premium for the entire 4-year term, with no monthly payments.

The cost depends on your state’s required bond amount. For example, a Texas notary bond (requiring $10,000 of coverage) typically costs around $76 for the full 4-year term—less than $20 per year.

Best of all, no credit check is required. Notary bonds are accessible to everyone, regardless of credit history, allowing for quick approval without financial scrutiny.

At BEST SURETY BOND COMPANY, we are committed to offering the lowest rates in Texas and nationwide. Whether you’re in Houston, Dallas, San Antonio, or Austin, we guarantee competitive pricing.

Does a notary bond protect me from mistakes?

This is a critical point: No, a notary bond does not protect you from your own mistakes.

The bond exists to protect the public from financial harm caused by your errors or misconduct. If a valid claim is paid by the surety company, you are legally obligated to reimburse that amount.

To protect yourself, you need Errors & Omissions (E&O) insurance. E&O is your personal safety net, covering legal defense costs and damages if you are sued for an honest mistake. While the bond is a legal requirement, E&O insurance protects your personal assets. We strongly recommend every notary purchase E&O insurance.

How fast can I get my notary bond?

We specialize in speed because we know you need your notary public surety bond near me quickly.

- Instant online purchase allows you to apply and get approved 24/7. The application takes only minutes.

- Immediate email delivery means you receive your digital bond document within minutes of purchase, which is often sufficient for filing.

- For states requiring original documents, we offer same-day issuance and expedited shipping options (Next Day, Two Day, or Three Day) to ensure you get your bond when you need it.

Whether you’re in Houston, Dallas, or anywhere else, we pride ourselves on having the fastest turnaround in the industry. Our goal is to get you bonded quickly so you can start serving your community.

Conclusion: Get Your Texas Notary Bond Fast

Becoming a notary public is a great way to serve your community. While getting a notary public surety bond near me is a requirement, it doesn’t have to be a hurdle. This bond is your promise of accountability to the public you serve.

At BEST SURETY BOND COMPANY, we make the process simple and stress-free. We are your local experts with national authority, combining digital convenience with human service.

Whether you’re starting your notary journey in Houston, Dallas, San Antonio, Austin, or anywhere across Texas and beyond, we have you covered. We offer fast approvals and instant online access, so you can secure your bond in minutes. With our low rates and expert guidance from our licensed agents, you can have peace of mind knowing you’re partnered with a trusted, BBB Accredited provider.

Don’t let the bond requirement delay your notary aspirations. Get Bonded Today with BEST SURETY BOND COMPANY and experience the difference that speed, affordability, and exceptional service make.

Serving Houston, Dallas, San Antonio, Austin, and all of Texas.