Why Texas Notary Public Bonding is Essential

Notary surety bond texas requirements are mandatory for all notaries public in the state. Texas law requires every notary to purchase and maintain a $10,000 surety bond for their entire 4-year commission term.

Quick Facts About Texas Notary Bonds:

- Bond Amount: $10,000

- Term Length: 4 years (concurrent with commission)

- Cost: $50 for the full term

- State Filing Fee: $21

- Credit Check: Not required

- Purpose: Protects the public from financial harm due to notary misconduct

Texas takes notary public accountability seriously. The bond acts as a financial guarantee that protects citizens from losses caused by a notary’s improper conduct, fraudulent acts, or failure to follow state law.

If a notary makes an error that causes financial harm to someone, the surety company will pay damages up to $10,000. However, the notary remains personally responsible to reimburse the surety company for any claims paid.

The Texas Secretary of State requires this bond as part of the commission application process. Without a valid surety bond, you cannot become a commissioned notary public in Texas.

As Haiko de Poel, I’ve helped thousands of business owners steer complex bonding requirements across multiple industries, including notary surety bond texas applications for professionals seeking fast, compliant solutions. My experience in fintech and legal services has shown me how critical proper bonding is for maintaining professional credibility and legal compliance.

Notary surety bond texas terms simplified:

Understanding the Texas Notary Surety Bond Requirement

Becoming a notary public in Texas is a wonderful way to serve your community. You get to witness important moments and ensure documents are handled with integrity. But with that important role comes a big responsibility – and that’s exactly where the notary surety bond Texas steps in.

Think of this bond as a vital safety net for the public. Its main job is to protect citizens from any financial harm that might come from a notary’s honest mistake, negligence, or even misconduct. Life happens, and sometimes errors occur. This bond ensures that if an error on your part causes someone financial loss, they have a way to recover.

This isn’t just a suggestion; it’s a mandatory state requirement. In fact, Texas law, specifically Texas Government Code §406.010, clearly states that all notaries public must have and keep this bond throughout their commission. If you don’t have a valid bond, your application to become a notary won’t even get off the ground. And operating without one? That’s a serious offense that could lead to fines, suspension, or even losing your notary commission entirely.

So, who exactly needs this bond? It’s pretty straightforward: anyone looking to become a notary public in Texas. Whether you’re applying for the very first time or it’s time to renew your existing commission, this bond is a must-have. This applies whether you plan to be a traditional notary or dig into remote online notarizations (RONs). From the busy streets of Houston to the vibrant culture of Austin, or anywhere in our great state, securing your notary surety bond Texas is your crucial first step.

What is the Required Bond Amount and Term?

The Texas Secretary of State has made it super clear what’s needed for your notary surety bond Texas. You’ll need to secure a bond with a value of $10,000. This amount isn’t just a random number; it’s carefully chosen to provide significant financial protection for the public you’ll be serving.

And how long does it last? This bond isn’t a ‘set it and forget it’ kind of thing. It’s valid for a 4-year term. Here’s a neat part: this term runs concurrently with your notary commission. That means as your commission term moves along, so does your bond’s coverage. When your notary commission is up for renewal, you’ll also need to get a new notary surety bond Texas for your next 4-year period. It’s all designed to keep things smooth and aligned for you.

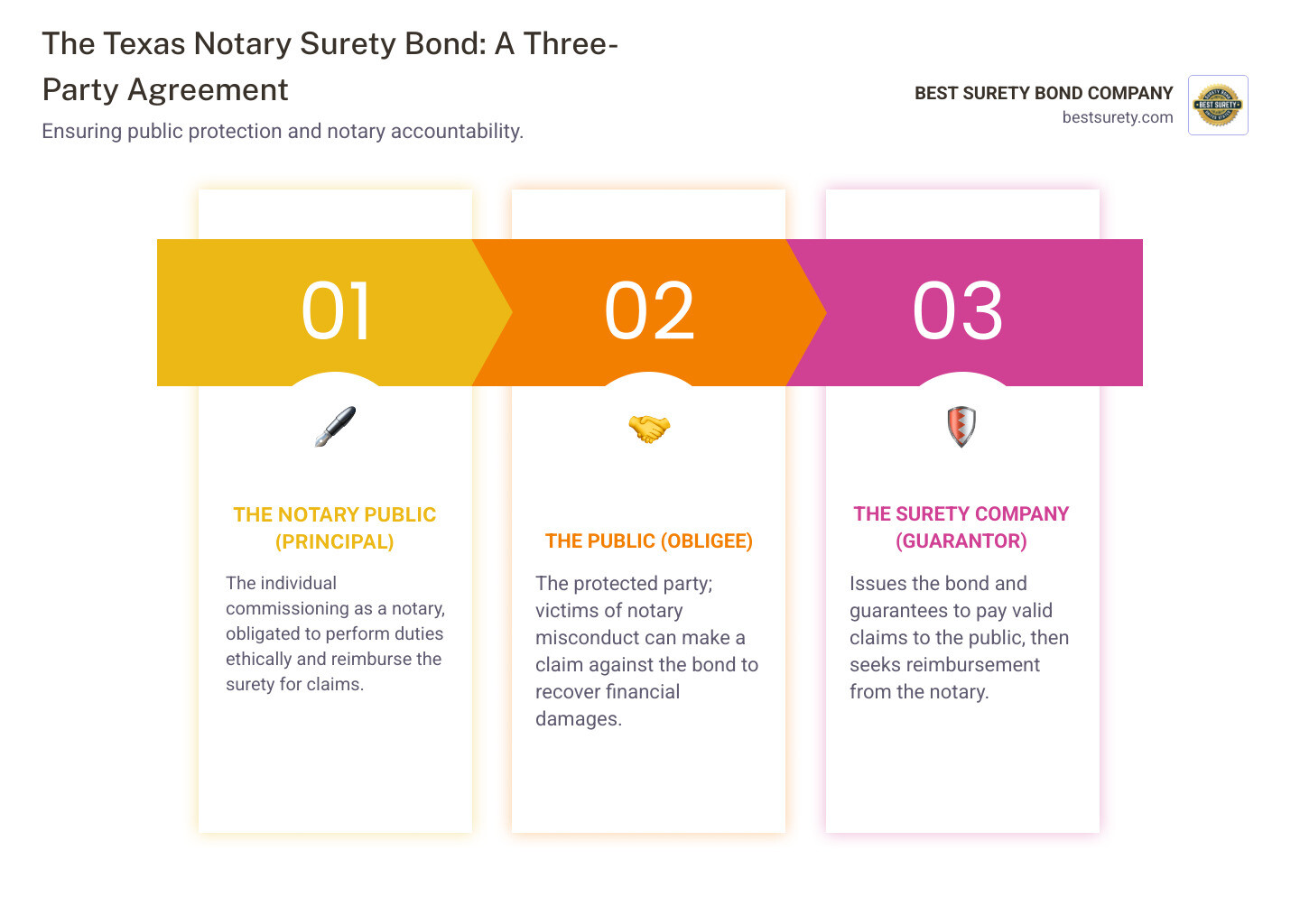

Who is Protected by the Bond?

Now, this is a really important point and sometimes a bit confusing: the notary surety bond Texas is specifically designed to protect the public, not you, the notary. Let’s say, despite your best intentions, an error occurs during a notarization, or perhaps there’s an omission that causes financial harm to a member of the public. The bond steps in here, offering a way for that individual to recover their losses, up to the $10,000 bond amount.

Here’s how it works: it’s a three-party agreement. We, as the surety company, essentially guarantee to the Texas Secretary of State that we’ll cover these losses if a valid claim arises. However, and this is key, if we do pay out a claim on your behalf, you are legally obligated to reimburse the surety company for the full amount paid. Think of it less like an insurance policy for your mistakes and more like a strong guarantee of your faithful performance and adherence to the law. Understanding this difference is vital, and it leads us perfectly into our next important topic.

The Notary Bond vs. E&O Insurance: What’s the Difference?

One of the most common questions I get from new notaries in Texas is about the difference between their mandatory notary surety bond Texas and something called Errors and Omissions insurance. It’s an important distinction that can save you from some serious financial headaches down the road.

Think of your surety bond as a promise to the state that you’ll follow the rules. It’s required by law, and it protects the public from your mistakes – not you. When someone files a valid claim against your bond because you made an error or acted improperly, the surety company pays them up to $10,000. But here’s the kicker: you then have to pay back every penny to the surety company. It’s essentially a loan that gets triggered when things go wrong.

Errors and Omissions (E&O) Insurance is completely different. This optional coverage is designed to protect you, the notary, from the financial burden of defending yourself against claims and paying damages. While your bond guarantees the public will be compensated for your mistakes, E&O insurance helps cover your personal liability when those unintentional errors happen.

The key difference? Your bond is mandatory and protects others from you. E&O insurance is optional and protects you from the consequences of honest mistakes. In Texas, you must have the bond to operate legally, but E&O insurance is your choice – though it’s a smart one.

For a deeper dive into how these protections work together with other bonding solutions, check out more info about our bond services.

Why You Should Consider E&O Insurance

Even the most careful notary can make an innocent mistake. Maybe you miss a signature line, forget to check an ID properly, or accidentally notarize a document with missing information. These things happen, and when they do, E&O insurance provides the peace of mind you need to sleep well at night.

The biggest benefit is covering legal fees. Even if a claim against you is completely frivolous, you’ll still need to defend yourself. Legal costs can easily run into thousands of dollars, and that comes straight out of your pocket without E&O coverage. With it, your insurance company handles the defense costs, letting you focus on your notary business instead of worrying about bankruptcy.

E&O insurance also offers protection against mistakes that your bond doesn’t cover. While your notary surety bond Texas requires you to reimburse the surety company for any claims paid, E&O insurance actually pays those costs for you. It’s true personal asset protection that keeps your savings, home, and other property safe from lawsuits.

Most E&O policies offer various coverage levels, typically ranging from $5,000 to $100,000 or more. This flexibility means you can choose coverage that matches your comfort level and the volume of notarizations you plan to perform. Whether you’re notarizing a few documents a month or running a busy signing service, there’s a coverage level that makes sense for your situation.

The bottom line? Your bond keeps you legal, but E&O insurance keeps you financially secure. Together, they provide comprehensive protection that lets you serve your Texas community with confidence.

How to Get Your Texas Notary Bond: A Step-by-Step Guide

Ready to get your notary commission? Getting your notary surety bond Texas might sound like a big hurdle, but we promise, it’s actually surprisingly quick and straightforward when you choose the right partner. At BEST SURETY BOND COMPANY, we’ve worked hard to make this process as easy as pie, offering fast approvals, instant issuance, and a super seamless online purchase experience. We want you to get commissioned and start serving your community as soon as possible!

Here’s a little peek at just how simple it is to get your bond with us:

First things first, you’ll want to find a licensed surety company that’s authorized to do business right here in Texas. This is crucial because it ensures your bond is legitimate and will be accepted by the Secretary of State. Next, you’ll simply provide a few pieces of required information, like your name, address, and the county where you reside. This helps us issue your official bond documents accurately. Finally, you can purchase your bond online through our secure portal. You can do this any time, day or night, and receive your documents instantly via email.

We truly understand that you’re eager to begin your notary journey. That’s why we’ve streamlined our entire process to get your bond into your hands in mere minutes, not days. We’re dedicated to providing the best surety bond rates in Texas, making getting bonded both affordable and incredibly efficient. Whether you’re in the busy heart of Houston, the vibrant streets of Dallas, or anywhere else across our great state, our digital convenience means you can get bonded from literally anywhere!

How Much Does a Notary Surety Bond Texas Cost?

This is often the best part for aspiring notaries! The required notary surety bond Texas is remarkably affordable. The premium for your full $10,000 bond is typically just $50 for the entire 4-year term. Yes, you read that right – it’s a flat rate of $50 that covers you for four whole years!

And here’s even more good news: unlike many other types of surety bonds, a credit check is absolutely not required to obtain a Texas notary bond. This means your personal credit score won’t affect your ability to get bonded or how much it costs. Everyone pays the same low rate, ensuring fair and accessible bonding for all notaries.

Now, while the bond itself is just $50, remember there’s also a mandatory state filing fee of $21 for your Texas Notary Application. So, when you combine the $50 bond premium with the $21 state fee, your total initial cost to cover the bond and state application comes to a very reasonable $71 for the entire 4-year term. Becoming a commissioned notary in Texas is truly one of the most cost-effective professional steps you can take!

Where Can I Purchase a Notary Surety Bond in Texas?

When you’re looking for the perfect partner to help you secure your notary surety bond Texas, you want a company that offers both unwavering reliability and incredible convenience. We believe we fit that bill perfectly, and here’s what we recommend you look for:

First and foremost, make sure the surety company is fully licensed and authorized to issue bonds right here in Texas. This guarantees the legitimacy of your bond and that it will be accepted by the Texas Secretary of State. You’ll also appreciate a provider that offers fast electronic filing, as this dramatically speeds up the process and cuts down on paperwork for you.

While our online process is super user-friendly, it’s always comforting to know there’s a team of excellent customer support professionals, like our licensed agents, ready to help if you have any questions or need a little guidance. Look for a provider with a secure online application platform, allowing you to purchase your bond quickly and safely from the comfort of your home or office. And of course, always check for competitive pricing. As a company that prides itself on offering the best surety bond rates in Texas, we understand the importance of affordability without any hidden fees.

We are proud to be a Texas-based surety bond company, serving notaries across Houston, Dallas, San Antonio, Austin, and every other wonderful community in our state. Our ultimate goal is to make the bonding process as fast, affordable, and hassle-free as possible, so you can focus on what truly matters: your exciting journey to becoming a commissioned notary public!

The Texas Notary Application and Filing Process

Phew! You’ve got your notary surety bond Texas secured, and that’s a huge step! Now, let’s talk about getting your official application submitted to the Texas Secretary of State. This part of the journey is all about making sure you meet the state’s high standards for public officers. It’s a bit like getting your ducks in a row before you can officially start serving your community in Texas.

First things first, let’s quickly check if you meet the basic eligibility. To become a notary public in our great state, you need to be at least 18 years of age and a legal resident of Texas. It’s also super important that you haven’t been convicted of a felony or any crime involving “moral turpitude.” The Secretary of State’s office does conduct thorough background checks on all applicants, so honesty is key here. If you have any criminal history (beyond minor Class C misdemeanors), you must fully disclose it on your application and provide all the necessary paperwork. Being upfront can save you a lot of headaches, as failing to disclose can lead to your application being denied or even your commission being revoked later on.

For the most comprehensive and official details straight from the source, always head over to the Official notary public information from the Texas Secretary of State. You’ll typically be looking to fill out the official “Application for Appointment as Texas Notary Public” (that’s Form 2301, if you want to get specific!).

Filing Your Notary Surety Bond in Texas

Once your notary surety bond Texas is purchased and you have those official bond documents in hand (usually sent to you electronically for speed and convenience!), it’s time to merge them with your notary application. The Texas Secretary of State has a really user-friendly online system, the SOS Portal, which makes this step much easier.

Here’s how you’ll generally complete your filing: You’ll start by thoroughly filling out your official notary public application form. Then, as you go through the online process on the SOS Portal, you’ll be prompted to upload your completed bond form. This is a crucial moment: make sure the name on your bond matches the name on your application exactly. Even a small difference can cause delays, and we want to get you commissioned as fast as possible! You’ll also pay the mandatory $21 state filing fee directly through this portal. Once your application is approved and everything is processed, you’ll receive your commission certificate. The final, very important step is to take your official oath of office before another authorized official (definitely not yourself!). This step formally makes you a commissioned notary public, and then your official commission certificate, your proof of becoming a notary, will typically arrive via email.

How to Become an Online Notary in Texas

The world of notarization is always growing, and Texas is leading the way with remote online notarization (RON). If you’re thinking about becoming an online notary in Texas, that’s fantastic! Just remember, the first step is always to be commissioned as a traditional notary public, and yes, that includes having your notary surety bond Texas in place.

Once you’re a traditional notary, there are a few extra, exciting steps to become an online notary:

- Digital Certificate: You’ll need to get a digital certificate from a third-party provider. This is what allows you to electronically sign documents. The Texas Secretary of State doesn’t recommend specific providers, so you’ll want to find one that meets the state’s technical requirements.

- Electronic Seal: You’ll also need an electronic seal. This isn’t a physical stamp but a digital image that adheres to specific size and content rules. For example, if it’s a circular digital seal, it can’t be more than 2 inches across. If it’s rectangular, it can’t be bigger than 1 inch wide and 2.5 inches long. Both types must clearly include “Notary Public, State of Texas,” your name, and your commission expiration date.

- Additional Application: After getting your digital tools, you’ll apply online through the Secretary of State’s electronic commissioning system. You can find that system right here: Online electronic commissioning system. There’s an additional application fee of $50 for online notary commissioning.

Becoming an online notary opens up new opportunities to serve clients remotely through secure video and audio calls. It’s an awesome way to expand your services, but just know it involves these extra technological and application steps beyond your traditional notary commission.

Frequently Asked Questions about the Notary Surety Bond Texas

Getting your notary surety bond Texas can feel overwhelming with all the requirements and paperwork involved. That’s completely normal! We’ve been helping Texas notaries steer this process for years, and we understand the questions that keep coming up. Let me share answers to the most common concerns we hear from folks just like you who are ready to take this important step in their professional journey.

Can I get a Texas notary bond with bad credit?

Here’s some great news that often surprises people: Yes, you absolutely can get a Texas notary bond with bad credit! In fact, we don’t even run a credit check. Your credit score simply doesn’t matter when it comes to obtaining your notary surety bond Texas.

This is different from many other financial products you might be familiar with. Whether your credit is excellent, fair, or has seen better days, you’ll pay the same flat rate of $50 for your four-year bond term. We believe everyone deserves the opportunity to serve their community as a notary public, regardless of their financial history.

This no-credit-check approach means approval is essentially guaranteed. You won’t face the stress of wondering whether your application will be approved or worry about paying higher premiums because of past financial challenges.

How quickly can I get my bond?

Speed is one of our specialties! With our online system, you can purchase and receive your official notary surety bond Texas documents via email instantly, 24 hours a day, 7 days a week. We’re talking minutes, not days or weeks.

This rapid turnaround is crucial because we know you’re eager to complete your state application and start your notary journey. There’s no need to wait for business hours or worry about postal delays. Our streamlined digital process means you can get bonded from your kitchen table at midnight if that’s when inspiration strikes!

Once you have your bond documents in hand (or rather, in your inbox), you can immediately proceed with uploading them to the Texas Secretary of State’s portal and completing the rest of your application process.

What happens if a claim is filed against my bond?

This is probably the question that causes the most anxiety, and I completely understand why. Let me walk you through exactly what happens if someone files a claim against your notary surety bond Texas.

First, our team will thoroughly investigate the claim. We don’t just automatically pay out – we carefully review all the facts and circumstances to determine whether the claim is valid. This investigation protects both you and ensures the bond system works fairly.

If we determine the claim is legitimate – meaning you did make an error or engage in misconduct that caused someone financial harm – we’ll pay the claimant up to the $10,000 bond amount to cover their losses. This is the bond doing exactly what it’s designed to do: protecting the public.

However, here’s the part that catches many notaries off guard: you are legally required to reimburse us for the full amount we pay out. The bond isn’t insurance for you – it’s a guarantee to the public that they’ll be compensated if you make a mistake, but ultimately, you’re responsible for covering those costs.

This is exactly why we strongly recommend considering Errors and Omissions (E&O) insurance alongside your bond. While the bond protects the public, E&O insurance protects you from having to pay these reimbursement costs out of your own pocket, plus it can cover your legal defense fees if you’re sued.

Get Bonded in Texas Today

So, you’ve learned all about the ins and outs of becoming a Texas Notary Public. It might seem like a lot to take in at first, but honestly, with the right help, getting your commission is a breeze! The most crucial step, and the one that truly secures your place as a public officer, is getting your notary surety bond Texas.

We’ve covered the essentials: it’s a $10,000 bond that protects the public, it lasts for a full 4-year term (just like your commission!), and the best part? It’s incredibly affordable at just $50. That’s right, fifty dollars for four years of peace of mind for the public you’ll serve!

We at BEST SURETY BOND COMPANY are all about making this part of your journey as smooth and simple as possible. We know you’re eager to get started, so we’ve streamlined our online process to give you instant approvals and quick delivery of your bond documents. That means you can submit your application to the Texas Secretary of State without any unnecessary delays. We’re proud to be your local experts, offering the best surety bond rates in Texas, whether you’re in busy Houston, Dallas, San Antonio, Austin, or any other vibrant community across our great state.

Compliance is absolutely key to building a successful and trustworthy notary career. Securing your bond isn’t just a requirement; it’s your very first major step toward that respected role. Don’t let paperwork or confusion hold you back from serving your community and making a real difference.

Ready to take that exciting next step? Let’s get you bonded today and officially kick off your journey as a trusted Texas Notary Public!

Ready to get started? Visit us now and Get Your Texas Notary Bond Instantly! We’re here to help you get bonded today.