Understanding Performance Bonds at a Glance

A performance bond is a guarantee that protects the project owner if a contractor doesn’t finish a job as agreed. In simple terms, it’s a promise—backed by a third party—that work will get done, or the owner will be compensated.

Here’s what you need to know, fast:

| What is a performance bond? | Who needs it? | How does it work? | Key benefit |

|---|---|---|---|

| A three-party agreement | Contractors & businesses | Surety pays if you default | Projects finish as promised |

Quick facts:

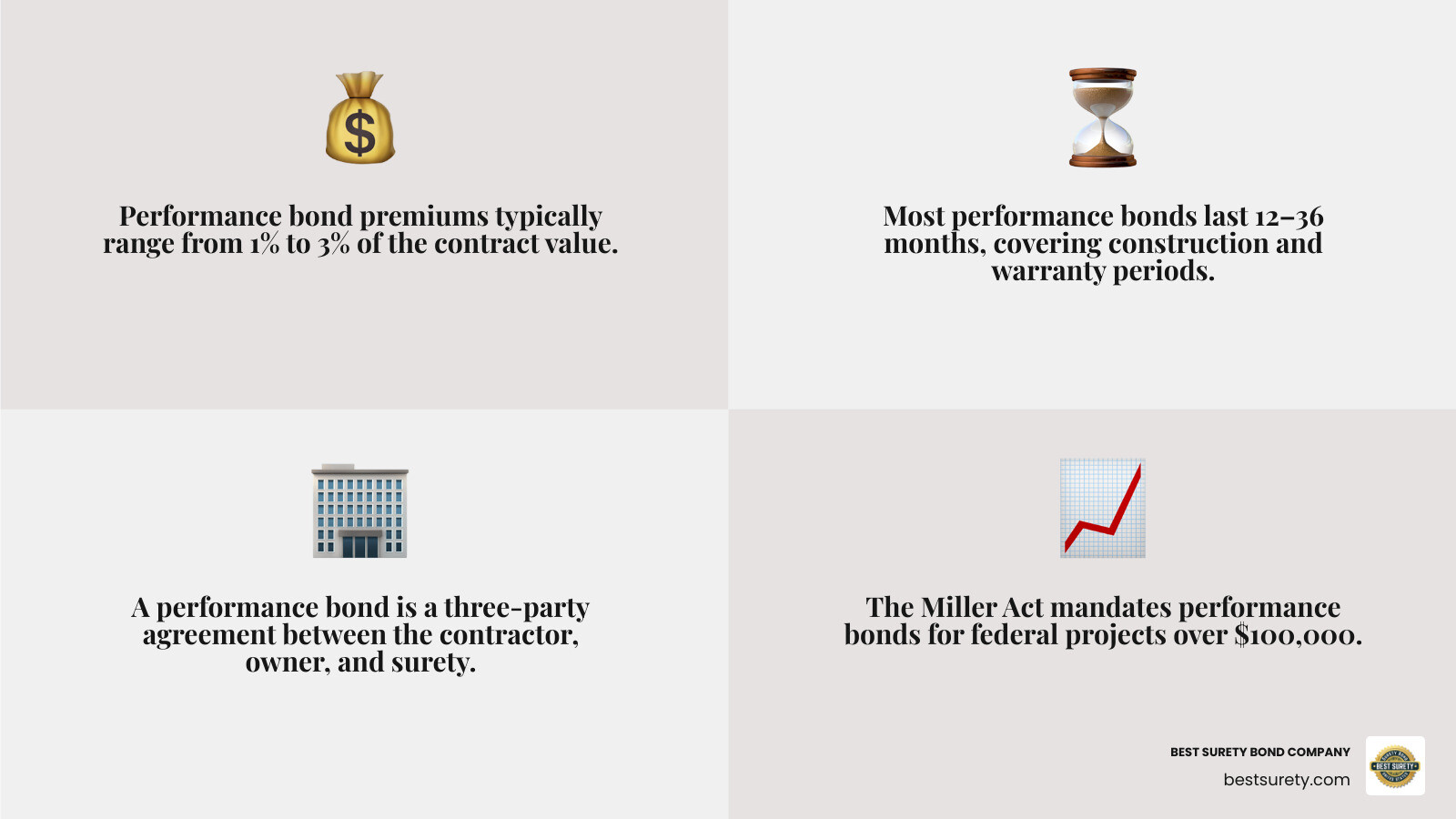

- It’s required for most public construction projects over $100,000 (Miller Act).

- There are three parties: the contractor (principal), project owner (obligee), and surety company.

- Typical cost: 1%–3% of the project value.

- Gives owners peace of mind and helps contractors qualify for bigger jobs.

“A performance bond is a safety net—if the contractor can’t deliver, the surety steps in so the project gets completed.”

If you want less risk and more trust when hiring or bidding on contracts, you should care about performance bonds.

What Is a Performance Bond?

A performance bond is a type of surety bond that guarantees a contractor will complete a project according to the contract terms. Think of it as an insurance policy for project completion—if the contractor defaults, the surety company steps in to either finish the work or compensate the project owner for losses.

This isn’t a new concept. Performance bonds have existed since 2750 BC, with Roman surety laws dating back to around 150 AD. The basic principle remains the same: provide financial assurance that contractual obligations will be met.

Unlike a bank guarantee that simply pays out on demand, a performance bond creates a more complex relationship where the surety company actively works to ensure project completion. Here’s how they compare:

| Performance Bond | Bank Guarantee |

|---|---|

| Surety investigates claims before paying | Pays on demand without investigation |

| May complete work or hire replacement contractor | Only provides financial compensation |

| Contractor must repay surety (indemnification) | No repayment obligation |

| Involves underwriting and risk assessment | Simpler collateral-based approval |

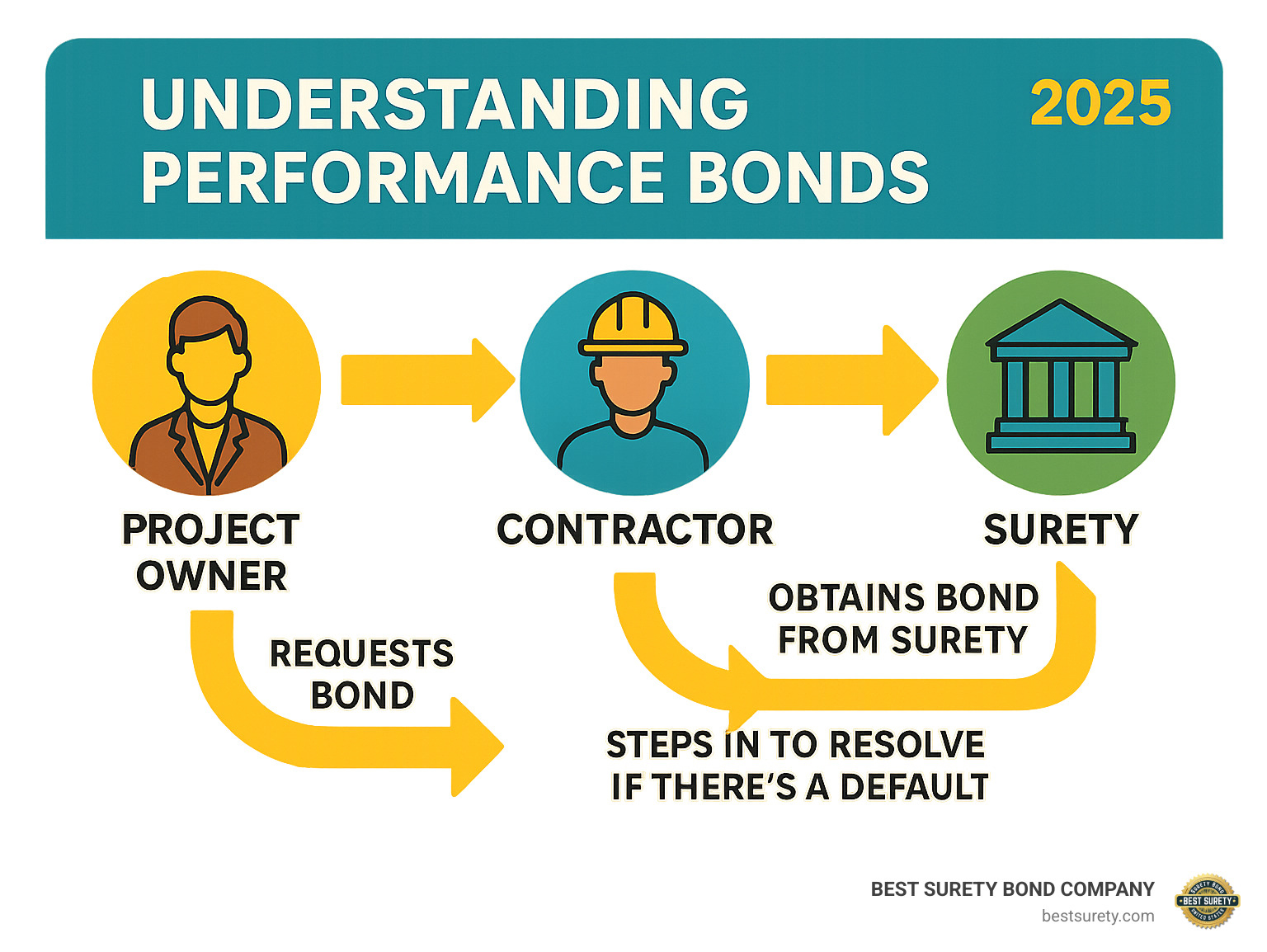

The Three Parties: Principal, Obligee, Surety

Every performance bond involves three key players:

- Principal (Contractor): The party performing the work who obtains the bond

- Obligee (Project Owner): The party requiring the bond for protection

- Surety: The company that issues the bond and guarantees performance

This three-party structure is what makes performance bonds unique. The surety doesn’t just write a check if something goes wrong—they have a vested interest in ensuring the project succeeds because they’re on the hook financially.

How a Performance Bond Works from Award to Completion

The performance bond process follows a predictable timeline:

Contract Award: Once a contractor wins a bid, they must secure a performance bond before work begins. The bond amount is typically 100% of the contract value, though it can range from 50% to 200% based on project risk.

Notice to Proceed: The project owner issues a notice to proceed only after the performance bond is in place. This protects them from the start.

Project Milestones: Throughout construction, the bond remains active. If performance issues arise, the project owner can notify the surety to investigate and potentially intervene.

Warranty Period: Most performance bonds extend beyond project completion to cover warranty obligations, typically lasting 12 months but sometimes up to 36 months.

When & Where Are Performance Bonds Required?

Performance bonds aren’t just nice-to-have—they’re often legally required. Understanding when you need one can save you from costly surprises.

Public Projects: The Miller Act mandates performance bonds for all federal construction projects exceeding $100,000. This law ensures taxpayer money is protected when the government hires contractors.

State and Local Projects: Most states have “Little Miller Acts” that mirror federal requirements for state-funded projects. These typically kick in at lower thresholds—sometimes as low as $25,000 for municipal work.

Private Sector: While not legally required, many private owners demand performance bonds for large projects. Real estate developers, manufacturers, and technology companies often require bonds to protect their investments.

International Projects: Many countries have their own bonding requirements, especially for infrastructure and energy projects funded by development banks.

Statutory Triggers You Must Know

Here are the key thresholds that trigger performance bond requirements:

- Federal Projects: $100,000 and above (Miller Act)

- State Projects: Varies by state, typically $50,000-$100,000

- Municipal Projects: Often $25,000-$50,000

- Private Projects: No legal requirement, but commonly required for projects over $100,000

Typical Projects That Demand a Performance Bond

Certain types of projects almost always require performance bonds:

Infrastructure: Roads, bridges, airports, and utilities

Commercial Buildings: Office complexes, shopping centers, hospitals

Public-Private Partnerships (P3): Energy projects, toll roads, government facilities

Technology Facilities: Data centers, manufacturing plants, research facilities

The common thread? These are all high-value, complex projects where failure would cause significant financial harm.

Getting & Pricing a Performance Bond

Securing a performance bond involves more than just filling out an application. Sureties carefully evaluate your financial strength, experience, and project specifics before issuing a bond.

Application Process: You’ll need to provide detailed information about your company, the project, and your financial position. This includes balance sheets, income statements, cash flow statements, and work schedules.

Underwriting: The surety’s underwriters assess your risk profile. They’re looking at your credit score, bonding history, financial stability, and track record of completing similar projects.

Financial Statements: For larger projects (typically over $250,000), you’ll need CPA-prepared financial statements. This isn’t optional—it’s a hard requirement from most sureties.

Bond Line: Sureties establish a “bond line” for each contractor, which includes both single project limits and aggregate limits for total bonded work.

SBA Program: Contractors who don’t qualify under standard underwriting may be eligible for the SBA’s bond guarantee program, which helps smaller and disadvantaged businesses access bonding.

Step-by-Step Application Checklist

Here’s what you need to gather before applying:

- Project Information: Bid amount, bid date, project description, timeline

- Company Details: Years in business, ownership structure, key personnel

- Financial Documents: Balance sheet, income statement, cash flow statement

- Work History: List of completed projects, references, current backlog

- Credit Information: Business and personal credit scores and history

- Indemnity Agreement: Legal document making you responsible for any claims

Cost Drivers & Ways to Save

Performance bond premiums typically range from 1% to 3% of the contract amount, but several factors influence the final cost:

Credit Score: Better credit equals lower premiums. A contractor with excellent credit might pay 1%, while one with poor credit could pay 5% or more.

Experience: Contractors with longer track records and relevant experience get better rates.

Project Risk: Complex or unusual projects carry higher premiums.

Bond Amount: Larger bonds often have lower percentage rates.

Ways to Save:

- Improve your credit score before applying

- Build a strong performance history

- Bundle performance and payment bonds

- Work with a surety that understands your industry

- Consider the SBA program if you’re a small business

Where to Find the Right Surety Partner

Not all sureties are created equal. Look for:

- Licensed Surety Companies: Ensure they’re admitted in your state

- Industry Experience: Choose sureties familiar with your type of work

- Financial Strength: Check A.M. Best ratings for financial stability

- Responsive Service: You want a surety that returns calls and processes applications quickly

You can find qualified surety professionals through the National Association of Surety Bond Producers.

What Happens If the Contractor Defaults?

When a contractor can’t complete a project, the performance bond kicks into action. Here’s how the process typically unfolds:

Default Notice: The project owner notifies the surety that the contractor has defaulted. This might be due to financial problems, poor performance, or abandonment of the project.

Cure Period: The surety usually gives the contractor a chance to fix the problems—typically 30 days to get back on track.

Surety Investigation: If the contractor can’t cure the default, the surety investigates the situation. They’ll review the contract, assess the work completed, and determine the best course of action.

Surety Response: The surety has several options:

- Payout: Compensate the owner for losses up to the bond amount

- Financing: Provide additional funds to help the contractor complete the work

- Arrangement: Hire a new contractor to finish the project

- Takeover: Assume direct control of the project completion

Filing and Managing a Claim

If you’re a project owner dealing with contractor default, here’s what you need to do:

- Document Everything: Keep detailed records of the contractor’s failures and your attempts to resolve issues

- Provide Formal Notice: Send written notice to both the contractor and surety

- Prove Your Loss: Calculate and document your actual damages

- Mitigate Damages: Take reasonable steps to minimize losses (you can’t just sit back and let costs pile up)

- Cooperate with Investigation: The surety will want to review contracts, inspect work, and interview key parties

Remember: the surety will eventually seek reimbursement from the contractor through the indemnity agreement. This means the contractor remains financially responsible even after the surety pays a claim.

Benefits, Drawbacks & Common Misconceptions

Performance bonds offer significant advantages, but they’re not without challenges. Let’s break down the reality:

Benefits for Project Owners:

- Financial protection against contractor default

- Assurance that projects will be completed

- Access to the surety’s expertise in resolving construction problems

- Protection against liens from unpaid subcontractors (when combined with payment bonds)

Benefits for Contractors:

- Access to larger, more profitable projects

- Competitive advantage in bidding

- Demonstration of financial stability and professionalism

- Potential for better relationships with project owners

Drawbacks:

- Cost: Premiums can be significant, especially for smaller contractors

- Qualification Requirements: Strict financial and experience standards

- Administrative Burden: Extensive paperwork and ongoing reporting requirements

- Cash Flow Impact: May tie up working capital through collateral requirements

Common Misconceptions:

- “Performance bonds are insurance” – They’re not. You must repay the surety for any claims

- “Bonds prevent all project problems” – They don’t prevent issues, just provide recourse when they occur

- “Sureties always pay claims quickly” – Claims are investigated thoroughly, which takes time

- “Performance bonds are only for construction” – They’re used in many industries, including IT, manufacturing, and services

Performance Bond vs Payment Bond

While often issued together, performance bonds and payment bonds serve different purposes:

Performance Bond:

- Guarantees project completion according to contract terms

- Protects the project owner from contractor default

- Covers the cost of completing unfinished work

Payment Bond:

- Guarantees payment to subcontractors, suppliers, and laborers

- Protects against mechanic’s liens

- Ensures the supply chain gets paid even if the contractor doesn’t

Most projects require both bonds because they address different risks. A contractor might complete the work (satisfying the performance bond) but fail to pay subs and suppliers (triggering the payment bond).

Performance Bond vs Bid Bond

These bonds serve different phases of the project lifecycle:

Bid Bond:

- Required during the bidding process

- Guarantees the contractor will enter into a contract if awarded the job

- Typically 5-10% of the bid amount

- Replaced by performance and payment bonds after contract award

Performance Bond:

- Required after contract award

- Guarantees project completion

- Typically 100% of the contract amount

- Remains in effect throughout the project and warranty period

Frequently Asked Questions About Performance Bonds

How long does a performance bond last and can it be extended?

Most performance bonds last 12 months, though some extend up to 36 months to cover warranty periods. The bond typically remains active until:

- The project is completed and accepted

- All warranty obligations are fulfilled

- The obligee releases the contractor from further obligations

Yes, bonds can be extended if the project timeline changes, but this usually requires surety approval and may involve additional premium payments.

Who actually pays for the bond premium?

Technically, the contractor pays the surety for the bond premium. However, in practice, contractors typically include bond costs in their project bids, so the project owner ultimately bears the cost. This is similar to how contractors include insurance costs in their bids.

For a $100,000 project with a 2.5% premium rate, the contractor pays $2,500 for the bond but includes this cost in their bid price.

Is a performance bond refundable if no claims are filed?

No, performance bond premiums are not refundable. Think of it like insurance—you pay for the coverage whether you use it or not. The premium compensates the surety for taking on the risk of your potential default.

However, some sureties offer partial refunds if a bond is canceled within the first year due to project cancellation or other circumstances beyond the contractor’s control.

Conclusion

Performance bonds are more than just paperwork—they’re powerful tools for risk mitigation and project success. Whether you’re a contractor looking to qualify for bigger jobs or a project owner seeking protection, understanding how performance bonds work is crucial.

The key takeaways:

- Performance bonds guarantee project completion, not just payment

- They’re required by law for most public projects over $100,000

- Premiums typically range from 1-3% of the contract value

- The three-party structure creates alignment between all stakeholders

- Proper preparation and strong financials lead to better rates and terms

At BEST SURETY BOND COMPANY, we understand that every project is unique. Our team of experts can guide you through the bonding process, whether you’re a first-time applicant or an experienced contractor looking to expand your bonding capacity.

Performance bonds build trust, enable growth, and protect investments. When project failures can cost millions, that peace of mind is invaluable.

Ready to learn more about how performance bonds can benefit your next project? Contact our surety services team today for a consultation custom to your specific needs.