Why Understanding Probate Bond Costs Is Critical for Every Executor

Probate bond cost varies significantly based on your credit score, estate value, and state requirements, but most qualified applicants can expect to pay between 0.5% to 1% of the total bond amount annually.

Quick Cost Breakdown:

- Excellent Credit (700+): 0.5% – 0.75% annually

- Good Credit (650-699): 0.75% – 1.5% annually

- Fair Credit (600-649): 1.5% – 3% annually

- Poor Credit (below 600): 3% – 5% annually

Example: A $100,000 probate bond costs between $500-$750 per year for most applicants with good credit.

When you’re appointed as an executor or administrator of an estate, one surprise expense often catches people off guard: the probate bond requirement. This court-mandated insurance policy protects beneficiaries and creditors from potential mismanagement of estate assets, but it comes with an annual premium that can range from a few hundred to several thousand dollars.

The cost isn’t arbitrary – it’s calculated based on specific factors including your creditworthiness, the estate’s total value, and your state’s legal requirements. In Texas, for example, probate courts often require bonds equal to the estate’s total value, while other states may have different formulas.

As Haiko de Poel, I’ve helped countless executors and administrators steer the complexities of surety bond requirements, including probate bond cost calculations across multiple states and estate sizes. My experience in financial services and regulatory compliance has shown me that understanding these costs upfront prevents delays and helps families move through the probate process more smoothly.

Introduction: What is a Probate Bond and Why is it Necessary?

A probate bond, often referred to as a fiduciary bond, executor bond, or administrator bond, is a type of court bond. Its primary purpose is to provide a financial guarantee that the individual appointed to manage an estate (the “fiduciary”) will fulfill their duties ethically and in accordance with the law. Think of it as a safety net, ensuring that if the executor or administrator mismanages funds, commits fraud, or fails to uphold their responsibilities, the beneficiaries and creditors of the estate are financially protected.

This protection is paramount. Without a probate bond, heirs could be left without recourse if an executor were to misappropriate funds, leaving them to steer a complex legal battle with little hope of recovery. The bond acts as a deterrent against misconduct and provides a mechanism for compensation should wrongdoing occur.

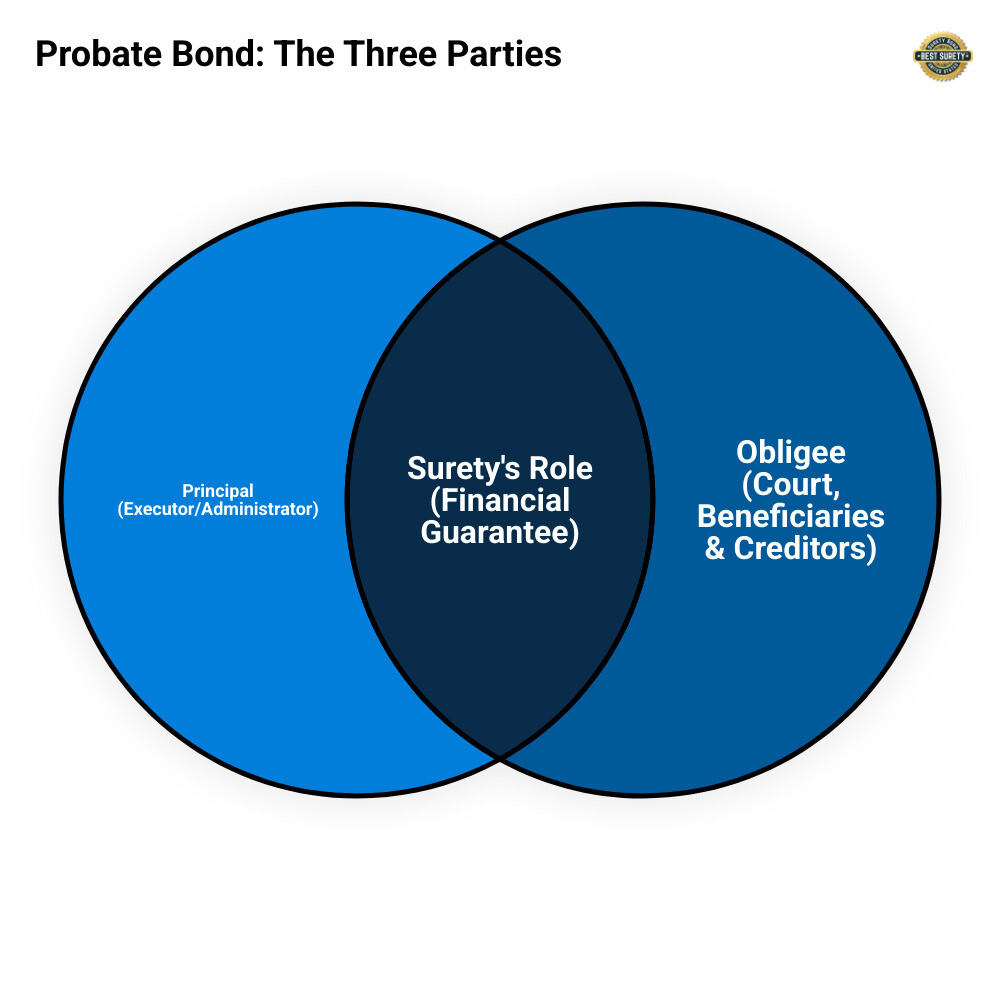

A probate bond involves three key parties:

- The Principal: This is the individual who needs the bond, such as the executor, administrator, guardian, or conservator. They are the ones responsible for managing the estate.

- The Obligee: This is the party requiring the bond, typically the probate court. The bond protects the interests of the estate’s beneficiaries and creditors, who are the ultimate beneficiaries of the bond’s protection.

- The Surety: This is the insurance company, like BEST SURETY BOND COMPANY, that issues the bond. The surety guarantees to the obligee that the principal will perform their duties as required. If the principal fails, the surety will pay out legitimate claims, and then seek reimbursement from the principal.

Understanding these roles is crucial to grasping why a probate bond is a necessary step in many estate administration processes. It’s not just a bureaucratic hurdle; it’s a vital safeguard for everyone involved.

How Much is a Probate Bond? Key Factors Influencing the Cost

When you’re appointed as an executor or administrator, one of your first concerns is likely the probate bond cost. Here’s the reality: there’s no one-size-fits-all answer. Think of it like car insurance – your premium depends on several personal factors that determine your risk level.

The cost you’ll pay is actually a bond premium, which is a small percentage of the total bond amount required by the court. While you might need a $100,000 bond, you won’t pay $100,000 – you’ll pay a fraction of that as your annual premium.

The biggest factor in determining your probate bond cost is your applicant credit score. If you have excellent credit (700+), you’re looking at premiums around 0.5% to 0.75% of the bond amount. Good credit typically means 0.75% to 1.5%, while those with credit challenges might pay 2% to 5% annually.

Estate value directly impacts your costs because it determines the bond amount the court requires. A simple $50,000 estate in Houston might only need a modest bond, while a complex $2 million estate in Dallas will require substantially more coverage.

State requirements vary significantly, and this is where our Texas expertise really matters. The Texas probate code has specific guidelines that differ from other states. Texas courts often require bonds equal to the full estate value, while some states use different formulas. Understanding these local requirements helps us get you the right coverage at the best rate.

Estate complexity also plays a role. A straightforward estate with just bank accounts and a house is different from one with multiple businesses, investment properties, and ongoing income streams. More complexity typically means higher bond requirements.

Finally, the fiduciary’s experience can influence both the court’s requirements and the surety company’s assessment. First-time executors might face slightly higher scrutiny than those who’ve managed estates before.

Understanding the Average Probate Bond Cost

For most Texas families, probate bond cost falls into predictable ranges. With good credit, you can expect to pay between 0.5% to 1% of the bond amount annually. This means a $100,000 bond costs between $500 and $1,000 per year – quite manageable for most estates.

Those with credit challenges face higher rates – typically 2% to 5% of the bond amount. While this sounds steep, the premium is an annual premium that’s paid from estate assets, not your personal funds.

The bond stays active throughout the probate process, which in Texas typically takes 6 months to 2 years depending on complexity. You’ll need to handle renewal costs each year until the court releases you from your duties. We make these renewals automatic and hassle-free.

For smaller Texas estates under $75,000 (which qualify for simplified probate procedures), bond costs are often just $150 to $300 annually. Larger estates requiring $500,000 or more in coverage might see annual premiums of $2,500 to $5,000.

How the Bond Amount is Determined

Texas probate courts determine the required bond amount using a court-ordered amount based on specific calculations. The formula typically includes the value of personal property like bank accounts, investments, vehicles, and personal belongings that you’ll be managing.

Courts also consider the annual gross income of the estate – things like rental income, business profits, or investment dividends that will flow through the estate during probate. If the estate owns rental properties in Houston or Austin, for example, that monthly income gets factored into the bond requirement.

Value of real estate may or may not be included, depending on whether you’re authorized to sell property. If the will requires you to sell the family home, that value typically gets added to your bond requirement. If you’re just transferring the deed to beneficiaries, courts might exclude real estate from the calculation.

State-specific formulas vary, but Texas requirements generally aim for comprehensive protection. According to California Probate Code §8482, similar principles apply across states – the bond should cover all assets you’ll control plus expected income.

The good news? Once we know the court’s required amount, we can typically provide same-day quotes and fast approval to get your probate process moving forward without delays.

Calculating Your Probate Bond Cost: Examples and Typical Rates

Understanding probate bond cost becomes much clearer when you see real-world examples. The beauty of probate bonds is their predictable pricing structure – once you know your credit score and the required bond amount, you can estimate your annual premium with confidence.

Let’s break down what you might expect to pay based on different bond amounts and credit tiers:

| Bond Amount | Excellent Credit (0.5%) | Good Credit (0.75%) | Fair Credit (1.5%) | Poor Credit (3%) |

|---|---|---|---|---|

| $20,000 | $100 | $150 | $300 | $600 |

| $50,000 | $250 | $375 | $750 | $1,500 |

| $100,000 | $500 | $750 | $1,500 | $3,000 |

| $250,000 | $1,250 | $1,875 | $3,750 | $7,500 |

| $500,000 | $2,500 | $3,750 | $7,500 | $15,000 |

| $1,000,000 | $5,000 | $7,500 | $15,000 | $30,000 |

| $2,000,000 | $10,000 | $15,000 | $30,000 | $60,000 |

That most surety companies have minimum premiums – typically around $175 for smaller bond amounts up to $15,000.

These numbers tell an important story. Even for substantial estates, the probate bond cost represents a small fraction of the total estate value. A $500,000 estate requiring a $500,000 bond might cost just $2,500 annually with excellent credit – less than 0.5% of the estate’s worth.

What surprises many executors is how manageable these costs really are, especially when you consider they’re reimbursable from estate assets. A $100,000 bond with good credit costs about the same as a modest monthly car payment, but provides crucial protection for all beneficiaries involved.

For comprehensive information about all our court bond services, including probate bonds and the fast approval process we’re known for, visit More info about our court bond services.

Typical Probate Bond Cost in Texas

Texas presents unique opportunities for cost-effective probate bonds, and as a Texas-based surety company, we understand the local landscape better than anyone. Whether you’re dealing with probate courts in Houston’s Harris County, Dallas County, San Antonio’s Bexar County, or Austin’s Travis County, we’ve streamlined the process to get you bonded quickly and affordably.

The probate bond cost in Texas follows the same percentage structure you see nationwide, but local court preferences can influence the overall experience. Houston probate courts, for instance, often appreciate expedited processing, which is exactly what we specialize in. Dallas courts might have specific documentation preferences, while San Antonio and Austin courts each have their own procedural nuances.

What works in your favor as a Texas resident is our deep local expertise combined with competitive rates. We’ve bonded thousands of executors and administrators across the Lone Star State, and that experience translates into smoother applications and faster approvals for you.

The absence of state income tax in Texas doesn’t directly impact your bond premium, but it does mean more of your estate’s assets stay within the estate rather than going to state coffers – a consideration that can indirectly benefit the overall probate process.

Who Pays for the Probate Bond?

Here’s where many people get pleasantly surprised: while you as the executor or administrator pay the premium upfront, it’s almost always a legitimate estate expense that gets reimbursed from estate assets.

Think of it like this – you’re not paying this cost out of your own pocket permanently. The probate bond cost is similar to attorney fees, court filing costs, or appraisal expenses. These are all necessary costs of administering the estate, and the estate itself bears these expenses.

The process typically works like this: You pay the premium initially to get bonded and fulfill the court’s requirements. You keep detailed records of this expense along with all other estate administration costs. You reimburse yourself from estate funds as you would with any other legitimate expense.

However, there’s an important distinction to understand. The premium itself is non-refundable – it’s the cost of having the bond protection in place. If a claim is ever filed against your bond and the surety company pays out due to proven mismanagement or misconduct, those funds won’t be refunded to you. In fact, you’d be obligated to reimburse the surety company for any valid claims paid.

This underscores why probate bonds are so valuable – they protect beneficiaries while giving you clear guidelines for proper estate management. The small annual cost provides peace of mind for everyone involved in the probate process.

The A-to-Z Guide to Getting Your Probate Bond

When you’re already dealing with the emotional weight of settling a loved one’s estate, the last thing you need is a complicated bond application process. That’s why we’ve streamlined everything at BEST SURETY BOND COMPANY to make getting your probate bond as painless as possible. Our fast approval process often means you can have your bond in hand the same day you apply – because we know the probate court won’t wait, and neither should you.

The beauty of working with a Texas-based company like ours is that we understand the local court requirements inside and out. Whether you’re dealing with probate in Houston’s Harris County or navigating the process in Dallas, we know exactly what each court expects and can guide you through accordingly.

The Application Process: From Quote to Approval

Getting your probate bond shouldn’t feel like solving a puzzle. We’ve designed our process to be straightforward, with same-day issuance available for most applications. Here’s how it works:

Start with our simple online application – it takes just a few minutes and gives us the basic information we need to get started. You can do this from the comfort of your home, any time of day.

Gather your court documents and send them our way. We’ll need the court order that specifies your bond amount, along with any other relevant probate paperwork. Don’t worry if you’re not sure what we need – our licensed agents will walk you through it.

We’ll handle the credit check as part of our underwriting process. Here’s some good news: for many executor and administrator bonds up to $150,000, we may not even need a full credit check. For others, a credit score of 600 or higher is typically sufficient to get you approved.

Receive your competitive quote within hours, not days. We pride ourselves on offering the lowest probate bond cost in Texas, and we’ll provide you with a clear, no-obligation quote that breaks down exactly what you’ll pay.

Pay your premium and get bonded – once you accept the quote, we process your payment and issue your bond immediately. You’ll have everything you need to submit to the probate court and move forward with your duties as executor or administrator.

Our team of licensed agents is standing by to help at every step. We’re not just processing paperwork – we’re here to make sure you understand the process and feel confident moving forward.

Can a Probate Bond Be Waived?

Sometimes you might wonder if you can skip the bond requirement altogether. The short answer is: maybe, but don’t count on it. While there are ways to request a waiver, courts have the final say, and they’re increasingly cautious about protecting beneficiaries.

If the will includes a waiver provision, that’s your best starting point. When someone writes their will, they can explicitly state that they don’t want their chosen executor to be required to post a bond. This shows the court that the deceased person trusted their executor completely.

Getting unanimous consent from all beneficiaries is another path to consider. If every adult beneficiary signs a written waiver agreeing that no bond is necessary, some courts will honor this request. Many states have specific forms for this purpose, like the example waiver form DE-142/DE-111 used in California.

But here’s the important part: even with a will provision or unanimous consent, the judge can still require a bond. Courts have broad discretion to protect estates, especially when there are minor beneficiaries, the executor lives out of state, or the estate is particularly complex or valuable.

Our advice? Always be prepared for the possibility that you’ll need a bond, even if you think it might be waived. This way, you won’t face delays in the probate process if the court decides to require one after all.

How Long Does a Probate Bond Last?

Your probate bond isn’t a one-and-done expense – it stays active for the entire duration of the probate process. This could be anywhere from several months for a simple estate to several years for more complex situations.

The timeline depends on your specific circumstances. A straightforward estate with clear beneficiaries and minimal assets might wrap up within a year. But if you’re dealing with multiple properties, business interests, or family disputes, you could be looking at a much longer process.

Annual renewal is the norm for probate bonds. Since we can’t predict exactly how long probate will take, bonds are typically issued for one-year terms. Don’t worry though – we make the renewal process simple and will remind you when it’s time to renew to ensure you maintain continuous coverage.

Your bond stays in effect until the court officially releases you from your duties. This happens after you’ve completed all your responsibilities as executor, filed your final accounting with the court, and received a formal discharge order. Only then can the bond be released.

We handle all the renewal paperwork for you, so you can focus on settling the estate rather than worrying about maintaining your bond coverage. It’s just one less thing on your already full plate during this challenging time.

What Happens if a Claim is Filed Against Your Bond?

Nobody wants to think about it, but understanding what happens if a claim is filed against your probate bond is essential knowledge for every executor or administrator. The bond exists specifically to protect beneficiaries and creditors from financial harm, and while most fiduciaries handle their duties with complete integrity, knowing the process helps you understand the seriousness of your responsibilities.

Claims against probate bonds typically arise when someone believes the executor has breached their fiduciary duties, resulting in financial loss to the estate. The most common scenarios include mismanagement of funds – perhaps mixing personal money with estate assets, making risky investments without court approval, or failing to pay legitimate creditors. More serious situations involve fraud or theft, where an executor deliberately embezzles money or sells estate property below market value for personal benefit.

Sometimes claims stem from distribution errors, where assets aren’t distributed according to the will or state law, or when an executor unreasonably delays distributions to beneficiaries. Even well-intentioned mistakes can sometimes result in claims if they cause financial harm to the estate.

When a claim is filed, the claims process begins with the aggrieved party – usually a beneficiary or creditor – submitting their complaint either to the probate court or directly to us at BEST SURETY BOND COMPANY. This isn’t taken lightly; it triggers a thorough surety investigation where we examine all relevant documents, court records, and estate transactions to determine whether the claim has merit.

Our investigation team works diligently to understand exactly what happened. We’ll review bank statements, property transactions, distribution records, and communication between all parties. We also speak with the executor to get their side of the story. This process protects everyone involved – beneficiaries get a fair hearing, and executors aren’t subjected to frivolous claims.

If our investigation determines the claim is valid, we’ll make a surety payment to beneficiaries or creditors up to the full bond amount. This is where the bond fulfills its promise – providing financial compensation for losses caused by the fiduciary’s actions. For example, if an executor improperly spent $50,000 of estate money and the court agrees this was wrongful, we would pay that amount to restore the estate’s losses.

Here’s the critical part that every executor must understand: the principal’s obligation to reimburse surety means you’re personally responsible for paying us back every dollar we pay out, plus legal fees and investigation costs. A probate bond isn’t insurance that protects you from the consequences of mistakes – it’s a guarantee that protects others from your mistakes, with you ultimately bearing the financial responsibility.

This reimbursement obligation underscores why the annual probate bond cost – typically just 0.5% to 1% of the bond amount – is such a small fraction of your total responsibility. You’re not buying protection for yourself; you’re providing a guarantee to others that you’ll handle their inheritance properly.

The good news? The vast majority of executors and administrators complete their duties without any claims. By keeping detailed records, seeking court approval for major decisions, maintaining separate estate accounts, and communicating clearly with beneficiaries, you can fulfill your fiduciary duties successfully and never worry about bond claims at all.

Get Your Fast, Affordable Probate Bond Today

When you’re dealing with the loss of a loved one and the complexities of estate administration, the last thing you need is additional stress from bond requirements. Understanding probate bond cost and securing the right coverage is essential for protecting beneficiaries and fulfilling your fiduciary duties, but it doesn’t have to be overwhelming.

At BEST SURETY BOND COMPANY, we recognize that you’re already carrying a heavy load during this difficult time. That’s why we’ve streamlined our entire process to provide fast approvals and same-day issuance when you need it most. As Texas-based experts serving Houston, Dallas, San Antonio, and Austin with national reach across all 50 states, we combine local knowledge with the authority to handle probate bonds anywhere in the country.

Our commitment goes beyond just issuing bonds. We offer human service coupled with digital convenience, meaning you can get instant online quotes while still having access to licensed agents who understand the nuances of probate law in your specific jurisdiction. Whether you’re dealing with a small estate in Harris County or a complex multi-million dollar estate that spans multiple states, we have the expertise to guide you through the process efficiently.

The probate bond cost represents a small investment compared to the peace of mind it provides. When beneficiaries see that you’ve secured proper bonding, it demonstrates your commitment to transparent, responsible estate management. This financial protection mechanism often prevents disputes before they start and shows the court that you take your fiduciary responsibilities seriously.

We pride ourselves on offering the lowest rates in Texas while maintaining the fastest turnaround times in the industry. Our digital platform allows for instant online approval in many cases, but our licensed agents are always available when you need personal guidance through more complex situations.

Don’t let bond requirements delay the probate process or add unnecessary anxiety to an already challenging time. We’re here to make this step as smooth and affordable as possible, so you can focus on what matters most – honoring your loved one’s wishes and serving the beneficiaries with integrity.

Ready to secure your probate bond with Texas’s most trusted surety provider?

Get Your Free Probate Bond Quote Now

Our licensed agents are standing by to provide personalized service and ensure you get bonded today with competitive rates and the reliability your situation demands.