Understanding Release of Lien Bonds in Construction and Real Estate

A Release of lien bond is a court-ordered surety bond that removes a mechanic’s lien from your property by transferring the financial liability to a bonding company. This allows property owners to clear their title and proceed with sales, refinancing, or construction projects while the underlying payment dispute gets resolved.

Quick Facts About Release of Lien Bonds:

- Purpose: Removes mechanic’s liens from property titles

- Bond Amount: Typically 1.5x to 2x the lien amount (varies by state)

- Premium Cost: 1-5% of the bond amount

- Processing Time: Can be issued within 24-48 hours with proper documentation

- Who Needs It: Property owners, contractors, and developers facing lien disputes

- Alternative Names: Mechanic’s lien bond, lien discharge bond, or “bonding off” a lien

With 49% of contractors not getting paid on time according to industry reports, mechanic’s liens have become a common problem. Over 60,000 mechanics liens were filed in 2021 alone, creating serious headaches for property owners trying to sell, refinance, or complete construction projects.

When a contractor files a lien against your property for unpaid work, it creates a “cloud” on your title that can stop transactions dead in their tracks. A release of lien bond essentially says “we’ll guarantee payment if the claim is valid – just remove the lien from the property.”

I’m Haiko de Poel, and through my experience scaling companies across construction, real estate, and financial services, I’ve seen how release of lien bonds can quickly resolve payment disputes that would otherwise drag on for months. Having worked with contractors and property developers nationwide, I understand the urgent need to clear title issues fast so business can continue moving forward.

What is a Release of Lien Bond and How Does It Work?

Imagine a contractor slaps a mechanic’s lien on your property right before a sale. Suddenly, the deal is on hold, and you’re stuck. This is where a Release of lien bond (also known as a mechanic’s lien bond or discharge of lien bond) comes to the rescue. It’s a powerful tool in the construction industry, especially in busy markets like Texas, to keep projects and property transactions moving.

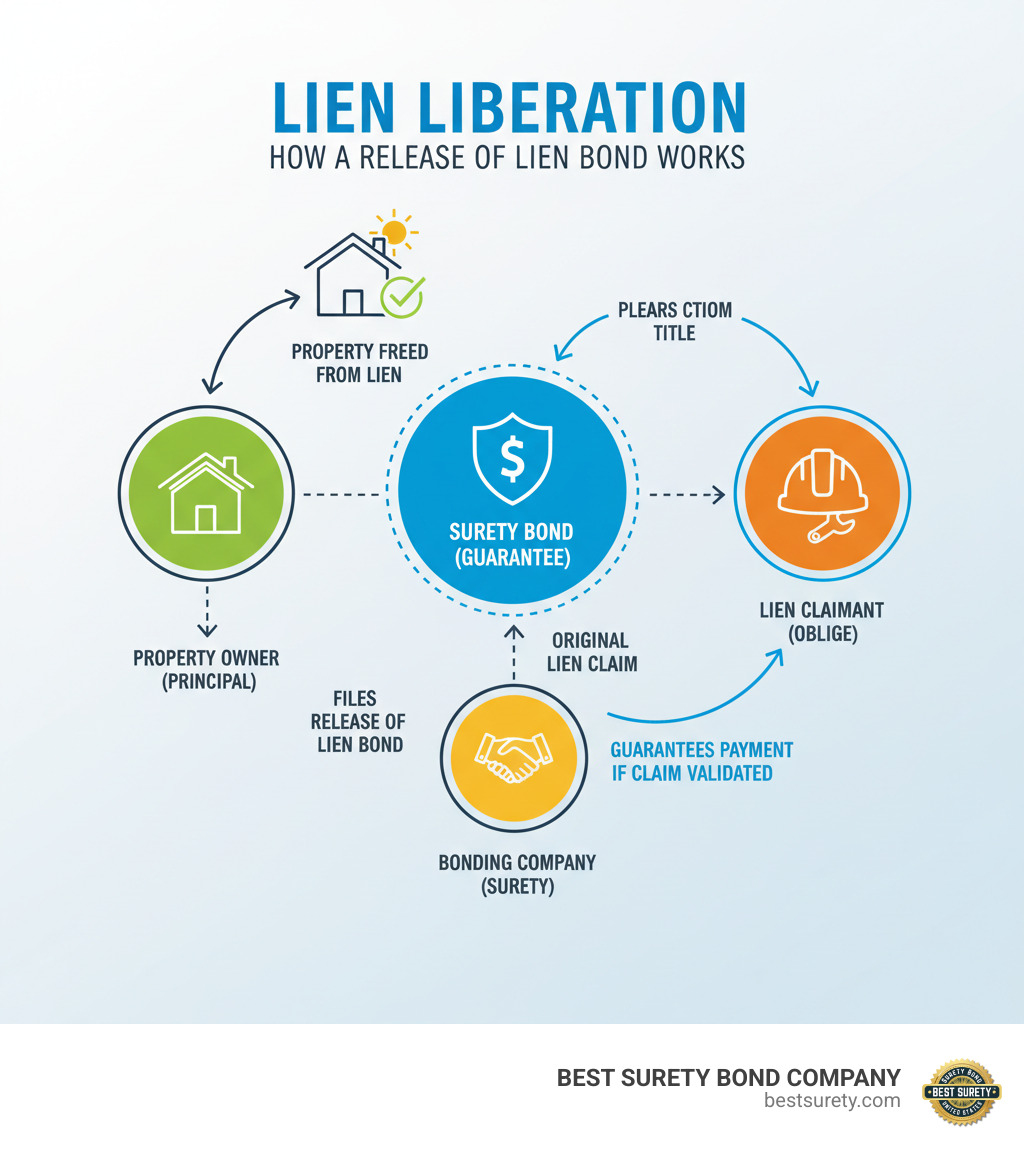

At its core, a Release of lien bond is a type of court bond that allows a property owner or general contractor to “bond off” a lien. Bonding off means transferring the financial claim from your physical property to a surety bond. The bond then acts as a financial guarantee that the lienholder will still get paid if their claim is eventually proven valid.

This arrangement involves three key parties:

- The Principal: This is you, the property owner or general contractor, who needs the lien removed. You purchase the bond.

- The Obligee: This is the lien claimant (subcontractor or supplier) who filed the original mechanic’s lien.

- The Surety: This is the bonding company (like us at BEST SURETY BOND COMPANY) that issues the bond and guarantees payment on a valid claim.

This three-party agreement is crucial for construction projects across Texas, from Houston to Dallas and Austin. It ensures payment disputes don’t halt progress or property sales. Understanding court bonds, specifically release of lien bonds, is essential for smooth operations.

The Key Difference: Mechanic’s Lien vs. Release of Lien Bond

To appreciate the power of a Release of lien bond, let’s clarify how it differs from the mechanic’s lien it replaces.

| Feature | Mechanic’s Lien | Release of Lien Bond |

|---|---|---|

| Security | Directly encumbers the physical property | Financial guarantee from a surety company |

| Impact on Property | Creates a “cloud” on the title, hindering sales/refinancing | Removes encumbrance, clearing the property title |

| Foreclosure Risk | Can lead to foreclosure if the debt is not paid | Eliminates direct foreclosure risk against the property |

| Dispute Resolution | Forces the property owner to resolve the debt to free the property | Transfers the dispute from the property to the bond, buying time for resolution |

| Nature | A legal claim against assets used to satisfy a debt | A promise to pay a valid claim, backed by a third party |

A mechanic’s lien protects contractors from nonpayment by attaching a legal claim to the property’s deed. This makes it hard to sell or refinance and acts as a powerful collection tool, but it’s a major roadblock for owners.

A Release of lien bond, on the other hand, doesn’t dispute the claim’s validity. Instead, it changes where the claim is secured. The claim shifts from a burden on your property to being backed by the financial strength of a surety company. This “lien liberation” is a game-changer for property owners and general contractors in Texas and beyond.

Benefits for Property Owners and Contractors

The advantages of obtaining a Release of lien bond are numerous:

- Clear Property Title: This is the primary benefit. The bond removes the lien, clearing the ‘cloud’ on your title so you can sell, refinance, or secure new financing.

- Facilitate Property Sale: A bond allows a stalled property sale to proceed without delay, preventing lost opportunities.

- Secure Project Financing: Lenders hesitate to finance properties with liens. A bond clears the title, making it easier to secure funds for construction.

- Avoid Foreclosure: An unpaid lien can lead to foreclosure. A bond removes this direct threat, buying you time to resolve the dispute.

- Fulfill Contractual Obligations: Many contracts require contractors to keep property lien-free. A bond helps meet this obligation, preserving your reputation and avoiding breach of contract.

- Project Continuity: A lien can halt a project by disrupting cash flow and delaying inspections. Bonding it off ensures work continues, keeping timelines and budgets on track.

- Buy Time for Dispute Resolution: The bond frees your property without admitting fault. It buys you time to negotiate, gather evidence, and resolve the dispute without the pressure of a frozen asset.

A Release of lien bond provides flexibility and control, allowing you to address payment disputes on your terms while protecting your assets and business interests.

The Process of Obtaining a Release of Lien Bond

Getting a Release of lien bond doesn’t have to be a bureaucratic nightmare. At BEST SURETY BOND COMPANY, we’ve helped thousands of property owners and contractors across Texas and nationwide steer this process smoothly. Whether you’re dealing with a lien on a Houston high-rise or a residential project in Austin, we understand the urgency and have streamlined our process to get you bonded fast.

The journey from lien headache to clear title involves three straightforward steps: application, underwriting, and issuance. We pride ourselves on fast approvals and often same-day issuance because we know that when a lien is clouding your property title, every day counts.

Step 1: Determining the Bond Amount and Cost

Before we can issue your Release of lien bond, we need to determine the required coverage and your cost. The bond amount isn’t a simple match to the lien amount.

State statutes dictate the required bond amount, often requiring it to be higher than the lien to cover potential interest and legal fees. In Texas, you’ll need a bond that’s 1.5 times the mechanic’s lien amount. So a $100,000 lien requires a $150,000 bond.

Other states have their own formulas: Arizona requires 150% of the demand, and New York sets it at 110%. The court where the lien was filed will confirm the exact required bond amount.

Now, for the good news about costs. The bond premium—what you actually pay—is a small percentage of the total bond amount, typically 1-5%. Our programs start at less than 1% for qualified applicants. On that $150,000 Texas bond, you might only pay $1,500 to $7,500 to free your property.

One catch is collateral requirements. Because Release of lien bonds are financial guarantees, most surety companies (including us) typically require 100% collateral. This could be cash, letters of credit, or marketable securities. It’s our insurance policy—if we have to pay a claim, we can recover our losses from your collateral.

Step 2: Meeting Underwriting Requirements for a Release of Lien Bond

Our underwriting process assesses the risk of issuing your bond. We want to get you bonded quickly while protecting everyone involved. We’ll look at the bond amount, your credit history (corporate and personal), your net worth, and the specifics of your case.

To speed things along, you’ll need to gather some documentation. Required documents include a completed application (our online form is designed for speed), a copy of the filed lien, any court documents, business and personal financial statements, and recent bank statements. We’ll also run a credit score review.

We don’t automatically turn away applicants with less-than-perfect credit. Our bad credit bonding options mean we consider each situation individually. If you have strong financials but a bumpy credit history, give us a call. Our expertise in commercial surety bonds allows us to steer complex situations that other companies might decline.

Step 3: Filing the Bond and Notifying the Claimant

Once your Release of lien bond is issued, it must be properly filed and all parties notified to be legally effective.

Filing with the court is the crucial first step. Your bond must be filed with the same court where the original lien was recorded or with the county recorder’s office where your property is located. This filing officially replaces the lien on your property with the bond.

Next comes serving notice to the lienholder—a critical step. The lien claimant must be properly notified that a bond has been filed, and state laws are specific about how this notice must be served. This ensures the claimant knows their security has shifted from your property to the bond.

Legal compliance isn’t optional. Each state has specific procedures, and Texas has its own particular requirements. Getting these steps wrong can render your bond ineffective. We always recommend working with an attorney familiar with your state’s property laws, especially given the nuances of the Texas Property Code.

Consequences of improper filing can be severe—your lien might not actually be released. That’s why we work closely with our clients to ensure every step is handled correctly. Once these final steps are completed, the lien is officially removed, and you’re free to sell, refinance, or continue your project.

Navigating Claims, Legalities, and Alternatives

Getting a Release of lien bond is just the beginning of the story. Understanding what happens next—how claims work, what the law requires, and when other surety solutions might be better—can save you from costly surprises down the road.

How Bond Claims Work with a Release of Lien Bond

Think of a Release of lien bond as changing the rules of the game, not ending it. The lien claimant still has the right to pursue payment, but now they’re coming after the bond instead of your property. This shift gives you breathing room while protecting the contractor’s financial interests.

When the underlying payment dispute isn’t resolved through negotiation, the lien claimant will file a formal claim against your bond. This starts our investigation process, where we review all documentation, interview both parties, and determine whether the claim has merit. It’s thorough but fair—we want to make sure legitimate claims get paid while protecting our clients from invalid demands.

Here’s what many property owners don’t realize: a surety bond is not insurance. When you sign the indemnity agreement, you’re promising to reimburse us for any valid claims we pay out, plus legal expenses. The bond protects the claimant and frees your property, but you’re still ultimately responsible for legitimate debts.

The good news is that claimants have limited time to pursue their rights. Most states require lien claimants to bring suit against the bond within one year of receiving notice. This statute of limitations provides certainty and prevents claims from dragging on indefinitely.

State-Specific Legal Requirements (Focus on Texas)

Every state has its own quirks when it comes to Release of lien bonds, and Texas is no exception. The Texas Property Code governs how mechanics’ liens work and how you can bond them off, but there are some important nuances that catch people off guard.

In Texas, your bond amount must be 1.5 times the lien amount—not just the exact amount owed. So if you’re facing a $50,000 lien, you’ll need a $75,000 bond. This extra cushion covers potential interest, legal fees, and court costs that might accumulate during the dispute resolution process.

But here’s a critical point that surprises many Texas property owners: posting a bond doesn’t eliminate your personal liability. The bond primarily serves to free your property from the lien, but you can still be held personally responsible for valid claims. This is different from some other states and underscores why working with experienced professionals matters.

Compare this to Nebraska, where statute 52-142 requires bonds to be 115% of the claimed amount, and the release of real estate from the lien transfers all claimant rights to the bond. Each state has developed its own approach to balancing property owner and contractor interests.

Having served clients across all 50 states, we understand these state-by-state differences intimately. Whether you’re dealing with a residential project in Houston or a commercial development in Dallas, our team ensures full compliance with Texas requirements. For contractors working on multiple projects, understanding these variations is essential, especially when managing various Texas contractor bonds.

Are There Alternatives to a Release of Lien Bond?

While a Release of lien bond is often the fastest way to clear your property title, it’s worth understanding when other surety solutions might be more appropriate for your situation.

On public construction projects, mechanics’ liens generally can’t be filed against government property in the first place. Instead, subcontractors and suppliers are protected by payment bonds—a type of construction surety bond that guarantees they’ll get paid even if the general contractor defaults. If you’re working on public projects, payment bonds provide the protection that mechanics’ liens offer on private work.

For ongoing construction projects, performance bonds and bid bonds might be required by contract to guarantee various aspects of project completion. These bonds work alongside payment bonds to create a comprehensive safety net for all parties involved.

The key insight is that when mechanics’ liens can be filed against private property—which is most residential and commercial work in Texas—a Release of lien bond remains your most direct path to freedom. It’s specifically designed to handle the unique challenge of removing an existing lien while preserving everyone’s financial rights.

At BEST SURETY BOND COMPANY, we specialize in the full spectrum of construction surety bonds and can quickly determine which solution best fits your specific situation. Sometimes the answer is bonding off an existing lien; other times it’s putting protective bonds in place before problems arise.

Frequently Asked Questions about Release of Lien Bonds

When property owners and contractors in Texas and beyond face lien issues, they have questions about how Release of lien bonds work. Having helped thousands of clients, we’ve heard just about every concern. Let me address the most common ones.

Who benefits most from a release of lien bond?

A Release of lien bond creates a win-win situation. While property owners usually initiate the process, the benefits ripple out to all parties.

Property owners get the most immediate relief. You regain control of your property, meaning you can move forward with a pending sale, secure refinancing, or continue construction without the lien hanging over your head. For homeowners in Houston or developers in Dallas, this freedom is invaluable.

General contractors find these bonds essential for maintaining their reputation and meeting contractual obligations. Most construction contracts require you to keep the owner’s property lien-free. A bond helps you fulfill your duties and keep projects moving.

Developers know that delays can be costly. A single lien can derail financing or halt construction. The bond ensures project continuity when stakes are highest.

Even lien claimants benefit. While the lien is removed from the property, the claim is now backed by the financial strength of a surety company like BEST SURETY BOND COMPANY. This often means faster resolution if the claim is valid.

What are the potential risks or disadvantages?

While these bonds are useful, they’re not magic wands that make problems disappear.

The bond premium cost is your first consideration. You’ll pay a non-refundable premium of 1-5% of the bond amount. This money is gone regardless of how the dispute resolves, though it’s often a small price to pay for freeing up a valuable property.

Collateral requirements can tie up significant assets. Since we typically require 100% collateral, your cash or other assets will be held until the dispute is resolved and the bond is discharged. This can impact your liquidity.

Crucially, the underlying debt doesn’t vanish. The bond removes the lien from your property, but you’re still responsible for resolving the payment dispute. If the claim is valid, you’ll need to pay it and reimburse the surety for any amounts paid out.

There’s also potential for continued litigation. The bond prevents foreclosure on your property, but it doesn’t end the legal battle. The dispute simply shifts from being about your property to being about the bond.

How long does the process take to get a bond?

Time is usually of the essence when you need a Release of lien bond. The good news is that with the right surety partner, the process can move remarkably quickly.

At BEST SURETY BOND COMPANY, we’ve streamlined our process because we understand the urgency. With complete documentation, we can often issue your bond within 24-48 hours. Our online application is designed for speed, and our experienced underwriters prioritize these time-sensitive situations.

The complexity of your case affects timing. A simple residential lien moves faster than a complex commercial dispute. Your financial strength and credit history also play a role.

We pride ourselves on same-day issuance whenever possible, especially for our Texas clients. Our fast approval process has helped contractors in Houston meet critical deadlines and property owners across the state close sales that might otherwise have fallen through.

The key is having your documentation ready: the filed lien, court documents, financial statements, and a completed application. When you come prepared, we can get you bonded and back to business fast.

Get Your Texas Release of Lien Bond Fast

When a mechanic’s lien suddenly appears on your property, it can feel like hitting a brick wall at full speed. Whether you’re trying to close on a home sale in Houston, secure financing for a Dallas development, or keep a construction project moving in Austin, that lien creates an immediate roadblock. But here’s the good news: a Release of lien bond is your express lane back to freedom.

The benefits are clear and immediate. You’ll have a clear property title that opens doors for sales and refinancing. Your project continuity stays intact, keeping timelines and budgets on track. Most importantly, you can facilitate property sales without the anxiety of last-minute surprises that could derail your transaction.

At BEST SURETY BOND COMPANY, we understand that when a lien hits your property, time isn’t just money—it’s everything. That’s why we’ve built our entire process around fast approvals and competitive rates that work for Texas contractors and property owners. We’re not just another national company trying to serve Texas from afar. We’re Houston’s trusted surety provider with deep roots in the Lone Star State, but with the national reach and licensing in all 50 states to handle your projects wherever they take you.

Our local expertise makes all the difference when navigating Texas Property Code requirements. We know that Texas requires bond amounts at 1.5 times the lien amount, and we understand the nuances that can trip up out-of-state providers. But we combine that Texas know-how with the efficiency and technology that gets you bonded faster than anyone else in the industry.

When you’re ready to liberate your property from that lien, our friendly and licensed agents are standing by to guide you through every step. We’ve streamlined the entire process—from your initial quote to final bond issuance—because we know you need solutions, not more complications.

Don’t let a mechanic’s lien hold your property hostage any longer. Whether you’re dealing with a residential project in San Antonio or a commercial development anywhere across the nation, we have the experience and speed to get you back on track.

Get Bonded Today and experience the fastest turnaround in the industry with the most affordable rates for small businesses and contractors in Texas and nationwide. Your property freedom is just one phone call away.