Understanding Small Business Bonds: Your Complete Guide

Small business bonds come in two main types that serve different purposes for business owners. Here’s what you need to know:

Surety Bonds (Business Protection):

- License & permit bonds – Required for business licensing

- Performance bonds – Guarantee contract completion

- Fidelity bonds – Protect against employee theft

- Median cost: $10-$90 per month depending on type

- Protect clients and the public from business misconduct

Investment Bonds (Financing Tool):

- Small Business Investment Bonds (like SMBX)

- Minimum investment: $10

- Potential returns: Up to 9% interest

- Help businesses raise capital from community investors

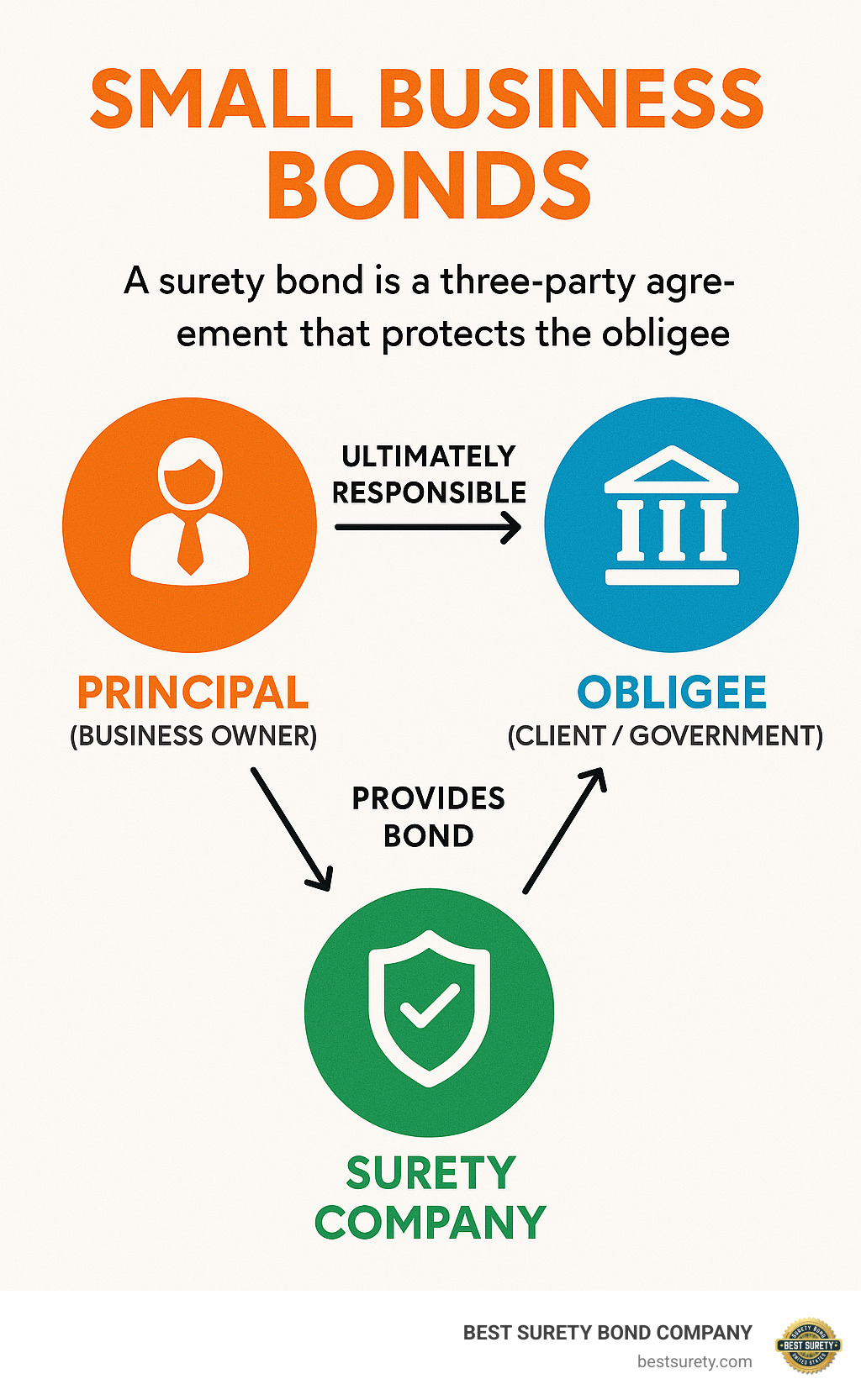

The most common type for business owners are surety bonds – three-party agreements that guarantee your business will fulfill its obligations. When you’re “bonded,” it means you have a surety company backing your promise to complete work or comply with regulations.

Many businesses must be bonded to operate legally. Construction contractors need performance bonds for projects. Service businesses often require license bonds. Even businesses offering employee benefits need ERISA bonds covering at least 10% of plan assets.

Why bonds matter for your business:

- Legal compliance – Required for licensing in many industries

- Client trust – Proves financial stability and accountability

- Competitive advantage – Many clients require bonded contractors

- Consumer protection – Guarantees clients will be compensated if you fail to deliver

As an entrepreneur who has scaled ventures across fintech, insurance, and franchise development, I’ve seen how small business bonds can make or break a company’s ability to secure contracts and build credibility. My experience with operational innovation and growth architecture has shown me that proper bonding is often the difference between landing that big contract and watching it go to a competitor.

The Essential Guide to Surety & Commercial Bonds for Businesses

Picture this: You’re a contractor who just finished a kitchen renovation, and you’re handing over the keys to a beaming homeowner. That moment of trust and satisfaction? That’s exactly what a surety bond helps create between your business and your clients.

A surety bond is essentially a three-party promise that protects your customers from getting burned if your business can’t deliver. Think of it as having a financially strong friend vouch for you – someone who’s willing to step in and make things right if you can’t.

Here’s how the three-party system works: You (the principal) need to prove you can complete a job. Your client or the government (the obligee) wants assurance you’ll follow through. A surety company like Best Surety Bond Company (the surety) steps in to guarantee your promise.

When you purchase a surety bond, you’re getting a powerful endorsement from a company with deep pockets. If something goes wrong and you can’t fulfill your obligations, the surety company will step in to compensate the harmed party. But here’s the catch – you’ll need to pay them back later.

This system creates a win-win situation. Your clients get financial recourse if things go sideways, and you get the credibility that comes with being backed by a reputable surety company. It’s particularly valuable for businesses where trust is everything – construction, home services, and professional consulting.

What Does It Mean for a Business to Be ‘Bonded’?

When someone asks if your business is bonded, they’re really asking: “Do you have a financial guarantee backing up your promises?” Being bonded is like having a co-signer with excellent credit – it shows you’re serious about your commitments.

Being bonded sends a clear message to potential clients. It tells them you’ve passed the financial and character requirements of a surety company. Most surety companies won’t bond businesses with poor credit or questionable track records, so having a bond is like carrying a badge of professional credibility.

Your clients also know there’s a clear path for accountability if something goes wrong. Instead of having to chase you down for damages or incomplete work, they can file a claim with your surety company and get compensated quickly.

Many large corporations and government agencies will only work with bonded contractors. It’s not just about trust – it’s about legal compliance and risk management. Being bonded can literally be the difference between landing a $50,000 contract and watching it go to your competitor.

Common Types of Small Business Surety Bonds

Different situations call for different types of bonds, and understanding which one you need can save you time and money. License and permit bonds are probably the most common – these guarantee you’ll follow industry regulations and protect consumers from unprofessional conduct. Whether you’re an auto dealer, mortgage broker, or contractor, chances are you’ll need one of these to operate legally.

Performance bonds are the workhorses of the construction industry. They guarantee you’ll complete your project according to contract terms, which gives project owners peace of mind when hiring contractors. These are especially common for government contracts, where taxpayer money is on the line.

If you’re bidding on projects, you’ll likely encounter bid bonds. These guarantee that if you win the bid, you’ll actually sign the contract and start work. They protect project owners from contractors who submit lowball bids just to waste everyone’s time.

Payment bonds often go hand-in-hand with performance bonds. They guarantee you’ll pay your subcontractors and suppliers, protecting the entire supply chain on large projects. Federal construction projects over $100,000 typically require both performance and payment bonds.

For businesses that handle cash or work in client facilities, fidelity bonds and janitorial bonds protect against employee theft. These are relatively inexpensive (often around $10-90 per month) but provide crucial protection for service businesses.

Finally, if you offer employee benefits, ERISA bonds are federally required. They must cover at least 10% of your plan assets, with minimums of $1,000 and maximums that can reach $1,000,000 for plans holding company stock.

Surety Bonds vs. Business Insurance: What’s the Key Difference?

Here’s where many business owners get confused – surety bonds and insurance serve completely different purposes, even though they both involve paying premiums for protection.

Insurance protects your business from external risks like fire, theft, or lawsuits. When you file an insurance claim, the insurance company pays out and absorbs the loss. You don’t have to pay them back.

Surety bonds protect others from your business. If a claim is filed against your bond, the surety company pays the claimant, but then comes after you for reimbursement. You’re ultimately responsible for any losses.

| Feature | Surety Bonds | Commercial Insurance |

|---|---|---|

| Purpose | Guarantee performance/compliance | Protect against losses |

| Parties | Three-party agreement | Two-party agreement |

| Who’s Protected | Clients and public | The business itself |

| Claims Process | Surety pays, business reimburses | Insurance pays, no reimbursement |

| Cost Structure | Annual premium (like credit) | Premium for coverage |

| Subrogation | Yes – you must repay claims | No – insurance absorbs losses |

Think of surety bonds like a line of credit – you’re borrowing the surety company’s financial strength to guarantee your promises. Insurance is more like buying protection for your own assets.

The good news? Small business bonds are typically much cheaper than insurance. Many bonds cost just $10-90 per month, making them an affordable way to boost your credibility and meet legal requirements. Most successful businesses need both bonds and insurance to be fully protected.

How to Get Your Small Business Bonded Quickly and Easily

Getting your small business bonds doesn’t have to feel like climbing Mount Everest. With the right preparation and a trusted surety provider, you can often get approved and bonded the same day you apply. I’ve helped thousands of Texas business owners steer this process, and I’m here to show you exactly how to make it smooth and stress-free.

The secret to fast approval? Having your paperwork ready and working with experienced professionals who understand your industry. When you come prepared, we can often issue simple license bonds within hours, not days.

Here’s what you’ll want to gather before starting your application: your business license and registration documents, financial statements from the last three years, your personal and business credit information, and specific details about the bond type and amount you need. If you’re applying for a performance bond, you’ll also need your contract details and project specifications.

Timeline expectations vary by bond type, but here’s what we typically see: Simple license bonds often get same-day approval, especially for established businesses with good credit. Performance bonds usually take 1-3 business days as they require more detailed underwriting. Large or complex bonds might need 3-5 business days for thorough review.

The key difference between a smooth application and a frustrating one? Preparation. When you have all your documentation organized and work with a surety company that knows your industry inside and out, the process becomes surprisingly straightforward.

The Application Process: A Simple Walkthrough

Think of getting bonded like applying for a business loan, but faster and with less paperwork. The process follows a logical sequence that we’ve refined over years of helping Texas businesses get bonded quickly.

First, you’ll need to determine your exact bond requirements. This information is usually crystal clear in your contract, license application, or regulatory requirements. Don’t guess – get the specific bond type and amount in writing. A $10,000 license bond and a $10,000 performance bond are completely different animals.

Next comes choosing your surety provider. Look for a company with fast turnaround times, competitive rates, and deep experience in your industry. You want someone who speaks your language and understands your business challenges. Strong financial ratings and excellent customer service should be non-negotiables.

The application itself asks for straightforward business information: your company structure, financial history, personal information for business owners, and details about the work or license being bonded. Most applications take 10-15 minutes to complete online.

Documentation submission depends on your bond size and type. Smaller bonds might only need basic business information, while larger bonds require audited financial statements, bank statements, tax returns, and references from clients or suppliers. We’ll tell you exactly what you need upfront – no surprises.

During underwriting review, our team evaluates your credit history, financial strength, industry experience, and track record. This isn’t about finding reasons to say no – it’s about understanding your business so we can offer the best possible terms.

Once approved, you’ll pay the premium, receive your bond document, and file it with the obligee (the client or government agency requiring the bond). We’ll walk you through the filing process and make sure you keep copies for your records.

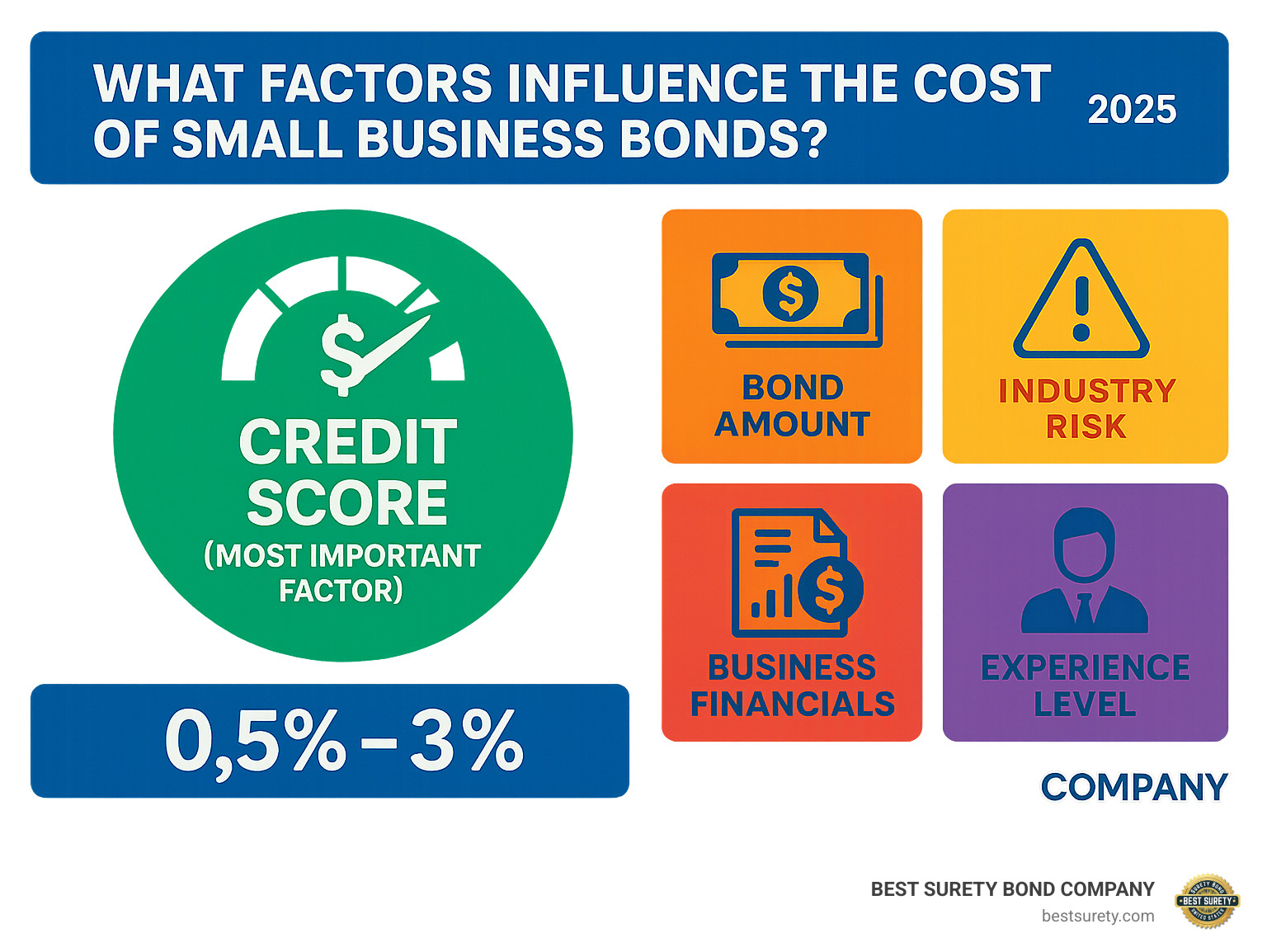

What Factors Influence the Cost of Small Business Bonds?

Understanding bond pricing helps you budget accurately and know what to expect. Small business bonds typically cost between 0.5% and 3% of the bond amount annually, but several factors determine where you’ll land in that range.

Your credit score is the biggest factor – and I mean the biggest. Excellent credit (750+) can get you rates as low as 0.5% to 1% of the bond amount. Good credit (650-749) typically sees 1% to 2% rates. Fair credit (550-649) usually means 2% to 3% of the bond amount. Poor credit (below 550) often pushes you to 3% or higher, and you might need to provide collateral.

Bond amount plays a role too, but not always how you’d expect. Smaller bonds often have minimum premiums, so a $5,000 bond might cost the same as a $10,000 bond. Larger bonds may qualify for volume discounts, but very large bonds require more extensive underwriting that can increase costs.

Industry risk level significantly impacts pricing. Low-risk industries like office-based services get better rates than high-risk industries like construction or demolition. New or emerging industries often face higher rates until underwriters understand the risk profile better.

Your business’s financial strength matters enormously. Strong cash flow and profitability earn you lower rates, while weak financials trigger higher rates or collateral requirements. Established businesses almost always get better rates than startups.

Experience and track record round out the major factors. A proven track record gets you preferred pricing, while new businesses typically face higher rates initially. Previous bond claims can significantly increase your rates – sometimes permanently.

Here are some real examples from our Texas clients: A Houston electrician with excellent credit paid just $150 annually for a $15,000 license bond (1%). A Dallas contractor with fair credit paid $900 for a $30,000 performance bond (3%). A San Antonio janitorial service paid only $125 for a $10,000 business service bond.

The good news? Even if you don’t qualify for the lowest rates initially, building a strong relationship with your surety provider and maintaining good business practices can earn you better rates over time.

Government Programs and Resources for Bonding

Access to affordable bonding shouldn’t stop a qualified company from winning work. Several federal and local initiatives can lower both the cost and the qualifying hurdle—especially for new firms or owners with imperfect credit histories.

SBA Surety Bond Guarantee Program

The cornerstone resource is the Small Business Administration (SBA) Surety Bond Guarantee Program. Rather than issuing bonds directly, the SBA promises to reimburse up to 90 % of a surety’s loss, which encourages carriers to approve applicants they might otherwise decline. Key details:

- Contract limits: up to $9 million for private jobs and $14 million for federal projects

- Covered bond types: bid, performance, payment, and maintenance

- Fees: 0.6 % of the contract price for performance/payment bonds; no fee for bid-bond guarantees

- Eligibility: meet SBA size standards for your NAICS code

State & Local Support

Departments of Transportation, Small Business Development Centers (SBDCs), and economic-development offices across Texas run “bond-readiness” workshops, free counseling, and even low-interest premium-financing programs. A quick call to your regional SBDC can uncover class dates and application checklists.

How BEST SURETY BOND COMPANY Helps

As an SBA-approved agent, BEST SURETY BOND COMPANY submits your application through the SBA’s e-portal, often cutting days off the process. Our licensed Texas team will also help compile financial statements, work-in-progress reports, and personal indemnity forms so you can move from quote to contract without delays.

By pairing public guarantees with our same-day underwriting, many first-time contractors lock in the bonds they need—at rates they can afford—in a single business week.

Frequently Asked Questions about Small Business Bonds

What is the fastest way to get a surety bond for my business?

The quickest method is to apply online through a specialized surety agency like Best Surety Bond Company. We offer instant quotes and same-day issuance for common bond types, especially if you have good credit and all necessary documentation ready.

The secret to lightning-fast approval is being prepared. Have your business license and financial statements ready before you start the application. Know the exact bond type and amount required – this information is usually spelled out in your contract or license application. If you apply early in the day (before 2 PM Central), you’ll have the best chance of same-day processing.

We use automated underwriting systems that can evaluate many license and permit bonds within hours. Performance bonds typically take 1-3 business days, but even those can move faster when everything’s in order.

How much does a typical surety bond cost a small business?

The cost, or premium, is a small percentage of the total bond amount, typically ranging from 0.5% to 3%. For a standard $10,000 license bond, a highly qualified applicant might pay just $100 per year – that’s less than $10 per month for peace of mind and legal compliance.

Industry data shows that most small business bonds are surprisingly affordable. The median surety bond costs just $10 per month, while fidelity bonds average around $90 monthly. Janitorial bonds, which protect clients from employee theft, typically cost only $10 per month.

Your actual cost depends on three main factors: your credit score (the biggest factor), the bond type, and your industry risk level. We’ve helped Texas businesses secure bonds for as little as $50 annually for small license bonds. A Houston contractor with excellent credit recently paid just $150 for a $15,000 license bond, while a startup with fair credit paid $900 for a $30,000 performance bond.

Can I still get bonded if I have a new business or bad credit?

Absolutely – and this is one of the most common concerns we hear from entrepreneurs. While new businesses or those with credit challenges may face higher premiums, we specialize in helping business owners who don’t fit the “perfect” profile.

The SBA Surety Bond Guarantee Program is specifically designed for contractors who don’t meet standard surety criteria. This government-backed program can help you access bonding even with limited track records or credit issues. We’ve successfully bonded many startups and businesses with credit challenges through this program.

Other options include collateral-backed bonds for credit-challenged applicants and indemnity agreements with business partners who have stronger credit. Some of our clients have used these stepping stones to gradually improve their credit while building their bonding history.

The key is working with a surety provider who understands your situation and knows which programs might work for you. We’ve been helping Texas businesses overcome bonding challenges for years.

Do I need to be bonded if I’m just starting my business?

It depends on your industry and local regulations, but many professions require bonding before you can even obtain a license or start operations. Construction contractors, auto dealers, real estate brokers, mortgage brokers, and security services typically need bonding from day one.

Even if bonding isn’t legally required for your business, it can give you a competitive advantage and help build client trust immediately. Many potential clients, especially larger companies and government agencies, will only work with bonded contractors.

Think of it as an investment in your business credibility. When you tell prospects you’re bonded, you’re essentially saying, “A financially strong company has evaluated my business and is willing to back my promises.” That’s powerful messaging for a new business.

What happens if a claim is made against my bond?

If a valid claim is made against your bond, the surety company will investigate and, if warranted, pay the claim to the injured party. However, you remain ultimately responsible for reimbursing the surety company – this is called subrogation.

Here’s how the process typically works: A claim gets filed with the surety company, who then investigates its validity. If the claim is legitimate, the surety pays the injured party to make them whole. Then they come to you for reimbursement, just like a credit card company would.

This is why surety bonds are different from insurance – they’re more like a line of credit than true insurance coverage. The goal is to avoid claims entirely by fulfilling your obligations. Most bonded businesses never face a claim, but it’s important to understand the process.

Can I get bonded in Texas if my business is located in another state?

Yes, we’re licensed to write bonds in all 50 states, though we specialize in Texas bonding requirements. Many businesses need bonds in multiple states, and we can help coordinate multi-state bonding strategies.

Each state may have different bond requirements, so it’s important to work with a provider who understands the nuances. Some bonds are valid across state lines, while others require state-specific filings. Federal contracts may have their own bonding requirements that supersede state rules.

Our Texas-based team understands both local and national bonding requirements, making us an ideal partner for businesses operating across state lines. We can help you steer the complexity of multi-state bonding while keeping costs manageable.

Conclusion: Secure Your Business and Support Your Community

Getting your business bonded isn’t just about checking a regulatory box – it’s about building the foundation for long-term success. When you invest in small business bonds, you’re making a statement about your commitment to professionalism, accountability, and excellence.

Think about it: every time a potential client sees that you’re bonded, they immediately know you’ve been vetted by a surety company. You’ve proven your financial stability, demonstrated your character, and shown you’re serious about protecting their interests. That kind of credibility is invaluable in today’s competitive marketplace.

The numbers speak for themselves. With bond premiums typically ranging from just 0.5% to 3% of the bond amount, the cost of being bonded is minimal compared to the doors it opens. A $10,000 license bond might cost you only $100 per year, but it could help you land contracts worth tens of thousands of dollars.

At Best Surety Bond Company, we’ve seen how the right bonding strategy transforms businesses. Our Houston-based team has helped thousands of Texas contractors, service providers, and entrepreneurs secure the bonds they need to grow and thrive. We understand the unique challenges facing small businesses, and we’ve designed our process to be as fast and affordable as possible.

What sets us apart? We combine the personal touch of a local Texas company with the efficiency of modern technology. Our streamlined application process means you can get quotes instantly and often receive same-day approval. We’re not just another faceless corporation – we’re your neighbors, and we’re invested in your success.

Whether you’re a startup needing your first license bond or an established business pursuing larger government contracts, we have the expertise and resources to support your goals. Our agents understand Texas regulations inside and out, and we’re licensed to write bonds in all 50 states for businesses ready to expand.

The bottom line: Being bonded isn’t optional in today’s business environment – it’s essential. Don’t let bonding requirements become a barrier to your growth. With the right partner, getting bonded can be quick, affordable, and straightforward.

Ready to take the next step? Our Texas-based experts are standing by to help you steer the bonding process and secure the coverage you need to succeed.

Get Your Free Surety Bond Quote Today!

Your business deserves the best. Contact Best Surety Bond Company for instant quotes, competitive rates, and the personalized service that only comes from working with true bonding professionals. Let’s get you bonded and ready to grow.