Your Guide to Getting a Surety Bond in California

If you need a surety bond california quickly, here’s the fast way to get one:

- Determine the bond you need. The agency or client requiring the bond (the obligee) will provide the specifics.

- Apply online. Fill out a simple, fast application.

- Get your quote. Your premium is based on your credit and the bond type.

- Receive and file your bond. After payment, your bond is issued. You then file it with the obligee.

Doing business in California often requires a surety bond california. These bonds are financial promises that ensure you will follow regulations or complete a job, protecting customers and the public.

California has more bond requirements than most states, which can seem confusing. However, getting bonded doesn’t have to be difficult. This guide simplifies the process, showing you exactly how to get the bond you need, fast.

What is a Surety Bond and Why is it Required in California?

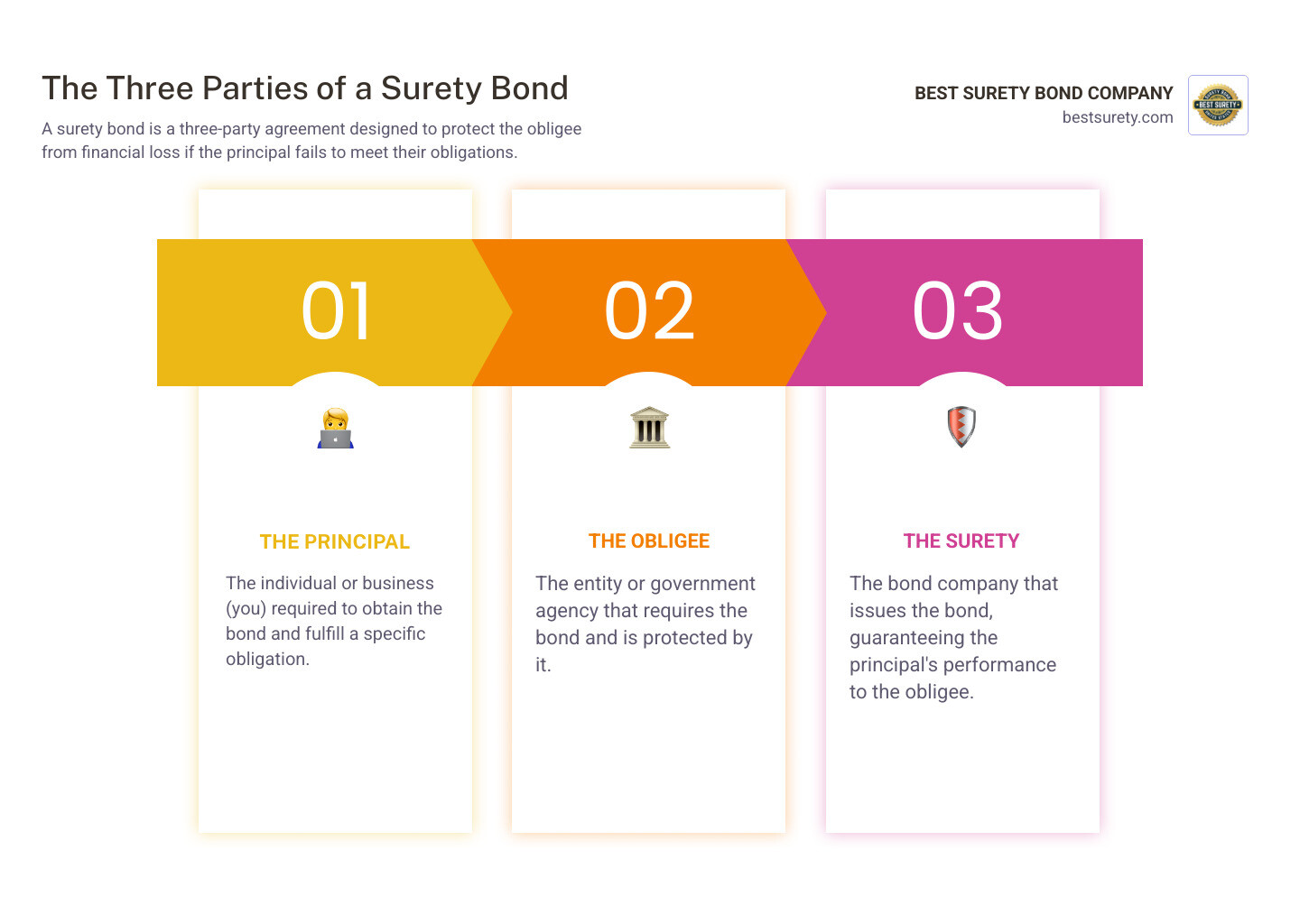

A surety bond california is a three-party agreement that ensures professional and legal obligations are met. It’s a commitment that protects consumers and maintains trust in the marketplace.

The key players in this agreement are:

- The Principal: You, the person or business required to get the bond.

- The Obligee: The government agency or client requiring the bond for protection.

- The Surety: The company that issues the bond and financially backs your promise.

If the Principal fails to meet their obligation, the Surety compensates the Obligee. The Principal is then required to reimburse the Surety. This makes a surety bond different from insurance; insurance protects you, while a surety bond protects your client or the public from your potential missteps.

In California, bonds are primarily required for consumer protection and legal compliance. They act as a financial guarantee that you’ll perform your duties ethically and correctly. With its large economy, California has more bond requirements than most states, affecting professionals from contractors to notaries. These requirements are detailed in the California Codes Legislation to ensure fair business practices and public safety.

Common Types of Surety Bonds in California

California’s diverse economy means many industries require a surety bond california to operate legally. Whether you’re a contractor, auto dealer, or notary, we can help you get bonded quickly and affordably.

License and Permit Bonds

These bonds guarantee you’ll follow state rules and treat customers fairly.

- Contractor License Bond: A $25,000 bond is required for most construction work over $500. It protects homeowners and ensures workers are paid. File with the California Contractor State Licensing Board.

- Auto Dealer Bond: The California Department of Motor Vehicles typically requires a $50,000 bond to protect customers from fraud.

- Notary Bond: A $15,000 bond is required for a notary’s four-year term to protect the public from notarial errors.

- Tax Preparer Bond: A $5,000 bond is required to show clients you handle their finances responsibly.

Contractor-Specific Bonds

Some contractors need additional bonds beyond the basic license bond.

- Bond of Qualifying Individual (BQI): This $25,000 bond is needed if your license qualifier owns less than 10% of the company. See the Requirements for the Bond of Qualifying Individual.

- Disciplinary Bond: Required if a license was previously revoked. The amount starts at $25,000 and can be much higher. It must be on file for at least two years. Details are in the Requirements for the Contractor’s Bond.

Other Commercial and Court Bonds

- Auctioneer Bond: A $20,000 bond filed with the California Secretary of State.

- Freight Broker Bond: A $75,000 federal requirement overseen by the Federal Motor Carrier Safety Administration.

- Lost Title Bond: Helps prove ownership of a vehicle when the title is lost. The bond amount matches the car’s value.

- Court Bonds: Cover various legal situations, like appeals or estate management, ensuring you follow court orders.

California has over 150 different types of surety bond california requirements. Whatever bond you need, we can help you get covered at a competitive rate.

How Much Does a Surety Bond California Cost?

You don’t pay the full bond amount. Instead, you pay an annual “bond premium,” which is a small percentage of the total bond coverage.

Understanding Your Bond Premium

Your premium is determined by several factors:

- Bond Type and Amount: Higher-risk or higher-value bonds typically have higher premiums.

- Credit Score: A strong credit score usually results in a lower premium, as it signals financial responsibility.

- Financial History & Experience: For larger bonds, your overall financial stability and industry experience can also influence your rate.

Our team works to find you the most competitive rates available, making the process as affordable as possible.

Cost Examples for a surety bond california

A surety bond california typically costs between 1% and 10% of the total bond amount. For a $25,000 bond, your annual premium could be between $250 and $2,500.

Here’s how costs can vary based on credit:

| Bond Type & Amount | Credit Score: Over 700 (Excellent) | Credit Score: 600-699 (Good/Average) | Credit Score: Below 599 (Challenged) |

|---|---|---|---|

| $25,000 California Contractor Bond | $250 – $750 | $750 – $1,250 | $1,250 – $2,500 |

| $50,000 California Auto Dealer Bond | $500 – $1,500 | $1,500 – $2,500 | $2,500 – $5,000 |

Note: These are estimated annual costs and can vary based on the surety company and specific underwriting factors.

Some bonds are very affordable. A $15,000 California Notary Public Bond can cost as little as $38 for a 4-year term. Many other bonds start at just $100.

Don’t let a challenging credit history stop you. We partner with a wide network of surety markets to find options for everyone. Applicants with credit issues typically see quotes in the 5%-15% range. Applying for a quote involves a soft credit pull, which won’t affect your score.

How to Get Your California Surety Bond: A 4-Step Guide

Getting your surety bond california is a simple process. With our streamlined approach, you can have your bond in hand within hours.

Step 1: Determine Your Required Bond

The obligee—the government agency requiring your bond—will tell you exactly what you need. Contact them to confirm the bond’s name, required amount, and if a specific form is needed. For example, the California Contractor State Licensing Board requires a $25,000 Contractor License Bond, while the California Department of Motor Vehicles specifies Auto Dealer Bond requirements. You may also need to check with the California Department of Financial Protection & Innovation for certain bonds.

Step 2: Apply for Your Bond

Our online application takes just a few minutes to complete. You’ll provide basic information like your name, address, and the bond you need. You’ll receive a no-obligation quote, often instantly. For most bonds, we use a soft credit pull, which does not affect your credit score.

Step 3: Receive Your Quote and Pay the Premium

After submitting your application, you’ll receive a clear, competitive quote. Our rates are among the best in the industry. If you’re happy with the quote, you can pay your premium securely online. For many bond types, you can get approved and purchase your bond instantly, with same-day issuance for most applications.

Step 4: File Your Official Bond

Once you’ve paid, we’ll send your official bond documents, usually via email within minutes, with the original to follow by mail. You must sign the bond as the principal and file it with the obligee. Some agencies accept digital filing, while others require the original document. We can help ensure your bond gets to the right place on time.

Maintaining and Renewing Your Bond

Securing your surety bond california is the first step; maintaining it is crucial for keeping your business compliant. Most bonds have a specific term, usually one year, and must be renewed to avoid license suspension or other penalties.

The Bond Renewal Process

We make renewals simple. Before your bond expires, we’ll send you a renewal notice. Simply pay the renewal premium on time to ensure continuous coverage. Once renewed, we’ll provide a continuation certificate or a new bond document, which you may need to file with the obligee. A lapse in coverage could require you to go through the full qualification process again.

Navigating Legal Changes and Requirements for your surety bond california

California’s regulations can change, so staying informed is important. For example, Senate Bill 607 increased the bond amount for contractors to $25,000 as of January 1, 2023.

Your surety bond california must be issued by an ‘admitted surety insurer’—a company licensed by the California Department of Insurance. You can verify a company’s status using the department’s search for licensed insurance companies tool. This ensures the company backing your bond is financially sound.

If a bond is canceled, the surety must provide at least 30 days’ written notice, giving you time to secure a replacement and maintain continuous coverage. We are always here to help you steer these requirements.

Frequently Asked Questions about California Surety Bonds

Here are answers to some common questions about getting a surety bond california.

Can a prior conviction affect my ability to get a surety bond in California?

It can, but it’s not always a barrier. A conviction may increase perceived risk for professions requiring a high degree of public trust. However, it doesn’t automatically disqualify you. Each case is unique, and while some roles have strict rules (like Immigration Consultants), we work with a broad network of surety markets to explore all options for you, even with past issues.

Where can I find a licensed surety company in California?

Your bond must be issued by an ‘admitted surety insurer,’ which is a company licensed and regulated by the state. You can verify a company’s license through the California Department of Insurance website. We are proud to be licensed to issue bonds in all 50 states, including California, ensuring you work with a reputable provider.

What happens if a claim is made against my bond?

If a claim is filed, we, as your surety, will investigate its validity. If the claim is valid, the surety will pay the obligee up to the bond amount. It’s crucial to remember that a surety bond is not insurance for you. You are legally obligated to reimburse the surety for any amount paid out on a valid claim. Cooperating with the investigation can help resolve the issue efficiently.

Conclusion

We hope this guide has clarified the process of getting a surety bond california. These bonds are vital tools for protecting consumers and ensuring businesses operate responsibly. A surety bond california is a three-party financial guarantee, not an insurance policy for you. The cost is an affordable annual premium based on the bond type, amount, and your credit score.

Our online application is designed to be simple and fast. Keeping your bond active through timely renewals is essential for staying compliant and avoiding license suspension. At BEST SURETY BOND COMPANY, we are your trusted partner, offering fast approvals, competitive rates, and expert guidance. We are committed to simplifying the process so you can focus on growing your business.

Ready to get bonded in California?

Get Your Free California Surety Bond Quote Now!