Understanding the Texas Surety Bond for Credit Repair Businesses

Operating a surety bond for credit repair business in Texas requires a specific financial guarantee to protect consumers and ensure compliance. If you’re a credit repair professional in the Lone Star State, understanding this requirement is key to lawful operation.

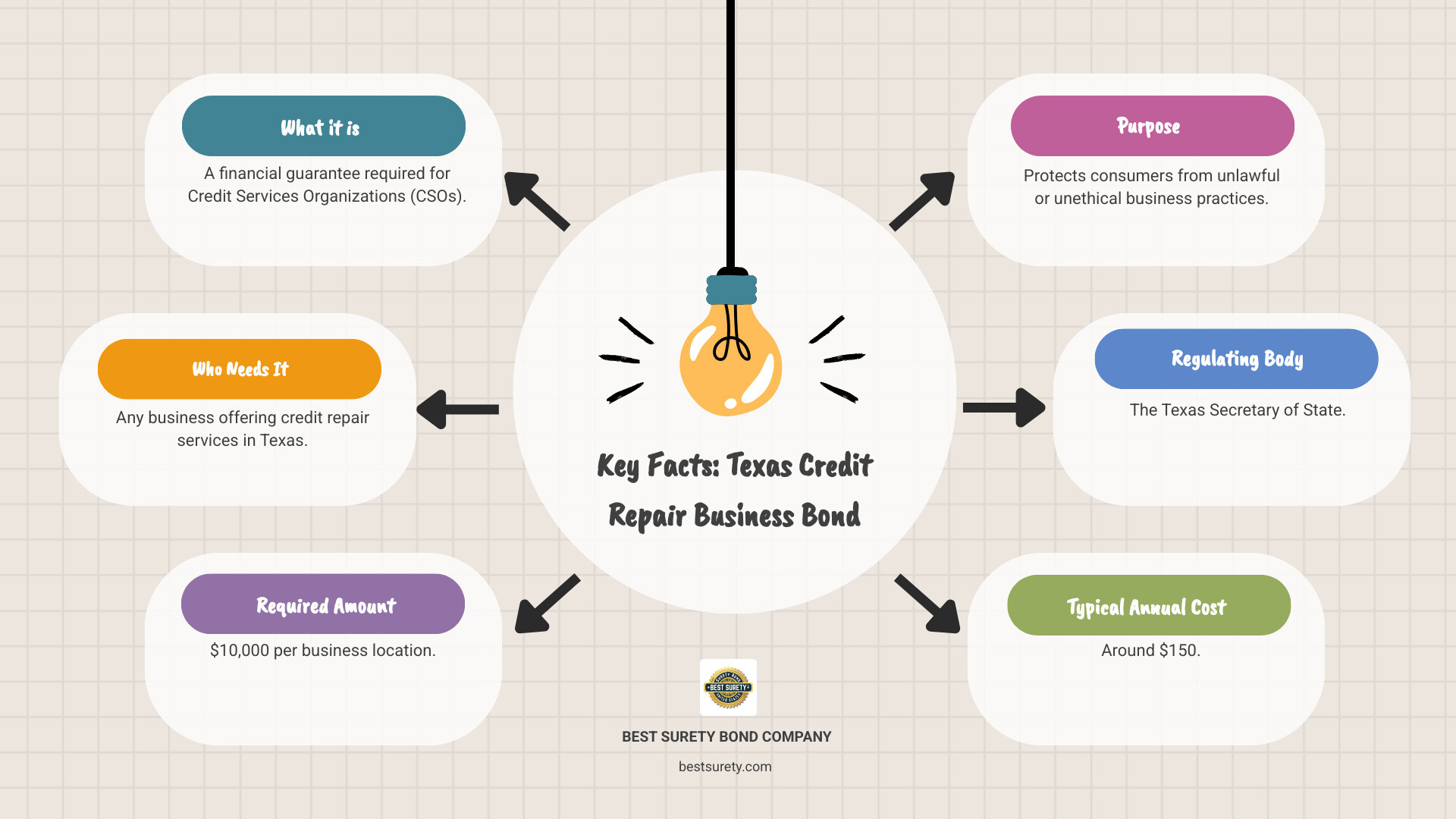

Here’s a quick look at what you need to know:

- What it is: A financial guarantee required for Credit Services Organizations (CSOs).

- Who needs it: Any business offering credit repair services in Texas.

- Required amount: $10,000 per business location.

- Purpose: Protects consumers from unlawful or unethical business practices.

- Regulating body: The Texas Secretary of State.

- Typical annual cost: Around $150.

A surety bond isn’t just a piece of paper. It’s a promise. It tells your clients and the state that you’re committed to doing business by the rules. It builds trust and ensures that if something goes wrong, consumers have a way to recover their losses.

The credit repair industry, while vital for many, has faced scrutiny. States like Texas have put these bonds in place to raise the bar for entry and protect consumers from bad actors. This guide will walk you through everything you need to know about these essential bonds.

I’m Haiko de Poel, and I’ve spent over two decades helping businesses, including those in fintech and legal services, steer complex regulatory landscapes and scale effectively. My expertise includes guiding companies through the specific requirements of a surety bond for credit repair business in Texas, ensuring compliance and fostering trust. This background helps me simplify what might seem like a daunting process.

Surety bond for credit repair business in texas terms to know:

What is a Texas Credit Services Organization (CSO) Bond?

So, what exactly is a Texas Credit Services Organization (CSO) bond? Simply put, it’s a special type of surety bond for credit repair business in Texas that the state requires. Think of it as a crucial financial safety net, designed with one big goal in mind: to protect consumers. This isn’t just a friendly suggestion – it’s a firm requirement, and you’ll find it clearly laid out in the Texas Finance Code Chapter 393.

The main purpose of this bond is straightforward: it acts as a financial guarantee. It assures everyone that your credit repair business will operate ethically and follow all the rules. If, for any reason, a CSO doesn’t meet its promises, engages in fraudulent actions, or breaks state regulations, this bond ensures that consumers who are financially harmed have a way to get things right. In an industry where trust is everything, this bond is vital. Without it, consumers would really struggle to protect themselves from bad practices.

Now, you might be wondering, who exactly is required to get a surety bond for credit repair business in Texas? Well, if you’re an individual or a company offering any kind of credit repair services in our great state, you fit the bill as a Credit Services Organization. This covers a wide range: businesses that charge clients to help them improve their credit history, get extensions of credit, or even just give advice about credit. So, whether you’re running a busy office in Houston, a growing firm in Dallas, or a dedicated one-person operation anywhere else in Texas, if you’re providing these services, this bond is a must-have.

Let’s break down how the bond works – it’s actually quite simple and involves three key players. First up, there’s the Principal, and that’s your credit repair business. Next, we have the Obligee, which is the authority that requires the bond – in this instance, it’s the Texas Secretary of State. You can learn more about them here. And finally, there’s the Surety (that’s us!), the company that issues the bond. Here’s the deal: if your business, the Principal, doesn’t follow the bond’s terms or the regulations in Chapter 393 of the Texas Finance Code, the Surety will step in. We’ll compensate the harmed consumer, up to the bond amount. Now, while the Surety pays that claim upfront, your business is ultimately responsible for reimbursing the Surety. This setup provides clear financial recourse for consumers and truly holds your business accountable, building that all-important trust.

Having this surety bond for credit repair business in Texas isn’t just about meeting a requirement; it’s a powerful statement. It shows your dedication to upholding the highest professional standards and truly building customer trust. It’s a clear signal to everyone that you’re serious about operating legally and ethically in the vibrant Texas credit repair landscape.

Key Requirements for a Surety Bond for a Credit Repair Business in Texas

Getting your surety bond for credit repair business in Texas involves more than just writing a check. There are specific requirements you need to meet to stay on the right side of the law and keep your business running smoothly. Think of these requirements as your roadmap to state compliance and proper business registration.

The state of Texas doesn’t mess around when it comes to protecting consumers from credit repair scams. They’ve put together a comprehensive framework of legal obligations that every credit repair business must follow. Let’s break down exactly what you need to know.

The $10,000 Bond Mandate for Each Location

Here’s where things get interesting – and potentially expensive if you’re not prepared. Texas requires a $10,000 bond amount for every Credit Services Organization operating in the state. But here’s the kicker: this requirement applies on a per-location basis.

What does this mean for your business? If you’re running a single office in Houston, you need one $10,000 bond. But if you decide to expand and open a second location in Dallas, you’ll need another $10,000 bond for that office too. Each physical location where you conduct credit repair services must have its own separate bond.

This continuous bond requirement means you can’t just get bonded once and forget about it. You need to keep that bond active for as long as you’re in business. Think of it like insurance – it only works when it’s current. Maintaining compliance means staying on top of renewals and making sure your bond never lapses.

CSO Registration with the Texas Secretary of State

Getting bonded is just the first step. You also need to register your business as a Credit Services Organization with the Texas Secretary of State. This filing process is straightforward, but it’s crucial to get it right.

You’ll need to complete Form 2801, which is your official registration application. Along with this form, you must provide proof of bond – typically the official Form 2802 (your surety bond) or Form 2803 if you’re using a surety account instead. These forms work together to show the state that you’ve met all the financial protection requirements.

The state charges filing fees of up to $100 for processing your registration or renewal application. The good news is that Texas has made this process more convenient through their SOSDirect online portal. You can submit your forms and pay your fees online, which speeds up the whole process considerably. For detailed information about the registration process, check out the Texas SOS: Credit Service Organizations page.

Key State and Federal Regulations to Follow

Running a credit repair business means juggling both Texas Finance Code requirements and federal laws. It’s like playing by two sets of rules at the same time, but once you understand them, it becomes second nature.

The Texas Finance Code Chapter 393 is your bible for state-level compliance. This chapter spells out exactly what you can and can’t do as a Credit Services Organization in Texas. At the federal level, the Credit Repair Organizations Act (CROA) sets the baseline standards for the entire industry.

When it comes to prohibited practices, Texas and federal law are crystal clear about what crosses the line. You cannot make false or misleading representations to consumers. You absolutely cannot guarantee to “erase bad credit” – that’s one of the biggest red flags in the industry. You also cannot guarantee that you’ll be able to get someone approved for credit, and you cannot make false statements to credit reporting agencies.

The contract requirements in Texas are particularly strict. Your contracts cannot exceed 180 days in length. You must give consumers a three-day right to cancel, and they’re entitled to a full refund within 10 days of signing. These aren’t suggestions – they’re legal requirements that protect both you and your clients.

Understanding these regulations isn’t just about avoiding trouble; it’s about building a business that consumers can trust. When you follow the rules and maintain your surety bond for credit repair business in Texas, you’re showing everyone – your clients, the state, and your competitors – that you’re serious about doing business the right way.

How to Get Your Texas CSO Bond: A Step-by-Step Guide

Getting your surety bond for credit repair business in Texas doesn’t have to be complicated or time-consuming. At BEST SURETY BOND COMPANY, we’ve streamlined the entire process to offer fast approval and low rates through our user-friendly online application. Whether you’re starting your first credit repair business in Houston or expanding to multiple Texas locations, we’ll have you bonded and ready to serve clients in no time.

The beauty of working with us is that you can complete the entire bonding process from the comfort of your office or home. No more waiting weeks for approvals or dealing with mountains of paperwork. Let’s walk through each step so you know exactly what to expect.

Step 1: Apply Online for an Instant Quote

Starting your application process is as simple as visiting our website and clicking “Get Started.” We’ve designed our online system to be intuitive and fast, because we know you’re eager to get your business legally operating in Texas.

During the application, we’ll need some basic information about your credit repair business. This includes your business name (exactly as it will appear on your Texas registration), your primary address where you’ll be conducting business, and key owner details. Don’t worry – we only ask for what’s absolutely necessary to process your bond.

We emphasize speed throughout our entire process. While traditional bonding companies might take days or even weeks to provide quotes, our system is built for efficiency. Most applicants receive their quote within minutes of submitting their application. This rapid turnaround means you can move forward with your Texas Secretary of State registration without delays.

For credit repair professionals who need additional licensing support, you can learn more about our comprehensive license and permit bond services to ensure you’re fully compliant with all Texas requirements.

Step 2: Understanding the Cost of a surety bond for a credit repair business in texas

One of the most common questions we hear is about cost, and the good news is that bonding your credit repair business is more affordable than most people expect. It’s important to understand the difference between the premium vs. bond amount – while the state requires a $10,000 bond amount, you don’t pay $10,000 for the bond itself.

The typical cost for a surety bond for credit repair business in Texas starts around $150 annual premium. This small investment provides the financial guarantee required by law and demonstrates your commitment to ethical business practices to potential clients.

Several factors influence cost, with your personal credit score being the primary consideration. Business owners with good credit typically qualify for our lowest rates, sometimes even less than the $150 baseline. Your business financials may also play a role, particularly for newer businesses or those seeking bonds for multiple locations.

We also offer attractive multi-year discounts that can save you both money and administrative hassle. A two-year bond term might cost around $270 (saving you about $30 compared to renewing annually), while a three-year term could run approximately $390 (saving you roughly $60). These longer terms also mean you won’t have to worry about annual renewals, giving you one less thing to manage as you focus on growing your credit repair business.

Step 3: File Your Bond and Complete Registration

Once your application is approved and payment is processed, receiving the bond happens almost instantly. We provide instant email delivery of your official Texas CSO bond documents, typically within minutes of completing your purchase. This means you can often have your bond certificate ready for filing the same day you apply.

The next step involves filing with the Secretary of State. Your original bond certificate (Form 2802) needs to be submitted to the Texas Secretary of State’s office. You can mail it to their Austin office or deliver it in person if you’re in the area. Many of our clients appreciate that we can handle this filing process directly, ensuring your bond is properly submitted and reducing the chance of any administrative errors.

After your bond is on file, you’ll need to focus on completing the CSO registration by submitting your Form 2801 application along with the required registration fee. Once the Texas Secretary of State processes both your bond and registration, your credit repair business will be officially licensed and ready to help Texas consumers improve their credit profiles.

The entire process, from initial application to final registration, typically takes just a few business days when you work with BEST SURETY BOND COMPANY. We’re here to guide you through each step and answer any questions that come up along the way.

Common Mistakes and How to Maintain Compliance

Running a credit repair business in Texas isn’t a “set it and forget it” operation. It requires ongoing attention to detail and a commitment to staying compliant. The good news? Most compliance issues stem from simple oversights that are easily preventable. Let’s walk through the most common pitfalls and how to avoid them, ensuring your surety bond for credit repair business in Texas continues to protect both you and your clients.

Consequences of Operating Without a Bond

Here’s the hard truth: operating without the required CSO bond in Texas isn’t just risky – it’s business suicide. The state takes consumer protection seriously, and the consequences of non-compliance can be swift and devastating.

First, you’ll face substantial penalties and fines. The Texas Secretary of State doesn’t mess around when it comes to enforcement. These financial penalties often far exceed what you would have paid for the bond in the first place. It’s like skipping a $150 annual insurance premium only to face thousands in fines later.

But the financial hit is just the beginning. Your business could receive cease and desist orders, which means you must immediately stop all operations. This leads to a complete loss of registration, stripping away your legal right to provide credit repair services anywhere in Texas. Imagine having to tell your clients that you can no longer help them because you failed to maintain a simple bond requirement.

Perhaps most frightening are the potential consumer lawsuits. Without a bond, there’s no financial safety net between you and angry clients. If someone feels wronged by your services, they can come directly after your personal and business assets. The bond is designed to handle these situations – without it, you’re completely exposed to legal claims, attorney fees, and damage awards that could bankrupt your business.

Avoiding Lapses and Ensuring Your surety bond for credit repair business in texas is Active

Even well-intentioned business owners can stumble into compliance traps. The most common mistake we see is forgetting renewal. Your CSO bond and registration expire annually, and many busy entrepreneurs simply lose track of the dates. One day you’re legally operating, and the next day you’re not – it’s that simple.

Another frequent error is not bonding each location. We can’t stress this enough: every physical office needs its own $10,000 bond. Opening a satellite office in Dallas while only having a bond for your Houston location leaves you exposed and non-compliant.

Some businesses also fall into the trap of misrepresenting bond status. Never, ever claim to be bonded when your bond has lapsed. This isn’t just a compliance issue – it’s potential fraud that can lead to criminal charges.

Don’t forget about updating bond information when your business details change. If you move offices, change your business name, or update your registration, your bond documentation needs to reflect these changes. We’re here to help you steer these updates and ensure the Texas Secretary of State has accurate information on file.

The key to keeping your surety bond for credit repair business in Texas active is organization. Keep detailed records of all your compliance dates, and don’t rely on memory alone.

Renewing Your Bond Annually

Think of bond renewal like renewing your driver’s license – it’s not optional, and the consequences of letting it lapse are serious. The renewal process itself is straightforward, but timing is everything.

Both your Texas CSO registration and your surety bond operate on annual cycles. The validity period typically runs for one year from the date of issuance. This means you need to stay on top of two separate but related deadlines.

Here’s where setting reminders becomes crucial. We recommend marking your calendar at least 60 days before your bond expires. This gives you plenty of time to process the renewal without any last-minute panic. Many of our clients set up automatic calendar alerts or use project management tools to track these important dates.

Working with a surety expert like us makes this process much smoother. We actively monitor your bond’s expiration date and send you renewal reminders well in advance. Our team handles the paperwork, processes your payment, and ensures there’s no gap in coverage. This means you can focus on growing your credit repair business while we handle the compliance details.

A lapsed bond doesn’t just put you at risk – it can also damage the trust you’ve built with your clients. Maintaining continuous coverage shows professionalism and demonstrates your commitment to operating by the rules.

Get Your Texas Credit Repair Business Bonded Today

Starting your credit repair business in Texas is an exciting venture, and getting properly bonded shouldn’t slow you down. Throughout this guide, we’ve walked through everything you need to know about the surety bond for credit repair business in Texas, and now it’s time to take action.

The path forward is clear and straightforward. You need that mandatory $10,000 CSO bond for each location where you’ll be serving clients. This isn’t just a bureaucratic hurdle – it’s your ticket to legal operation in the Lone Star State. Without it, you’re looking at serious penalties, potential lawsuits, and the very real possibility of having to shut down your business before it even gets off the ground.

But here’s the thing: this bond does so much more than keep you out of legal trouble. It builds consumer trust in a way that no marketing campaign ever could. When potential clients see that you’re properly bonded and registered with the Texas Secretary of State, they know you’re serious about doing business the right way. In an industry where trust is everything, that bond certificate becomes one of your most powerful business tools.

At BEST SURETY BOND COMPANY, we’ve made it our mission to serve Texas credit repair professionals with the fast and affordable service you deserve. Whether you’re setting up shop in Houston, expanding to Dallas, or serving clients anywhere across Texas, we understand the unique challenges you face. Our Texas-based team knows the local regulations inside and out, and we’re here to make sure you get bonded quickly and affordably.

We know you didn’t get into the credit repair business to deal with paperwork and regulatory compliance. You’re here to help people rebuild their financial lives. That’s why we’ve streamlined our process to get you bonded as quickly as possible – often with same-day approval and instant online quotes. Your time is valuable, and we respect that.

Don’t let another day pass operating without the protection and credibility that comes with proper bonding. Your business, your clients, and your peace of mind all depend on it.

Get Your Texas Surety Bond Now and join the thousands of Texas business owners who trust us to keep them compliant and protected.