Navigating Surety Bonds in San Antonio

If you’re a business owner or contractor in San Antonio, understanding and securing a surety bond San Antonio is often a critical step to operating legally and successfully. A surety bond is a three-party agreement that provides a financial guarantee, ensuring you meet your obligations.

When looking for a surety bond provider in San Antonio, you’ll find both local specialists and national online companies that serve the area. The key is to find a partner who understands Texas’s specific requirements and can provide fast, affordable service. Whether you need a bond for a city contract, a state license, or another commercial purpose, choosing the right provider is the first step toward a smooth process.

Surety bonds are generally required for two main reasons: to guarantee you’ll fulfill a contract or to ensure compliance with specific licenses, statutes, and ordinances. Think of it as a promise backed by a third party, protecting the entity requiring the bond (the “obligee”) from potential financial loss if you (the “principal”) fail to meet your commitments. The bond company (the “surety”) guarantees this promise.

This guide will break down what you need to know about surety bonds in San Antonio, from common types required by the city and state to valuable local assistance programs. We’ll show you how to steer the process simply and affordably, so you can get back to what you do best.

I’m Haiko de Poel, and for over two decades, I’ve helped businesses steer complex financial requirements, including securing the right surety bond San Antonio businesses need to thrive. My expertise spans fintech, insurance, and strategy, ensuring companies find scalable and tech-forward solutions for their bonding needs.

What is a Surety Bond and Why Do You Need One in San Antonio?

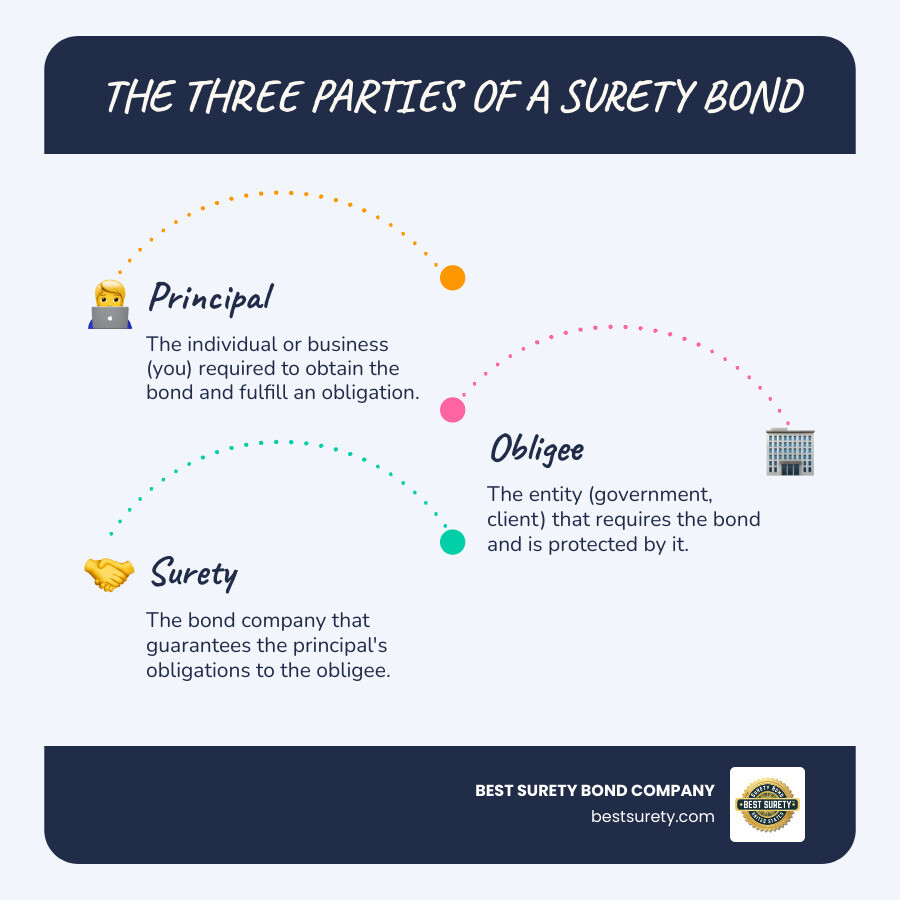

A surety bond is a fundamental financial tool that underpins trust and compliance in many business dealings. At its core, it’s a three-party agreement designed to protect one party (the “obligee”) from financial loss if another party (the “principal”) fails to fulfill a specific obligation. We like to think of it as a financial safety net, ensuring promises are kept.

Let’s break down these three crucial parties:

- The Principal: That’s you! The individual or business required to obtain the bond. You are making a promise to the obligee, and the surety is backing that promise.

- The Obligee: This is the entity requiring the bond. It could be a government agency (like the City of San Antonio or a Texas state department), a court, or even a private company. They are the ones being protected by the bond.

- The Surety: This is the bond company, the third-party guarantor. We, as your surety partner, guarantee to the obligee that the principal will fulfill their obligations. If the principal fails, the surety will pay out legitimate claims to the obligee, and then seek reimbursement from the principal.

So, why might a business in San Antonio need one of these? Surety bonds are typically required to guarantee:

- Compliance with Laws, Statutes, and Ordinances: Many industries and professions in San Antonio, and across Texas, must adhere to specific regulations to operate legally. A bond ensures they will.

- Fulfillment of Contractual Obligations: Especially common in construction, bonds guarantee that a contractor will complete a project as agreed, or that suppliers and subcontractors will be paid.

Whether you’re a contractor bidding on a city project, a used car dealer, a freight broker, or even an individual acting as an estate administrator, you might find yourself needing a surety bond. These bonds act as a powerful form of credit, giving the obligee confidence that your obligations will be met.

Common Surety Bonds Required in San Antonio

San Antonio is a busy city with a fantastic, diverse business scene. Because of this vibrant activity, there are many situations where a surety bond San Antonio business or individual might need to operate legally and successfully. We see certain types of bonds pop up again and again, whether they’re required by the city itself or by the State of Texas.

Contractor License & Permit Bonds

If you’re a contractor dreaming of building or renovating in the Alamo City, you’ll likely need contractor bonds San Antonio for your licenses and permits. It’s a common misunderstanding that Texas licenses contractors at the state level. Actually, it’s cities and counties, like San Antonio, that set their own rules, including specific license and surety bond requirements.

These bonds are really important because they help protect the public. For example, a City of San Antonio Demolition Contractor Bond, often around $5,000, ensures that demolition work is done safely and according to regulations. This particular bond can sometimes cost as little as $100 per year! Contractor bonds also help make sure building codes are followed and can even protect against shoddy work or if a contractor doesn’t follow their license rules. So, whether you’re a general contractor, an HVAC expert, or in any construction trade, you might need a unique license or permit bond specifically for the City of San Antonio, or for other cities where you work. We’re here to help contractors like you easily steer these different requirements to stay fully compliant.

Motor Vehicle Dealer Bonds

Are you in the exciting business of selling cars in San Antonio? Then you’ll definitely need a motor vehicle dealer bond. The State of Texas requires all licensed motor vehicle dealers to get a $50,000 Texas Motor Vehicle Dealer Surety Bond. This bond is absolutely essential for protecting consumers, making sure dealers follow all state laws and regulations when selling and transferring vehicles. It’s a non-negotiable part of getting and keeping your dealer license.

Other Common Commercial Bonds in Texas

Beyond contractors and car dealers, many other professions and situations in San Antonio and across Texas often need surety bonds. We frequently help our clients with a variety of these bonds, including:

- Probate Bonds, Court Bonds, and Fiduciary Bonds: These are often required by courts when individuals are managing estates, trusts, or guardianships. For instance, a guardianship bond makes sure that the guardian responsibly handles the finances of a minor or someone who can’t care for themselves.

- Notary Bonds: If you’re a Texas Notary Public, a mandatory $10,000 Notary Surety Bond is required to ensure you perform your duties faithfully.

- Public Adjuster Bonds: For those who help policyholders negotiate insurance claims, a typical $10,000 bond is required.

- Mortgage Broker Bonds: Depending on how much business they do, mortgage brokers in Texas might need a bond ranging from $25,000 to $50,000.

- License and Permit Bonds: This is a big category covering many different types of businesses. It includes bonds for freight brokers, third-party debt collectors (often $10,000), money transmitters (which can range from $100,000 to $500,000), and credit services organizations ($10,000). These bonds are all about ensuring compliance with specific industry rules and protecting consumers.

- Utility Bonds: Some utility providers in San Antonio, like the San Antonio Water System, might ask for a utility bond instead of a cash deposit to guarantee payment for services.

This is just a quick peek, as there are actually over 150 different types of Texas surety bonds! Each one is designed to meet a specific legal or contractual need. No matter what kind of bond you need, we’re here to make the process easy and efficient for you.

A Unique Local Resource: The San Antonio Capacity Building & Bonding Assistance Program

The City of San Antonio truly steps up to support its local businesses, especially those that might find bonding a bit tricky when it comes to city contracts. The City of San Antonio’s Capacity Building & Bonding Assistance Program is a fantastic initiative. It’s designed to level the playing field, helping our local small, minority, and woman-owned businesses participate in those valuable city construction projects. It’s all about making sure more local businesses can thrive right here in San Antonio!

Who is Eligible for the Program?

This program is specifically custom to assist certain businesses, ensuring the support goes where it’s needed most. You’re likely a great fit if you’re a Small, Minority, or Woman-Owned Business (SMWBE). The program actively works to empower these vital businesses, recognizing how much they contribute to San Antonio’s economic growth. Plus, to ensure the benefits stay right here at home, your business needs to be located within San Antonio city limits. And finally, the program focuses on helping businesses that are actively seeking City of San Antonio construction contracts, guiding them through the process of securing and successfully executing work with the city.

What Benefits Does the Program Offer?

This program isn’t just about one thing; it’s a truly comprehensive offering, providing both financial and educational support to help you succeed. One of the biggest perks is the financial assistance for bond costs. There’s a generous $500,000 revolving fund specifically set up to help eligible businesses cover the expenses related to City of San Antonio bonding requirements. This can make what seems like a big financial hurdle much more manageable.

Navigating surety bonds San Antonio businesses need can feel complicated, but the program offers one-on-one bonding counseling to simplify it all. You’ll get personalized guidance to help you understand your specific bonding needs and figure out the best way to meet them. Beyond just bonds, the program also provides technical assistance and financial literacy support. This means custom needs assessments, educational support, and training to help strengthen your business’s overall capacity. And the support doesn’t stop once you get the bond! If you’re awarded a City contract, the program continues with project support for contract awardees, helping ensure your project runs smoothly and successfully.

How to Apply for the Surety Bond San Antonio Program

Ready to take advantage of this fantastic resource? Applying for this invaluable program is a straightforward process. The best first step is to visit the official City of San Antonio’s Capacity Building & Bonding Assistance Program page for detailed information, eligibility requirements, and application forms. The application usually involves a needs assessment, which helps the program understand your business’s specific requirements. This program is truly a shining example of how the City of San Antonio is actively working to foster local business growth, making it easier for more businesses to access and win city contracts.

How to Get a Surety Bond in San Antonio

Securing a surety bond San Antonio can be a quick and efficient process, especially when you partner with us. We pride ourselves on fast approvals and low rates, making the path to getting bonded as smooth as possible.

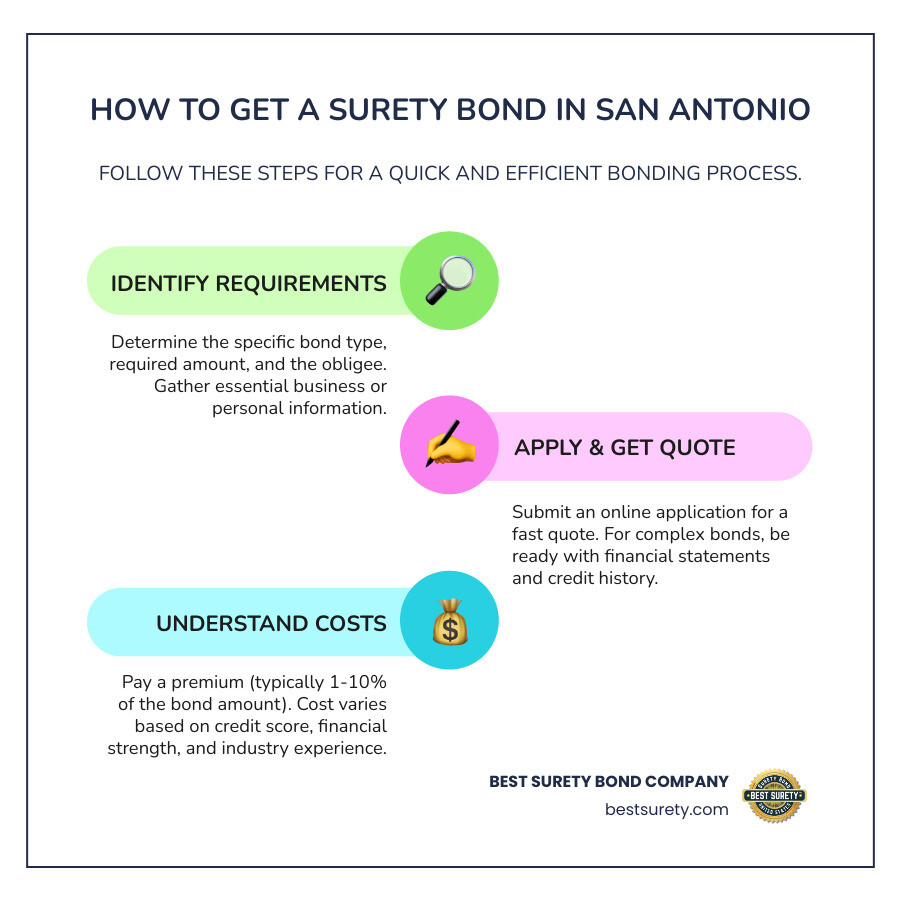

Step 1: Identify Your Specific Bond Requirement

Before you apply, it’s crucial to know exactly what bond you need. Here’s what we recommend:

- Determine the Obligee: Who is requiring the bond? Is it the City of San Antonio, a state agency like the Texas Department of Motor Vehicles, or a court? The obligee is the best source for confirming requirements.

- Confirm Bond Type and Amount: The obligee will specify the exact type of bond (e.g., contractor license bond, motor vehicle dealer bond) and the required bond amount (e.g., $5,000, $50,000). If you’re unsure, ask for a copy of the bond form; it will state everything you need to know.

- Review City or State Statutes: Some bonds are mandated by specific laws. Understanding these can help clarify the purpose and requirements of your bond.

Here’s a list of key information to gather before you apply:

- The full name of the obligee.

- The exact name of the bond type (e.g., “City of San Antonio Demolition Contractor Bond”).

- The required bond amount.

- Your legal business name or individual name.

- Your business address and contact information.

- Your Employer Identification Number (EIN) or Social Security Number (SSN).

Having this information ready will significantly speed up your application process.

Step 2: The Application and Quoting Process

Once you know your requirements, applying for a surety bond is remarkably simple with our streamlined online process.

- Online Applications: We offer user-friendly online applications that allow you to apply from anywhere, at any time.

- Fast Quotes: For many common license and permit bonds, you can get an instant online quote within minutes. For more complex bonds or larger contract bonds, we typically provide a quote within 24-48 hours. Our goal is to make the process of obtaining approval easy and fast, avoiding long online searches.

- Information Needed for Application: For most bonds, you’ll need to provide basic personal and business information. For larger or more complex bonds, the surety company may request financial statements (like balance sheets, income statements, or tax returns) and conduct a credit report review to assess your eligibility and ensure you can meet your obligations.

- Soft Credit Pull: For many instant quotes, we use a “soft credit pull.” This is a preliminary check that does not impact your credit score, so you can confidently explore your options without worrying about affecting your credit.

- Underwriting Process: This is how the surety assesses the risk. For most small license and permit bonds, it’s a quick, automated process. For larger contract bonds, it involves a more detailed review of your financial stability, experience, and character.

Costs for a Surety Bond in San Antonio

The cost of a surety bond San Antonio is typically a small percentage of the total bond amount, known as the premium. You don’t pay the full bond amount; you pay this premium.

- Bond Premium vs. Bond Amount: While the bond amount can range from a few thousand dollars to hundreds of thousands, the premium you pay is usually between 1% and 10% of that total amount. For example, a $25,000 bond might cost you anywhere from $250 to $2,500 annually. Many Texas bonds, especially license and permit bonds, start as low as $100 per year.

- Factors Influencing Price: Your specific rate is determined by several factors:

- Credit Score: This is a major factor. Applicants with good credit (typically a 700 FICO score or higher) generally qualify for the lowest rates, often in the 1%-3% range.

- Financial Strength: For larger bonds, the surety will look at your business’s financial health, including working capital and overall solvency.

- Industry Experience: Your track record and experience in your field can also influence the rate.

- Bad Credit Options: We understand that not everyone has perfect credit. The good news is that obtaining a surety bond with less-than-perfect credit is often possible. While you might pay a higher premium (typically 5%-15% of the bond amount), many providers, including us, have specialized programs to help you get the bond you need. We believe in our mission to get you the bond you need regardless of bond size or applicant credit condition.

Here’s a general idea of how credit can affect the premium for a $25,000 bond:

Frequently Asked Questions about San Antonio Surety Bonds

We often hear similar questions from our clients in San Antonio. Let’s address some of the most common ones to help you understand surety bonds even better.

What is the difference between a surety bond and an insurance policy?

This is a fantastic question, and it highlights a crucial distinction. While both involve financial guarantees, their fundamental structures and purposes differ significantly. Think of it this way:

A surety bond is a three-party agreement. You, the Principal, make a promise to an Obligee (the party requiring the bond). And we, the Surety (your bond company), back that promise. The main goal of a surety bond is to protect the Obligee from financial loss if you, the Principal, don’t fulfill your obligations. It’s like a line of credit that we, as your Surety, extend on your behalf. If we pay out a claim because you couldn’t meet your commitment, you are legally obligated to pay us back in full.

An insurance policy, on the other hand, is usually a two-party agreement between you, the Insured, and the Insurer (the insurance company). Its main purpose is to protect you from unexpected financial losses due to covered events, like a car accident or property damage. If a claim is paid, you typically don’t have to pay the insurance company back (beyond your premium and any deductible). Insurance is all about transferring risk from you to the insurer.

So, the key takeaway is this: A surety bond guarantees your performance and obligations to a third party, with the expectation that you’ll reimburse us if things go wrong. Insurance protects you from unexpected losses.

Can I get a surety bond in San Antonio with bad credit?

Yes, absolutely! We understand that financial situations can be complex, and a less-than-perfect credit score doesn’t mean you’re out of options for a surety bond San Antonio. While a lower credit score might mean a higher premium for your bond – typically ranging from 5% to 15% of the total bond amount – many providers, including us, offer specialized programs designed for applicants with non-standard credit.

For many common license and permit bonds, credit checks are often very lenient or not even the biggest factor. For others, while your credit is considered, approval is still very much possible. Our goal at BEST SURETY BOND COMPANY is to work with you, regardless of your credit history, to find a solution that meets your bonding requirements. Helping you get the bond you need is truly our passion!

How quickly can I get my surety bond?

One of our core commitments is speed, and we’re proud to say that getting your surety bond can be incredibly fast! We know your time is valuable, and we don’t believe you should spend long hours searching or waiting.

For many common license and permit bonds, especially those with smaller bond amounts, you can apply online, receive an instant quote, pay your premium, and have the official bond document emailed to you within minutes. Yes, literally minutes! This means you can get your bond and move forward with your business right away.

Most other standard bonds can be approved and issued within the same business day, provided we have all the necessary information from you. For larger contract bonds or those requiring more extensive underwriting, the process might take a little longer, typically 24-48 hours. Even then, our streamlined process and experienced team work diligently to minimize delays. Our efficient systems and dedicated team ensure you get your bond quickly so you can focus on what matters most: running your business.

Finding the Right Surety Partner for Your Needs

Navigating surety bonds, especially in a busy market like San Antonio, can sometimes feel a bit overwhelming, right? But it truly doesn’t have to be complicated or stressful! The secret to a smooth experience? It’s all about finding the right partner – one who truly ‘gets’ the specific requirements here in San Antonio and across the great state of Texas, and who always puts your needs first.

When you’re looking for that perfect surety bond partner, what really matters?

First off, speed is king! You’re busy running your business, so you need a partner who can offer instant online quotes and get your bond issued lightning-fast, often the same day. We totally get that time is money, and we respect yours.

Then there’s affordability. Nobody wants to pay more than they have to! Look for a partner who not only offers competitive rates but also understands that every situation is unique, providing options even if your credit isn’t perfect. Our commitment is to get you the lowest rates possible.

And let’s not forget Texas expertise! San Antonio and Texas have their own unique rules, from contractor requirements to motor vehicle dealer bonds. You need a partner who deeply understands these local and state-specific needs. While we’re licensed in all 50 states, our roots run deep right here in Texas, making us local experts with national authority.

Finally, look for a blend of digital convenience with a warm, human touch. You should be able to apply online quickly and easily, but also have the peace of mind knowing you can pick up the phone and speak to a licensed, knowledgeable agent whenever you need personalized advice. We truly offer the best of both worlds!

By choosing an experienced surety specialist like us, you’re not just securing a bond; you’re gaining a reliable partner. We’ve proudly bonded over 10,000 clients, helping them steer their obligations quickly and confidently. So, you can get back to what you do best – running your business, knowing you have strong backing.

Ready to get bonded with confidence?

Get Your Instant Surety Bond Quote Today