Understanding the Auto Dealer Bond: Your Essential Guide

Operating a legitimate auto dealership starts with understanding what is a dealer bond for auto dealers.

Here’s a quick look at what it means:

- A dealer bond is a type of surety bond required by most states for auto dealers to get licensed.

- It acts as a financial guarantee that the dealer will follow state laws and ethical business practices.

- Its main purpose is to protect consumers and the state from financial harm due to dealer misconduct, not to protect the dealer.

Before they can be licensed in most states, auto dealers must file a surety bond with their state’s Department of Motor Vehicles (DMV). This bond is a critical assurance that as a dealer, you’ll operate ethically and legally, protecting your customers and the public from potential fraud or misrepresentation.

This comprehensive guide will break down everything you need to know about dealer bonds. We’ll cover why they are required, who they protect, how they work, and what factors influence their cost. By the end, you’ll have a clear picture of this vital licensing requirement.

What is a Dealer Bond for Auto Dealers and Why is it Mandatory?

What is a dealer bond for auto dealers? It’s a surety bond required by state governments to obtain and maintain an auto dealer license. It’s a financial promise, guaranteed by a third party, that a dealer will conduct business according to all applicable laws and regulations. It’s a legal requirement in every state and the District of Columbia.

This mandatory requirement ensures legal compliance, allowing regulatory bodies to enforce standards and protect consumers. It also builds consumer trust. A dealer bond signals that your dealership is accountable and provides a mechanism to address potential misconduct, demonstrating your commitment to ethical practices.

Finally, it provides financial recourse. If a dealer fails to uphold their legal and ethical obligations, the bond provides a financial safety net for affected parties. State and local agencies can also make claims against these bonds to collect penalties or fines. For instance, the New Jersey Motor Vehicle Commission enforces the surety bond to protect its citizens.

Who Does an Auto Dealer Bond Protect?

An auto dealer bond primarily protects the public, not the dealer. It gives consumers financial recourse if they are harmed by a dealer’s unethical actions.

Specifically, the bond protects:

- Car buyers and the general public: These are the primary beneficiaries. If a consumer suffers financial harm due to a dealer’s illegal or unethical practices, they can file a claim against the bond to seek compensation.

- State government agencies: The Department of Motor Vehicles (DMV) or other licensing authorities are also protected. They can make claims to enforce licensing laws, collect unpaid taxes or fees, and ensure dealers adhere to license terms.

- Sellers, lenders, and creditors: Other parties involved in a transaction can also be protected. If a dealer fails to pay for a trade-in or misrepresents financial information, these parties may have grounds to file a claim.

While the dealer must repay any claims paid by the surety, the bond indirectly benefits them by boosting credibility and reputation, which can attract more customers.

What Specific Issues Does a Dealer Bond Cover?

An auto dealer bond covers a broad range of dishonest, fraudulent, or illegal actions, ensuring dealers operate in compliance with legal and ethical standards.

Common reasons for claims against a dealer bond include:

- Financial fraud: Misleading financial techniques or failing to pay for a vehicle.

- Fraudulent representation of motor vehicles’ state during a sale: Providing incorrect information about a vehicle’s condition, history, or mileage (odometer tampering).

- Not furnishing motor vehicle titles: Failing to provide a valid, clear title for a purchased vehicle.

- Not meeting warranty obligations: Failing to honor warranty agreements.

- Not paying for a trade-in motor vehicle: Taking a trade-in but failing to pay off its lien.

- Not paying sales taxes or fees to the state: Failing to remit collected sales taxes and other fees.

- Not reporting a sale: Failing to properly register a vehicle sale with the state.

- Selling stolen motor vehicles: Knowingly or unknowingly selling a stolen vehicle.

- Unethical sales strategies: Using deceptive or misleading sales tactics.

Claims can arise from deliberate acts, errors, or misunderstandings. To prevent claims, it’s wise to resolve customer disputes amicably. Operating ethically saves money and distinguishes your dealership.

How an Auto Dealer Bond Works: The Key Players and Processes

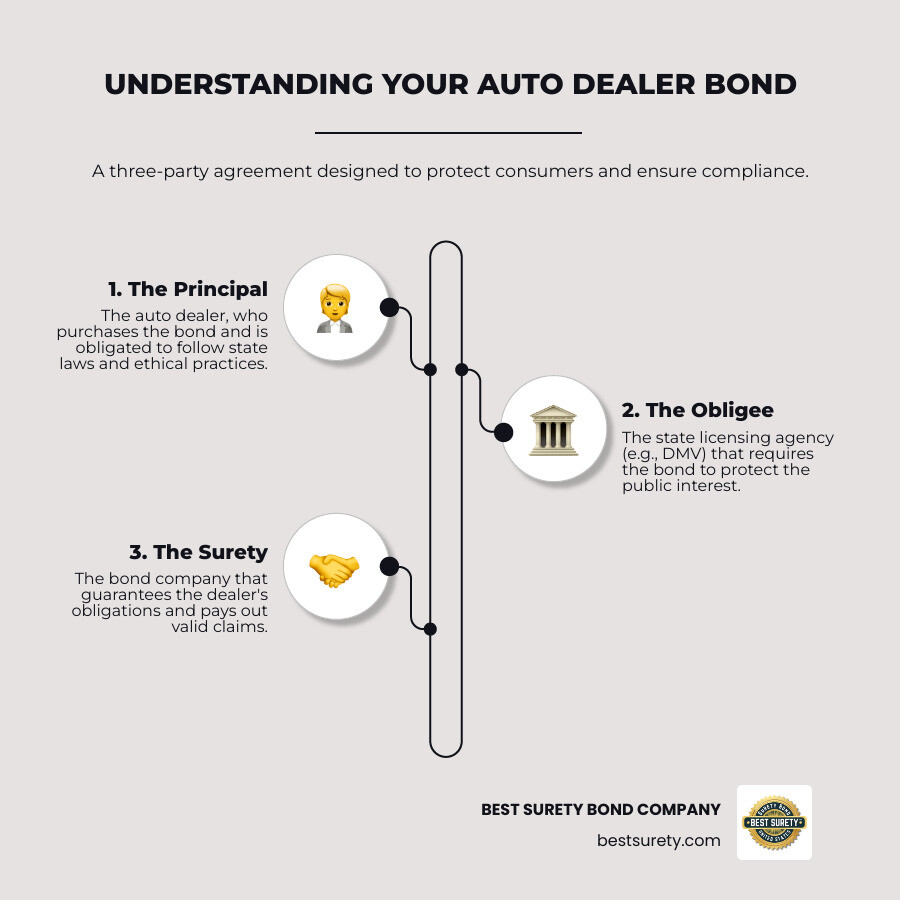

Understanding what is a dealer bond for auto dealers means knowing the key players. Unlike regular insurance that protects you, a dealer bond is a three-way agreement designed to protect your customers and the state. It’s a promise, backed by a surety company, that you’ll conduct business ethically.

The Three Parties Involved in a Surety Bond

Every surety bond has three main players:

- The Principal (The Auto Dealer): As the principal, you apply for the bond and make a legal agreement to follow all state laws. You are ultimately responsible for your actions and must repay the surety company for any valid claims.

- The Obligee (The State’s DMV or Licensing Body): This is the entity that requires the bond, such as the state DMV. The obligee sets the rules and bond amount and is protected by the bond, ensuring dealers operate legally.

- The Surety (The Bond Company): The surety is the neutral third party providing the financial guarantee. After vetting the principal’s financial health, the surety agrees to pay valid claims if the principal fails to meet their obligations. The principal must then reimburse the surety in full, creating a system of accountability.

The Claim Process Explained

If a customer or the state believes a dealer has violated the bond’s terms, the claim process begins:

First, the wronged party will file a claim with the surety company, providing evidence of the misconduct and resulting financial harm.

Next, the surety company conducts a careful investigation to determine if the claim is valid under the terms of the bond and state regulations.

If the claim is valid, the surety provides financial compensation to the claimant for their proven losses, up to the bond’s full amount. This offers quick relief without a prolonged legal battle.

Finally, the dealer has an obligation to repay the surety. The bond is a form of credit, not an insurance policy. The dealer signs an indemnity agreement, legally obligating them to reimburse the surety for any paid claims. Failure to repay can result in legal action.

This process highlights the importance of running a dealership with integrity. A claim can be costly to your finances, reputation, and license. Understanding these requirements helps you avoid claims and keep your business running smoothly.

The Cost of Compliance: How Dealer Bond Premiums Are Calculated

A common question is, “How much does what is a dealer bond for auto dealers cost?” The cost isn’t a flat fee. You pay a “premium,” which is a small percentage of the total bond amount required by your state.

The required bond amount varies significantly by state, from $10,000 to $300,000. For example, New Jersey requires a $10,000 bond. In New York, the amount depends on sales volume: a $100,000 bond for selling over 50 vehicles annually, $20,000 for fewer than 50, and $50,000 for new car dealers.

What determines your premium? For dealers with solid credit, premiums are typically 1% to 5% of the total bond amount. For those with credit challenges, the premium might be 10% to 20%.

What Factors Determine the Cost of an Auto Dealer Bond?

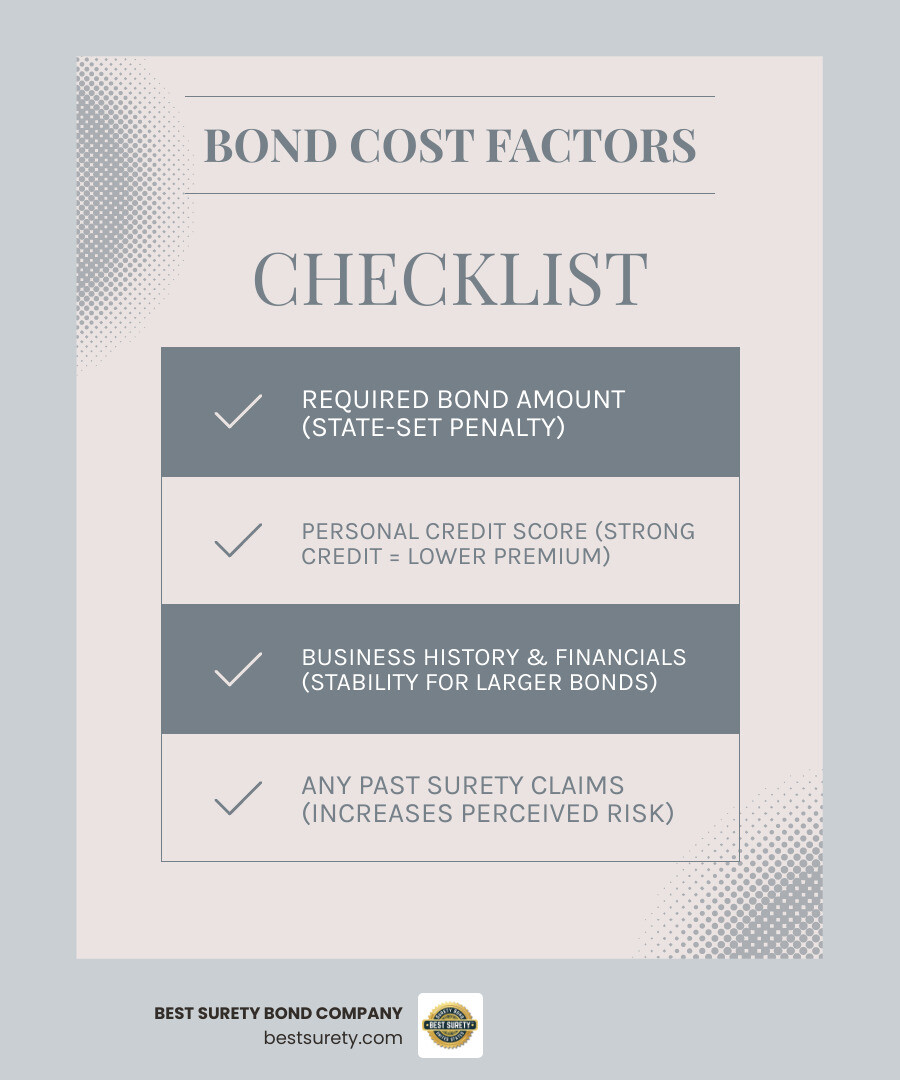

The cost of your premium is influenced by several key elements that help the surety company assess risk.

The Required Bond Amount (Penalty) is set by your state’s licensing authority and represents the maximum payout for a claim. A higher bond amount typically means a higher premium.

Your Personal Credit Score is a significant factor. Surety companies view it as an indicator of financial reliability. A strong credit score signals lower risk and results in lower premium rates.

Underwriters also consider your Business History and Financial Credentials, including your time in business, industry experience, and financial stability. For larger bonds (over $50,000), they may review business financial statements.

Any Past Surety Claims can also play a role. Previous claims increase perceived risk and can lead to a higher premium.

To give you a clearer picture, here’s an example of how your credit score can impact the premium for a hypothetical $50,000 auto dealer bond:

This table clearly shows that keeping your credit in good shape is a fantastic way to secure the most favorable rates for your dealer bond!

Is a Credit Check Required to Get a Dealer Bond?

Yes, a credit check is a standard part of the application process. However, surety underwriters perform a “soft credit check,” which does not impact your credit score like a “hard inquiry” from a loan or credit card application.

This soft check is for underwriting purposes, helping the surety company to:

- Determine Eligibility: It helps them assess your risk profile and decide if they can offer you a bond.

- Set the Premium Rate: As we’ve discussed, your credit score is a big piece of the puzzle in figuring out how much you’ll pay for your bond. A higher score often means you’ll get a lower percentage rate on your premium.

Yes, you can still get a dealer bond with a lower or “substandard” credit score. Many companies, including BEST SURETY BOND COMPANY, specialize in helping applicants with credit challenges. The premium will likely be higher due to the increased risk, but reputable providers often offer flexible payment plans to make the bond more affordable.

State-Specific Bond Requirements and Dealer Types

While the concept of what is a dealer bond for auto dealers is consistent, the specific rules, bond amounts, and licensing procedures are localized and vary by state.

Always check your state’s specific requirements directly with its Department of Motor Vehicles or licensing agency for the most accurate information. DMV.ORG is a useful resource for general guidance.

What Types of Auto Dealerships Need a Bond?

The need for an auto dealer bond extends beyond traditional new car dealerships. Many auto-related businesses must obtain a bond to get licensed, protecting the public in various vehicle transactions.

This includes Retail Dealers (selling to consumers) and Wholesale Dealers (selling to other dealers). In California, for instance, wholesale dealer bond amounts can depend on annual sales volume.

Franchise Dealerships and Independent Used Car Dealers almost universally need a bond. Niche markets like Motorcycle/ATV Dealers, RV Dealers, Salvage Dealers, and Auto Auctions also typically have bond requirements.

The type of dealership directly influences the bond amount and regulations; it’s not a one-size-fits-all requirement.

How do State Requirements Vary?

State laws for dealer bonds vary substantially, and understanding these nuances is key to compliance.

Bond Amounts: Required bond amounts vary widely, from $10,000 in New Jersey to as high as $300,000 in other states.

Sales Volume Impact: Some states tie the bond amount to sales volume. New York, for example, ties the bond amount to sales volume: $100,000 for over 50 vehicles sold annually, $20,000 for fewer than 50, and $50,000 for new car dealers.

Fixed Expiration Dates: Some states have universal expiration dates. For example, Florida independent dealer bonds expire on April 30th, and Georgia bonds expire on March 31st of even-numbered years. This standardizes renewal dates for all dealers in the state.

Specific Definitions of “Dealer”: States define “dealer” differently. In California, selling one vehicle for profit makes you a dealer. In Florida, it’s more than three. In Texas, selling more than four vehicles for profit requires a license and bond.

Additional Bond Types: Some states might require separate bonds for specific services, such as a motor vehicle repairer bond in Connecticut.

Understanding these state-specific rules is vital. With deep expertise in Texas regulations and a nationwide reach, we can guide you through any state’s requirements to get you bonded quickly and affordably.

Frequently Asked Questions about Auto Dealer Bonds

Here are answers to common questions that clarify what is a dealer bond for auto dealers.

What is the difference between a dealer bond and business insurance?

This is a critical distinction. Both offer protection, but for different parties and reasons.

A dealer bond is a three-party contract that protects your customers and the state from dealer misconduct. It’s a financial guarantee for your compliance with the law. If the surety pays a claim, you are legally obligated to repay that amount in full. It is not an insurance policy for your business.

Conversely, business insurance (e.g., garage liability) is a two-party agreement that protects your dealership from risks like accidents, property damage, or theft. The insurer pays for covered losses, and you are not required to pay it back beyond your deductible.

In short: a dealer bond protects others from your actions, while business insurance protects you from unforeseen events. You will almost certainly need both to operate a compliant and secure dealership.

How long does it take to get an auto dealer bond?

At BEST SURETY BOND COMPANY, we make the process fast and efficient because we know time is money when starting a dealership.

With your business information ready, you can get an instant online quote and often receive same-day issuance. Our streamlined process means you can get your bond in hours, not days. We’re here to help you get bonded today.

Can I get an auto dealer bond with bad credit?

Yes, absolutely. Having less-than-perfect credit does not disqualify you from getting an auto dealer bond. We provide access to bonding for all legitimate businesses, regardless of credit history.

Your credit score is a key factor in determining your premium. With credit challenges, the premium will be higher due to the increased risk, typically ranging from 10% to 20% of the total bond amount.

However, we help you find competitive rates and offer flexible premium financing plans. These plans make the cost more manageable with monthly payments, ensuring you can meet licensing requirements and launch your business.

Get Your Texas Auto Dealer Bond Fast and Affordably

After exploring what is a dealer bond for auto dealers, you now understand it’s more than just a piece of paper. It’s a vital part of your dealership’s foundation, building trust with your customers and ensuring you meet all state legal requirements. This bond is truly a foundational piece of your business’s credibility and operational integrity.

Ready to secure yours? We at BEST SURETY BOND COMPANY are here to make that process simple, fast, and affordable. We pride ourselves on our deep expertise, especially for dealers in Texas, but our reach extends across the entire nation. So, whether you’re looking for a colorado auto dealer bond, a florida auto dealer bond, or any other state-specific requirement, we’ve got you covered.

Our goal is to get you licensed and operating quickly. That’s why we offer instant quotes online and often provide same-day approvals. With local experts, especially here in Texas, and our national authority, we’re able to offer some of the lowest rates in the industry, across all 50 states. We’ve had the privilege of bonding thousands of clients, and we’re ready to help your business thrive too.

Don’t let bond requirements slow you down. It’s time to take the wheel of your dealership! Get Bonded Today and experience the fastest turnaround in the industry, coupled with the most affordable premiums.